Following the first post about Societé D’Edition de Canal+ (“SECP”), let’s look how our “camouflaged” bond trades before we move to the valuation:

It is quite amazing to see this security trading so close to the CAC 40. For me it seems clear that not many are aware of the “special” characteristics of this security. Statistically, this translates “only” into a correlation of 0.48 and a beta of ~0.66 in this period but just from the graph one can see this is a very close relationship.

Compared to “parent” Vivendi, we can clearly see that SECP was the better investment:

Over the past 5 years, SECP and Vivendi moved closer together, but correlation is still much higher with the CAC40.

My valuation approach

So to summarize the results from the first post, for valuing the security, I will:

a) use only 90% of the guaranteed after tax result as coupon (plus the 2.5% growth rate)

b) expect so “sell out” at the end at NAV (incl. the 10% retained guaranteed profits)

c) will use discount rates as mentioned between 4.7% and 5.7% representing long duration hybrid high grade corporates

d) deduct a 0.25% from the discount rate for the “inflation protection”

Results:

Based on a current value of 4.525 EUR per share, my estimated cashflows represent an IRR of 8.2% p.a.

On a discounted basis, we get a fair value range of 6.87 EUR to 8.23 EUR per share, so quite a nice upside to the current share price but lower than the author determined in his analysis. The reason is simply the assumption of only using 90% payout ratio and not counting the cash upfront but the NAV “back ended” in year 2050.

Due to the long duration of the cashflows minor changes in those assumptions change the value significantly.

Opportunity / Special situation: Investor constraints

In principle, SECP would be a highly attractive high yielding long duration corporate investment for any pension fund or life insurance company. Due to the fact that this is officially a stock and it also behaves like a stock, many of those institutions will no be allowed to buy it as listed equity is a quite unpopular asset class these days.

On the other hand, for a typical equity investor, the stock is too boring, as a growth rate of 2.5% is not very sexy.

The characteristic of a long duration corporate exposure itself is relatively attractive as there is only very limited supply in the market. Most of the long dated (hybrid) stuff is financial which no one wants to buy these days. Long dated corporate exposure, especially to high quality corporate is very very scarce.

Catalyst

In the original research from the Value investor Club, the author says the following:

To review the corporate structure, C+ is 49.5% owned by C+ France, which is 80% owned by Vivendi and 20% owned by Lagardere. Lagardere has been trying to simplify its business and raise cash to repay debt over the past few years. It has been trying to sell its 20% interest in C+ France for a while, either as an IPO or to Vivendi, but has not been happy with the available prices. Lagardere has recently re-committed to sell its 20% interest one way or another in 2012. Vivendi has had an active policy of purchasing its French minority interests but has not yet agreed with Lagardere on price. Two weeks ago Bloomberg News reported that Vivendi will consider breaking itself up and will perhaps separate C+ Group from the rest of its businesses.

I am not sure how all this plays out, but I think that within 1-2 years C+’s parent company C+ France will be 100% owned by someone, and that there is a pretty good chance that party will want to acquire the 51.5% public float of C+’s shares. I believe that purchase will make economic sense at prices well above today’s €4.05 since at today’s price C+ is receiving a payment implying a 12.3% FCF yield. At €8/share the implied FCF yield is close to 5% and I think an acquirer would still want to purchase C+ at that level to avoid the cash payment, simplify ownership and eliminate any duplicated costs/public listing costs and tax inefficiencies. Vivendi can borrow short-term money at around 0.5% and long term below 5% so it has leeway to make a purchase at €8 that is EPS-enhancing.

I agree, that it is not totally unlikely that at one point in time Vivendi will repurchase the minorities. However one has to be careful not to overestimate the price they are paying. At the moment, the minority share costs them 6% dividend yield but has the advantage that it does not count as debt.

If Vivendi really would issue debt to repurchase minorities, their debt will increase, even if they could then consolidate the cash in SECP. At S&P, Vivendi has a BBB with negative outlook and more importantly a A-2 Short term rating with negative outlook. So even if its good for EPS, I think Vivendi does not have a lot of leeway to increase debt at the moment, especially if they would buy the Lagardere stake first.

Nevertheless, there is a relatively high probability that something might happen in the next 2-3 years.

How to tackle the stock volatility

So the problem is: SECP has a nice “special situation” angle, but for the time being it behaves like a CAC 40 index tracker without having a fundamental stock upside. It is a bond with an equity volatility. Normally I am rather looking for equity with bond volatility.

There are 2 potential ways to “mitigate” this:

1. Wait for the Stock to follow the CAC down in a correction and buy really really cheap.

2. Try to implement a long/short or hedge strategy in order to take out some volatility

The nice thing about SECP is that the dividend yield with 6% is higher than the CAC 40 yield with 4%, so we do have in principle a “positive carry” against the index (all other things equal).

In theory, one would implement a short position according to the beta of the stock to the CAC 40. Adjusted Beta has been quite stable to the CAC with 0.67, Raw Beta is at around 0.48.

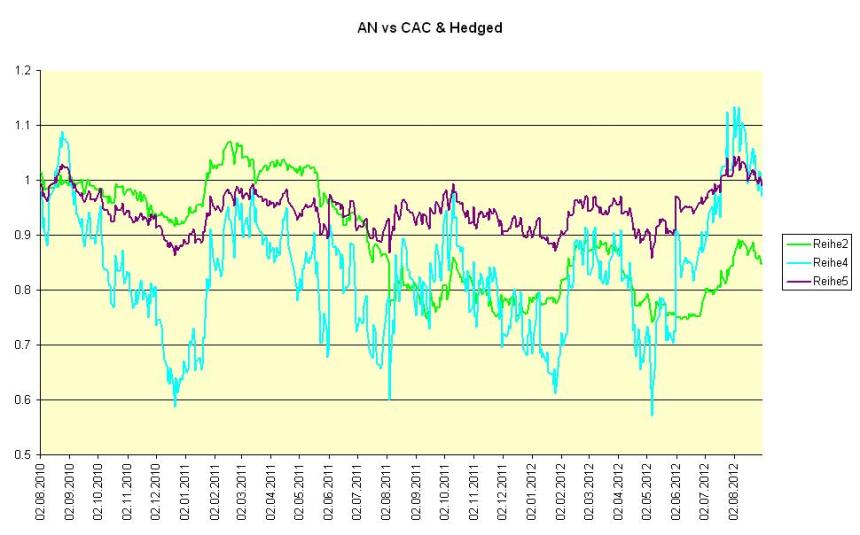

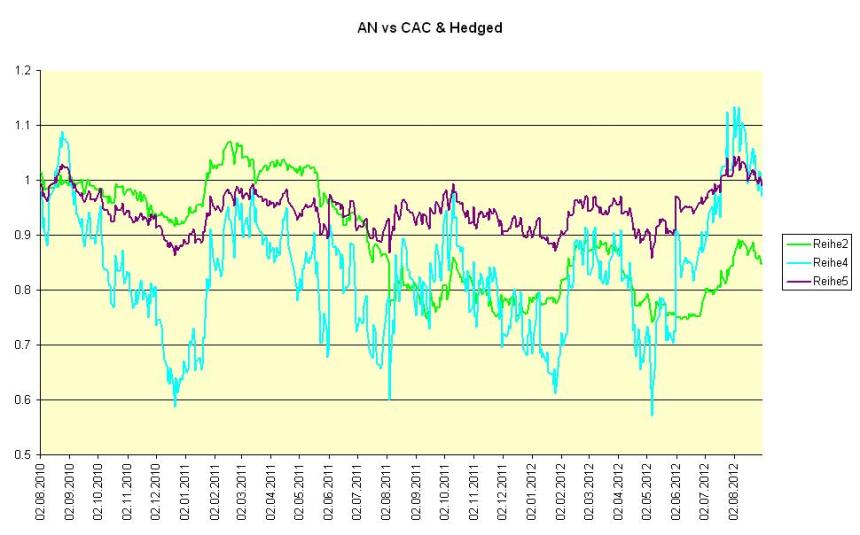

I have run a quick simulation (30.07.2010-31.08.2012, daily basis) with some interesting results:

Standalone, the CAC 40 returned -6.3% against -5.2% for SECP for this period. Volatility was 10.2% for the CAC and 9.7% for SECP.

A static long / short (funding through the effective sale short position as an ETF) with a 0.67 short CAC position returned -2% ROI with a Vol of 10.9%, however a 0.5 CAC 40 short position returned -4% with a Vol of 8%.

A Long stock / short future (Ratio 0.5:1) strategy, despite requiring a higher capital investment shows almost “bond like” characteristics with a vol of 3.6% and a performance (before forward discount) of -1%.

Graphically we can clearly see that the index hedge (purple) creates a much less volatile pattern than the stock alone (green) and the long/short strategy (blue):

So this strategy could basically achieve the following:

– lower volatility to a “bond like” profile

– generating a small positive carry

– “extract” the special situation aspect

The result would be an “ok yielding” position with some small remaining market exposure and the “special situation” upside option.

Summary:

I was rarely so unsure about an investment as in this case.

On the one hand, it is clearly a misunderstood security with a potential catalyst trading at a quite attractive discount. So in the beginning I thought this really will be the next special situation investment.

On the other hand, I am usually looking for stocks which trade like bonds not vice versa. Also for a bond alone, the 8.33% IRR is OK but not spectacular. And for a bond you normally have a “hard” catalyst in form of a maturity or call date.

Also I don’t think we see a “gradual” revaluation, as there are just no natural buyers for this security. Maybe “yield hogs” will warm up to that at some point in time but I am not sure. They will rather buy crappy high yield bonds because this is the “right” asset class.

Combined with a CAC 40 hedge, Canal+ might be an interesting “special situation”. Although I am also not totally convinced that we see a short term buyout offer from Vivendi yet, so for the time being “no action”.

I would go long the security if prices come back to like 4 EUR or we see some action on the Vivendi buyout front.

Edit & lessons learned

This was again a good learning experience. If you invest a lot of time into analysing such a security, one is sometimes tempted to “make it look good” in order to justify the effort. I really felt this effect myself a couple of times. I think this is one of the typical mistakes made by many fundamental investors and something one has to monitor closely.