Special situation “Quicky”: Delta Lloyd / NN Group take over (and some learnings form Aixtron)

Some of my readers might remember that I looked at Delta Lloyd a long time ago as it was one of David Einhorn’s top pick back then, but we didn’t like it back then.

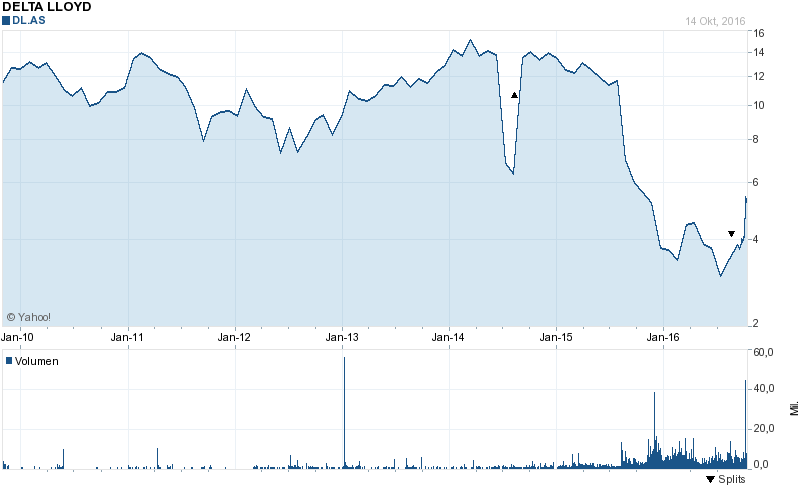

A quick look at the chart shows, that the problems I had identified were indeed there and the stock never really recovered:

Early 2016, Delta Lloyd executed a rights issue which they had to downsize due to massive protests especially form one shareholder. Einhorn sold most of his stock in September 2015, netting himself a significant loss on the position.

Then, a couple of days ago, my former holding NN Group offered 5,30 EUR per share for Delta Lloyd but after a few days Delta Lloyd rejected. Interestingly they did not reject the offer in principle but argued for a (significant) higher price.

My take on the situation is as follows:

- Delta Lloyd is now in play and a deal will most likely happen as it makes economically sense

- There is a good chance that either NN will slightly raise the price or that another bidder steps up. Aegon for instance could be a potential bidder and maybe only just to annoy NN.

- The chance of the deal not happening is very small. Despite having a potential poison pill, I do think that Delta Lloyd knows that they will not survive on their own. The Dutch regulator is known to be the toughest one in the Euro Zone with regard to Solvency II and with their large Life Insurance book, they won’t have a lot of fun going forward, unless there is some very serious cost cutting

- There will be little or no issues with anti-competition. Both players combined, despite their domestic overlap would not dominate the Dutch market. In contrast, I think the Dutch are rather interested to build a “National champion”. However, this also reduces the probability of a foreign bidder.

Valuation / expected return

Valuation wise, I would use 3 cases with the following probabilities:

a) Deal goes through at 5,30: 20%

b) Deal goes through (NN or other bidder) at a price of 6 EUR: 70%

c) Deal fails for whatever reason, stock drops back to 4 EUR 10%

So we can pretty easily calculate a “fair value” of (0,2*5,30)+(0,7*6)+(0,1*4)= 5,66 EUR.

At a price of 5,20 EUR (on Friday), this gives us an expected return of ~8,8%. Even at 5,30, the expected return would still be 6,8%. I think this is quite attractive, especially as I assume that the downside risk is clearly not zero but really small in this case.

This does not include the “option” that maybe some kind of bidding war could start and provide an ever higher price. I would assume within 12 months we know how this will be turn out.

So for the portfolio, I bought a 2% position on Friday. I was lucky enough to get it at 5,19 EUR per share.

Some lessons from the Aixtron case

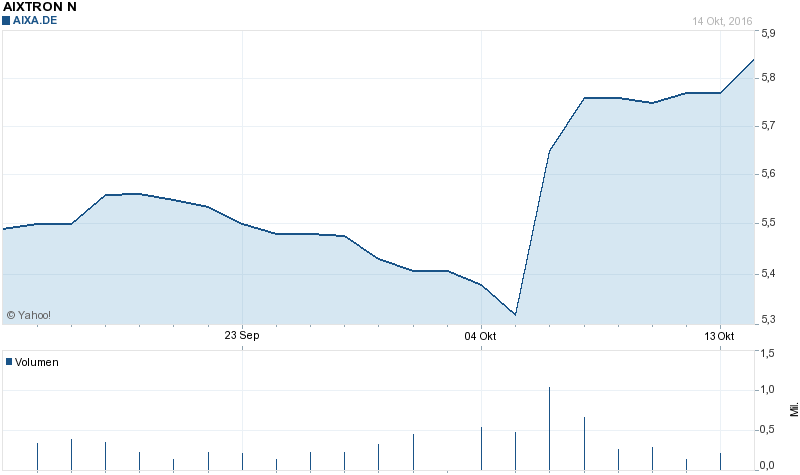

I think I handled the Aixtron special situation case not well. I bought the stock with relatively little research at ~5,50 EUR, hoping that the 6 EUR bid of a Chinese investor would go through.

However, a few days before expiry I got nervous and sold the stock at a loss (5,34 EUR) as only a relatively small amount of stocks had been registered in favor of the offer.

If we look at the chart, this was exactly at the lowest point within the last 4 weeks:

What happened? The very next day after I sold the shares, the Chinese investor first extended the offer period for another 2 weeks and lowered the threshold to 50,1%.

Then, a day later, they informed the investors that at the end of the initial period, 47% of the investors had handed in their share, and Friday last week they had 60%.

I think I made at least 3 mistakes:

- I didn’t take into account that the acceptance percentage usually dramatically increases on the last days

- I did not take into account that the investor could always lower the threshold and extend the period. In general I have the impression that Chinese bidders for German companies rarely “chicken out”

- I didn’t have the conviction to hold the shares and be patient, because I hadn’t done enough research

For future cases I hope a can avoid those mistakes.

With regard to the Delta Lloyd case above, I think despite the short post, I have done enough research, as I analysed and followed both stocks for quite some time and owned NN for 2 years plus. But let’s wait, see and hopefully be patient enough.

The offer is now “official” and unconditional as the EU cleared the deal: Money will come on April 12th.

https://globenewswire.com/news-release/2017/04/07/956769/0/en/79-9-of-the-Shares-committed-NN-Group-declares-Offer-for-Delta-Lloyd-unconditional.html

Those who won’t tender will receive NN Stock according to this release.

I have tendered my shares now “officially”.

Why already? According to my broker and the investor relation it is still time until the beginning of April.

I’m wondering why it dropped today, 1,5% in 2 months is not bad these days.

Best whishes from Freiburg

Johannes

P.S. thank you for sharing your thoughts, I enjoy reading them.

Well, I think there is nothing to gain in waiting and before i forget it i just tender.

And I don’t know why it dropped today either.

From Reuters:

Delta Lloyd says solvency fell in Q3; to consider right bid from NN

AMSTERDAM, Nov 16 (Reuters) – Delta Lloyd (DLL.AS), the

Dutch insurer that is being pursued for a takeover by larger

peer NN Group (NN.AS), said on Wednesday its solvency has

slipped during the third quarter and repeated it would consider

a better offer from NN.

On Oct. 7, Delta Lloyd rejected an unsolicited bid of 5.30

euros per share from NN Group valuing the company’s equity at

2.4 billion euros ($2.6 billion). Delta Lloyd shares closed at

5.56 euros on Tuesday.

In a statement, Delta Lloyd said NN Group’s offer

“substantially undervalues” the company, though “we are not

opposed to transactions that will create value for our

shareholders.”

“Delta Lloyd estimates that a transaction with NN Group

could deliver cost synergies of approximately 200 million euros

per year over and above our existing cost savings plans updated

today.”

The company said it would also benefit from NN’s stronger

capital position.

Delta Lloyd reported solvency of 156 percent at the end of

third quarter, under Europe’s new Solvency II rules, down from

173 percent at the end of June.

ING analysts had forecast a decline to 163 percent.

Analysts pay close attention to the figure as a sign of a

company’s ability to pay dividends.

Delta Lloyd was forced to issue 650 million euros worth of

new shares in March after its solvency fell below levels

acceptable to its regulator, the Dutch central bank.

(nL5N16O4HV)

By comparison NN Group has a Solvency II ratio of 252

percent.

“We need to continue to improve the quality of our capital,”

Delta Lloyd said.

Delta Lloyd’s trading update also warned of weaknesses in

its business and contained a notable change in guidance.

“Our business is solid, but operational performance needs

improvement, including further necessary cost reduction,” it

said. “During the first nine months, our commercial performance

was mixed.”

The company, which had previously said it would generate

200-250 million euros in cash annually, said Wednesday it would

meet that goal “over time.”

This is not a surprise looking at the interest rate movements. However since Q3, interest rates recovered significantly which in turn improves Solvency.

Slightly higher recommended offer at 5.40 EUR out. NN Group played it well, I think.

I sold today as the spread is 2% only and with a close in April (my estimate) the annualized return is sub-10%.

Even though it is somewhat disappointing. I still liked the optionality of the deal and the limited downside prevailed. On the next one!

Ahhh…one more thing…Merry Christmas!

As i don’t have better ideas so far, i will keep it. There was indeed little downside wirh this one.

Via Globalnewswire:

Today at 08:59

Delta Lloyd has noted today that NN Group has reconfirmed its intention to

make a public offer for Delta Lloyd.

The boards of Delta Lloyd are not opposed to transactions that would create

compelling value for shareholders and deliver benefits to other stakeholders.

However, the proposal announced by NN Group on 5 October 2016 substantially

undervalues Delta Lloyd, its prospects and its strategic opportunities and

fails to reflect an appropriate share of the benefits of Dutch consolidation.

Following its rejection of NN Group’s proposal on 7 October 2016, Delta Lloyd

has shared its views on a possible transaction directly with NN Group. Delta

Lloyd has also provided to NN Group its estimates of the substantial cost and

capital benefits that a combination could deliver.

Delta Lloyd will make further announcements if and when required.

Full press release (http://hugin.info/142905/R/2053567/768605.pdf)

Interesting “news” on Bloomberg, might explain the price increase:

Fubon Life May Increase Stake in Delta Lloyd: Commercial Times

By Yu-Huay Sun

(Bloomberg) — Fubon Life Insurance may raise its holding from 15% as co. plans to increase overseas investments, Taipei-based Commercial Times reports, citing unidentified people familiar with the issue.

Fubon Life may also invest in insurers in Southeast Asia: report

NOTE: Oct. 11, Delta Lloyd counter bid from Fubon unlikely soon, DealReporter said Link

Link to report in Chinese: http://alturl.com/9b36f

remember that France, in the case of Danone, considered Yoghurt as a threat to national security.

Maybe that’s one of the reasons why the French economy is “so strong” ?

wow, ministry opens up again the Aixtron case:

http://www.handelsblatt.com/unternehmen/industrie/aixtron-uebernahme-gabriel-will-chinesischen-kaeufer-erneut-ueberpruefen/14728232.html?nlayer=News_1985586

Quite unexpected…..

Not good!

Not good for “Standort Deutschland” (and for the arbs, of course).

Germany – “Banana Republic”. And it is still 12 months to go until the election.

Und wegen was will Gabriel es verhindern? Wenn deutsche Unternehmen bei den Chinesen kaufen können, dann muss das umgekehrt auch gehen. V.a. wenn es sich um ein kleines Unternehmen mit Verlusten handelt. Für die Sicherheit von Deutschland besteht dadurch keine Gefahr und der Rest ist Marktwirtschaft. Ich hab mir mal ein paar gekauft, aber mit 5,43 und 5,38 wohl zu früh. Denke, dass es auch mit der harten Linie der Chinesen bei Syngenta heute zu tun hat. Am attraktivsten dürfte beim Absturz der 3 Übernahme-Aktien wohl Kuka sein. Bei 105 Euro sind es 9,5%.

Ich tippe mal, dass Gabriel wie bei Kuka in 2-3 Wochen wieder kleinlaut bei gibt. Ich denke, dass man vllr verhindern will, dass es zu einem Osram-Angebot kommt. Denn das Unternehme sagt den meisten Deutschen was. Aixtron kennt doch kaum einer außerhalb der Börse.

m.E: muss Aixtron froh sein dass jemand 6 EUR für die Aktie zahlt.

Klar muss AIX das. Deswegen auch der Absturz, da eben ein anderes Risiko bei Scheitern als bei Kuka, Monsanto oder Syngenta droht.

Für mich stellt sich eben die Frage, wo Gabriel was gefunden hat, dass die Sicherheit der BRD gefährdet. Und wenn es das tatsächlich gibt, dann ob man nicht eine Lösung findet. AIX wird ja nicht geheim an Raketen forschen 😀

Dazu finde ich es merkwürdig, dass es genau da passiert, als die Frist vorbei war. An Kurse um 5,10-5,15 hätte ich nicht gedacht. Hab deswegen mal verdoppelt und in die inzw. günstigeren eingereichten Aktien getauscht. 5,10 Euro entspricht >17%. Ohne konkrete News finde ich das schon hart, v.a. wenn man bedenkt, dass zuvor zu 3,x% gehandelt wurde.

War kein guter Tag für die Besitzer von AIX, Kuka und Syngenta. Allerdings sind die Umsätze auch sehr dünn. Bin mal gespannt, ob alles so heiss gegessen wird wie es gekocht wurde. 😀

now it becomes even mor wired and it sounds like a conspiracy: The US intelligent Service might have influenced the stop…

http://www.handelsblatt.com/my/politik/international/geplatzter-deal-us-geheimdienst-stoppte-aixtron-uebernahme-durch-chinesen/14741500.html

yes, very starnge. I mean anyone can buy the Aixtron machines and produce the chips. So why now block the sale of the company ?

If those machines are so special, why don’t they earn some money ?

Strange…

http://blog.argonautcapital.co.uk/articles/2016/10/26/politics-protectionism-and-posturing/

“he extension of the German Economic Ministry logic that this deal is a danger to security would perhaps prevent a merger between a Chinese and German steel company purely on the basis that steel is used in the manufacturing of US and German tanks.”

Plain stupid politics. – Argonaut is the largest holder in AIXA

M.E. hast du damals zu viel Risiko für die gleiche Rendite wie bei Kuka genommen. Ich denke, dass wenn sich alles in 4- Wochen beruhigt hat, dann kann man vermutlich noch mal im Bereich 5,65 Euro kaufen. Außer die Chinesen kaufen den Markt leer.

Derzeit gibt es übrigens Syngenta zu 379,xx Euro. Angebot ist bei 465 USD ==> 422,xx Euro. Dort fusioniert der chin. Bieter jetzt selbst und die EU muckt auch etwas, nachdem die USA zugestimmt haben. Leider hat man durch das USD-Angebot ein USD-Risiko. Ansonsten fände ich 11.x% interessant.

Aixtron: I dare to say that you are wrong. Once the tender period expires AIXA will fall like a rock similar as Kuka (untendered shares) is currently diving. Why? As there will be no Dominiation Agreement and Squeeze out, fundamentals will matter and take over again. And they look ugly and the shares are overvalued.

Great post – but I personally am happy to have booked a loss on Aixtron. I find that this style of risk management pays off on the long run.

I bought again at 5.70 by the way when the equation had changed.

You’re more experienced than me but from my experience I’d never assume a just 10%-fail-probability in any potential takeover case. Perhaps I’m biased by the current Tengelmann/Rewe/Edeka-Case (well – kind of different situation) or the failed K+S/Potash-deal last year but with your assumptions there’s almost no margin of safety. If you calculate with 20/50/30 you get to around 5,30 €…

Well, we will see. In the DL case I would actually assume a close to zero percentage of fail given the facts, but of course I could be totally wrong.