Majestic Wine (GB00B021F836) – Nothing to see or potential UK “Outsider” company ?

DISCLAIMER

As always: this is not investment advise. Please DO YOUR OWN RESEARCH. Never trust any “stock tips” from anyone.

A few weeks ago I already mentioned that I had invested into a UK small cap company. Because of a lack of time I had to delay finishing the write-up but now I happily reveal the “UK mystery stock”:

Majesic Wine Plc is the dominant wine retailer in the UK for “medium to higher priced” wines, from 5 GBP/bottle upwards. They run a retail chain plus a commercial service for restaurants and a “fine wine” subsidiary. They recently purchased online only wine trader “Naked Wine” but we come to that later.

Charly Munger’s mantra is “Invert, always invert”. So let’s start this one with a couple of reasons why you shouldn’t buy Majestic Wine at the moment:

- BREXIT: This has potentially multiple negative impacts on Majestic. With a lower Pound, imports get more expensive plus a general potentially weak consumer climate could make things really difficult and squeeze margins and/or reduce volumes. On top of that, many of the bankers who might need to leave the City might be target customers

- The overall wine market in the UK hasn’t been growing in the last years so any growth needs to come from competitors. If Wine importers need to raise prices there is also the potential of a “substitution effect” towards other, cheaper alcoholic beverages like for instance craft beer which can be made locally.

- Current numbers do not look that good, even if one adjusts for one-offs etc. the stock is not “cheap”. The company cancelled the dividend for the current year.

- Even before the Brexit discussion, the business had weakened. The earnings peek has been the business year 2013/2014

- As everywhere in retail, online is definitely an issue for the wine trade.

So why not just filter out the company at this stage and move on to more interesting stuff ?

Well, first I made the experience that “macro stress” often creates opportunity for the more adventurous investor. The UK Brexit debate could be one of those instances. At them moment it looks that people expect more and more the “Hard Brexit” which in turn could mean that maybe (and that is a big maybe) a lot of risk is already priced in.

That macro stress is not a reason to buy per se but in my experience often justifies to look deeper if there is opportunity (and value).

Secondly, I would recommend anyone who likes to read good annual reports to read the 2015/2016 annual report of Majestic, which in my opinion is one of the best annual reports I have been reading for a long time. Why ? This leads us to the most interesting aspects of Majestic:

The “Naked Wine” acquisition and the new CEO Rowan Gormley

In early 2015, Majestic acquired online Wine retailer Naked Wines for 70 mn GBP. Coincidence or not, the Majestic CEO had just been fired a few weeks before and the CEO of Naked Wine, Rowan Gormley became CEO of Majestic.

Interestingly, Rowan Gormley decided not to receive cash for his personal stake in Naked Wine but opted for Majestic Wine shares instead (for the most part) and is now the second largest shareholder with 6,4% (after the founding Apthorp family).

Normally, if you google a CEO and almost any picture you find shows you the guy either with a glass or a (big) bottle of wine, you might get concerned as he maybe is drinking too much. Of course this is different for someone running (passionately) a wine business.

There are quite many stories about Gormley for instance here or here., so let’s just summarize them:

- born in South-Africa, trained as an accountant, age 54

- started as an accountant

- worked in Private Equity

- Started to work for Richard Branson / Virgin

- Founded Virgin Money

- Founded Virgin Wine which was sold

- Founded Naked Wine which was sold to Majestic

He also seems to possess a healthy dose of humour. This is how he describes his first two jobs in his Linked.in profile:

Dogsbody

Electra Partners

1995 – 1999 (4 years)

Slave

Arthur Andersen

1983 – 1986 (3 years)

Gormley is clearly a good communicator and story-teller. Normally, I am not such a big fan of “CEO story tellers” because telling a story and actually doing things are characteristics which are rarely found in one person. So I think it is quite important to check if the stories that are told are supported by facts. I think there are clear indicators that Gormley is more than a story-teller. According to this article for instance, he was offered a significant long-term incentive plan of around 7 mn GBP which he declined and passed on to his employees.

Another “walking the talk” is capital allocation. Gormley and his CFO speak a lot about capital allocation, but in my opinion the proof that they take this seriously was the decision to cancel the dividend. They could have paid it but in the current situation it was clearly better to preserve the cash and invest in the business. Clearly many investors want to have their cake and eat it at the same time but in reality and for the long-term benefit I think this was a very good decision.

Naked Wine

So what is so special about Naked Wine ? There is a very good video from 2010 explaining how Naked Wines work:

My interpretation is the following: Naked Wine could be a very interesting business because it combines elements of a typical “platform business” with a loyal “Amazon Prime” like customer base.

The “platform” is to link (small) producers with customers directly, which up until now was quite difficult for both sides. The “angel” concept is also quite clever marketing and convincing someone to pay 20 GBP per month is clearly only possible if the customer is really interested and satisfied with the product.

The question is of course: How expensive is it to get more “Angels” on the platform and will those expenses pay off in the long run (will the stay long enough). Reading the available material (including the 6 month trading update), it is not easy but Gormley seems to approach this with a very data driven approach which should help them to identify the best ways to expand the customer base. Reading for instance the 2016 trading update we can read the following:

The decision was taken to accelerate a number of initiatives, including testing a significant new direct mail campaign. It is now clear that, whilst most initiatives were successful, the direct mail campaign was not. We have now stopped this investment, but the short term impact will be higher costs in the first half of the year, with fewer new Angels acquired than hoped also impacting profits over the next 12 months. Accordingly, we now anticipate that the Naked Wines business will move back into making a small loss for the current financial year with an EBIT performance also approximately £2m lower than expectations.

Whilst it is disappointing that the direct mail channel has not proved to be as viable as early tests suggested, we are getting very encouraging returns from other channels, and are ready to scale them when we are confident that the returns are sustainable

This pretty much sounds like it was directly taken out of the “Lean Start-up” playbook: Test, measure and then either continue or “pivot”. To me this looks like a very good approach but investors seem to prefer the “smooth” earnings approach.

I do think that Naked Wine also fits into the current big trend that consumers at the higher end of the spectrum want to know more where their food (and beverages) come from and prefer more artisanal products which creates issues for big brand producers.

Wine was always to a large extent artisanal but in a normal supermarket shelf, it is not so easy to create a relationship between vineyard and customer.

The most interesting aspect is of course that potentially this could mean that Majestic could access and grow in the huge US market which would be very difficult through a classic retail concept.

Another interesting aspect (and proof that those guys are still very entrepreneurial) is that they seem to try out if the concept also works for local/craft beer in a new beta version.

I think that is fair to say that the ultimate success of Naked Wine is not yet proven, but they clearly are approaching it in a different way and have come quite far with currently ~100 mn GBP of sales and being more or less break even on a GAAP basis. With regard to the GAAP account one needs to be aware that Naked Wine is fully expensing all new customer acquisition costs.

From what I have heard, if the would stop acquiring new customers and just stabilize the current ones (including churn), the business should already generate 6-7mn GBP profit annually. Insurance companies in comparison for instance are able to capitalize their customer acquisition costs which of course makes GAAP results much better.

The traditional wine retail business

For any intermediary, there are three major forces which influence the potential profitability:

Power of suppliers, power of customers and competition. The wine trade scores well in the first two categories. Suppliers (vineyards) are very fragmented and there are no dominating buyers, most of the business is retail and even in commercial they trade mostly with single restaurants. However competition is clearly an issue, mostly with supermarkets pushing into wine trading.

However I do think that there is space for specialist retailers. Take Germany as an example. Germany has two of the most aggressive discounters in the world (Aldi & Lidl) which pushed hard into wine a few years ago and are offering more and more wine above 10 EUR per bottle. But the listed Wine retailer Hawesko has been going strong for many years and is actually gaining market share in the “premium” segment.

How can this be ? I think this has to do with the fact that the wine market is much more “Bifurcated” than for instance beer or spirits. According for Hawesko for instance, 5 bn EUR of Germany’s 7 bn EUR wine sales are in the low-cost area (below 4 EUR) which is covered by the supermarkets / discounters. That still leaves a significant segment for specialist retailers.

For wine, people in general are prepared to pay much more for something “special” like for beer or “Normal” spirits.

In the past, Majestic easily managed to generate ROE and ROIC of 20% on average with a net margin between 5,5-6,5%, which clearly shows that the business as such is (or has been) pretty Ok.

Valuation

So now comes the more difficult part. How can we value the business ? Based on the normal multiples, Majestic doesn’t look like a value stock:

Market Cap: 206 mn GBP (at 2,92 GBP/share)

P/E (trailing) 85,6

P/E (2016): 21,9

P/B 1,9

EV/EBITDA 19,1

Div. Yield: n/a

Majestic doesn’t give any profit targets, only a sales target of 500 mn GBP for 2019.

If we assume that Majestic reaches the sales target and manages to return to its old margins of between 5-6%m this would mean an expected net profit of 25-30 mn GBP. Based on today’s 210 mn GBP market cap, one would buy Majestic at an implicit 2019 P/E of 7-8,5. One could then attach a “fair” or “mean reversion” P/E multiple which in my opinion would be in the 12-14x range (Hawesko trades at 19x).

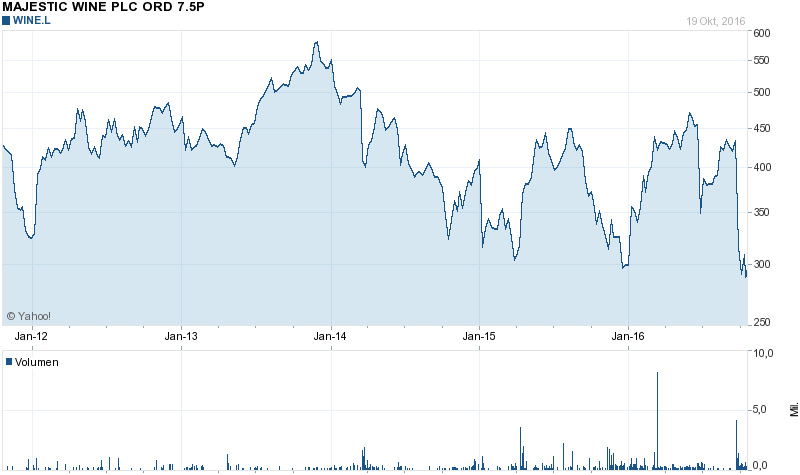

However there is clearly a risk that there are negative surprises as we have already seen in the 6 month trading update. The current market clearly is nervous when expectations are not met which we can clearly see expressed in a -30% share price drop directly afterwards:

Putting an assumption (future margins) on top of another assumption (P/E mean reversion) is clearly not classic value investing.

Another attempt to approach this would be to assume the following. Based on a longer term average for EPS (20 pence per share over the last 10 year), the current market cap more or less should cover the value of the traditional business including the Brexit risk and the leverage from the Naked Wine acquisition. So the Naked Wine business comes for “for free”.

The question now is: How much is Naked Wine worth ? The 70 mn GBP they paid or even more ?Structurally they Naked Wine business could actually lead to higher margins and ROICs than the traditional basis. No retail outlets, prefunding through the “Angels” and low staff requirements could make this a very interesting business and one could argue for significantly higher margins than the traditional business.

Form a value perspective, I do think it is quite interesting to get something at “fair value” plus a significant “option”, especially as the principal “proof of concept” is already there (there is a significant market). There is another “option” there as well: I t will be interesting to see what a guy like Gormley will do when he combines his online asset with the physical stores of Majestic. According to the company, they have already combined the IT systems (Majestic of course uses Naked Wine’s) and you can pick up Naked deliveries at MAjestic. I think this could be a huge competitive advantage against other competitors at least in the UK.

Summary:

Majestic Wine is a very interesting case. I think the stock offers good long-term value without looking like a typical value stock due to the potential of the “Naked Wine” business and a maybe temporarily depressed price due to Brexit.

It is also an interesting bet on an “Outsider style” CEO whose interest is aligned quite well with shareholders and who seems to know what he is doing.

That is why I bought a in total a 3,5% position (2,5% position back in September and 1% in October) share for my “Outsider bucket” of my portfolio at around 3,13 GBP/Share. In EUR, I am already down -9%, so any reader who will buy now already has a nice advantage…..

The stock will clearly be not a smooth ride, with the “real Brexit” on the horizon, but for me it is a very attractive “Outsider style” situation with a little contrarian aspect.

DISCLAIMER

As always: this is not investment advise. Please DO YOUR OWN RESEARCH:

Links:

http://forums.moneysavingexpert.com/showthread.php?t=2125033

https://www.trustpilot.com/review/us.nakedwines.com

https://www.thedrinksbusiness.com/2016/06/uk-wine-retail-market-2015-the-facts/

http://www.ft.com/cms/s/0/c474cdb8-df61-11e4-a6c4-00144feab7de.html#axzz4JlTUlGSV

http://www.wsj.com/articles/SB10001424052702304885404579547712514147246

Sold some Naked Wine shares today a 7,60 GBP/share, total volume 1,5% of portfolio (reduction from 8,4% of the portfolio to ~6,9%).

I am not 100% comfortable in a “Hedge Fund Hotel” and need to manage risk.

Today’s numbers were pretty impressive. I have added ~1,5%portfolio weight to Naked at % GBP/share.

Curious why you designated this a value trade and not a value investment? Seems like the NW focused business now has a very long potential runway in the DTC wine market?

Simple answer: I invested into the Founder/ Ceo and the Business. Now that the CEO is gone it is a different Story.

Protector has reduced the number of its shares from 3,95% to 2,2% of voting rights as of 5-Apr-19:

https://www.investegate.co.uk/majestic-wine-plc–wine-/rns/holding-s–in-company/201904080700043581V/

Not sure whether they want to dispose of the position completely.

Darf ich erfahren, was Du über die neue Strategie von Majestic Wine denkst?

Die wollen ja sich komplett auf Naked Wine konzentrieren und sich umbenennen.

Die Börse findest das nicht überzeugend und seither rauscht der Kurs nach unten.

Ennismore hat seen Short-Position Anfang Januar 2019 gestartet und seither auf 1,91% ausgebaut.

https://shorttracker.co.uk/company/GB00B021F836/

Ich finde den strategiewechsel überzeugend.

Any thoughts on the recent glassdoor reviews for Majestic? 35% recommend, 35% CEO approval rating, 2.8 overall rating – all very low. Obviously it’s anonymous reviews on internet so take with a huge grain of salt…but they have been brutal over last 6-12 months. Sounds like chronic under-staffing hurting employee morale and less-than-great take on the CEO (chronyism, etc).

Importantly, the ratings have deteriorated rapidly over the last 12 months i.e. CEO approval was 80-85% in late 2017 before falling off a cliff to lowest levels. Seems to run contrary to the glowing press articles on CEO..

Welcome to the real world of big bonuses for the top, and misery for the rest…

Looking forward to an update on that one…

Moin MMI

I also bought some shares yesterday – half position @ 264p.

Increase my position in Majestic by 0,6% of portfolio value at aroun 2,70 GBP/Share.

Yes it hurts, but I do think Majestic will even survive a Hard Brexit and will have good chances to come out as a “relative winner”.

Bought another 0.5% at 2,60 GBP/Share

yacks!

This is when “Please DO YOUR OWN RESEARCH. Never trust any “stock tips” from anyone.” becomes very relevant.

What exactly do you mean by that ? The stock is pretty much at the level when it was introduced on the blog. This is not so bad considering what happened in between…

2 options: hard brexit (WTO) or soft brexit (customs union).

Option 1: their business model as a net-net importer will take a hit period. £8m in stock will get depleted quickly and the NPV of the brexit-adjust FCF will be reflected in the share price.

Option 2: They have hurt their balance sheet on the short term by depleting cash and increasing operational leverage. They will have to start fireselling stock which will hurt their EBITDA margins which will be reflected in the share price, fair market share and brand perceived goodwill.

Is their a 3rd scenario I am not about?

3rd scenario: smuggling 😉

4rt scenario: global warming taking Bordeaux & Priorat towards brit latitudes. 🙂

Are you short?

Not sure if i understand your 2 “options”. In the short term, wine consumption might be hurt, but long term i think wine will be still relevant. Wine has centuries of history and all wine importers in the uk are hit in the same way.

Personally, the 8 mn extra stock sounds like a small hedge to me and not a very significant event in the long term. Kg this is the only reason for the price drop. I would be an aggressive buyer.

Well done if you are short….

Read your post with interest at the time but didnt have the guts to back the position like you (well done). I’m surprised the share price hasnt reacted more positively to the recent results – free cashflow up signficantly and really showing the Naked concept is working. Also interesting to see recent broker report (RBC) comments: “”Our proprietary US survey highlights Naked Wines as the number one website for selling wine among its target consumers, reflecting its overall superior proposition compared to peers as our research also reveals. RBC’s analysis suggests Naked Wines is valued by the market at a 55% discount to internet peers on EV/EBITDA and a 50% discount on a growth-adjusted basis. The valuation discount is even greater on EV/sales at 70%, which RBC said is excessive.”

Any thoughts what is causing the recent share price weakness – is it Sterling weakness?

Thanks for the investment idea. The first time I followed one of your ideas. Was a risky retail bet but I liked your assessement on the CEO and the way they are scalling the Naked Wine business. Interestingly the store in Ldn close to my place had a good refurb and it really looks much better than before. Even my wife buys online from them now… A sign of a successfull turnaround! 😉

It looks like value investors are circling the Uk retail market: Pets, DFS, Virtue motors… I am not so convinced yet but Brexit clearly had an impact on valuation.

Thanks again!

The most inspiring connection between wine and economy, the Ashenfelter wine foreteller:

http://www.nytimes.com/1990/03/04/us/wine-equation-puts-some-noses-out-of-joint.html

http://wine-economics.blogspot.ch/2007/10/ashenfelter-vs-parker-bout.html

I heart in the meantime Ashenfelter traded wines and speculated a bit based on his wine-forecasts… and he turned a millionaire (while parking still is sipping wines)

Nice results from Majestic today. I know you’re not overly focused on ST results, and the results by itself are not that impressive. But there is a clear tendency that Gormley simply executes on the strategy he has laid out. A nice sign for his abilities to execute.

Somehow I don’t have the nerves to buy at 4 today, when I clearly missed the opportunity when it was at ~GBP 3. I wish I would have followed you into this one back then, as I was really tempted to do so – and still am…

It is fascinating to see how UK stocks react on quarterly numbers.

Gormley reminds me a bit of Horst Lühning from whisky.de (https://www.youtube.com/watch?v=wIipjuGL58g) who´s also an “outsider” CEO. Always interesting to look at managers of companies like admiral, majestic wine or whisky.de. Thank´s for the insights!

hmm, I haven’t seen that a video of Gromley talking about his Rolex though….

FT article on MajesticWine:

http://www.ft.com/content/49f2908e-51d8-11e7-bfb8-997009366969

FWIW, I sold my position the past couple days at an average price of around 350. Made some money (luckily given the < 1 year holding period). Would have made more if I had put the sell order in a day or two earlier when I originally intended 😉 Oh well.

Reason I sold was I've now been using Naked Wines since last November 2016, and I'm just not that impressed.

* The wine quality wasn't quite good enough. Had some decent pinot noir + cab, but the chardonnay (and other whites) were pretty weak. This is a problem for me since reds started messing with my sleep recently, so I sadly stick more to white these days. For red drinkers, you may have better luck at Naked Wines than I did.

* The website and app user interface are not very well done. Feels like they were designed in the 2000's, not 2010's.

* The marketing emails are messy and erratic. I found them too wordy and rarely read through them. They need to be straight to the point and better designed stylistically. Plus too many promotions. They should just hyper focus on quality at a reasonable price, without feeling the need to constant throw in freebies and one-time discounts.

I still think the business model is interesting and I like the CEO. I hope this business hits its potential and builds a great network effect (loyal network of angels + small high quality winemakers) but I haven't seen enough to bet capital on that happening vs. the competition in the market (I still prefer WTSO for example).

Thomas,

thanks for your insights. I keep the stock for the time being but according to their own standards, the website and mailings should be better….Clearly a point to watch.

MMI

Amazon is rolling out 1-2 hour beer and wine delivery in Cincinnati and Columbus, Ohio. I’m trying to wrap my head around the long-term ramifications of this for Naked Wines US expansion. It is certainly never a good thing to compete against Amazon. Naked Wines will have to continue to build out its network effect (show consistent producer / angel growth) and use it to beat Amazon on the price / quality combination. Amazon still may be more of a larger producer outlet (your Kendall Jackson’s, etc). Naked Wines surely won’t win on the 1-2 hour delivery front, which I don’t think is massively important. Could definitely be an uphill battle though, especially if Amazon types eventually take aim at Majestic’s retail in the UK.

http://www.cincinnati.com/story/entertainment/2017/03/15/amazon-begins-superfast-booze-delivery-cincinnati/99203818/

How you feeling about this one, MMI? Wishing my conviction was a little higher…

increased Majestic from ~2,5% to 4,1% of the portfolio. Now a “top 10” position

Any fundamental reason(s) behind the increase or just normal portfolio re-weighting?

no specific reasons. After reducing my French exposure I decided to reinvest into my “better” ideas and give thme a higher weighting.

The “market” seems to like Majestic’s 6M numbers quite a lot……

The market is liking the top line revenue figure – surely not the 92% drop in adjusted EBIT.

Profit margins are the rule of the game in a cut-throat industry…

And more cash will now have to be spent to compete with this:

http://www.telegraph.co.uk/business/2016/11/16/heineken-joins-deliveroo-to-create-booze-delivery-brand/

The so-called future proof next-day delivery platform is under threat already!

#Tony,

I am not sure if you did actually read the article that you have linked to. Heineken joins the company/network which is already cooperating with Majestic. It seems that they seem to be a step ahead 😉

mmi

Actually i had not read the Telegraph one :). Read it in another printed paper on the way to work (that clearly missed out to mention Majestic) and posted the first link that came on google on this matter for the benefit of readers of this blog (without reading it).

That does throw my last argument in the bin!

Yes it does 😉 But nevertheless thanks for the link, I wasn’t aware of this.

I think Majestic has clearly communictaed what to expect. They changed a lot of things and exensed everything. They delivered on sales growth. If they are right and the one-off expenses will be one-offs, then it doesn’t look bad.

MajesticWine may be a great company, but I think it is a bad time for UK wine market at all.

My main concern are based on the discounter attack in UK.

You already wrote: “However I do think that there is space for specialist retailers. Take Germany as an example. Germany has two of the most aggressive discounters in the world (Aldi & Lidl) which pushed hard into wine a few years ago and are offering more and more wine above 10 EUR per bottle. But the listed Wine retailer Hawesko has been going strong for many years and is actually gaining market share in the “premium” segment.”

I think you target too short:

– Aldi and Lidl in UK are still in full growth mode (perhaps further doubling market share in the next 10 years) while they are struggling to hold their (higher) market share in Germany since several years. So in Germany the market shock, the disruption is already over, while UK is just in the midst of it. Hawesko has found its niche and is going strong (from its niche) in a time when Lidl and Aldi are not in rapid growth mode – thats not comparable.

– One of the main strategies of the discounter attack in UK is market upgrading. They target more affluent shoppers than in earlier times. A central component to demonstrate their market upgrading is growing its competence in higher quality wines for fair prices. I think Lidl acts there even more aggressive than Aldi. Wine is a category less intended to increase profits but to improve the image toward affluent shoppers, as a kind of longterm marketing tool.

You find lots ofexamples of their growing quality wines offerings and their growing market acceptance in offering high quality wine. Some for Lidl UK

http://www.telegraph.co.uk/finance/newsbysector/retailandconsumer/11216317/Lidl-crowned-the-best-supermarket-for-wine-in-the-UK.html

http://www.harpers.co.uk/news/lidl-ramps-up-wine-cellar-promotions-to-capitalise-on-profitable-footfall-driving-initiative/537823.article

http://www.thisismoney.co.uk/money/news/article-2825213/Experts-crown-Lidl-best-supermarket-wine-says-wotwine.html

https://www.theguardian.com/business/2015/nov/11/lidl-expansion-stores-self-checkouts-toilets

Aldi UK started their online shop with wine, and they opened a first popup-shop just for wine:

http://www.independent.co.uk/news/business/news/aldi-to-open-standalone-wine-pop-up-store-in-east-london-a7047961.html

http://www.dailymail.co.uk/femail/food/article-3822831/Going-gold-Aldi-s-5-99-dessert-wine-triumphs-Waitrose-s-19-99-bottle-prestigious-international-contest.html

http://www.ibtimes.co.uk/aldis-new-wine-collection-raises-bar-supermarkets-off-licences-1584625

When we speak about market disruption by Aldi and Lidl for UK supermarkets, we can expect an even stronger market disruption for the UK wine market. As Aldi and Lidl both plan to double their number of stores, and they focus now on regions with more effluent shoppers, this attack toward the wine market has just begun and may further accelerate.

In Germany Aldi is already the biggest wine trader – a position they (and Lidl) presumably try to get in UK too.

http://www.handelsblatt.com/unternehmen/handel-konsumgueter/winzer-verlieren-aldi-ist-deutschlands-groesster-weinhaendler/9636298.html

This attempt will leave blood on the british wine market. Probably majestic wine will survive this doubled attack, but will they stay unharmed? Investing in a very good company in a bad market – you know what Buffet later wrote about the textile business of the original Berkshire Heathaway.

Additionally Brexit already means a declining pound, hence rising prices for exports like wine. Usually price shocks make people think more carefully about prices. Some accept paying higher prices, but quite some people try to stabilize their costs and change their shop or their quality level. This effect may further increase the market disruption in the wine market.

In my opinon it is very bad time to invest in the UK wine market. There will be blood on the floor.

#Roger,

thanks for the comment. The big question is: As the Brexit and the Pound are not a secret, is this already reflected in the price or not ? And as I mentioned, I do think that the wine market is quite “segmented”. Plus the Lidl/Aldi move to higher priced wine could go also the other way: Maybe this leads to more people being interested in better (and more expensive) wine and at some point they want more choice and go to majestic or Naked ? Who knows….

We will see.

mmi

A big question, hence quite a big bet. Personally I cant see a kind of the “safety buffer” that would increase my appetite for such a bet.

IMHO the chance-risk-relation is not preferable, reminding how the Aldi-Effect can shred the margins of disrupted markets for a very long time.

But everyone has different risks he likes to take. I am sceptial, but I wish you good luck with Majestic wines, if you really want to take their risks.

I wouldn’t call it a “bet” but clearly risk appetites are different. For me it is a combination of “contrarian” investment combined with a very good management and a very interesting potentially “disruptive” business model.

This is a good point by Roger… “Wine is a category less intended to increase profits but to improve the image toward affluent shoppers.” Retail is already brutal given this kind of intense competition and low switching costs, so it would be overly optimistic to think Majestic Wine (the UK retail business) would be able to compete sustainably at anything other than thin margins.

The interesting piece of the business is Naked Wines which the market is kind of throwing in for somewhere between free and cheap. That’s interesting since Naked Wines has a better business model by far (IF the network effect takes hold — the big IF). Naked Wines is also playing in a way bigger market ($17B including the US and Australia vs. $2B for UK only).

I really think Naked Wines’ model “could” work well in the US if wine quality / exclusivity vs. price is where it needs to be. Their business concept is easily sellable to other wine drinkers here so they just need to retain customers and grow the network. I (an American) signed up yesterday and look forward to testing it out. There aren’t many other great competitors in the US right now for this kind of service. I use WTSO, but their “deals” aren’t usually as great as they advertise — I could see Naked Wines replacing them since they have a better story as to why you (the “angel investor”) are getting the deal. Amazon can’t actually ship to my state (yet) and I don’t see small-medium sized winemakers selling through them necessarily (only the bigger ones). I do believe the true upside for this stock will rest on Naked Wines success (or not) in the US.

Another interesting idea, thanks MMI. I’m a sucker for these ‘outsider’ types. Agree this is the way to look at it…

“Based on a longer term average for EPS (20 pence per share over the last 10 year), the current market cap more or less should cover the value of the traditional business including the Brexit risk and the leverage from the Naked Wine acquisition. So the Naked Wine business comes for “for free”.”

Positives:

* Potentially oversold due to Brexit. My personal feeling is I don’t agree with the UK’s decision and clearly it will cause some short-term pain, but long-term this is not the end of the world. It is probably more reason to drink than anything else for Brits (good for Majestic!).

* Love the sound of this CEO. Received stock instead of cash (believes in Majestic and personally aligned). Accountant by trade (I’m biased as a finance / accountant guy clearly). Not too old so has a career runway (only 54). Passing the incentive plan down to his employees is an incredibly admirable jester and speaks to his character. Cancelled the dividend — love when companies make the right decision on that and get hammered in terms of stock price.

* Big fan of the network effect Naked Wine is trying to generate. I think that model makes perfect sense as both an investor and wine consumer. The CEO’s ability as a “story teller” will be useful to marketing and growing this network.

Negatives:

* Saturated UK market means intense competition, squeezed margins.

* As tonyfonda mentions is his good counterpoints, “Lease-Adjusted Net Debt to EBIT is in excess 5.3x.” (I would prefer they de-leverage quite a bit before resuming dividends as seems to be the plan.)

I established a foothold position today while I dig deeper. Thanks for the idea!

#Thomas,

thank oyu for your comment. My biggest (and maybe unfounded) concern that what I hear and read from management almost sounds “too good to be true”……

mmi

I think a big question for Naked is long-term retention. Most customer reviews seem relatively negative on the quality of the wine which could prevent long-term customer retention which is critical to the health of a subscription business.

https://www.trustpilot.com/review/us.nakedwines.com

http://disqus.com/embed/comments/?base=default&version=483ec65e31318f9edf8f7fb1185f782b&f=digiday-comments&t_i=digiday-comments-200021&t_u=http%3A%2F%2Fdigiday.com%2Fbrands%2Fuks-naked-wines-us-marketing-push-flopped%2F&t_e=Why%20UK's%20Naked%20Wines'%20US%20marketing%20push%20flopped&t_d=How%20Quartz%20makes%20sure%20it's%20a%20global%20brand&t_t=Why%20UK's%20Naked%20Wines'%20US%20marketing%20push%20flopped&s_o=default&l=en

#David,

the Trustpilot page you referring to has 574 reviews, therof 61,5% 5 stars and around 20% 4 stars, so mostly the reviews are quite positive. What I do like is that Naked Wine answers constructively to even the most stupid comments. In general, the coupon mailing marketing in the US didn’t work out well, that’s what Majestic clearly stated in their trading update.

And indeed, customer retention is the big driver and one needs to see if they manage to retain the “angels” for a long enough time.

I actually looked at Majestic last month again (I used to hold the stock in the past), and got interested again when Gormley was appointed (I had attended an entrepreneurship presentation given by him based on a Naked case study), and was an Angel for a couple of years:

A few observation:

*Lease-Adjusted Net Debt to EBIT is in excess 5.3x. They wont pay a dividend before deleveraging.

*They overpaid for Naked Wine (some say to acquire Gormley).

*Customer acquisition costs going up – revenue generated per customer purchase going down – Profit margin shrinking on an absolute AND relative basis.

*Supermarkets stealing the walk-in customers aggressively, with cheaper single bottle and multi-packs offerings.

*Online competitive space in the UK is very aggressive (Tesco Wines and recently Amazon UK)

*Majestic’s online event focused platform lagging (wedding orders, parties, etc…)

*GBP:EUR contraction will hit sales of the Mid-range (£10-£15 per bottle) – customers scaling down to new world lower priced items (Supermarket have the upper hand there)

*Direct competitors (like Nicolas) diversifying and becoming Delicatessens: selling French cheese and fresh bread.

*No organic growth as stated by MMI – wine market is saturated

In short: Majestic’s biz model is not broken but outdated (not worth 2x BV). Naked Wine flattered on a stand alone basis. Integration with Majestic stores has little impact. Naked Wines failed to migrate to a platform and is doomed to be a club v.s. mass-market.

They could well hit the £500m target, but odds are not particularly stacked in their favour. There are better turnaround stories out-there where the cause of distressed is easier to fix (v.s. a full revamp of a business model)

@tonyfonda: Realizing that you know more about the business than me, I try to tackle some of your observations:

*Net debt to EBIT relatively high, no dividend: granted, but deleveraging at the expense of no dividend does not have to be a bad sign. In fact, I think it is not, agreeing with what MMI wrote in the article.

*Revenue per customer down, cost up: agreed, but on the other side revenue per retail store showed a little uptick, at least a stabilization (like-for-like). That’s maybe a consequence of having more customers per store? There could be a connection with the following sentence from the AR: “During the year we got rid of the requirement to buy six bottles – we do not expect this to have a material impact on the results one way or another but it reflects our focus on making the shopping experience better for the customer.”

*GBP:EUR contraction, new world wines, supermarkets, pressure: isn’t one point of acquiring Naked Wines exactly to tackle those issues?

*Nake Wines failed: okay, you have some experience there, it’s hard to argue. So, question: Why are you so sure of this (that it has already failed to migrate to a platform)? If you’re correct, the “free option” part of MMI’s investment thesis seems questionable, but since you obviously know the company way better than me, I am very interested in your arguments.

*Agreed on your other points (or at least I haven’t looked deep enough into them)

Thanks for bringing up those points,

Tom

Hey Tom,

That’s what I like about this blog – looking at things from a different angle and leveraging on the “collective wisdom”

Experience: nothing much more than being a customer really…

Naked Wine: I look at the biz model as an incubator (or seeder) of independent, small, unknown, startup wineries. The value add is that the platform gives you access to wine your neighbour does not have access to. The producer benefits from a guaranteed off-take.

The issue is the following: Naked is promoting/incubating/seeding start-ups with no equity participation in their success! I asked specifically this question to Gormley during his talk and he baffled me when he said that he hand no interest in taking an equity stake in a small Chilean winery that he was promoting (by way of example). This is unheard of in any other line of business – royalties and profit participation structures are common place.

Furthermore, such an equity will guarantee the exclusivity of future supply if and when they land on a a hidden gem – compounding value through-out.

We can discuss all day long that Naked did not make any money, etc…but to me, the above is the most crucial shortfall in the business model.

Then comes the point of synergies between naked and Majestic: none so far. Hence my conclusion that Majestic was headless, and the Naked acquisition was a proxy to put Gormley as a CEO.

as for the Net Debt/EBIT point : I agree with you – but it still stands at 5.3x today in a space where margin are shrinking!

One point I did not touch earlier is this “Outsider” mantra – these guys have been elated since that book was published a few years ago….

Trump is an outsider – that does not mean that he is the right person for the job!

My view is that we should judge outsiders more critically that CEOs with proven track records….

Tony

Tony,

allow me a few comments:

1) I don’t see any advantage in taking equity stakes when you run a platform business. I think this could actually have negative consequences as the clients then could think that you are not independent.

2) Majestic’s online platform has been migrated to Naked already and I am pretty sure more stuff is coming (you can already pick up Naked orders at Majestic). I think in remodelling the stores and motivating employees, Gormley has tackled the important things first.

3) Did Majestic overypay for Naked ? In my opinion to early to tell. In my opinion, running a subscription based business with such growth rates at break even is impressive.

4) I think the track record of Gormley speaks for itself, I am not sure why you think his track record is “not proven”. And “outsider” has nothing to do with Trump, whio is simply an idiot. I do like managers who do things differently. Especially I prefer management teams who look at their employees as “partners” rather then human robots. That’s the reason why I prefer them to Sportsdirect. I think long term success has a lot to do with hoiw you treat and motivate your employees.

5) As I said, it is not only about the turn-around but more about the potential growth.

6) and yes, all the market issues are obvious, but as I explained, the market is not one big homogenious market but a (very) segmented one.

mmi

@tonyfonda: do we have different definitions of “platform”? I guess you think of a “platform business” in the classical sense? (like the, somehow, confusing Wikipedia definition here: https://en.wikipedia.org/wiki/Platform_company). If so, I see your point, and: sorry for my abysmal English.

I think of it as something similar to the ebay-model (for example here: http://sloanreview.mit.edu/article/how-to-win-with-a-multisided-platform-business-model/)

So, in my view, the point is not to get an equity stake, but to match buyers and sellers (wine drinkers and winerys) directly, processing the funding, part of the logistics, and collecting a small fee on these activities. The more wineries, the more buyers, the more wineries, …. achieving cross-side network effects. An equity stake in wineries is not necessary for this. The crucial point is the grow the network (number of buyers and sellers). The numbers for Naked Wines for the last two years:

-Sellers: 2016: 152 and 2015: 130

-Buyers (mature angels, they call it, as you know): 2016: ~301k, 2015: ~241k

Of course, it would be interesting to get some numbers on processed volumes or something similar, but, to me, it looks like a growing network. There are only small profits until now, but I do not look at it as already failed. Maybe they will fail, granted, but it still looks interesting to me.

However, maybe I am completely wrong on this since I only began with my research on the company and I don’t know about the royalties and/or profit participation structures (something I will try to find out about) – so feel free to prove me wrong 😉

Tom

TomB,

one remark: Don’t focus too much on GAAP numbers in a strongly growinng subscription business….. break even is in my opinion a pretty impressive achievement.

mmi

@ mmi: don’t focus too much on GAAP

Sorry, but a part of me is a hopeless number cruncher 😉

me too. But there is always the chance to “widen the horizon”. I think I looked at Amozon 10 tiems over the last 10 years and didn’t buy it because of “GAAP earnings” or the lack of earnings. GAAP is important, but it is not everything, rather a strating point.

I will need a bit of time to process your thoughts (Tom and MMI) and revisit from a different angle to see if I can reach a different conclusion….

Thanks for your thoughts.

take your time 😉 and thanks for the input.

Interesting. I live in Australia, received a Naked Wines promotion but did not end up buying because by the time I made up my mind the wine I was after had gone ! Your article has prompted me to have another look and I see that they’ve now got “fresh” stock ! So thank you, I might buy !

Paul Scott from Stockopedia has also commented on majestic a few times. Here is one of the links:

http://www.stockopedia.com/content/small-cap-value-report-21-sep-2016-swp-wine-egs-dx-dsg-151181/

Thanks for the write-up. I just looked at the Naked Wines website and saw that they are fully subscribed and that there is a waiting list to join. Why are they trialing larger ad spend when they do not have the capacity? Is this a short term capacity issue?

well, I guess that could be a markteing “trick” ? Anything that is full and where you can’t get in easily, is attractive for many. Just look at restaurants or clubs.

Yes, one of the six main influencing strategies:

https://en.wikipedia.org/wiki/Persuasion#Scarcity

Wow, thanks.

I am doing some research on Majestic Wine too, so it looks like we’ve got the same idea at about the same time. I am not done yet though, but I was having some similar thoughts. Especially Naked Wines looks very interesting.

It looks like they have some kind of first mover advantage with Naked Wine and they can, like you write, leverage their retail outlets. Also, Gormley is already talking about how to defend the competitive advantage in the AR – he clearly sees some risk of competitors copying the Naked Wines business model. I don’t know how that will play out, but Naked has a first mover advantage which could be hard to copy, since there seem to be some (rather small?) networks effects – you’ve mentioned “platform”. All in all, not LT proven, but very interesting indeed.

I agree that Gormley could be an “outsider” CEO.

Very interesting read,

Thanks

Tom