Special Situation: Celesio AG / McKesson take over – “Swimming with sharks”

DISCLAIMER: The securities discussed in this post are very risky and the author might have already bought some before publishing the post. The overall situation is tricky and not really recommended for “normal” investors due to the involvement of some well known capital market “sharks”.

Celesio, the German pharmaceutical wholesaler has received a takeover offer a few days ago from US giant McKEsson at 23 EUR per share under the condition that at least 75% of shareholders will tender their shares

A few facts/background:

– majority owner Haniel (also largest shareholder of Metro) needs money and committed to tender their controlling block of 50.01% for around 2 bn

– in the meantime however Elliott, the US Hedgefund acquired more than 25% and threatened yesterday to block the deal

– under German law, 75% is the threshold to establish a profit & Loss transfer agreement which gives full control to the acquirer as well as tax benefits

As a result, the share price of Celesio dipped slightly below 23 EUR after hitting 23.70 EUR earlier.

The offer

McKesson has actually created a dedicated website for the offers with all documents, some videos etc here including the detailed offer document.

The acceptance period runs until early January with a potential extension period until end of January. Similar to Vodafone/Kabel Deutschland, talks about the take over become public already several weeks before the official offer. I think this is clearly part of the game from the seller in order to get a good price.

Nevertheless I found it surprising that since the first announcements of the deal, McKesson’s share price surged and dropped when Elliott said that they want more. Elliott is even using this as their main argument according to this article:

The surge in McKesson’s value by $7.7 billion since early October, when reports on a takeover offer appeared, was a clear sign the Celesio acquisition offers high synergies for the U.S. group and is a bad deal for minority shareholders, Elliott said.

Celesio looks clearly expensive at 23 EUR. However even without operational synergies there is a lot of potential for improvement. Celesio pays ~150 mn interest on 2bn loans, a 7.5% interest charge. McKesson is able to refinance below 2%, this alone is more than 100 mn p.a. savings.

Elliott Management

Elliott Management is a well known US hedgefund ran by Paul Singer. They are most famous for their over a decade long fight with the Argentinian Government, where some months ago, the even went so far to seize the sailing ship of the Argentinian Naval forces.

In Germany, they were already active in two similar Deals, Demag Cranes and Kabel Deutschland. At Demag Cranes, they already cashed out with a nice profit (~+30%), after blocking the threshold at 90% which allows a complete squeeze out. At Kabel Deutschland, the hold 11%, again blocking the squeeze out which works only if the acquirer has more than 90%.

With Celesio they seem to slightly change the tactic by acquiring 25% and actually threatening to block the entire bid. However, one aspect remains the same: They involve themselves only when Anglo-Saxon bidders are in the game. I guess they don’t want to involve themselves with potential unpredictable players in “Local feuds” like in the Rhoen case.

Anyway, one thing is clear: Elliott is clearly not a player which gets pushed around easily. On the other hand, they are in to make money. This is the main difference to the Rhoen case, where some of the players (B. Braun) wanted to block the deal at any cost.

Simple “Valuation exercise”:

I would assume that the “undisturbed” Celesio share price in the months before the offer was around 17 EUR. So if the deal falls through, at the current price one would experience a loss of -25%.

If we assume that there will be no “top up”, than we can easily calculate the implied current probability that the deal will not happen based on a simple “binary” model:

x = (current price-offer price) / (undisturbed price – current price) = (22.80-23)/(17-22.80) ~ 3.4%

Now if we want to speculate on a top up, we have to make two assumptions: How likely is a top up and how large will it be ? In order to keep it simple, I would assume a 50/50 chance for a top up and as I like “round” numbers, I assume 5 EUR per share or a final offer at 28.

This leads us to the following expected value under those assumptions:

Exp. value Celsio share = (3.4% x 17) + (48.3% *23) + (48.3%*28)= 24.25 EUR or around 10.6% higher than the current share price.

Not a monster undervaluation but still a very attractive “bet” as the time horizon is rather short until the end of January.

A Twist: The Convertibles

Up until recently, Celesio had to struggle to refinance their debts. So they had to offer two convertibles in the past, each with an amount of 350 mn EUR which convert each into 17 mn extra shares (current total shares out: 170 mn).

The 2014 convertible will mature in 2014 nd is not a big issue with regard to the take over. However, the 2018 convertible is in my opinion much more interesting. First of all, the official strike price of 22.49 EUR will be adjusted down in case of a take over to compensate bondholders for the conversion premium paid at issuance.

Unfortunateley, I could not locate the full prospectus, only the 4 page summary from Celesio’s homepage. One 100 k EUR bond allows the holder to convert into 4.448 Celesio shares at the initial conversion price of 22.49 EUR per share.

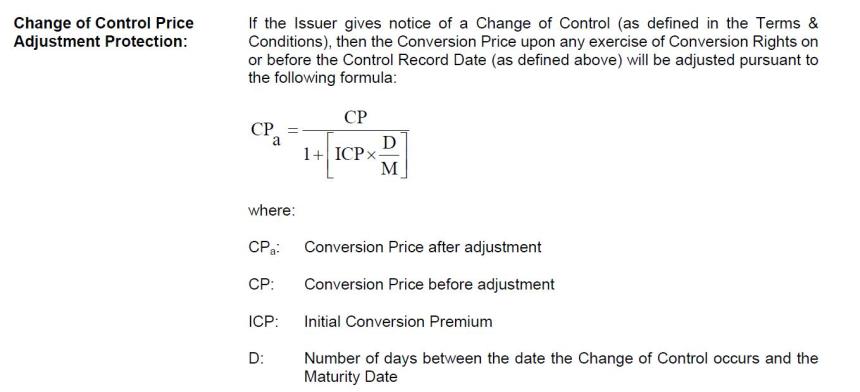

But now it gets interesting: In the case of a “change of control” event, the conversion price is adjusted downwards based on the following formula:

This means that holders of the bonds now get more shares than before.

The “new” conversion price now would be now approx. 18.99 EUR, and the amount of shares accordingly 5.266 per 100k nominal. This in turn, multiplied with a share price of 23 EUR would mean a fiar value of the convertible of 121k or 121%, pretty much exactly where it is trading now.

In total, the 2018 convertible will be exchangeable into 19 mn shares, more than 10% of total outstanding shares at any time after the take over happens. However, this could turn out to be a big problem for McK. Any company doing such a takeover wants to get rid of minorities as quickly as possible and is therefore trying hard to squeeze out shareholders and delist the company.

With the 2018 convertible, this could be very difficult. Even if McK owns more than 95% of the shares, convertible holders could suddenly convert bonds into shares and then make a squeeze out impossible. The 2018 convertible therefore has a quite high “annoyance factor” for McK. In general, when a company has a more complicated capital structure, an “annoying” security can be a very good security to own.

In the case of the convertible, the only possibility for MCK to get rid of the convertible early, is the so-called “soft call feature”. This enables the issuer to call the bond, if the stock price is at or above 130% of the initial conversion price of 22.48. This would mean a stock price of around 29,20 EUR or an implict bond price of 154%.

EDIT: The soft call in the complete prospectus refers to the “applicable” conversion price. So in our case, after a change of control, it would be ~19 EUR and the call level would be around 24.70 EUR. This reduces the upside potential of the convertible, but it might increase the chances of a better offer overall.

That those thoughts are not totally without merit could be indicated via the disclosure int he offer documents that they seem to be already buying busily convertibles with the focus on the 2018 bond:

McKesson International Holdings IV S.à r.l., eine mit der Bieterin gemeinsam handelnde Person, hält 105 Anleihen 2014, welche zum regulären Wandlungspreis Wandlungsrechte in 233.437 Celesio Aktien gewähren, was 0,137% der derzeit ausgegebenen Celesio Aktien entspricht, und zum angepassten Wandlungspreis infolge eines angenommenen Kontrollwechsels am 17. Januar 2014 Wandlungsrechte in 242.494 Celesio Aktien gewähren,

was 0,143% der derzeit ausgegebenen Celesio Aktien entspricht, sowie 139 Anleihen 2018, welche zum regulären Wandlungspreis Wandlungsrechte in 618.327 Celesio Aktien gewähren, was 0,364% der derzeit ausgegebenen Celesio Aktien entspricht, und zum angepassten Wandlungspreis infolge eines angenommenen Kontrollwechsels am 17. Januar 2014 Wandlungsrechte in 730.042 Celesio Aktien gewähren, was 0,429% der derzeit ausgegebenen

Celesio Aktien entspricht.

Swimming with the Sharks

Why did I call this “Swimming with the sharks” in the headline ? Well, this is clearly not a small unknown company. We have Goldman Sachs (advisor McK) and Elliott in the game, both very very clever financial market players which i would consider as “sharks”.

The true “decision” tree ogf the players involved clearly includes a lot more branches with some of them resulting in negative payouts for “innocent bystanders”. So there is always the possibility that one ends up as “prey” in such situations, so be careful and don’t bet the house on any outcome.

So to summarize this quickly:

1. The Celesio share looks like “good value” if one believes in a certain upside due to the Elliott involvement and no dirty deals on the side

2. The 2018 convertible looks like the even more interesting part. In order to get rid of this bond, MCK will have to offer ~30% more than the current price which I think is very likely even if the Elliott trade doesn’t work out

In order to play both “games”, I will allocate 1.25% each for the portfolio, the stock and the 2018 convertible at current prices (22.80 EUR, 121%).

habe meine 2000 Stück nun zu 24 gegeben…verrückte Welt…mal wieder einen Dank an MMI für das Ausgraben dieser schönen -aus meiner Sicht risikoarmen- Geschichte….whats next?

alles gaga…ich hab heute nochmal aufgestockt zu rund 23…ich verstehe diese Kurskapriolen nicht…aber ich verstehe vieles nicht.

wie wäre das eigentlich, wenn die auf 28 erhöhen und Elliot dann andient…gibts eine neue Tender-Period oder kann man das gleich in die laufende packen?

na das wäre aber dünn…ob es wohl das letzte Wort ist?

Kreise – McKesson stockt Übernahmeofferte für Celesio leicht auf

Donnerstag, 9. Januar 2014, 08:03 Uhr Diesen Artikel drucken [-] Text [+]

Frankfurt (Reuters) – Der US-Konzern McKesson hat im Ringen um die Übernahme des Pharmahändlers Celesio seine milliardenschwere Kaufofferte Finanzkreisen zufolge leicht erhöht.

Kurz vor Ablauf der Annahmefrist stockte der kalifornische Pharmagroßhändler sein Angebot an die Celesio-Aktionäre um 50 Cent auf 23,50 Euro je Aktie auf, wie eine mit den Gesprächen vertraute Person der Nachrichtenagentur Reuters am Donnerstag sagte.

McKesson rechnet damit, den widerspenstigen aktivistischen Finanzinvestor Elliott mit dem Einlenken auf seine Seite zu ziehen, der mehr als 22 Prozent an Celesio hält und die Übernahme zu blockieren drohte. Denn McKesson muss mindestens 75 Prozent der Celesio-Anteile – zwei Wandelanleihen eingerechnet – einsammeln, damit die Transaktion zustandekommt. 50 Prozent an Celesio hält der Mischkonzern Haniel. Die Übernahmeofferte läuft am Donnerstagabend aus. Elliott wollte sich am Donnerstag zunächst nicht zu den Informationen äußern, McKesson war nicht für eine Stellungnahme erreichbar.

fast schon schade wenn es so glatt geht…ich bin nämlich nur zu 50% drin und dachte ich käme nach Offertenauslauf nochmal zu 20 zum Zuge…anyhow es bleibt spannend und vielleicht wirds der erst “special situation” deal 2014.

Insider – Bewegung im Ringen um Celesio-Übernahme

Mittwoch, 8. Januar 2014, 14:33 Uhr Diesen Artikel drucken [-] Text [+]

Frankfurt (Reuters) – In das Tauziehen um die Übernahme des Stuttgarter Pharmahändlers Celesio durch den US-Konzern McKesson kommt offenbar Bewegung.

“Es wird an einer Lösung gearbeitet”, sagten drei mit dem Vorgang vertraute Personen am Mittwoch der Nachrichtenagentur Reuters. McKesson arbeite an Zugeständnissen an den US-Hedgefonds Elliott, um diesen zu einer Zustimmung zu der sechs Milliarden Euro schweren Transaktion zu bewegen. Nähere Einzelheiten waren zunächst nicht zu erfahren.

Elliott hat für rund 800 Millionen Euro eine Beteiligung von 22,7 Prozent an Celesio zusammengekauft – Wandelanleihen eingerechnet. Damit hat die Investmentgruppe die Macht, die Transaktion vor die Wand fahren zu lassen. Elliott war mit seiner Forderung nach einer Erhöhung des Angebotspreises von 23 Euro je Celesio-Aktie bei McKesson bislang auf taube Ohren gestoßen und bei seiner Blockadehaltung geblieben.

Elliott lehnte eine Stellungnahme ab, McKesson war für eine Stellungnahme zunächst nicht zu erreichen.

Die Angebotsfrist für die Offerte von McKesson läuft am Donnerstag um 24 Uhr aus. Bis Dienstag hatte sich der Pharmagroßhändler lediglich 2,13 Prozent der Celesio-Anteile gesichert. McKesson muss aber bis Fristende Zusagen für mindestens 75 Prozent der Celesio-Anteile – zwei Wandelanleihen eingerechnet – in der Tasche haben, damit die Übernahme gelingt. In Finanzkreisen war bereits damit gerechnet worden, dass sich erst kurz vor Toresschluss entscheidet, ob der Übernahmevorstoß klappt oder scheitert.

© Thomson Reuters 2014 Alle Rechte vorbehalten.

Also ein Nobrainer ist das nicht:

Die Hedgefonds Manager haben am 27.12.2013 ihre Short-Position von 0,95% auf 1,00% der Celesio-Aktien erhöht. Seit Erreichen eines Zwischentiefs von 0,47% am 05.12.2013 befinden sich die Leerverkäufer des Hedgefonds Magnetar Financial wieder im Attackemodus.

http://www.aktiencheck.de/exklusiv/Artikel-Celesio_Aktie_Leerverkaeufer_Hedgefonds_Magnetar_attackiert_weiter-5440707

Klar, das sollte der Titel auch “Swimming with sharks” auch hoffentlich klar machen.

Da Magnetar eigentlich eher ein Credit Hedge Fonds ist, vermute ich mal dass es sich um einen Hedge einer long Convertible Position handeln könnte und nicht um einen “outright” short.

Hopp oder Topp :-)…mögliche Konkurrenzbieter werde auch gleich genannt.

Elliott denies it may accept McKesson’s Celesio bid

Reuters

* Elliott says has seen reports that it may change its mind

* Says is bound to reject offer in current form

* Shares in Celesio down 0.4 pct

FRANKFURT, Dec 23 (Reuters) – Hedge fund Elliott International stood firm in rejecting U.S. wholesale drugs group McKesson’s $8.3 billion offer for European counterpart Celesio on Monday, saying it was “irrevocably bound” not to accept the bid at is stands.

Celesio management this month recommended its shareholders accept the bid from McKesson, the largest wholesale seller of drugs in the United States, which wants to expand abroad and boost its purchasing power with pharma majors.

Germany-based Celesio supplies pharmacies across Europe and owns Britain’s Lloyds pharmacy chain. A combination with McKesson would create a global group with annual sales of around more than $150 billion and would be Germany’s biggest healthcare deal since drugmaker Bayer bought rival Schering in 2006.

McKesson’s 23 euro-per-share cash bid represents a 43-percent premium over Celesio’s share price prior to speculation in June that majority owner Franz Haniel & Cie might sell its stake.

Celesio shares were down 0.4 percent at 22.92 euros by 1409 GMT on Monday, implying scepticism among investors that the wrangling will conclude with a far more attractive deal for Celesio shareholders, who have until Jan. 9 to tender their stock.

Elliott, run by U.S. investor Paul E. Singer, has spent about 800 million euros ($1.09 billion) building a stake in Celesio and already said this month it would not tender its shares, calling upon McKesson to sweeten its offer.

“Elliott has seen reports suggesting that it will change its mind and accept McKesson’s offer. These reports are categorically incorrect,” Elliott said in a statement on Monday. “To be absolutely clear, Elliott’s final, binding decision is not to accept McKesson’s offer on its current terms.”

Celesio declined to comment. A Germany-based spokesman for San Francisco-based McKesson also declined to comment.

“NO GOING BACK”

Elliott has 25.16 percent of the voting rights in the company, enough to block a deal that needs the support of investors holding 75 percent of Celesio’s shares.

“It looks as if Elliott is prepared to let the deal fall through unless they get more money. Elliott has gone out on a limb and it seems there’s no going back now,” a Frankfurt-based trader said.

McKesson and its closest U.S. rivals, AmerisourceBergen and Cardinal Health, have all been looking to expand outside their domestic market, where they command a combined 95 percent share.

The bid valued Celesio including its debt at about 11 times expected earnings before interest, taxes, depreciation and amortization (EBITDA) for this year. That is in line with the multiple that Walgreen Co paid for a 45 percent stake in European pharmacy chain Alliance Boots last year.

Elliott has been strongly active in Germany this year, having also built a large position in Kabel Deutschland and aiming to sue bidder Vodafone for a better price than was accepted by other shareholders, according to people familiar with the matter.

http://finance.yahoo.com/news/celesio-shareholder-elliott-remains-opposed-105234901.html

The convertible bonds of TUI Travel increased by approx 30% in the last three days. (WKN A1AWP5 and WKN A1ANDX). The appreciation of the convertibles seems to be triggered by an expected capital increase. So the likelihood of a reverse takeover of TUI AG seems to be high.

I join the party with some shares…the convertible is too bulky for my portfolio…for 1,25% as you mentioned you must have a real big 8digit portfolio…

my VIRTUAL portfolio is big enough 😉