This is a follow-up to both, my recent post about EV/EBIT & Co as well as a discussion in a forum about how cheap German utility stocks really are.

German utility stocks are clearly in many lists for cheap stocks. Here is for instance a list of large utilities in Europe sorted by EV/EBIT:

| Name |

Mkt Cap |

Curr EV/T12M EBITDA |

EV/T12M EBIT |

| |

|

|

|

| ENDESA SA |

23038.45 |

4.43 |

7.17 |

| RWE AG |

16827.67 |

3.06 |

7.27 |

| E.ON SE |

27849.92 |

4.89 |

7.64 |

| PGE SA |

8340.95 |

4.55 |

7.74 |

| GDF SUEZ |

41669.47 |

5.31 |

10.04 |

| VERBUND AG |

5739.31 |

4.93 |

10.07 |

| EDF |

49364.74 |

5.83 |

11.08 |

| GAS NATURAL SDG SA |

18052.44 |

6.91 |

11.26 |

| DRAX GROUP PLC |

3286.74 |

9.41 |

12.12 |

| NATIONAL GRID PLC |

34397.63 |

10.20 |

14.02 |

| ENEL SPA |

30805.4 |

6.22 |

14.94 |

| A2A SPA |

2562.72 |

7.52 |

15.16 |

| ROMANDE ENERGIE HOLDING-REG |

1066.69 |

9.56 |

18.64 |

| SSE PLC |

15811.63 |

12.01 |

18.76 |

| IBERDROLA SA |

29309.16 |

9.92 |

21.69 |

| PUBLIC POWER CORP |

2343.2 |

6.87 |

21.72 |

Apart from Endesa, EON and RWE really look like bargains. Even most “club Med” Italian utilities are trading at twice the EV/EBIT or Ev/EBITD levels than RWE and EON. A “mechanical” investor will say: I don’t care if they have issues, I will buy them because they are cheap.

However, there is a small problem: As many people know, following the Fukushima incident, the German Government decided in 2011 to speed up the exit from nuclear power and switch off the last nuclear power plant in 2011. Funnily enough, only in 2009, they decided to extend the licenses significantly.

Anyway, just switching of a nuclear power plant is not enough. Especially in a densely populated country like Germany, you don’t want to have those nuclear ruins everywhere. So the utilites are required to fully “decommission” the reactors and also all the nuclear waste. Decommissioning is expensive, for instance it is estimated for instance at currently 70 bn GBP for all UK nuclear power plant.

In order to avoid that utilities just go broke before they close their nuclear power plants, the are required to build up reserve accounts in their balance sheet. Let’s take a look into their 2012 annual report page 159:

EON has 16 bn EUR of reserves on its balance sheet for the decommissioning of nuclear power plants. Those 16 bn are clearly already reserved in the balance sheet, but as they will be due in cash rather sooner than later, they should be clearly treated as debt and added to Enterprise value.

However, there is a second issue with them: For some reasons, they are allowed to discount those amounts with 5% p.a. This is around 2% higher than for pension liabilities which in my opinion is already quite “optimistic”. They do not offer any hint about the duration of those liabilities, but if we assume something like 10-15, just adjusting the discount rate to pension levels would increase those reserves by 3-5 bn and reduce book value by the same amount.

So all in all, net financial debt for EON more than doubles if we take into account a realistic value for the nuclear waste removal obligations.

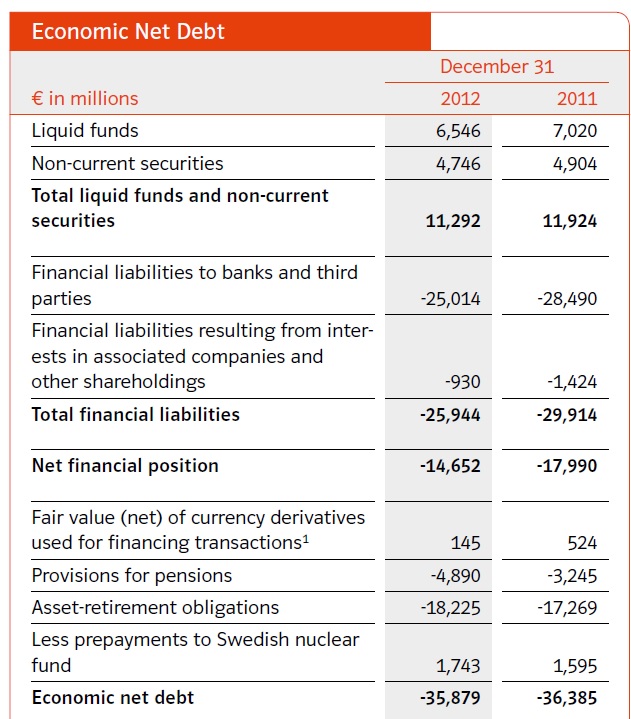

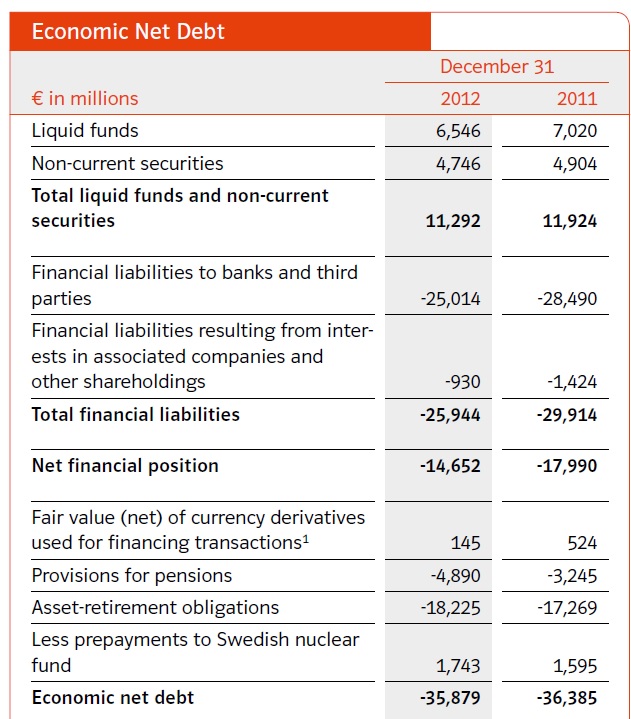

Interestingly enough, E.on presents its own “economic financial debt” calculation on page 45 of the annual report, including pensions etc.:

If we adjust the nuclear liabilities for the unrealistical discount rate, we get around 40 bn “economic” finanicial debt. So let’s look how EV/EBIT and EV/EBITDA change if we use those debt figures:

Before adjustment:

Enterprise Value of 48 bn (28 bn Equity, 3 bn minorities, 23.5 bn debt minus 6.8 bn cash)

EBITDA ~ 9.8 bn

EBIT ~6.3 bn

Adjusting for economic debt, we get an EV of 71 bn and the ratios change as follows

EV/EBITDA adj = 7.2 v. 4.9 unadj.

EV/EBIT adj = 11.3 vs. 7.6 unadj.

So adjusting for economical debt already eliminates most of the “undervaluation” compared to the peers. All things equal, a Verbund for instance which only produces “clean” power at the same valuation seems to be a much much safer bet than EON.

Summary:

Even quite useful metrics like EV/EBIT and EV/EBITDA can be misleading if a company has large other liabilities which turn out to be very similar to debt. If a company looks cheap under EV/EBITDA, always check if there are pensions, operating leases or in the case of utilities Decommissioning liabilities which are not captured by the standard formula.

In this case, the company evene presents its “true” debt, but it is still not adequately reflected in almost every investment database.

Finally a quick word on “mechanical” investment strategies: I cannot prove it, but I am pretty sure that a mechanical strategy based on EV which adjusts for “obvious” shortcomings like operating leases should perform even better than the published results from O’s et al. However It is almost impossible to backtest this.