A different take on Performance Measurement – FPA /Crescent Fund

One of my quarterly “must reads” are the FPA Crescent quarterly letters.

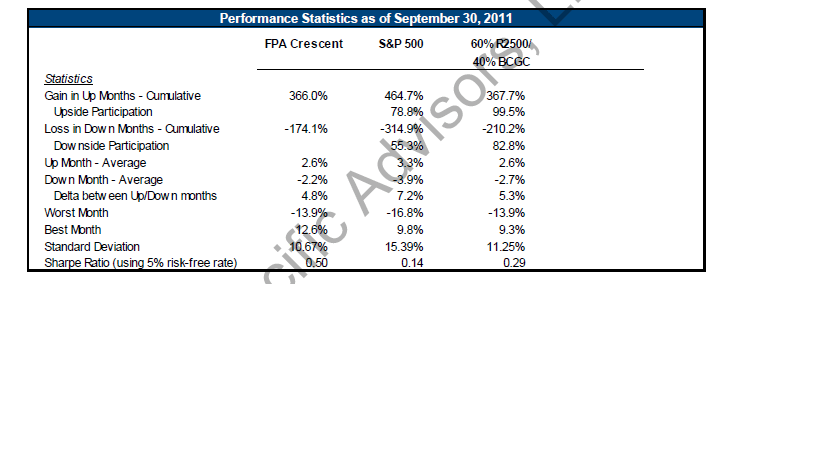

In the current one, they show in the attached slides a very interesting way of presenting performance (page 5).

What they are doing is the following:

– they seperate up and down months in a first step

– in a second step they look how much they particpate in up periods and how in down periods

– the goal over the long run is of course to participate relatively more in up periods than in down periods

For me this is very interesting, as their investment style is very similar to my own strategy.

Unfortunately, I have only 10 months of data, but here are the monthly performance numbers against the Benchmark:

| Start | Jan | Feb | Mrz | Apr | Mai | Jun | Jul | Aug | Sep | Okt | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Bench | 6394 | 6567 | 6645 | 6559 | 6833 | 6645 | 5646 | 6486.69 | 5504.92 | 5154.68 | 5667.92 |

| Portfolio | 100 | 101.46 | 102.49 | 103.92 | 105.07 | 101.23 | 95.35 | 99.03 | 91.73 | 92.75 | 95.46 |

| Perf BM | 2.7% | 1.2% | -1.3% | 4.2% | -2.8% | -15% | 14.9% | -15.1% | -6.4% | 10% | |

| Perf Portf. | 1.5% | 1% | 1.4% | 1.1% | -3.7% | -5.8% | 3.9% | -7.4% | 1.1% | 2.9% |

In the first 10 months of 2011, the benchmark had 5 down months and 5 up months whereas the portfolio had 7 up months and only 3 down months. So far so good.

Howver if we look at the cumulated numbers:

| Cum Months up | |

| BM | 33% |

| Portf. | 10.4% |

| Participation: | 31.52% |

| Cum months down | |

| BM | -40.6% |

| Portf. | -14.4% |

| Participation: | 35.47% |

One can clearly see, that the relative “particpation rate” in down months is higher then in up months.

I interpret this as follows:

– the portfolio outperformed, because it was more defensive than the benchmark and the benchmark went down.

– However, if the benchmark would have been zigzaging and ending flat, I would have most likely underperformed

I am not sure where this comes from, but one of the reasons could be the short side. The short of the momo stocks actually added volatility in the down months because those stocks where outperforming the BM by a large margin. Usually the short side should reduce volatility.

If we look at the FPA statement in the same presentation they say the following:

So this is something to remember that shorts primarily should help to reduce the volatility. Shorting explicit momentum stocks might not be the best implementation of this goal.

Another reason could be that the portfolio is geared towards special situations, which are expected to “sleep” for some time before they are hopefully “exploding” to the upside.

In any case I will look from time to time into this measure, if I can improve those relative ratios somehow.

Ich verwende zum Reduzieren der Vola das Shorten von Indiex Futures. z.B. MDAX, SP 500 oder Russell 2000. Das reduziert die Vola im Depot tatsaechlich. Ich kann dadurch auch die Investitionsquote sehr einfach steuern.

Hallo derivatus, ja das ist keine schlechte Strategie. Mmi