Performance review 2016 – Comment “Active vs. Passive: The Story of Mr. Cool and Mr. Crap”

Performance 2016:

In 2016, the blog portfolio gained +12,42% (including dividends, no taxes) against 4,55% for the Benchmark (Eurostoxx50 (Perf.Ind) (25%), Eurostoxx small 200 (25%), DAX (30%), MDAX (20%)).

Some other funds that I follow have performed as follows in 2016:

Partners Fund TGV: +15,95%

Profitlich/Schmidlin: +3,13%

Squad European Convictions +18,51%

Ennismore European Smaller Cos -1,49% (in EUR)

Frankfurter Aktienfonds für Stiftungen +6,2%%

Evermore Global Value +21,5%

Greiff Special Situation +5,88%

Since inception (01.01.2011), this translates into +135,6% or +16,9% p.a. vs. 69,5% or 10,1% p.a. for the benchmark. Graphically this looks like this:

The full details can be seen as always on the performance page.

This was now the 6th year in a row that the performance of the portfolio outperformed the benchmark. For the statistics fans, this was achieved with a Sharpe Ratio of around 1,51 based on monthly returns over 6 years.

The portfolio is a lot less volatile than the market because of many “idiosyncratic” risks in the portfolio. I would not call it less risky than the benchmark, but it has (on purpose) a different risk profile. The maximum drawdown 2016 was somewhere in the range of -7% to -8% in February compared to drawdowns of -15% to -20% of most benchmarks in the same period.

Again, as I mention every year: This outperformance is to a large extent coincidence. Normally I would expect to slightly underperform in a positive year.As every “hot streak” will come to an end at some point, I expect relative underperformance in the future especially if the markets keep going up like the do at the time of writing.

Current portfolio / Portfolio transaction

The current portfolio can be seen as always on the portfolio page. I have already mentioned the 2016 transactions in the “27 for 2017” post. As I forgot one stock (Delta Lloyd), here is the full list of transactions for 2016:

Compared to last year, Hornbach, Koc, the Depfy TRY bond, the HT1 Bond, NN Group, Citizen’s and Greenlight have been sold. New positions bought in 2016 are Dom Security, Majestic Wine, Handelsbanken, Coface, Silver Chef, Italgas and SAPEC, Kuka And Delta Llyod. 2 positions (Gaztransport and Kinder Morgan) went in and out in 2016.

Of the 2016 year-end positions, Kuka will already leave the portfolio in a few days as the deal is closing. The Delta Lloyd deal will also close in spring 2017.

The question remains if the current 28 positions are maybe too much in regard of diversification. I will need to come up with a better way to maneg this in 2017.

Performance attribution

This year I decided to rank the top performers and the losers by absolute contribution to the performance, i.e. multiplying the performance with the beginning portfolio weight. This is the result:

Top 10 positive contributors

| Weight 12/2015 | Perf 2016 | Attribution abs. | |

|---|---|---|---|

| TGS Nopec | 3,02% | 48,81% | 1,47% |

| Installux | 3,44% | 40,76% | 1,40% |

| Bouvet | 2,43% | 57,43% | 1,40% |

| Sapec | 5,00% | 26,60% | 1,33% |

| Coface | 3,00% | 33,33% | 1,00% |

| Partners Fund | 5,34% | 15,95% | 0,99% |

| G. Perrier | 3,94% | 22,30% | 0,85% |

| Dom Security | 2,00% | 39,34% | 0,79% |

| Handelsbanken | 2,50% | 31,18% | 0,78% |

And the 10 most negative contributors:

| Weight 12/2015 | Perf 2016 | Attribution abs. | |

|---|---|---|---|

| Ashmore | 3,54% | -0,13% | 0,00% |

| Majestic Wine | 2,50% | -0,31% | -0,01% |

| Silver Chef | 2,50% | -3,57% | -0,09% |

| Depfa 0% 2022 TRY | 2,25% | -6,10% | -0,14% |

| Van Lanschot | 2,68% | -5,91% | -0,16% |

| Aggreko | 2,43% | -11,65% | -0,28% |

| Hornbach Baumarkt | 3,39% | -9,67% | -0,33% |

| Dt. Pfandbriefbank | 2,41% | -14,73% | -0,35% |

| NN Group | 3,45% | -12,90% | -0,44% |

| Lloyds Bank | 2,32% | -23,42% | -0,54% |

A quick fun fact here: With a group of friends I have a small bet running. Every year we pick our 3 “top picks” for the year and at year-end we make a ranking. The losers have to pay the winners dinner (plus drinks….).

For 2016, my “top 3” had been Lloyd’s, Aggreko and Electrica. So none of my top 10 performers would have been in my top picks but 2 of the top losers. For me that is one clear indication that at least for me a highly concentrated portfolio might not work out all that well…..

One pretty obvious observation is that having UK exposure and financial exposure in 2016 was not helping much.

As a Group, my French stocks performed best, followed by everything (except Aggreko) that had oil/energy exposure. Looking back, I should have clearly done more in Energy as it was pretty clear that some rebound could be expected. I scored some gains with Gaztransport and KMI but I clearly could have done more.

Comment “The story of Mr. Cool and Mr. Crap”

2016 was the year when stock picking (and active investing) died, at least if you did read a lot of “mainstream” financial publications. “Actively managed” funds are losing money at an increasing pace, Index ETFs are booming. As a dedicated stock picker myself, I have to ask myself of course the question: Should I continue do what I am doing or just move into some index funds and use the saved time for doing something else ?

Aswath Damodaran has 2 posts on that topic: Part 1 and Part 2.

One aspect which in my opinion has not been covered well is the following: How do you actually determine if someone is a good active portfolio manager ?

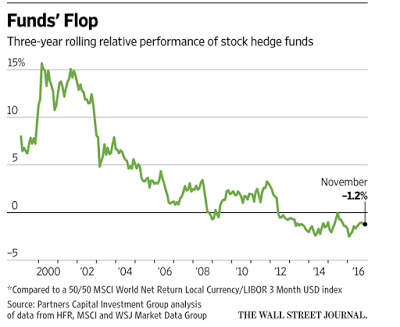

One of the more popular measure (also used by Damodaran) is that you look how a manager who outperforms in a given year performs the next 3 years or some other measure of years of annual outperformance over a fixed time period. This is the chart he is showing

This implies that a good active investor should outperform EVERY year or every period x of rolling years. In my opinion this is a pretty idiotic point of view, especially if you think about the importance of compounding.

Mr. Cool and Mr. Crap

As a matter of fact, there are really many crappy active investors out there. Many fund managers, especially in larger organisations are either glorified but crappy traders or “professional investors” who are actually not very interested in what they were doing, but do the job because it paid exceptionally well.

In many large organizations, people who move to the top are not those who are the best at doing the actual task but those who have the ability to manage the “system” of the organization to their advantage. Especially larger investment management organizations prioritize Assets under Managment (AuM) growth before anything else. As many strategies don’t scale well, larger AuM often negatively impact performance.

The big question is: Why has crappy active investing so successful for such a long time ? My guess is that it is a combination of intransparency, aggressive selling, overall positive markets and short termism.

Let’s look at two different strategies (which I made up but are not totally unrealistic) of 2 portfolio managers, one that I call Mr. Cool, the other is Mr. Crap. Both run a German Large Cap portfolio with the DAX as a benchmark.

Here are the returns of those strategies for the last 20 years:

| DAX Index | ||||||

|---|---|---|---|---|---|---|

| Date | DAX | DAX Return | Mr. Cool Return | Mr. Crap Return | Mr. Cool Outperf. | Mr. Crap Outperf. |

| 31.12.1996 | 2888,69 | |||||

| 31.12.1997 | 4249,69 | 47,1 % | 49,5 % | 44,8 % | 2,4 % | (2,4 %) |

| 31.12.1998 | 5002,39 | 17,7 % | 18,6 % | 16,8 % | 0,9 % | (0,9 %) |

| 31.12.1999 | 6958,14 | 39,1 % | 41,1 % | 37,1 % | 2,0 % | (2,0 %) |

| 29.12.2000 | 6433,61 | (7,5 %) | (11,3 %) | (3,8 %) | (3,8 %) | 3,8 % |

| 31.12.2001 | 5160,1 | (19,8 %) | (29,7 %) | (9,9 %) | (9,9 %) | 9,9 % |

| 31.12.2002 | 2892,63 | (43,9 %) | (65,9 %) | (22,0 %) | (22,0 %) | 22,0 % |

| 31.12.2003 | 3965,16 | 37,1 % | 38,9 % | 35,2 % | 1,9 % | (1,9 %) |

| 31.12.2004 | 4256,08 | 7,3 % | 7,7 % | 7,0 % | 0,4 % | (0,4 %) |

| 30.12.2005 | 5408,26 | 27,1 % | 28,4 % | 25,7 % | 1,4 % | (1,4 %) |

| 29.12.2006 | 6596,92 | 22,0 % | 23,1 % | 20,9 % | 1,1 % | (1,1 %) |

| 31.12.2007 | 8067,32 | 22,3 % | 23,4 % | 21,2 % | 1,1 % | (1,1 %) |

| 31.12.2008 | 4810,2 | (40,4 %) | (60,6 %) | (20,2 %) | (20,2 %) | 20,2 % |

| 31.12.2009 | 5957,43 | 23,8 % | 25,0 % | 22,7 % | 1,2 % | (1,2 %) |

| 31.12.2010 | 6914,19 | 16,1 % | 16,9 % | 15,3 % | 0,8 % | (0,8 %) |

| 30.12.2011 | 5898,35 | (14,7 %) | (22,0 %) | (7,3 %) | (7,3 %) | 7,3 % |

| 31.12.2012 | 7612,39 | 29,1 % | 30,5 % | 27,6 % | 1,5 % | (1,5 %) |

| 31.12.2013 | 9552,16 | 25,5 % | 26,8 % | 24,2 % | 1,3 % | (1,3 %) |

| 31.12.2014 | 9805,55 | 2,7 % | 2,8 % | 2,5 % | 0,1 % | (0,1 %) |

| 31.12.2015 | 10743,01 | 9,6 % | 10,0 % | 9,1 % | 0,5 % | (0,5 %) |

| 30.12.2016 | 11481,06 | 6,9 % | 7,2 % | 6,5 % | 0,3 % | (0,3 %) |

| Period with outperformance | 15 | 5 | ||||

| Period with underperformance | 5 | 15 |

If we look at periods of under/outperformance, Mr. Cool has periods of long outperformance: one 3 year “streak” in the beginning and even two 5 year streaks with positive outperformance. Overall he outperforms in 75% of the 20 years. His funds would be easy to sell after those streaks and the mentioned metrics above would identify him as a outperformer most of the time. Investors (especially via consultants or fund of funds) would flood him with money after outperforming several years in a row. His bosses in the large asset management company would pay him nice bonuses in the years where he outperformed which would be 15 out of 20 years. After a bad year he will maybe switch employers however with a much higher salary. He will have a nice house , drive at least 2 or 3 different sports cars or old timers and spends his holidays either helicopter skiing or on his boat in St. Tropez.

Mr. Crap in comparison will be identified by the “years of outperformance” metric as a constant loser. His fund is almost impossible to market. Some will tolerate 1 or 2 years of underperformance but finally they will pull their money out because “he has lost it” and allocate the money happily into Mr. Cool’s fund. Mr. Crap will have lost his job at least twice during these 20 years, maybe three times. He will not get big bonuses and maybe he is not even managing a portfolio anymore but has been degraded to simple analyst as his fund did not attract money in the beginning. He will most likely drive an old car, live in a rented apartment and goes hiking for vacations.

So this is how the returns actually work:

Strategy 1): Mr. Cool runs a strategy which gives him 1.05 times Dax Perfomance in any year with a positive return but he will suffer 1,5 times the loss in a negative year

Strategy 2): Mr. Crap runs a portfolio where he underperforms by -5% in every positive year (Dax performance times 0,95) but only takes 50% of the loss in a loss year for the DAX

But now let’s have a look how the investors of Mr. Cool and Mr. Crap would have done if they would have stayed in the portfolios for the full period and what kind of 20 year compound return they will have achieved:

| DAX | Mr. Cool | Mr. Crap | |

|---|---|---|---|

| Total return | 297,4% | 39,8% | 725,1% |

For anyone knowing remotely how compound interest works, this is not a surprise. Mr. Crap’s (most likely non-existent) investors would be very happy whereas at some point in time Mr. Cool’s investors have become angry and are shifting into Index ETFs and call active investment a game for idiots.

Just to be clear: Do not forget that most large institutional active funds are actually crap, but there are active investors who outperform significantly, however not in the metric that is often used.

One could argue that the strategies are unrealistic, but effectively those are relatively simple strategies: Mr. Cool is selling constantly puts which look great if stock go up, but really bad if stocks go down. Mr. Crap sacrifices performance by buying puts but then earns it back in bad times.

In my opinion bashing active portfolio managers for (temporary) under performance is quite popular, especially after the recent bull market, but part of the problem are fund investors themselves.Many professional advisors are often not more than performance chasers. When those performance chasers meet “Asset gatherers” then you can be sure that the actual investor will pay the bill.

Not many investors actually try to really understand what the asset manager is doing. On the other hand, especially the crappy asset managers try to make their strategy a “secret” as otherwise it would become quite apparent that their strategy is mostly crap. Take it a a warning sign when portfolio managers make a big secret out of what they are holding.

I don’t know if one could analyse the data but I would bet that among those active asset managers whose primary target is performance and not Assets under Management, there is as surprisingly high percentage of investors who will show superior long-term compounded returns although they will outperform the benchmark only during a few years. Maybe there is a way to distinguish between funds that are closed to new money (permanently) against all the others. I would bet that those funds as agroup perform quite well.

So as a quick summary of this comment/rant:

- Good active management doesn’t manifest itself in beating the benchmark every year

- Good active management will show in superior compound returns after a sufficient long period of time (10 years or more)

- Good active management will focus on performance and not on Assets under Management

- Good active management will be transparent at what they do and how they do it.

Punchline:

Good active management is actually not that difficult to achieve with a consistent strategy and focus on performance, however it is relatively rare as the allure of AuM growth is always there and investors are often not able to identify superior long-term active mangement or don’t have the patience to stick with it through rough times.

Pingback: 2016 Portfolio review: Steady progress and still on target — UK Value Investor

Did you notice the difference in performance in EUR (+14.5%) and in GBP (-1.2%) at Ennismore Funds? That is even more amazing if you think how big they scored on the Globo short and JD Sports long that year….

Yes, big difference but I think EUR performance was negative and GBP positive. I think they have significant GBP exposure in their fund.

Excellent rant on the insanity of short-term performance tracking. I’m seriously considering dropping any monitoring of performance over periods of less than five years. Just keep an eye on 5yr, 10yr, 20yr etc. performance and that’s it. Forget about the “I beat the market by 7% in 2016!” rubbish as it’s completely irrelevant.

Thanks for nudging me away from short-termism.

Congrats on a good year and may skill and luck-presented-opportunity continue to be on your side, on average.

Since we’re on the topic of investment styles, I’d like to touch on a comment you made about fund manager approaches to disclosing their positions.

You advise that people consider it a big warning sign when managers make a big secret about their holdings.Perhaps it’s the way it was worded, but that’s either such a generalized statement starving for a slightly deeper dive or poor logic. Let me explain.

In this era of Me, Inc (blogging our every thoughts and action not for self a la diary or for later biographical content a la philosophers’ diaries but for public consumption and branding), transparency of thoughts and actions is now conventional, but conventional doesn’t mean conservative.

Some folks may well consider an investment idea a trade secret — which like all such should be safeguarded — and are further wary about taking on unnecessary consistency-to-commitment bias (i.e. defending positions out in the open thereby reinforcing even a flawed view / pounding in commitments and making it difficult to let go since you have the confirmation of not just yourself but your readers/listeners). Some also consider using an open sphere as a pulpit to talk one’s own book a little unscrupulous (I know some must consider it rather nauseating when fund managers gather together at a conference dispelling their latest short theses which other PMs immediately act on only to see the stock later vindicated and said fund managers unwinding their positions as was the case with David Einhorn/Green Mountain). So a case can be made for either extreme being unpleasant. Again, why your point needs more nuance.

Now, if a fund manager both doesn’t reveal his holdings and doesn’t allow investors to exit until new partners come in, THAT is an obvious red flag. (Lol, funny enough that’s basically venture capital yet it doesn’t stop VC funds from deploying money). Or if said manager never communicates his philosophy about markets but instead uses the latest complex strategy buzzwords, yeah, THAT should be worrisome. Or if at least past ideas/monetizations no longer at risk of appropriation never seem to become topics of conversation or exemplars in outlining the manager’s approach, THAT would be naturally strange (it’s hard to have a passion for something without leaving a trail behind proving you’re very much not hiding because you have nothing. This should be no different for fund managers).

To blanket criticize those who choose not to discuss their holdings out in open without giving more detail about what you mean is to indite the Buffetts, Li Lus (who for sure “makes a big secret” of his holdings these days) and Seth Klarmans of the world. People merely have different personalities and different ideals as to participating in markets.

Well, as every topic there can be different opinions. I don’t think that holding a stock is a “Trade secret”. The trade secret is how the stock has been chosen and when it is going to be sold and how the managera analyses a specific stock.

I would personally not invest in such a fund. I think Warren Buffett has shown clearly that you can be transparent and succesful.

The premise of your seeming conclusion is incorrect. Buffett is open about his philosophy (always has been) but highly secretive about his investment ideas.

Hows Buffett ever been (voluntarily) transparent? lol. You can track this all the way back to his Partnership days. Even now, the guy often laments having to file 13F reporting requirements and the lengths they have to go to hide their trading activities. See the original Lowenstein book: he took it to ridiculous proportions such as being scared of revealing his stocks to his wife in bed while asleep….

Look, point is, there’s a difference between clandestine operations for nefarious purposes and playing your cards close to chest because you don’t want your ideas mis-appropriated in a way that can impair profits.

I think we are talking about ttwo different things here. It is clear that Buffett does not disclose everything he buys, but via his shareholders letters he very tranparently describes how he thinks. This is the transparency I am talking about.

Great post! That’s one of the eternal “scratching my head” things. People will always chase short-term performance. They will always chase a Ponzi scheme like Madoff or invest in some short-vol strategy that will give them a cozy feeling for a few years and then blow them up. Marty Whitman talked about the nonsense of “consistent” outperformance. It’s stupid to test money managers for consistency as you explained nicely in your example.

All the best for 2017 and keep up the good work!

Well done on the out-performance. Would you mind sharing your “top 3” for 2017. Is Electrica still in the top 3?

That is a secret 😉

@MMI! Herzlichen Glückwunsch zu deinem guten Jahresergebnis und deiner stetigen Outperformance!

Ich bin mittlerweile der Ansicht, dass 5% langfristige Outperformance gegenüber dem Vergleichsindex für (gute und erfahrene!) Amateure nicht leicht, aber machbar ist, aber du liegst sogar darüber. Respekt!

Die Überraschung über die Depotgewinner teile ich. Auch bei mir waren meine persönlichen Favoriten für 2016 im letzten Jahr relativ ruhig, aber dafür überraschten mit mehrere andere, eher als ruhig und unspektakulär erwartete Werte sehr positiv. Im letzten Jahr haben mich neben anderen meine Ölwerte getragen – die mich aber in 2015 ausbremsten. Daher stimme ich dir zu: Anlagetiming kann auch ich nicht, Depotvielfalt hat sich ausgezahlt.

Dein Beispiel ist interessant für mich, da ich die Finanzbranche nicht kenne.

Meine spontane Reaktion war: Wow, Mr. Crap hat jemand ein Werkzeug gefunden, das ihn in guten Zeiten nur 5% der Performance kostet, aber in schlechten Zeiten vor 50% der Verluste rettet – was für ein Genie! 1:10 ist ein grandioser Hebel. Wer eine so günstige Depotabsicherung für Aktien entwickelt, gehört auf den Händen getragen.

Ich kenne ja die Finanzwirtschaft nicht, aber es fällt mir schwer zu glauben, dass sich eine Wertanlage mit solch einer Absicherungsqualität nicht verkaufen lässt, gerade bei den in der Geldanlage eher risikoaversen Deutschen.

Ich dachte immer, Investitionsqualität bemisst sich einerseits aus der Performance und andererseits am eingegangenen (respektive vermiedenen bzw. gekonnt verteilten) Risiko – hazardeurmäßig anlegen kann jeder.

Ich denke, das Thema Depotabsicherung sollte in diesem Jahr weiter an Bedeutung gewinnen. Einerseits sind viele Börsen und Einzelwerte hoch bewertet, enthalten also viel Absturzpotential, andererseits ist die politische Großwetterlage im letzten Jahr zunehmend stürmisch geworden, also voller potentieller Schockpotentiale. Niemand weiß, was oder ob etwas passieren wird, aber die Wahrscheinlichkeit für unerfreuliche Triggerereignisse sind weiter gestiegen.

Hallo Roger,

das Beispiel war vielleicht etwas übertrieben aber nicht viel. Wenn jemand im professionellen Bereich 5 Jahre lang unterperformt, dann hat er wirklich ein Problem. Dazu kommt, dass evtl. der Manager selber anfängt, seine Absischerung zu vernachlässigen um endlich mal outzuperformen. Ich habe das nicht nur einmal gesehen…

mmi

Happy 2017 to MMI & its blogosphere.

I could not agree more in (1) that financial firms typically promote staff based on their ability to ‘play the game’ (manage the system), and (2) that it is primarily marketing the job of pseudo-asset managers. This is also a part of the system, and a consequence of the poor (fin) education in western societies.

The importance of AuM size comes from the mgmt fee charged upfront, which is what mostly bring money to the company in bad (&good) years, not its growth. Again another part of the system. Maybe going to performance-incentivised investment is a partial solution?

Finally, imho best result is obtained by a combination of good financial analysis, honesty, patience & moderation, and focus mainly in small caps (ie. under-researched firms). Finding equilibrium across all these lines & persevering on it is uneasy but my best recipy for success.

Very insightful post. The same dynamic can be observed between companies that are managed by agent-operator or owner-operator. The agent-operators outperform in heady times but the owner-operators (family companies etc.) make it up and then some when the industry goes bad.

I think Morningstar recognizes this and does give some weight to fund managers having a stake (but the criteria is to easy to meet) in the fund they manage.

Hi memyselfandi007, Great review and thought provoking as always, so thank you.

I especially enjoyed looking at your stats, as its something I am looking to improve on for my own portfolio in 2017. Could I trouble you to ask how you go about measuring performance i.e. website/excel/other? I use excel and have agonised for some time about the performance calculations and whether I’m using the wrong ones. Also, I liked your drawdown stats and am intrigued how to implement that going forwards as I take a daily valuation, but with money going in and out of the fund all the time I’m currently pondering how best to analyse this element too. So any pointers or guides would be gratefully received.

Finally, well done on your performance. Certainly beat my UK focussed 11.36% total return.

Regards