Quick Updates: Frosta, Alimanetation Couche-Tard, Bombardier, Bouvet & Robertet

- Gross Margin of Frosta actually slightly increased from 48,9% to 50%

- Personal cost in % of sales developed slightly negatively from -14,7% to -14,9%

- The big driver were “other costs” that increased from -21,9% to -24,1% (or a full -28 mn EUR before tax)

Frosta explains this as follows:

“Der Anstieg der sonstigen betrieblichen Aufwendungen ist zum einen auf die erneut erhöhten

Werbeinvestitionen in allen Märkten zurückzuführen, die notwendig sind, um zukünftiges

Wachstum im Markengeschäft zu sichern. Zum anderen wurden Maßnahmen zur Optimierung

der Lagerkapazitäten und der Sicherheitsbestände umgesetzt. Diese führten zwar vorüberge-

hend zu höheren Kosten in der Supply Chain, haben FRoSTA jedoch gut darauf vorbereitet,

auch in den kommenden Jahren ein hohes Servicelevel für unsere Kunden sicherzustellen.”

So they say that this increase is mostly driven by higher advertising expenses and “Supply chain optimization” to prepare for the future. You could also interpret this as investments into the future. In the notes this position contains an extra of 5 mn FX expenses (most likely Zloty) compared to last year.

Overall, my first verdict is that the numbers are much better than the look at first sight.

Alimentation Couche-Tard

ACT had their Investor Day 2 days ago with a brand new Investor presentation. A few highlights from my side:

The long term growth track record is still good, but the last 2 years were not good. What I like from ACT that they don’t hide it.

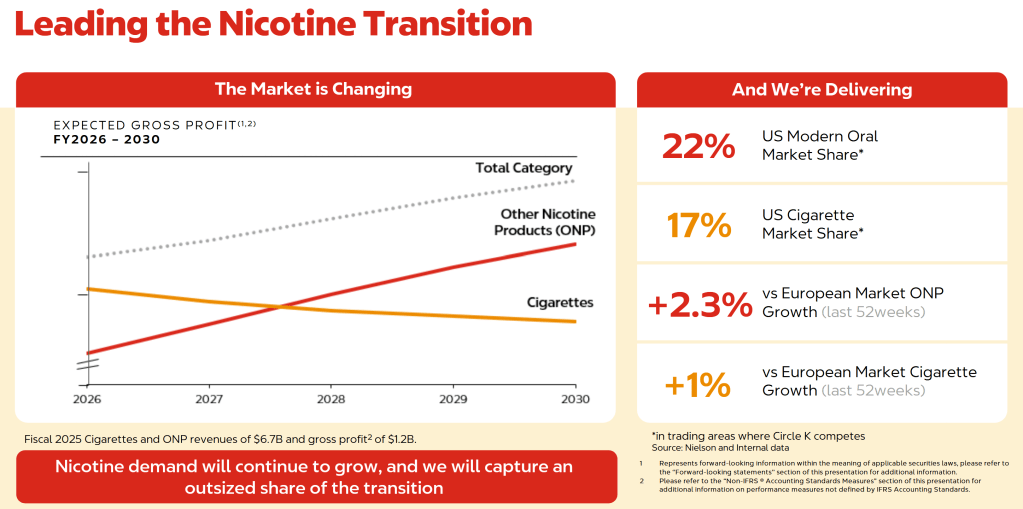

Owning ACT also means significant Tobacco exposure. I was surprised on how large their market share is in North America is. To be honest, I am not 100% comofrtable wiht this.

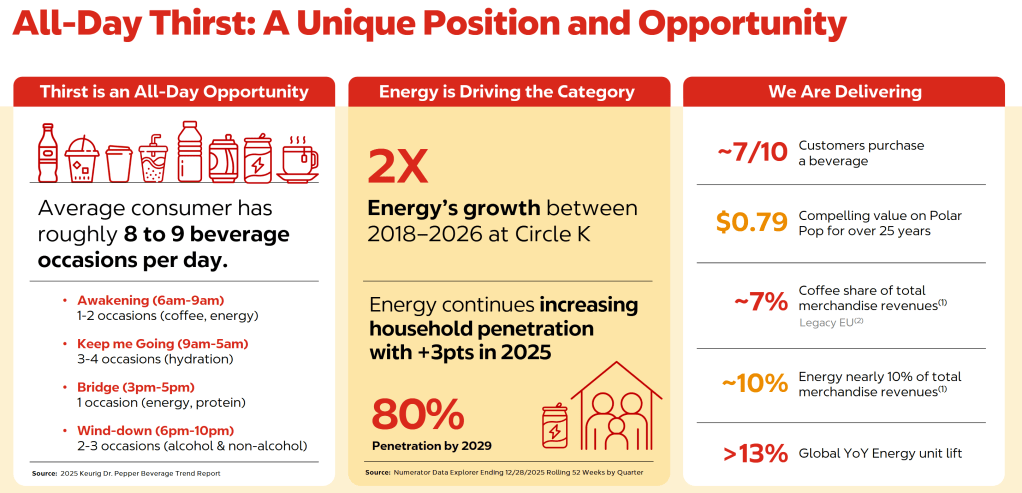

Also, Energy Drinks play a significant role at ACT:

Overall, my impression is that they now seem to focus again on “operational excellence” and store roll-outs after the broken Mega Deal with 7-eleven from Japan.

They target 10%+ EPS growth until 2030 (including buybacks). At a current P/E of 20xNTM and a dividend yield of ~8,8%, I do think that the Growth rate also equals more or less the expected return. The question I need to answer at some point is, if this is attractive relative to other opportunities or not.

Bombardier

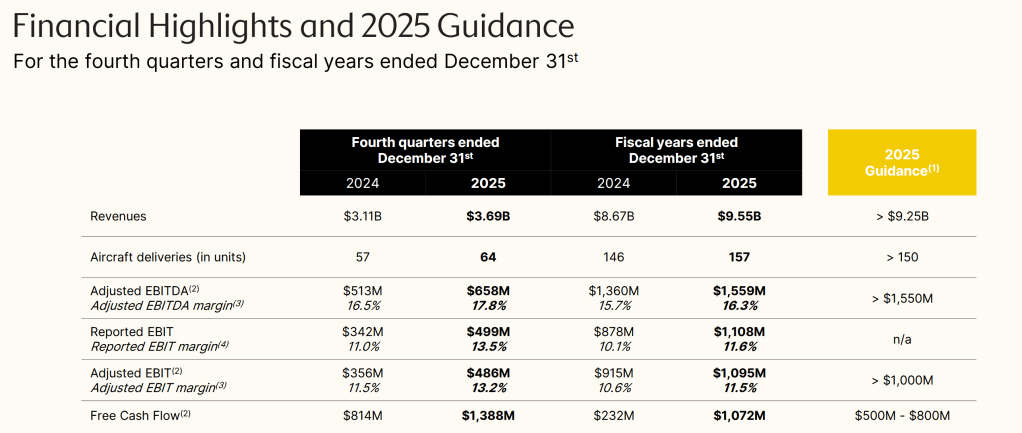

Bombardier published 2025 numbers yesterday and especially Cash flow generation was significantly above guidance:

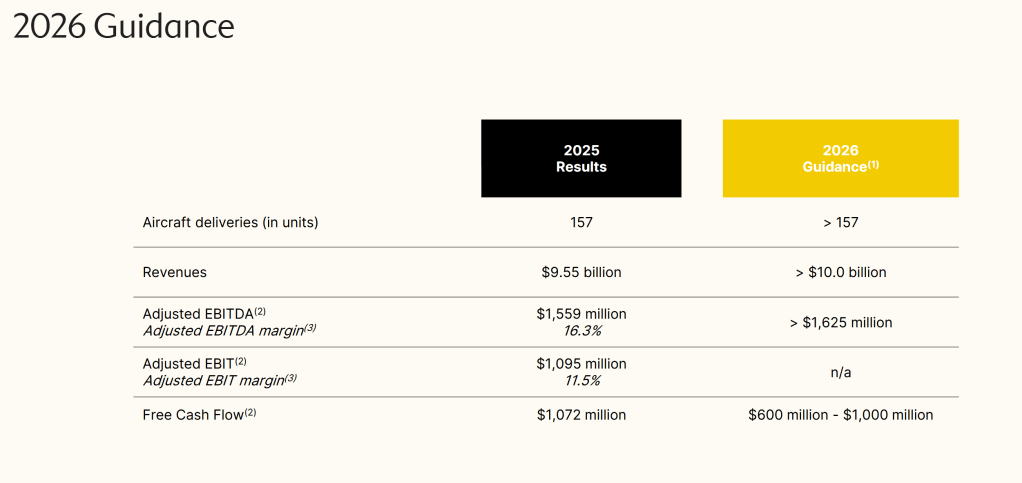

Margins increased nicley. Maybe only the guidance was a little bit on the conservative side:

A less than 5% increase in sales and in EBITDA is maybe a little bit on the low side for a stock that now trades at 24x NTM P/E. However, with the inreased backlog, overall the future still looks quite bright for Bombardier despite Trump’s recent attempts to hurt the Canadian Aviation industry.

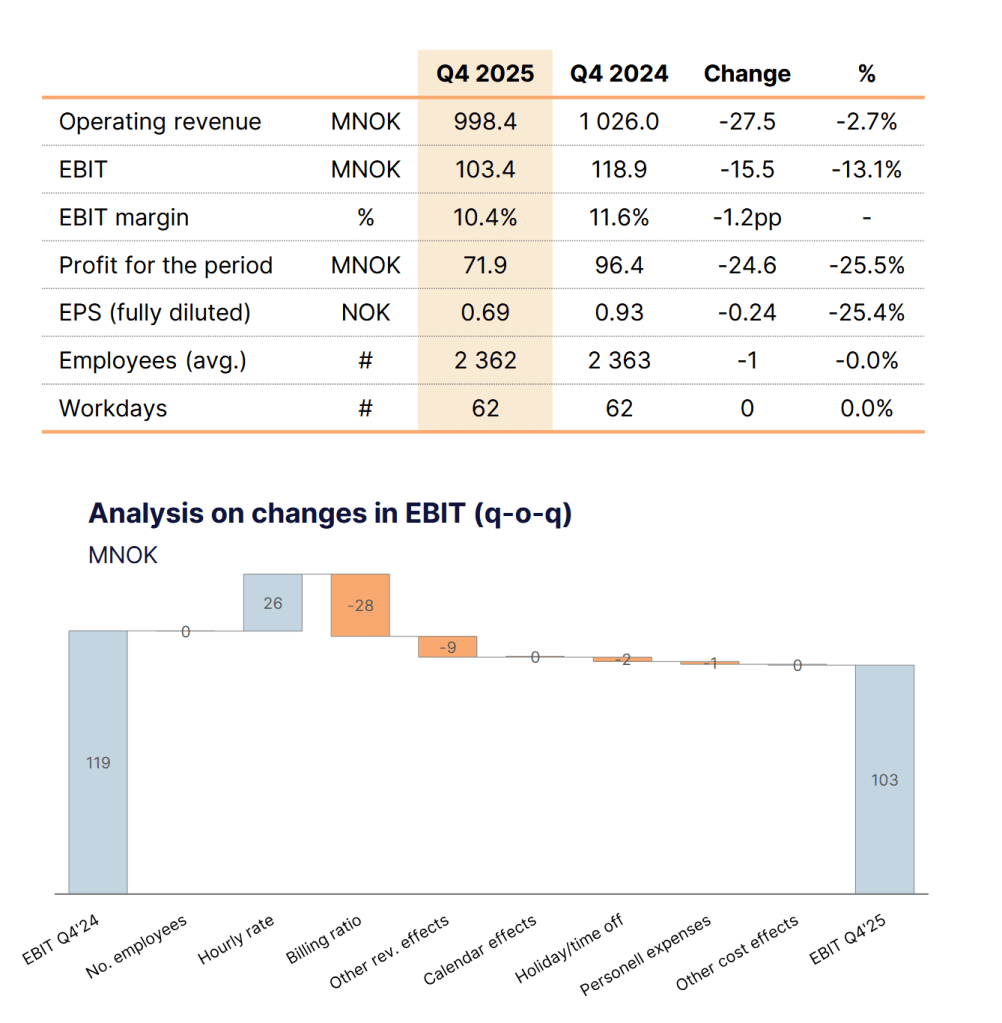

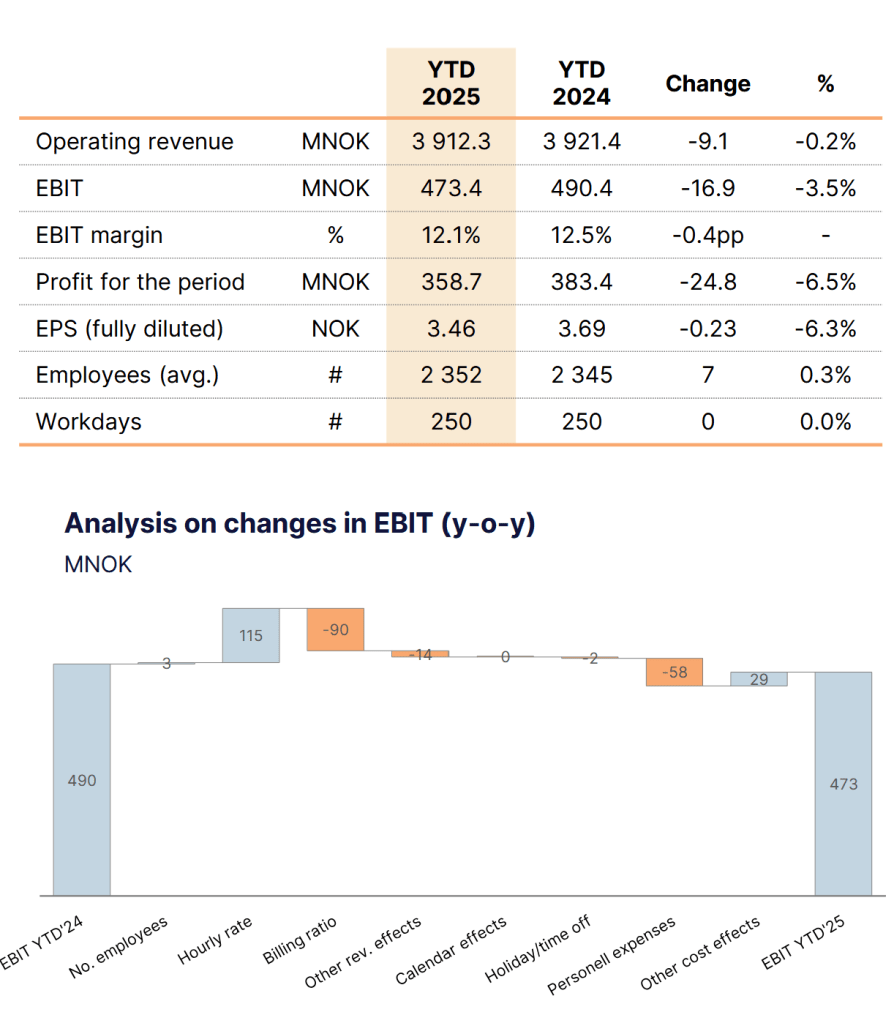

Bouvet

Bouvet released Q4 2025 and 2025 numbers today. In a nutshell, Q4 2025 was not a good quarter:

Looking at the chart it becomes clear that despite price increases, they could just not sell enough consulting services.

On a full year basis, th weak Q4 lead to a slight decrease in slaes and earnings:

I think they still manage this quite well but for the time being, things don’t look so good. It explains the~-30% stock price decline over the past 12 monhts. At 14x NTM, the stock is not expensive but I think it is now important to undertand if this is temporary or more structural (AI).

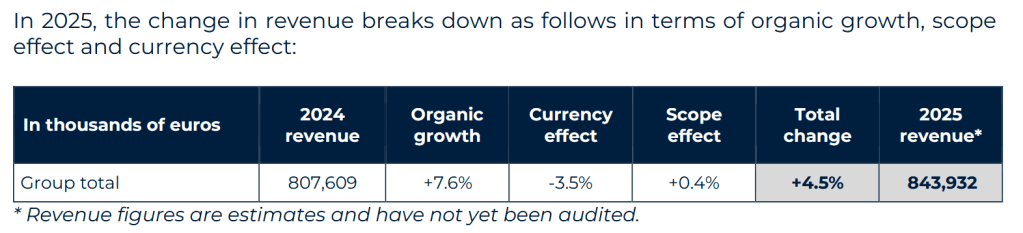

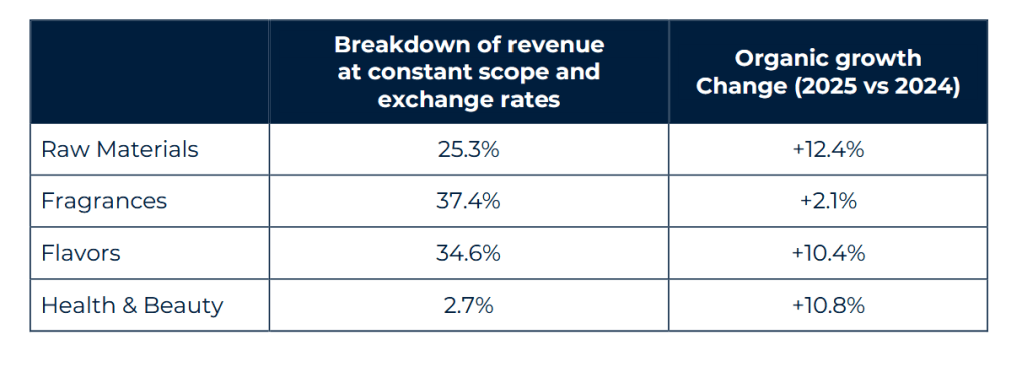

Robertet

Robertet came out with 2025 revenue numbers yeasterday. At first sight they look good. Despit currency headwinds, Sales were up organically +4,5%:

Interestingly, this was driven by flavors and raw materials, not fragrances:

The most positive sentence of the release is the last one:

So overall, very decent numbers from Robertet, also especially compared to its competitors.

Appreciate the write-up. Glad I added a position in Bombardier when you recommended it, though in retrospect the position was way too small…

Have you looked at Adyen (Dutch payments company Wintergems has written up)? The stock took a beating because they lowered guidance for 2026 from 25% growth to 20% growth and from margin expansion to no margin expansion. The payments space is a little dynamic lately (and perhaps too competitive from an investors point of view) with both Fiserv and Paypal having issues. Adyen’s best positioned competitor appears to be Stripe, but they are privately held. Anyways, I think the stock price looks interesting and bought some.