Alcoholic Update: TFF Group 6M results & Mercosur-EU Trade agreement

Disclaimer: This is not investment advice. PLEASE DO YOUR OWN RESEARCH !!!!

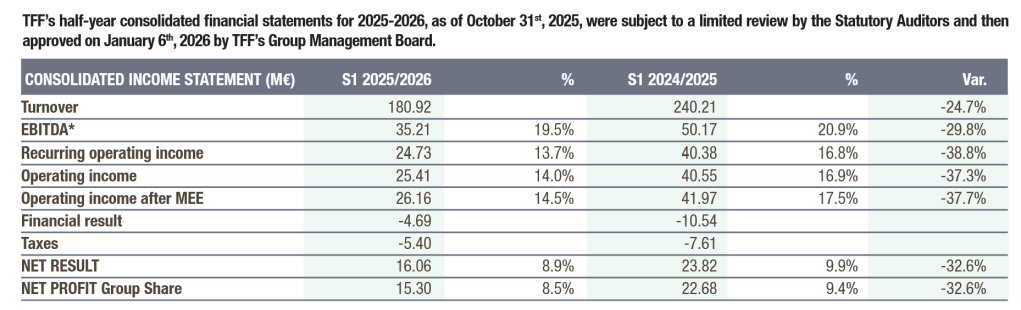

TFF Group 6M numbers

No matter how you put it, TFF Groups 6M release on January 7th was pretty bad.

Sales down ~-25%, net profit down -33%. The only positive aspect is that the operating leverage (i.e. how much more profit declines than sales) is surprisingly modest.

Last year for instance, a -9% decline in sales led to a -40% decline in profits as we can see in the respective report form last year:

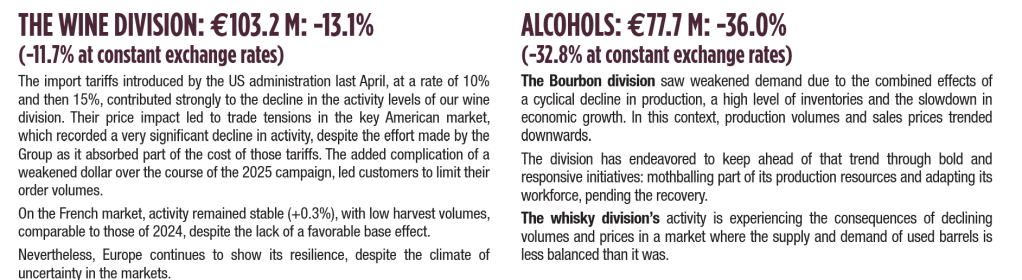

One level deeper, Wine is doing relatively better than BourbonWhisky which saw an very sharp drop:

It is pretty obvious that it is easier for a Whisky distiller to decrease annual production than for a Winemaker who would need to throw away valuable grapes.

Just a few days earlier, news that Jim Beam will close its main distillery for a full year made the rounds, indicating that the pain for TFF is far from over.

The big question is if we are already at the low point or not .I honestly do not know.

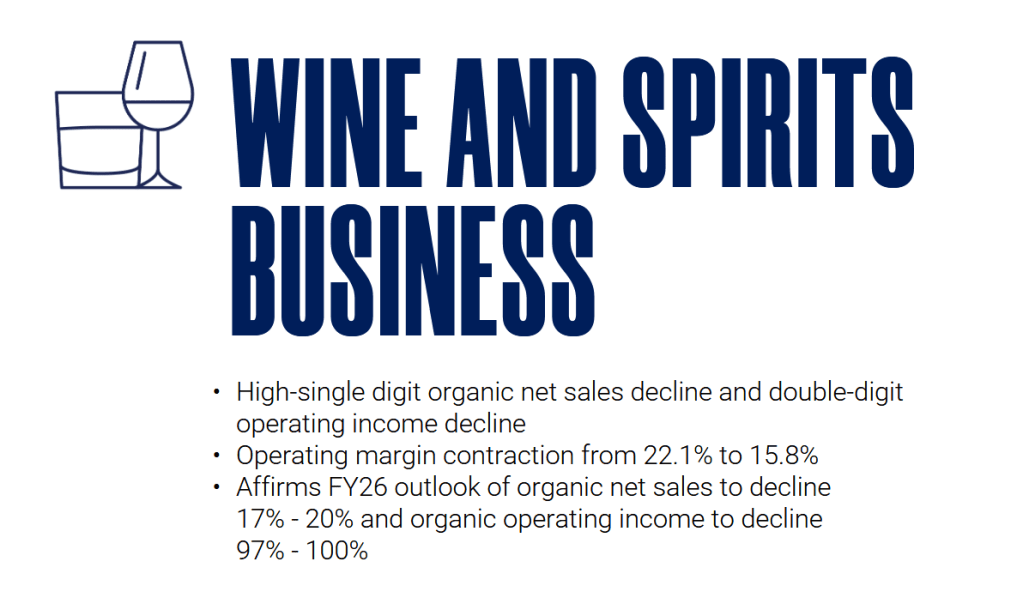

If we look at Constellation brands for instance, who presented results on the same day, the outlook for Wine & Spirits doesn’t look pretty either:

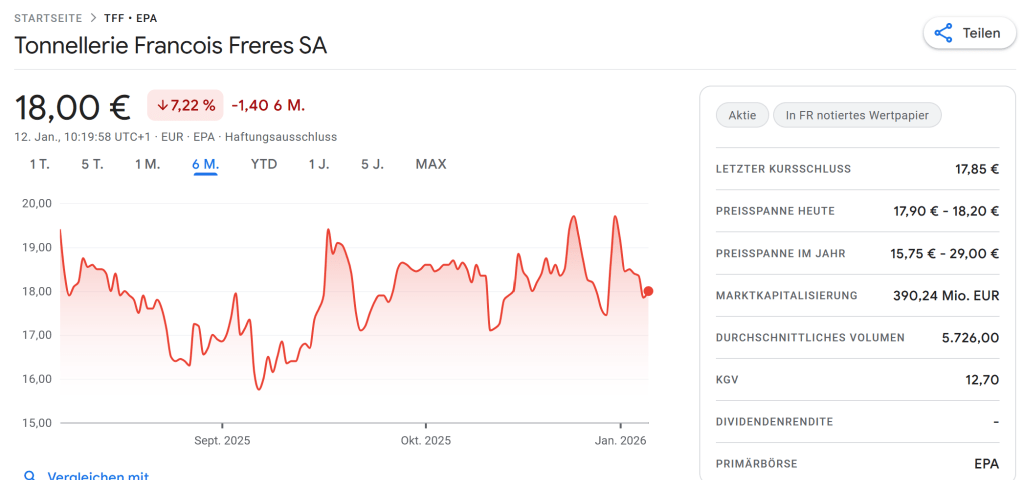

After a year-end bump, TFF’s share price consolidated a little bit but so far didn’t drop to new lows.

It seems that the market seems to have expected bad news.

TFFs outlook for the rest of the financial year was somehow a little bit optimistic as after a -25% revenue decline in the first 6 months, they now guide for -20-25% for the full year:

Another positive sign is that they could lower net debt mainly through managing down inventory which was a big issue last year:

So overall, things are clearly not great, but TFF surprisingly still manages to earn a double digit operating profit margin and seems to have gotten costs under control.

TIKR tells me that analysts expect 1,25 EUR EPS for FY 2026/2027 and 1,62 EUR for 2027/2028. This has been lowered a little since last time I checked this but should support the current share price in my opinion..

Would I buy TFF shares right now ? I don’t think so, but I won’t sell any right now either as my current exposure with around 3% of the portfolio (after the big decline) is quite low anyway. And, as mentioned in the Performance review, it forces me to review and follow the Alcohol/Spirits Sector in more detail.

EU-Mercosur Trade Agreement Agreement

Just a few days ago, the EU finally agreed on signing the Trade agreement with the Mercosur region, which comprises countries like Brazil and Argentina.

Among others,to my understanding tariffs on Spirits and Wines will be removed. For EU exports, tariffs have been 17% on wine and 20-35% on spirits.

This clearly goes both ways. For European wine producers, I am not sure what the net effect will look like. Argentina and Chile both have excellent and internationally appreciated wines and they will be more competitive now.

However, for spirits, things could get interesting. While Cachaça could clearly become cheaper in Europe, it could be interesting for specific European spirits like Cognac or Campari’s Aperol if tariffs fall away. Champagne could also be a beneficiary due to its global status, although Brazil seems to grow great sparkling wines, too.

As this only covers the EU, UK Whisky producers for instance will not benefit from this agreement due to Brexit (Diageo etc).

So overall, for the EU spirits industry, this seems to be a net positive, for wine I am not so sure.

Extra Soundtrack: Mano Chao – Me gustas tu