The German Mittelstand is maybe Down but not Out: Hermle AG – Hidden Automation Champion from the “Ländle”

As always with my longer write-ups, I will attach the full PDF below. In the post itself I will focus on the Exec summary, Pro’s and Con’s and the conclusion. And the Bonus Track of course at the end.

Executive Summary

Hermle AG is a typical “Hidden Champion” Mittelstand company from Southwestern Germany (Baden Wuerttemberg, the “Ländle”) that managed to carve out a very nice niche in 5- Axis CNC machines and connected production automation. The company is able to earn industry leading EBIT margins (>20%) and Returns on Capital (>30%), has a Fortress Balance sheet and trades only at a relatively modest valuation of around 7,7x EV/EBIT.

The business is exposed to the economic cycle, but a combination of competitive advantages, a flexible cost base and a structural tailwind (Automation) make the stock attractive in the mid- to long term

Full PDF can be read & downloaded here:

Pros/Cons

As always, a quick run down of positive and not so positive aspects of Hermle:

+ Industry leading margins and returns indicating significant competitive advantages

+ very reasonable valuation

+ Fortress Balance sheet & capital efficient business mode, highly flexible cost base

+ long term oriented family ownership and management

+ structural tailwind Automation

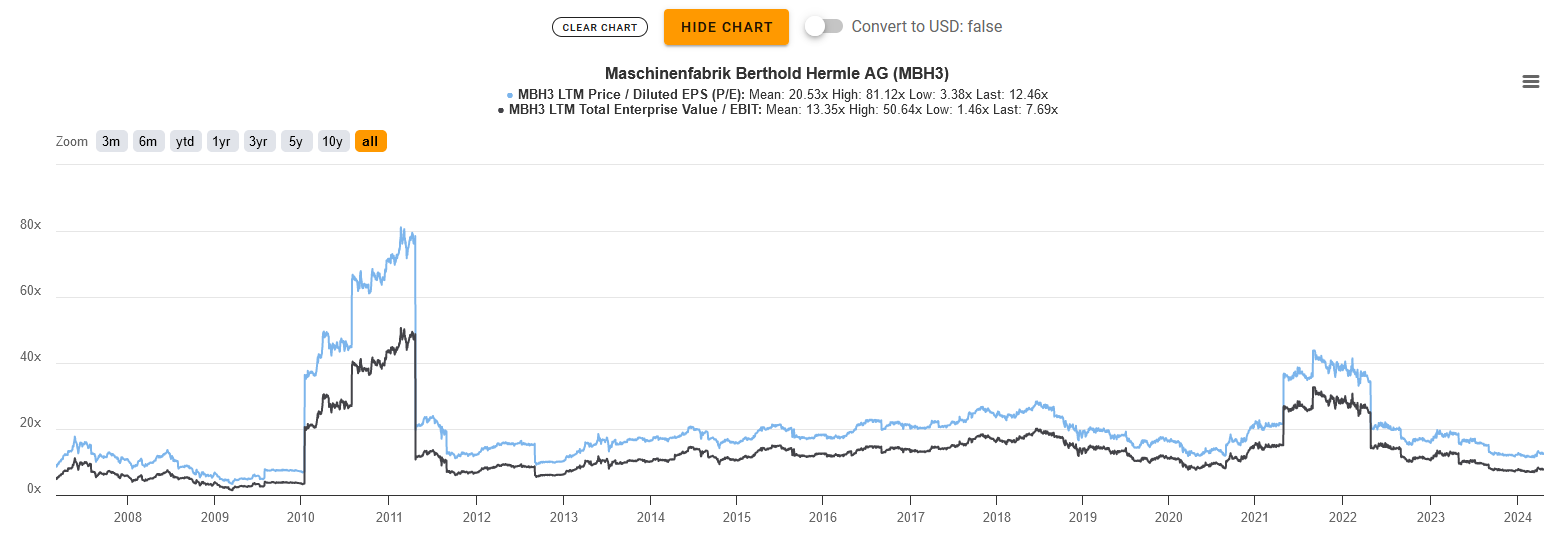

+ additional multiple mean reversion potential

+/- Reporting could be more granular, but no adjustments

+/- Business momentum has slowed down

+/- no share buy backs, only dividends

– significant exposure to business cycle

– upcoming full generational change

– only non-voting shares listed

Valuation /return expectation

The current P/E of ~13 (or 11 ex Cash) and EV/EBIT of 7,7x is clearly below where Hermle has been trading over the past 17 years, where on average the P/E was around 20 and EV/EBIT at around 14x.

Compared to its peers, the stock is priced like the average, but the margins and returns on capital are much much better. Industrial companies with similar margins are usually valued much much higher.

The current dividend yield is quite high at 7%. Even if we normalize this to 5% and think over the next years Hermle should be able to grow at the historic 10 year CAGR of 7%. First, inflation is higher and second, the demand for automation will not go away.

Very roughly this would mean an expected return of 12%-14% p.a. plus any multiple mean reversion potential.

As we have discussed, the business as such is cyclical but Hermle has a very flexible cost basis, so I am actually more than OK with that expected return compared to the quality of the business and the “Fortress balance sheet”.

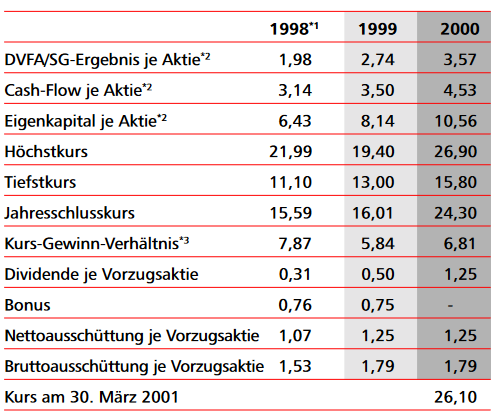

However we should not forget that a potential cyclical stock like Hermle can trade even lower. This is a table from the annual report 2000 showing that during the Dot.com boom in 1999/2000, Hermle traded at a PE of 6 and 8x despite doubling profits over a 2 year time span from 1998-2000.

Nevertheless, for my the cyclical risk is more than mitigated by the far below histaorical averages valuation of the stock.

Summary & Game plan

As outlined above, I do think that Hermle offers a decent risk/return profile for the patient investor. The current dividend yield is almost 7%, there is a good chance of some growth going forward and any multiple mean reversion comes on top.

On the other hand, the order book at year end 2023 was weaker than in 2022 and the company already mentioned that the first few weeks in 2024 have been more difficult. The big question is of course to what extent this is priced in or not.

Because of the current weak business momentum, I decided to start with a 3% position at an average price of 222 EUR/share. Based on its quality, Hermle would justify a larger position, but I am “speculating” here that I can maybe increase the position cheaper during 2024.

We will see if this works out our. Not. Funnily enough, in the last 18-24 months, my smaller positions have almost always performed better than my larger “conviction buys”.

Bonus Track: Don’t bring me down – Electronic Light Orchestra

As in my last few pitches, here is a Bonus track that in my opinion fits very well to a hidden German Mittelstand Champion like Hermle: Don’t bring me down from ELO.

Let me share some experience from semiconductor industry for CNC use cases:

Yes, 5 axis is great and beautiful jigs, fixtures can be manufactured

But: it can be done at 80% less cost in china when accepting worse tolerances and quality.

Manufacturing is in China and local sourcing is just crazy.

So maybe this slows down TAM for these high end devices. Let’s see!

Agree that doing things in China is cheaper. But I guess for certain high end Applikations (defense, med tech) it is simple not an option.

I love the pdf! It is so cool that you have presented an old favorite of mine. All the information is correct, and prette comprehensive. What I love most, is the service spirit. All people dealing with Hermle that I have spoken to, have also said they think the service is a true asset.

As I also wondered which industries Hermle mainly serves, they told me they do not publish exact segments – as they told you. But they also said that there is no cluster risk, that their machines are used in a wide array of industries and applications. Just the same with markets – there does not seem to be one core market, but rather business in many countries.

This is a keeper.

Hi mmi,

Good post and nice to see that you like Hermle too.

Far and away my largest holding before and again since last year. I just can’t understand why it’s trading so low, in my personal opinion of course. No need to understand it either, I just kept buying. But the thin trading is certainly an issue. I like it, because it’s probably one of the main reasons for the price inefficiency (subjective of course). I guess it’s not interesting for many larger market participants. Even as a private investor it can take some days to fill orders sometimes.

And you mentioned Returns on Capital. I always look at Return on Equity, which I found similarly impressive, especially with the high equity ratio. And I take it mainly as signs of pricing power and product quality, just as you did seemingly.

Funny thing to me personally. I am always outspoken about my holdings and what I like. But so far, judging from feedback, I couldn’t yet convince anybody (outside my family) about Hermle. So, I find that amusing. My very high conviction and others not sharing it obviously. Always interesting how people value the same thing (with same information) differently.

Well, lets see how it will all work out. Two more things. 1. I am very positive about the US market. 2. Similiar to what you wrote about their IPO, I have no idea why Hermle is a listed company in the first place. No idea why they don’t take it private. However, I hope they don’t, at least not with the current stock price. I would value Hermle at around 500 €/share and such a premium seems improbable. Actually I value it higher than that, but ok.. We will see.

buccaneer

Interesting. Good work, as usual. Are their 2023 annual report/financials available? I only found 2022.

For 2023, there are only preliminatry numbers. Annual report is yet to be published.

hermle.de/fileadmin/website/5_News-und-Media/5_2_Mediathek/Geschäftsberichte/Geschäftsbericht_2023.pdf

Hermle is my largest position. Thanks for covering it. I was at the Annual Meeting 2023 in Gosheim (takes a long time to get there from Lower Saxony). It was worth is. Round trip through the factory included.