Waddell & Reed (WDR): “mean reversion” opportunity or potential Value Trap ?

The company:

Waddell & Reed is a Kansas based Asset Manager (mostly listed equity) & Financial Advisory firm. The company became somehow infamous during the 2010 “flash crash” when they were initially blamed that one of their order had caused the crash. Later, the SEC blamed a guy in London for it.

W&R looks like an interesting “High quality mean reversion” type of value stock.:

Market Cap: 1,4 bn

P/E (2015): 6,9

EV/EBIT: 4,5

Div. Yield: 10,3%

10 year avg. ROE: 33,4%

10 Year avg. NI margin: 14,1%

So we have a high ROE/ROCE, high margin business with significant net cash that trades at a ridiculously cheap level (based on 2015 earnings). There is a relatively recent SeekingAlpha “long” pitch with the following summary:

Summary

Recent underperformance of the funds under management has fueled redemptions, and the company’s top and bottom lines are under stress as a result.

The stock has lost 63% of its value in the last year and is now trading into value territory on fears of a bleak outlook for the company.

The company has a long history of profitability and is equipped to withstand future challenges, suggesting the title has been oversold.

DDM valuation model suggests a strong long term potential upside of 40% – 170%, betting on the stabilization of the company.

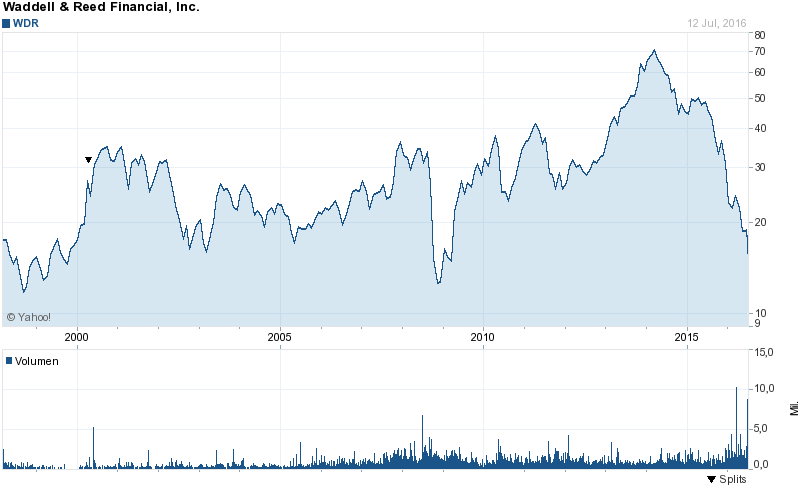

The stock has clearly seen better times, the stock price is close to the 2008/2009 bottom:

On top of that, the company has started to buy back shares, they have bought back ~3% of the shares since 2013 on top of the dividend paid.

So what can go wrong ? Well, at this stage I think it makes sense to take a step back and look what is happening in the Asset Management industry.

Asset Management industry.

The asset management industry, especially in the US has been a very good industry to be in for a very long time. The business was usually quite “sticky” and volumes (and fees) went up automatically with the increase of asset prices. The US created an incredible amount of paper wealth and returns. This made life great for asset managers.

Recently however, especially for the “classical” asset managers who manage mostly “normal” stock and bond funds, life became a lot harder.

On the lower end, cheap index funds and/or ETFs are gaining popularity. Here for instance is an interesting study from Morning Star that clearly shows that not only Index shares have gained market share, but also drove down fees for active managers.

In the last 10 years, the asset management industry in total could compensate those fee reductions via a significant increase of Assets under Management (AuM).

From the high-end, all kind of “Alternative” Investment managers (Hedgefunds, Private Equity ect.) have gained significance as many investors think they can get better returns there despite the even higher costs.

As a classical investment manager, the only chance is to have a really great performance track record. If you outperform consistently (which is very very hard) then you will attract AuM and fees, if not, you have problems.

The problems at Waddell:

And this is where the problem at Waddell lies right now. The performance of the funds is not even average but disastrous and money is flowing out of the door.

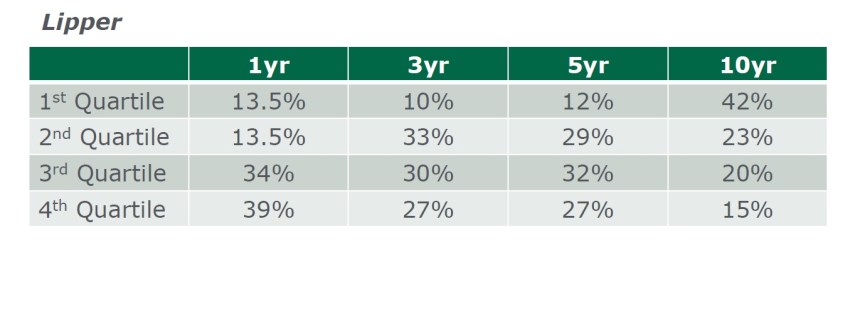

According to the Q1 report 2016, AuM have shrunk from ~124 bn USD in 2015 to 95 bn USD in Q1/2016. Especially retail assets were hit with a decrease from 59 bn USD to 38 bn. In the Q1 investor presentation they show this table:

This is the aggregated performance of W&R funds against the competition and it clearly shows that they seem to have done something profoundly wrong over the last 5 years. The majority of their funds is worse than average in their category and most likely even much worse compared to index funds.

Their biggest fund, the Ivy Asset strategy fund lost -5,66% in 2014, -9,05% in 2015 and -3,2% YTD 2016. The fund managers seem to have “retired”, but it looks like that the outflows continue.

The major “Moat” of an active asset manager is its long-term track record. History shows that if an Asset Manger really screws up his long term record, it is very hard to come back.

More pain: Fiduciary rules for investment advisors in the US

A few weeks ago, the Department of Labor has issued a proposal to establish fiduciary duties for investment advisors that advise for individual pensions. This means that advisors, instead of maximizing commission income need to make sure that they act int he best interest for their clients.

Waddell and Reed runs a sizable investment advisor/broker organization, mostly selling its own products. If the rules actually come into effect, it would be quite hard to justify selling the own underperforming high fee products. W&R explicitly mentions this as a risk factor in the quarterly report:

In April 2016, the U.S. Department of Labor (the “DOL”)released its final rule that, among other things, expands the scope of a “fiduciary”under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and Section 4975 of the Internal Revenue Code of 1986, as amended (the “Code”).The DOL rule also creates new exemptions and amends existing exemptions from theprohibited transaction rules applicable to fiduciaries under ERISA and the Code that allows broker/dealers, investment advisers and others to continue to receive a variety of common forms of compensation that otherwise would be prohibited as conflicts of interest. The DOL rule may have a material impact on the provision of investment services to retirement accounts, including imposing additional compliance, reporting and operational requirements, which could negatively affect our business.

Currently it is not clear how this will be actually implemented, but in my opinion it will further increase the pressure on fees.

Time to stop the analysis

In my opinion, this is actually the time to stop the analysis. Yes the stock looks cheap based on past results but we have identified already 3 major issues:

- a strong fundamental shift in the underlying business away from their business model which will lead to significantly lower fees

- significant individual problems (performance track record) which are not that easy to fix and will lead to more outflows

- A potential regulatory change that will also effect the advisory side of the company

The combination of these three issues are in my opinion a potential “lethal” mix and creates a significant probability that WDR ends up as a typical “value trap”.

In general, I think hard times are coming for all active “traditional” asset managers and only a really strong track record can counter those fundamental shifts.

To a certain extent this reminds me of German utility companiees and big box retailers. When there are such big fundamental changes and you don’t catch them very early on, it will be very hard to get back into the game.

Clearly, the stock could bounce back temporary at some point or someone could be actually interested in taking them over or an activist shows up, but as a value investor, this is not a solid foundation for an investment case.

I think in this environment, one should be very careful when investing in “cheap” asset mangers. In my opinion one should prefer the ones with good track records and/or more exposure to “alternative” strategies.

Another piece of well-written analysis. At the risk of generalization, the asset management industry is heading toward a world of the haves and have-nots. The haves are the large scale + low cost beta providers and “small and beautiful” alpha generators, as well as specialized alternative asset managers (not hedge funds but true asset classes such as real assets).

From what you write it looks like a value trap to me, too. I recently had a look at Diamond Hill (see my blog – sorry, German only) and they seem to be in a better situation since they at least bet their benchmarks in recent years. It will be interesting to see how they handle the new DOL-rules and how that effects their business.

Time to move out of Ashmore Group Plc and into Ashmore Global Opportunities Limited instead perhaps…

Hmm, for the time being I like Ashmore. EM assets are coming back strongly.

I also found this not really brand building article.

http://www.bloodyelbow.com/2016/5/2/11553662/investors-sue-waddell-reed-over-al-haymon-premier-boxing-champions-boxing-news

Wow, that sound really bad. Thanks a lot….

That’s why Ashmore Global Opportunities Limited fits your thesis above. EM assets exposure instead of management fee. Ashmore Group equally quite rich at this stage.

Sorry – that last comment was meant to the thread above…

Hi mmi,

schön etwas über diese Aktie von dir zu hören. Ich habe zufällig gestern den Geschäftsbericht von WDR überflogen und mir ist aufgefallen, dass sie 80 Mio. $ an operating leases ausweisen. Dazu kommen noch pensions (49 Mio. $) und purchase obligations (148 Mio. $).

page 42, AR 2015

Other than operating leases, which are included in the table above, the Company does not have any off-balance sheet financing.

Ich hätte gedacht, dass der durchschnittliche Gewinn von WDR noch ganz schön fallen muss um eine derart günstige Bewertung zu rechtfertigen. Allerdings hast du natürlich recht damit das die grundlegenden Probleme der Branche nicht von der Hand zu weisen sind.

Gruß Micha

Waddell has two big problems. First, they were dependent on the performance of almost a single fund, Ivy, for flows and reputation. I believe that fund’s performance has not been great. Second, their best advisors are fairly old and newer advisors simply haven’t been able to build the same books of business. It’s a tough business and I don’t think they can grow it at the current size.

It still amazes me that these guys caused the flash crash in 2010. Everyone assumed it was some slick NYC-based high frequency shop and it ended up being a sleepy Kansas investment advisor.