Biontech: Checking in once again & using LLMs to value the Pipeline

Disclaimer: This is not Investment advice. PLEASE DO YOU OWN RESEARCH:

Management summary (Spoiler):

After selling Biontechs a few years ago, I reviewed Biontech once again by using LLMs to evaluate the development pipeline. Although this was an extremely interesting exercise, it is not an investment for me for the time being.

Background:

Biontech is a company I have owned in the past and written about. It became famous because they were the first to develop a MRNA based vaccine against Covid which they sold worldwide together with Pfizer.

My initial write-up can be found here, a follow up here.

Especially the follow up analysis was clearly too optimistic with regard to the general vaccine market. I eventually sold the rest of the position for ~77 EUR/share in 2024 but overall it was very profitable. My goal was to continue to follow the company as it is clearly one of the most innovative German companies.

Just recently, Profitlich & Schmidlin dedicated a recent post to Biontech which triggered this review. They had written in the past about Biontech, for instance in January 2025.

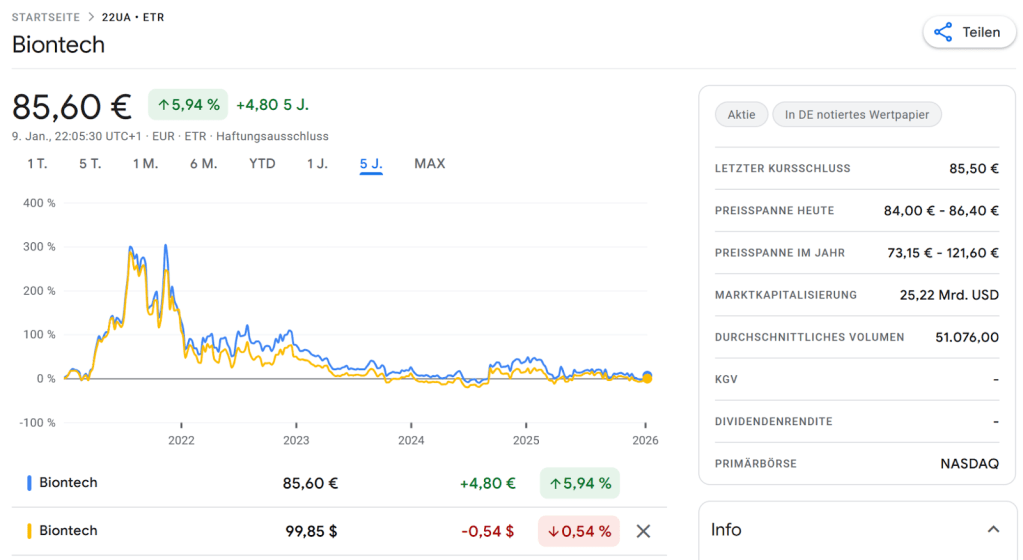

Before diving into the fundamentals, let’s look quickly at the stock chart: The share price in of Biontech has flatlined in USD and EUR.

Interestingly, Biontech is now back to where it was before the Covid hype and valued at 25 bn USD or ~22 bn EUR..

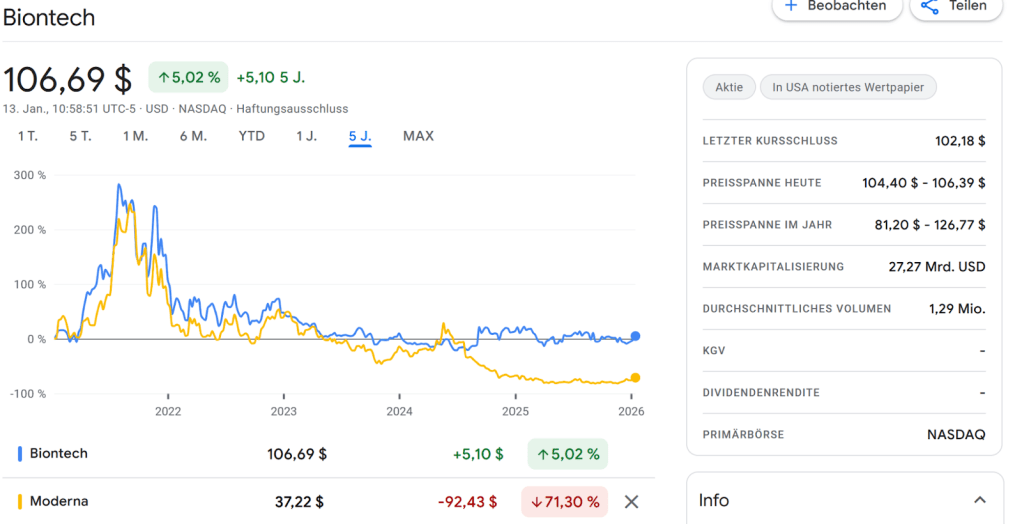

Looking at this positively, the stock has done a lot better than Moderna over the past 5 years:

To my understanding, Moderna had focused more or less fully on vaccines and spent aggressively which under the current “ anti vaxxer” regime of RFK jr was not a ery good strategy.

Biontech in contrast seems to have “diversified” much better. The blockbuster Deal of “BNT327” with Bristol Myers for instance is not a MRNA based technology. This BNT327 had been licensed by Biontech only 6 months earlier from a Chinese company at a fraction of the value they will get from Bristol Myers.

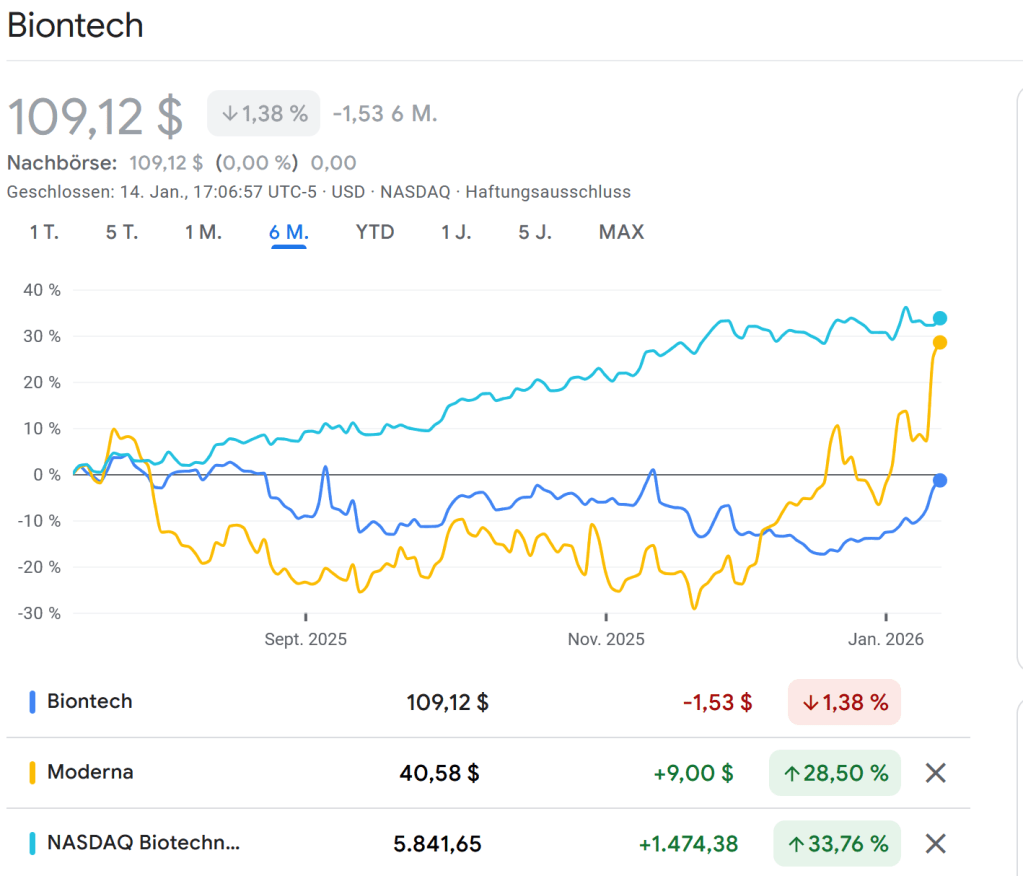

Another interesting observation is that Biotech so far did not participate much in the recent recovery in the Biotech indices as we can see in this 6M chart:

Even Moderna did participate in the last few days but not Biontech.

Maybe that’s the reason why even “trendsurfer” Ritchie Dobensberger has them in his Wikifolio as a smaller position.

Back to Biontech

Strategically Biontech seems to be quite flexible and nimble to go for opportunities outside its core MRNA technology which was the basis of the Covid Vaccine.

The purchase of the Chinese Startup Biotheseus for instance seemed to have been a real coup. Bought for 800 mn USD in November 2024, only 6 months later, they landed a big deal with Bristol Myers for exactly that one drug which is now called BNT327, giving them 2 bn USD in advance payments plus a 50% royalty share

This deal aside, for the rest of the company it is for someone like me very challenging to understand what is really going on and especially how to value the company.

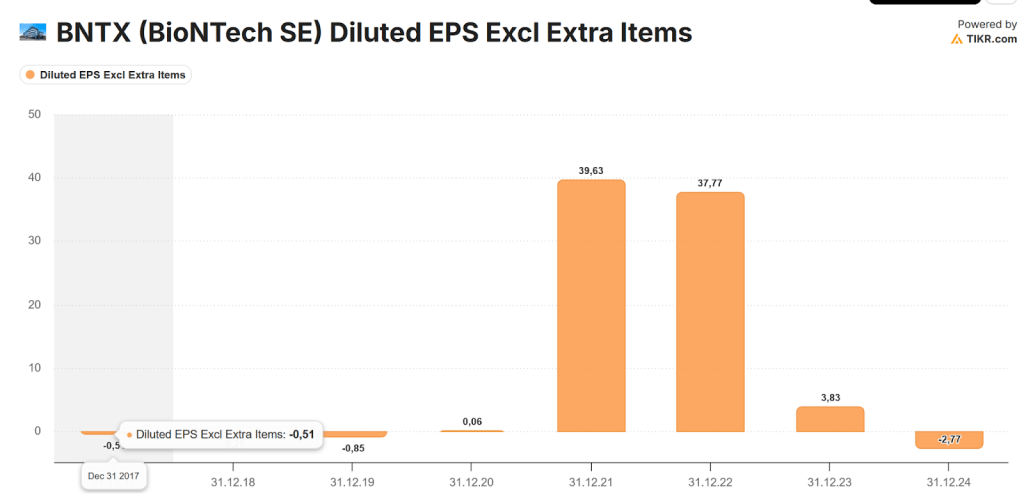

Looking at the EPS since IPO tells us that the Covid Vaccine led to 2 great years but this is clearly no indication what is going to happen in the future:

So in Biotech’s case, the valuation needs to be a combination of using the existing Net cash plus an assumption on how much the pipeline of projects is worth.

Looking at the most recent presentation from a few days ago, I have very little idea which of those projects has what kind of chance of success.

Financials

So let’s quickly look at the financialsl. At year end 2025, Biontech had around 17 bn EUR in Cash or securities against a Market cap of 22 bn EUR. To my understanding, this includes already the 1,25 bn EUR cash out for the Curevac acquisition which in itself was an interesting transaction.

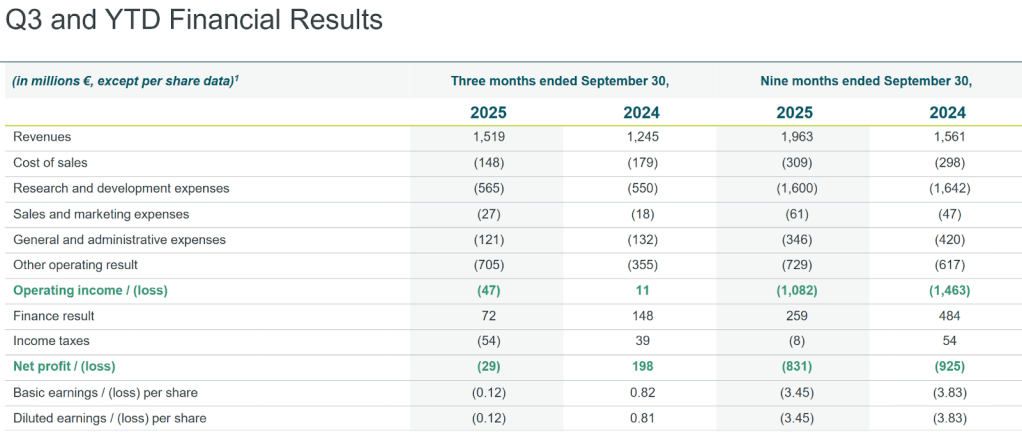

A quick look at Q3 numbers and the presentation shows that the company is GAAP loss making, although 2025 YTD loss is smaller than 2024:

On the plus side, operationally they seem to have been cash flow positive in 2025, mostly due to the payments for BNT 327 and the remaining Covid vaccine sales.

This is quite an achievement for a Biotech company and Biontech indicated that 2026 will look roughly the same with slightly lower vaccine sales.

Maybe a bet on the Jockey ?

In my earlier posts I mentioned that I consider Biontechs Management, Ugur Shain and his wife as absolute top notch scientists and entrepreneurs, which so far they clearly have proven.

So one could simplify the analysis and say: At a 5 bn valuation ex cash, this could be a relatively easy bet in the Jockey(s).

On the other hand, the Moderna CEO and founder looked like a genius for some time until he didn’t.

My preliminary (human) Summary: Too hard pile

Somehow I am really tempted to do a “trade” here: Biontech looks cheap, is lagging the Biotech indices significantly and has some nice successes plus very good management.

On the other hand, I have no idea how to value this company which is of course not a good thing for a “value investor”.

So normally I would put them right on the “too hard” pile.

AI enters the room: Gemini & ChatGPT Deep research

I asked Gemini Deep Research to look at the latest Biontech presentation and analyse the pipeline with regard to sales potential, probability of success and time to market.

Gemini gave me a detailed report and without being explicitly asked for came to the following conclusion:

Valuation Outlook: Our detailed modeling of clinical assets suggests that the risk-adjusted Net Present Value (rNPV) of the oncology pipeline underestimates current market sentiment, which is still heavily influenced by declining COVID revenues. We forecast the beginning of a new revenue era starting in 2026/2027 driven by initial oncology launches, leading to a diversified revenue stream by 2030 that significantly reduces reliance on infectious diseases.

I ask myself now what do I do with it ?

One obvious thing to do is to let ChatGPT Deep research analyse Gemini’s results critically. That’s what I did. i also asked ChatGPT to put a value on Biotech’s Pipeline.

ChatGPT basically agreed with Gemini (I guess both are trained on the same data) and gave me this conclusion:

Conclusion (Early 2026)

BioNTech has transitioned from a pure COVID vaccine company to a diversified oncology player. Based on rNPV analysis, the stock appears undervalued. Even conservative assumptions imply fair value above current market capitalization. Significant risks remain (competition, regulatory hurdles, manufacturing complexity), but BioNTech’s €17.2bn cash position provides a substantial safety buffer. The market currently prices the pipeline close to a bear scenario, creating meaningful upside if upcoming Phase 3 readouts are positive.

With regard to the value of the pipeline ChatGPT gets the following results:

Risk-Adjusted Pipeline Valuation (rNPV) and Scenarios

- Base case: Oncology pipeline rNPV ~€7–8bn → total equity value incl. cash ~€24–25bn

- Bull case: rNPV ~€14–15bn → total ~€32bn

- Bear case: rNPV ~€2–3bn → value largely equals cash (~€19–20bn)

Running these two analyses only took me like 30 minutes, including wait time. I guess if I would have tried to do that myself with Google Search, it might have taken me a 100x in real time.

The ChatGPT Cross check is quite easy to read and lines out what assumptions are made which I find super interesting. I still cannot fully judge if this is any good but it all sounds quite plausible.

Just for Fun, I asked ChatGPT to do a Deep Dive into BNT 327. It gave me a very detailed review of the expected timeline, issues and competition. Including the Bristol Myers Deal, it gave me an approx. NPV of around 8 bn which is roughly 50% of the value of the overall pipeline in the Bull case.

So what to do now ?

The question now is: Do I trust the results ? And even if I do, is it an attractive investments given the inherent risks in Biotech ?

Leaving the pipeline aside, the following points speak for Biontech:

- run by very capable management

- successfully broadened their offering / Technology from the initial MRNA

- achieved a potential “blockbuster deal” with BNT 327

- Operating cashflow positive

- did not participate in the recent Biotech rally

On the minus side we have:

- additional complexity due to the Curevac take-over

- law suits (from Moderna)

- Covid vaccine business shrinking

- chaos/uncertainty in the US, both on the regulatory side but also with regard to future pricing (Thanks to “MAHA”)

- overall increasing competition from China. It is questionable if a deal like BNT 327 could be repeated.

Scenarios:

Let’s park the LLM question for a second and look at an Upside and downside scenario for the next 12 months..

Let’s assume that the ~17 bn EUR cash or 72 EUR per share will remain constant. Then I would argue that the lower bound for the share price should be maybe the lows from 2024 at around 80 EUR per share as they now have at least the potential BNT 327 Blockbuster including the 2 bn payment from Bristol Myers. This would be the Cash plus the residual value of vaccine sales.

From the current share price of around 92 EUR, this would be a downside of ~13%.

For an upside scenario one could either assume that Biontech closes the gap with Moderna and the Biotech index over the past months which would be +30%.

Or I could also assume that the market attributes 100% of the Pipeline value on top of the cash which would be 17 bn plus 15 bn= 144 EU per share or an upside of 45%

If I average the two upside cases and assume a simple 50/50 chance for both, the downside and (average) upside scenario, I get an expected return of ~16%. Not great but not that bad either, depending on the estimated time frame.

The issue for me here is clearly that we don’t have a clearly defined time scale.

For a typical special situation investment, I would need scenarios that I can assign probabilities to as well as a good understanding until when this scenarios can be realized.

In Biotech’s Case, I am not 100% sure how the timeline looks like which makes it very difficult for me to “qualify” this as a special situation.

One could argue that maybe the timeline for BNT 327 could be the trigger.

Why Biontech might not be so attractive for traditional Biotech investors

Traditionally, Biotech investments are characterized by a large number of “duds” and a small number of spectacular outperformers. In Biontech’s case, the issue is that even if BNT 327 will become a blockbuster, you won’t get a 10x return, as the company sits on 17 bn in Cash which is part of the valuation.

Summary:

For me, the summary can be structured into 2 main take-aways:

- Biontech at the moment is not an investment for me. It is not a clear Special situation, nor is it the “steady Eddy” company that I prefer outside special situations. Yes, it has great management, a decent track record and the downside seems to be protected, but it is not a fit for what I am looking for.

- With regard to the capabilities of the LLMs, I was quite impressed by what the models can deliver. It would be interesting to hear from specialists on how they perceive the quality of the analysis, but my gut feeling is that those results are maybe 70-80% of what a real specialist could do.

I find it really fascinating that you can get to this level by using LLMs. And clearly a further argument that LLms can help to widen the circle of competence in a much shorter period of time than in the old days.

P.S.: In the past, I might have not written about such an analysis if it doesn’t lead to an investment. As I now have more time, I will also publish efforts that don’t lead to an investment.

I hope that this is still interesting for readers. For me it is also a tool to better track “second order” mistakes that I make when I do not invest in a potentially interesting stock.

it is a speculative bet. Rwd or black not an investment