All Norwegian Stocks Part 19 – The “Grand Final” and the next Target

With a delay of a few calendar days against the original 2023 year end target, I am very happy to conclude the “All Norwegian Stocks” series with the final “Top 20” Watchlist.

Overall, I was somehow a little bit underwhelmed by the Norwegian stock market, at least it doesn’t offer that much of what I am interested in.

From the 270+ stocks, there is a large share of what I would call “listed early stage VC companies” that have been IPOed in the last 3 years. These companies have normally little sales and little cash left but high losses. If you pick the right one, one could make a bundle, but most of them will disappear into bankruptcy sooner or later. This is not my game. Then there are something like 40 different Sparebanken, many Shipping companies and Fish farmers that have business models where I am not 100% comfortable either.

I still managed to collect 20 stocks that I find worth watching going forward, In contrast to for instance the “All Swiss” series I didn’t find any company that I felt the urge to directly invest into (besides my portfolio holding Bouvet).

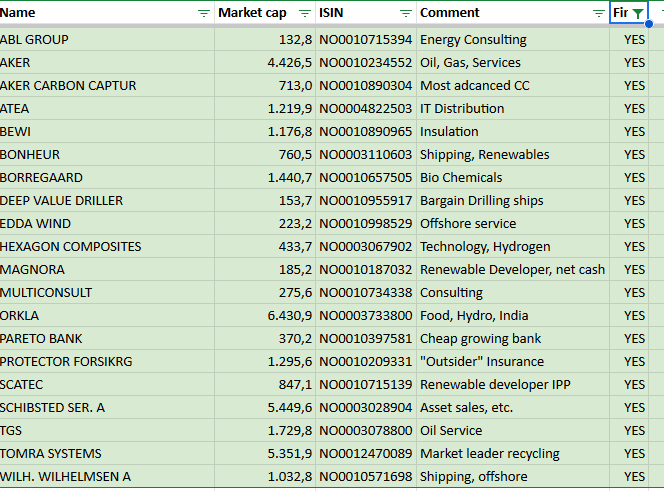

Final Top 20 Watch list

Without further intro, here are the 20 stocks that I decided are worth watching going forward (on top of my portfolio holding Bouvet ASA):

If you ask me what the scientific basis behind the selection is, I don’t have a good answer. The final sele ction was a very subjective walk through.With “Deep Value Driller” I actually selected a stock that I initially put on “pass”.

So what’s next ?

As I have teasered a potential new taregt country a couple of time, again with little Intro my next target: Belgium.

Why Belgium ? The reason is simple: Over the past 13 years, I covered quite a lot of Belgian companies and I was always surprised, how such a small, unspectacular country can create so many interesting companies. There are a lot of companies that I wanted to look at anyway or again, so Belgium it will be. Via the three relevant segments (Euronext, Growth, expert makret) Belgium has around 215 companies, which I think is a realistic target to finish in 2024. For the “Expert Market” however, there seems little information available, so let’s see ho that will work.

Looking forward to your review of Bois Sauvage every day of 2024!

Thank you very much for your effort. I really enjoyed your norwegian tour. Maybe your impression of being underwhelmed correlates to your aversion towards shipping stocks. From the point of view of a person interested in shipping stocks, New York and Oslo are the two main exchanges to look at. Most of the interesting shipping companies listed in Oslo are, however, not incorporated in Norway. So they did not show up in your list. This way your review did not cover 5 out of the 25 stocks in the OBX:

Frontline, Golden Ocean, Borr Drilling, Hafnia and Subsea 7 (incorporated in Cyprus, Bermuda and Luxembourg, respectively). The first three in this list have a dual listing in New York. My guess is that you would have given a ‘pass’ to at least 4 of these 5. However, you might have found Subsea 7 interesting.

I wish you a successful and happy new year.

Thank you for the input. Ever since “The Shipping Man”, i am very prejudiced against shipping companies. However I actually put a few into the final watch list. Subsea7 is a name I heard quite often….

Hi!

I am an interested investor and have been following your blog for some time. I was wondering if you would enter the Bewi ASA stock.

The stock has fallen sharply in recent months and is currently around 61% below its level at the beginning of 2023. This has led me to wonder if an entry at these prices is worthwhile.

I have looked at the arguments for and against an entry and have come to the conclusion that the stock is currently undervalued. The company is a solid company with a strong market position and the demand for wood products is stable in the long term.

However, I am aware that the general market conditions are currently difficult. Inflation, central bank interest rate hikes and geopolitical tensions could lead to a slowdown in the global economy. This could also weigh on demand for wood products.

I would be grateful if you would share your opinion on this topic.

Thank you for your time and effort.

Sincerely,

Semih

Hi, I had briefly looked at BEWI, although the business as such looks interesting, the financials look not so nice. Declining margins (loss in the recent period), increasing debt levels and an increasing share count are some indicators that show that the company could be in trouble.

The fact that the stock is down -61% as such is not an indication for undervaluation.

I am really interested in quirky stuff like expert market stocks, so I dug a little. Here is the list of expert market stocks: https://live.euronext.com/en/markets/brussels/stocks/expert-market/list