A very quick Champagne Peer Group Check (Laurent Perrier, Vranken-Pommery, Lanson BCC)

For the new year, one of my todos was to check the other two listed Champagne Houses in France, Vranken-Pommery and Lanson BCC.

As I mentioned in the original post, my main motivation to buy Laurent Perrier was that it’s name always showed up when I looked up Gerard Perrier.

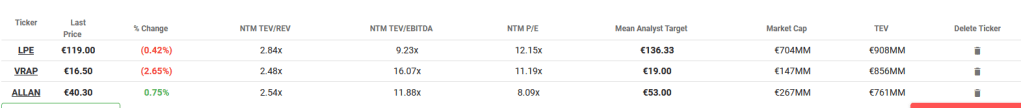

Using TIKR as a quick comparison tool, one can see, that the two other players; Vranken-Pommery and Lanson-BCC trade at even lower PEs than Laurent Perrier:

Financials

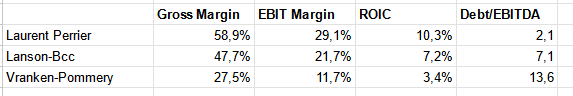

However, we can also see that the other players are much more indebted that Laurent Perrier. The next table that I have compiled from TIKR numbers shows that Laurent Perrier ist both, more profitable ad a lot less indebted than the oher two:

One could argue that the potetnial of Vranken-Pommery could be higher if they manage to improve their margins. However their EBIT margin is currently at the 15 year average and was only better some 20 years ago. I honestly do not fully understand why their margins are so much lower than Laurent Perrier’s (and Lanson’s), but I am not sure if it is worth finding out. The high debt load also inserts some existentia risk into this businesses if, for some reason, they would have a really bad year or two.

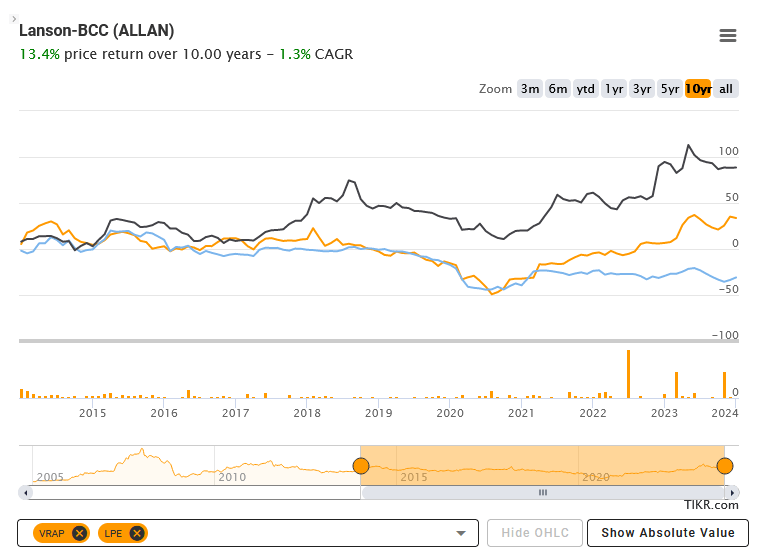

lso the 10 yearchart shows a clear picture: Over then years, Laurent Perrier (black) outperformed its peers clearly.

Logos

My final, subjective criteria would be the Logo. Here are the three logos:

I am maybe biased here, but for my, only Laurent Perrier’s logo has real class. The other logos look more like logos for fireworks.

Taste:

One thing I will not discuss here is taste. I did a Champagne tasting once and I was surprised how different different brands of Champagne are actually tasting. However, taste is a very subjective thing and I am not sure what amount of Champagne is actually bought for taste. Myself, I only drink Champagne very occaionally, maybe once a year so I am definitely not qualified to come up with an opinion here. Even worse, personally, I do actually prefer a good Prosecco if I would have the choice. Much better value for money.

Summary:

This was clearly not a deep dive and as mentioned, my Laurent Perrier position is only a small position for me that I own more for fun. It is however interesting to see that based on a couple of KPI’s, Laurent Perrier looks much better than the other two “pure play” listed Champagne houses. Therefore I’ll stick with LAurent Perrier for the time being…

Some Belgian (I know you have a soft spot for Belgium) insights on Vranken: it was founded by the son of a manager of D’Ieteren (holdco). Vranken is a company that sells their Champagne in large retail chains (publicly traded (Ahold-)Delhaize and Colruyt I know of). I have seem them on shelves in Belgium and France.

The recent tendency of wine enthousiasts is more toward so called grower champagnes because these are farmers who are realizing themselves that there is money in keeping the grapes and making the wine themselves. When combined with renewed interest in sustainable farming practice, these make much better wine. If this path in producing Champagne and costumer behavior is to become widespread, brands like Vranken will probably suffer more because they are neither one of the large houses nor are they known for producing high quality small scale wines.

In an article from a couple of years ago one of Vrankens top managers declared that they keep a high ratio of debt because of the fact that they have an inventory worth two years of production in their cellars so in case of trouble they can just start selling off these already produced wines. That, at least, is what they claimed. Sounds credible to me but what do I know.

For me this company has been for many years one of the type I like to categorize as „possibly interesting but too high a chance of being a boring trip to nowhere. Also known as nicht anfassen.

Thank you very much. very insightful.

I‘d go for a Franciacorta instead of a Prosecco.

You do have a point here.

The problem with the big champagne houses is that they don’t own the actual vineyards (L-P is only about 20 %). The growers are starting to produce their own champagnes, presumably with their better grapes, and there evidently isn’t much the big houses can do about it, except to buy more land. It looks like the vineyard owners are going to be the major beneficiaries in the business.

Thanks for finding. If you ever want to go down the rabbit hole a quick book is But First Champagne. A longer book is Widow Cliquot. It’s surprising how many champagne houses buy all of their grapes. That is probably what causes the much lower gross margin you are seeing at Pommery. Because frankly, a consumer staples should have a much higher gross margin with the brand like that.

Thank you for the reading tips. Highly appreciated.

Not pure Champagne, but Schloss Wachenheim AG is in adjacent business and you should check it too.