Draeger Genußscheine (ISIN DE0005550719) Update

No real news but a very interesting developement at my largest portfolio position, Draeger Genußscheine.

As a refresher: The “Genußscheine” include the right to receive 10 times the dividend of the pref shares (DRW3, ISIN DE0005550636). I started the position as a long Genußschein / Short pref shares “carry trade”. I decided to cover the short when Drager issued a EUR 210 offer and keep the Genußscheine as this put a floor under the price.

Now, in the last view days one can see something interesting happening: The Pref shares trade lower while the Genußscheine jumped.

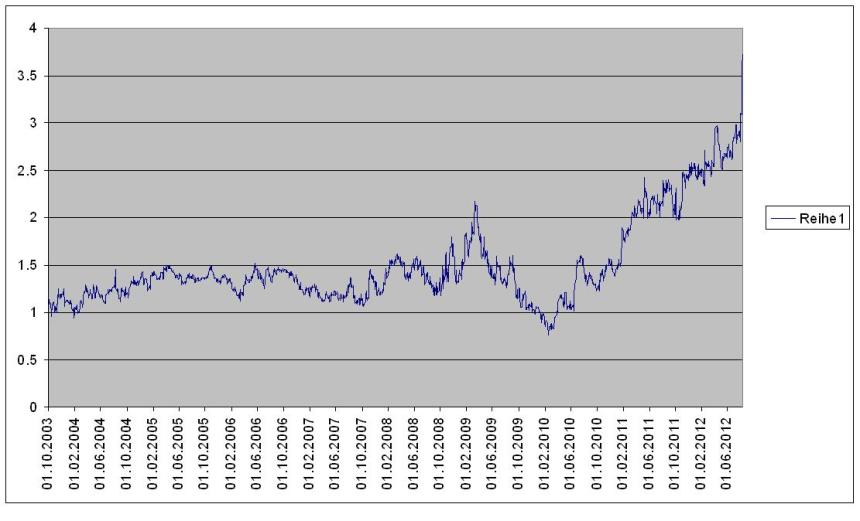

If we look at the 10 year history of price of the Genußscheine divided by price of the prefs , we can see that the relation has increased significantly to a 10 year high at currently around 3.7 times.

I didn’t find any real news, however in some internet boards there is a speculation that either Draeger might increase the dividend or even come out with a higher offer. I am not sure about that if they will really do something.

Back then I wrote the following:

For the patient investor, I think the Genußscheine will be still an intersting medium term investment. For the portfolio I will hold them unless I find something better, there is no need to sell.

I think this is the same lesson as from the AIRE KGaA example as well as with the Bertelsmann Genußschein: If someone really wants to have a company or a certain share class / security , it usually pays off to wait and not jump on the first offer.

In the past, I often used to sell at the first offer, being happy to make a nice gain quickly. But as those two example show (so far), the risk /return relationship of just doing nothing and wait further seems to be quite good.

The only “problem” now is that the position is currently 10.2% of the portfolio. a ~10% is kind of the maximum I can stand for a single position, I will have to decide to sell if the Genußschein moves further.