BioNTech: The Founders announced their exit – what’s next ?

Disclaimer: This is not investment advise. PLEASE DO YOUR OWN RESEARCH !!!!

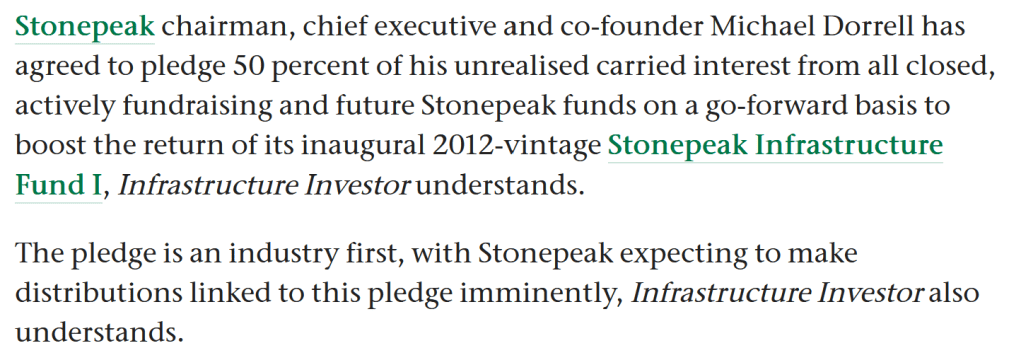

I wrote this post this morning (CEST) when the stock price was around 73-74 EUR. I then had to run some errands before being able to post and the stock price moved already significantly. All calculations etc. are based on a stock price of 73,50 EUR.

By coincidence, I just wrote about Biontech a few weeks ago. Luckily my summary back then was not to invest:

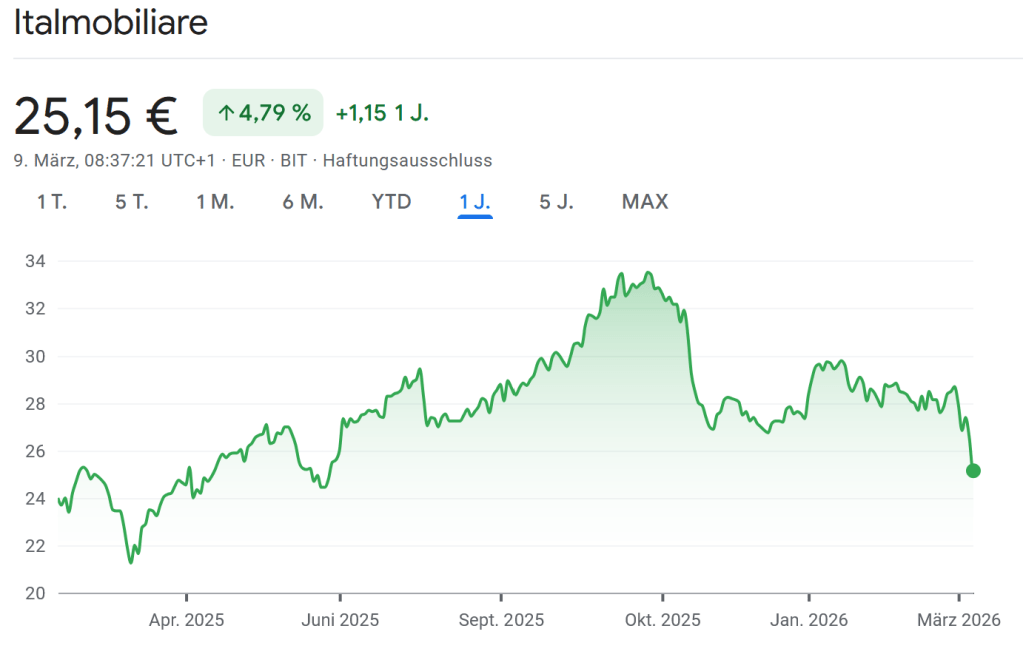

Now two things happened yesterday on March 10th, when they were supposed to talk about Q2 earnings:

- The two founders announced that they will leave by the end of 2026 in order to start a new company

- The share price dropped significantly after the announcement

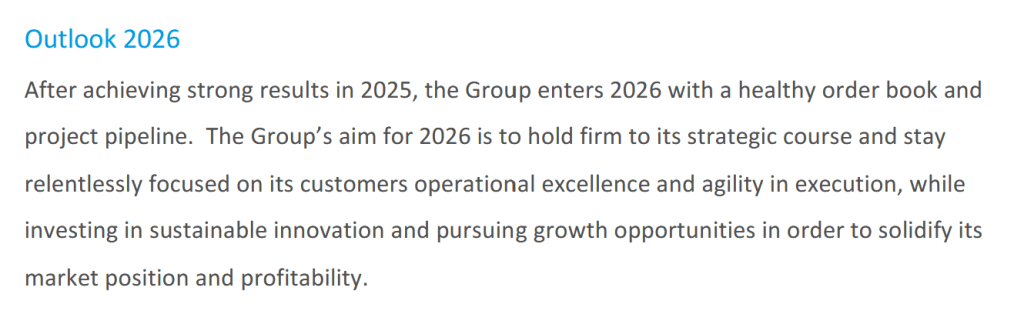

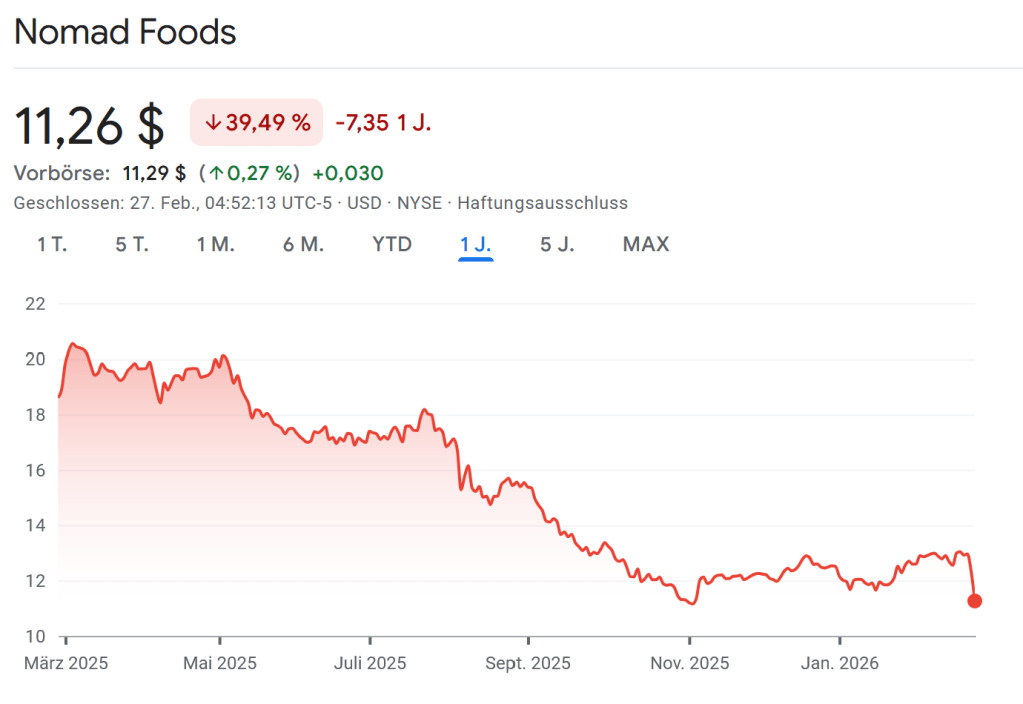

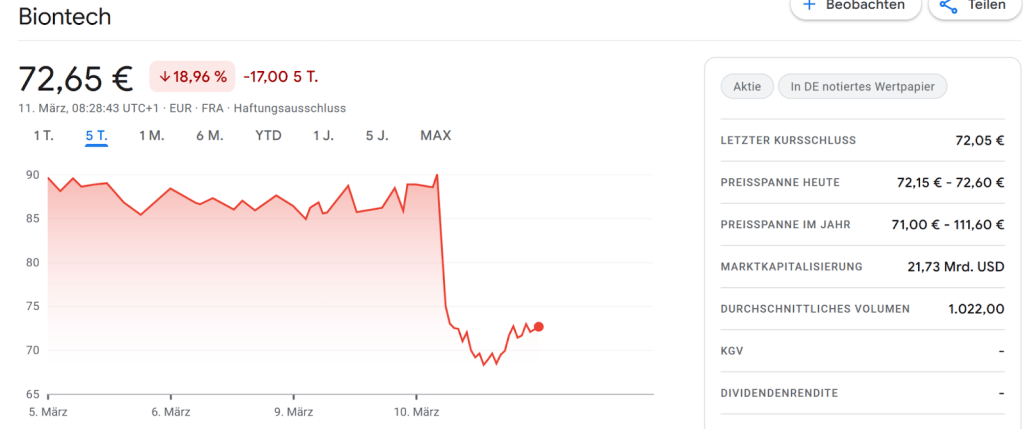

This is the stock chart in Germany (in EUR):

After a low of around 68 EUR, the shares currently trade at 73-74 EUR at the time of writing.

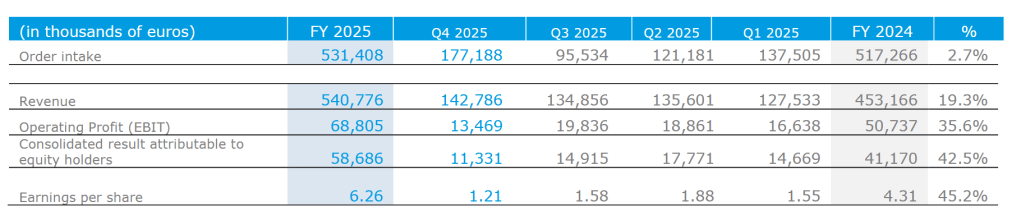

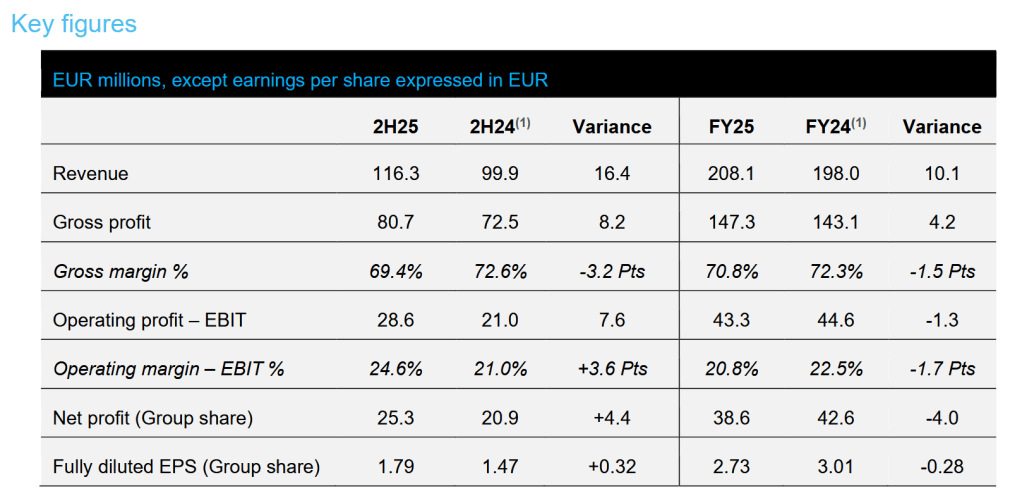

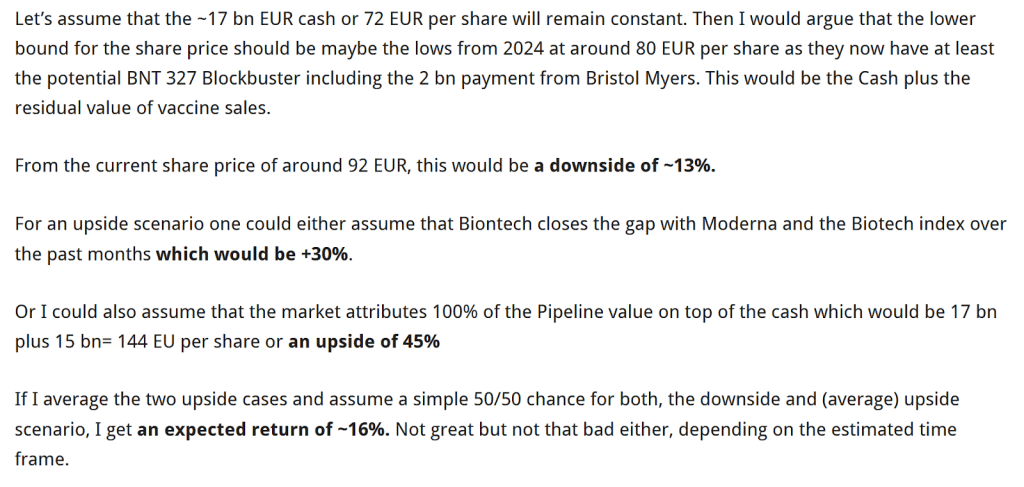

Funnily enough, this is almost exactly the current net cash per share and even 10% below my “worst case” assumption:

Using my “old” scenario, the potential upside would now be obviously a lot higher.

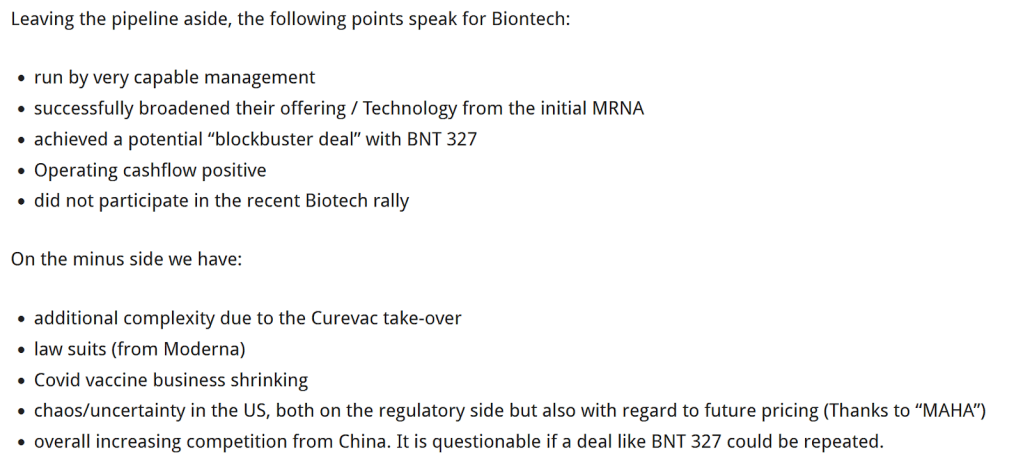

But, and this is a BIG BUT: With the founders leaving, one of the main qualitative arguments became a lot weaker. This was my Pro & Con list back then:

We just don’t know who will run the company from next year onwards. Initially this was a big negative news for me.

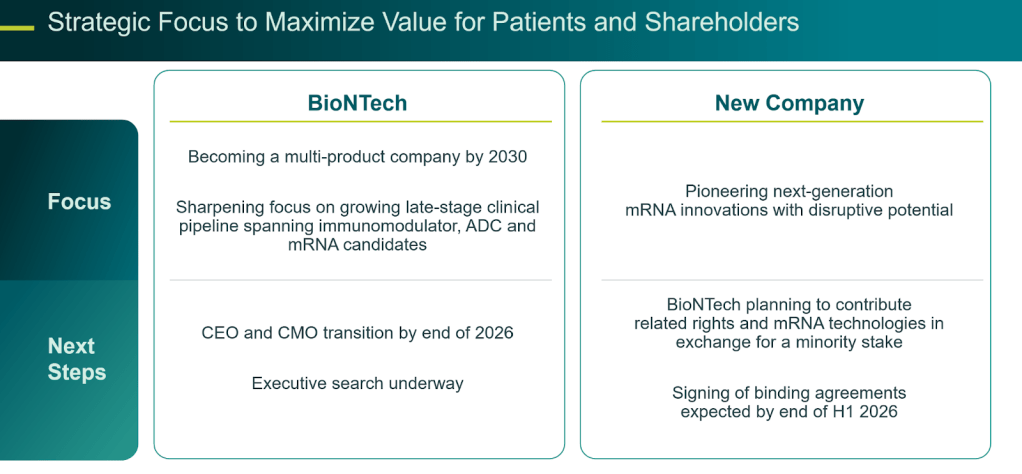

What did the founders actually announce:

I haven’t listened to the call yet, so I stick to the slide from the results presentation from yesterday:

So Sahin and his wife will leave by the end of the year and basically take some (or most ?) of the mRNA technology in exchange for a minority stake into a new company. We do not know if they also get cash or not. I would assume not.

Normally, one sees such “deals” only after a Biotech company is taken over by a big Pharma company and a founder wands to make sure that early stage projects are not getting killed.

One such situation was the Actelion/Idorsia Special Situation I invested 9 years ago, where after the take-over of Actelion by Johnson & Johnson, the founder Clozel took the whole development department including the early stage pipeline into a new company called Idorsia which was then spun-off to shareholders.

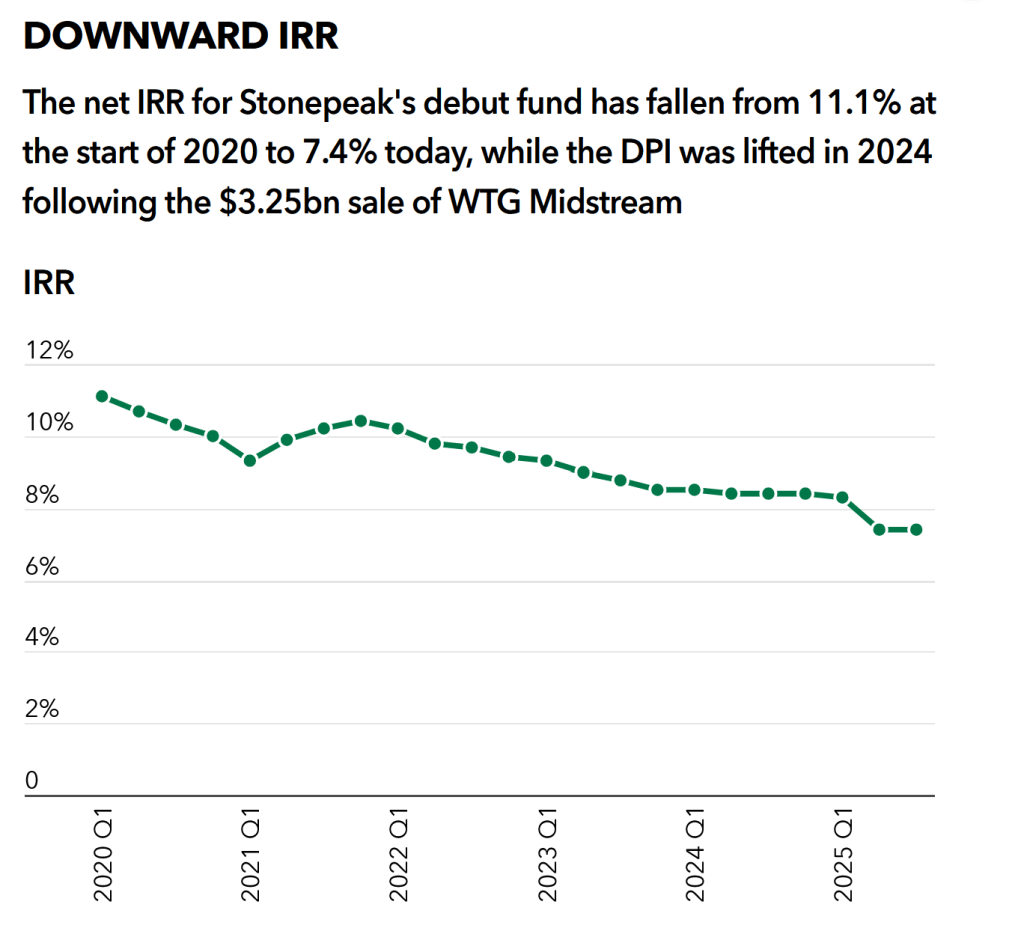

Interestingly, Idorsia, even after 9 years didn’t do too well and trades significantly below the value right after the spin-off:

In the German press, there are some rumors that the founders have made that move because a sale of Biontech to a bigger Pharma company might be imminent, although officially the founders have said this is not the case.

What I find most striking is the issue that they haven’t announced a successor for the founders yet.

Without a potential sale of Biontech on the horizon, the founders could have just “hired” or promoted someone to CEO who takes care of commercializing the late stage pipeline and continue to do their research within Biontech.

I get the impression that maybe, after 18 years, the billionaire Strüngemann Brothers who put up the initial funding and still own 40% do not agree anymore with the founders who own around 15%. In some older articles, both the Strüngmanns and Sahin always made the point that they want to create a “full blown” BioPharma company that can play in the first league internationally.

At least Sahin and his wife now decided that they actually prefer to do research.

Another dicey issue is that the founders will basically negotiate the transfer of the mRNA technology with themselves as they want to close this before the end of the next quarter, maybe specifically before a new CEO is installed. My impression is that they are honest people and really interested in research, but it is of course not ideal if they negotiate with themselves.

Also the announcement that Biontech will only get a minority share seems to indicate that this time, Sahin and his wife want to have the full control which they currently don’t have.

It will be also interesting to see if and how many of Biontech’s R&D staff will follow them to the new company.

What is the worth of a charismatic founder ?

Yesterday’s announcement is also an interesting datapoint regarding the question: What is the worth of a charismatic founder? In this case, for most shareholders, the announcement was clearly a big surprise.

The -20% clearly indicate that at least in the short term, investors think that the company is worth less without its founders.

So what about Biontech now ?

As I mentioned in the beginning, the share price is now around -25% lower than in January. On the other hand, without the founders, a lot of things could be more difficult, especially if a lot of people follow them to the new company..

As a compensation, the possibility of a take-over/sale of the company to a large international player has clearly increased, I would assume that in the case of a takeover, the pipeline value would be paid to a large extent by an acquirer.

I have asked various versions of LLMs who the most likely acquirer would be. The favorites were Merck (US), Bristol Myers (with which they partnered) and Roche. All of them could make use of Biotech’s pipeline and have the means to do the transaction.

I also think that once the mRNA deal is signed, a subsequent sale of the company could happen rather sooner than later.

New scenario:

My new downside case would be 80% of net cash which is a level that many loss making Biotech firms trade at.

My upside scenario would be the 144 EUR with the pipeline value from the last post.

If I use a 50/50 scenario this would translate into (-20%+100%)/2= +40%

That looks a lot better than in January.

Of course anyone could add a lot of other cases but I like to keep it simple.

There is still the issue that we don’t have a “hard” deadline for a potential deal, but on the other hand, the year end deadline for their exit could be interpreted as a deadline for the Strüngmanns to find a buyer.

Playbook:

My assumption is that this situation doesn’t escalate totally between the founders and the Strüngmann brothers. One big warning sign and red flag would be, if the agreement for the new company would not be signed until the end of June.

Summary:

In a nutshell, Biontech now looks much more like an interesting “Special situation” than in late January.

Yes, the founders will be gone by year end, but the stock is 25% cheaper and we now have a “soft deadline” for a potential M&A announcement.

My “back of the envelope” calculation indicates and expected average return of 40% for roughly one year which is attractive. I therefore allocate 1,5% of the portfolio into Biontech at current prices of 73,50 EUR/Share.

Bonus Soundtrack:

I imagine that the founders will play that Soundtrack if the walk into their new company in 2027: Jon Batiste – Freedom