Italgas SpA (ISIN IT0005211237) – Spin-off special situation meets contrarian opportunity

Management Summary

As this turned into a pretty long post again, quickly the highlights. I do think that Italgas SpA, the recent Spin-off from SNAM SpA represents a potentially interesting special situation investment because:

- overall sentiment towards Italy is really bad (“Renzi referendum”)

- the Spin-off was not timed well just a day before the US election

- the current uncertainties within Italian regulation changes further deters potential investors

- all this is reflected in asset multiples at the very low-end for comparable regulated assets

For those reasons I initiated a 2,7% position for my portfolio for my “Special Situation” bucket.

DISCLAIMER: This is not investment advice. Please do your own research !!!!

According to Bloomberg, Italgas SpA

provides gas distribution services. The Company offers delivery points management,

pressure reduction plants, withdrawal cabins, fault reporting, and laboratory testing services. Italgas conducts its business in Italy.

Italgas Spa was spun-off from SNAM SpA on November 7th. 2016.

Spin-off background:

SNAM, the stock listed Italian natural gas distributer decided this year to separate its national local distribution system from its Italian and international transmission business.

This is from the SNAM IR website:

Following the demerger, Snam can concentrate its energies on the development of the transport, storage and regasification activities in Italy and abroad in order to maximise the current asset portfolio value and offer new services for satisfying a market which is developing continuously. A strategy which will be pursued by maintaining – as always – rigorous financial discipline, a solid balance sheet structure and a low risk profile, to ensure the profitable and sustainable growth which the Shareholders have always appreciated over time.

My interpretation is the following: SNAM has ambitions to become a European gas infrastructure provider. Due to the Italgas business, the stock market didn’t give them a lot of credit (and multiple) for their non-Italian assets, so splitting up the company then should result in a nice valuation boost.

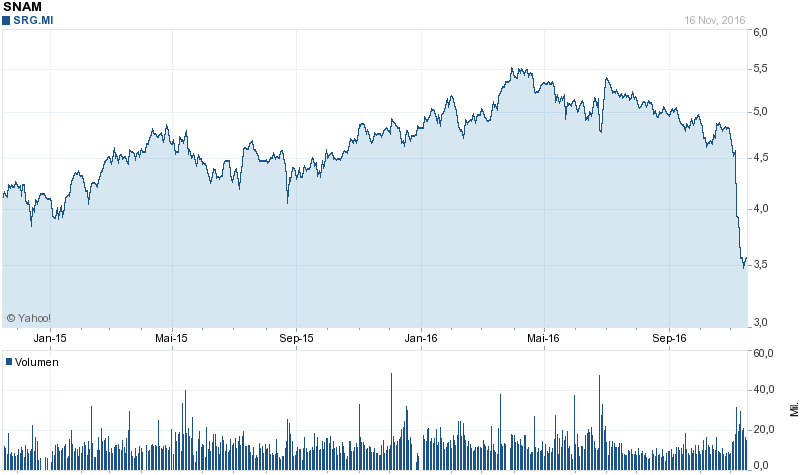

If we look at the chart we can clearly see that this didn’t work, even if we adjust for the 0,82 EUR per share “official” spin-off adjustment which is not reflected in the chart:

The spin-off details:

Official spin-off date was November 7th, the day before the US election which was maybe not optimal. Every SNAM shareholder got 1 Italgas share for 5 SNAM shares, representing in total ~86% of ITalgas, SNAM kept a stake of~14%.

The offical price was ~4,10 EUR which corresponded nicely to the analyst price targets of ~4,10-4,50.

Looking at the detail chart we can see that for until the day of the US election, the stock price kept up to around 3,90-4,00 EUR but then dropped like a stone to around 3,15 EUR/sahre at the time of writing

If we look at the Uniper Spin-off, we can see that for the first 10-12 trading days the stock was also under pressure but not as much as Italgas:

This is quite interesting, as in my opinion the “Must sell” ETF shareholders were more important for E.On than for Snam. If I use the Bloomberg HDS function, ETF ownership is 7% for E.On vs. 3,3% for SNAM.

So now one could speculate why the Italgas Spin-off performed so badly. I think it could be a combination of bad timing (US election), fear of an adverse outcome of “the referendum” and neglect by the market as everyone tried to figure out what Trump means for anything. In my opinion this is clearly a hint that some “market dislocation” could be at play here which makes this interesting.

Some thoughts on Italy & “The referendum”

I guess many people think: Oh my god, how can you even think to invest in Italy before “the referendum”. Shouldn’t we just wait and invest then ? Well, if I have learned one thing after Brexit and the US elections then it is the following: First of all, these days it is very difficult to predict outcomes of such events. Just forget the polls (where currently Renzo is supposed to lose and resign). Second, even if one would know the outcomes, it is still close to impossible to predict the market’s reaction. So for me it is clear that the best strategy remains to just ignore those kind of political events.

On top of that, many people I know think that Italy is doomed and will go the same way as Greece. I have no crystal ball, but on the other hand some things are happening in Italy. It looks like that the old “Italy Gentlemen’s club” gets slowly dismantled with outsiders coming in and changing things. One very good example in my opinion is Unicredit. French CEO Mustier really has moved things since he started a few months ago and there also seems to be some progress. Also other long-standing Italian strongholds like Pirelli, Telecom Italia or Generali have been shaken up by outsiders/Foreigners. Such things take time as the end of the “Deutschland AG” has shown, but the changes are almost always profound and very positive.

The stock market however is not impressed. With -24% YTD the Italian stock market is one of the worst markets globally this year, only Nigeria is doing worse with -40%.

It is interesting to compare the Italian FTSE MIB index for instance with the French CAC40. Until January this year they went more or less parallel, before then Italian stocks significantly underperformed:

Based on my experience, I will be too early, but on the other hand if the investment is attractive enough, I just don’t care.

Valuation: It’s all about the Regulated Asset Base (RAB)

For “simple” regulated distribution networks like Italgas, the basis for valuation in “professional circles” is the regulated asset base (RAB). This is the basis for what the company can charge the amount granted by the regulators.

Depending on the jurisdictions, there are different multiples used, but as a general rule neither gas nor electricity networks trade below RAB (Enterprise value, including debt).

On average, such assets have a private market value anywhere between 1,0 and 1,5x RAB (based on EV).

For Italgas, the RAB is 5,9 bn EUR (5,7 bn direct, 0,2 indirect).

The current valuation a 3,15 EUR/share looks as follows:

Market value: 2,5 bn

Net debt: 3,7 bn

EV = 6,2 bn or around 105% of the RAB.

So Italgas is clearly trading at the lower point of potential ranges.

A Valuation at the top of the range (1,5x) would mean around 8,9 bn EV and ~6,37 EUR per share. The middle of the range (1,25x) would be 4,54 EUR per share. At the lower end (1xRAB), the stock price would be ~2,72 EUR per share.

Interestingly, In march 2016 when the spin-off was discussed for the first time, Jeffries thought that this would be the appropriate valuation:

A research note from London-based Jefferies said that it valued Italgas at about 7.3 billion euros, representing a premium to the roughly 5.6 billion euro value of its regulated asset base (RAB).

This would translate into 1,24x RAB and a share price of (7,3-3,6)/0,809= ~4,40 EUR, which is very close to the 4,30 EUR target price of the 12 analysts listed on Bloomberg..

Finally, based on traditional valuation metrics, the Stock doesn’t look that expensive either:

P/E 2016: 10,6

P/B 2,0 (based on pro forma numbers)

ROE ~20% (2015)

Dividend Yield 6,3% (20 cent per share was indicated by management)

If we assume that in 2/3/4/5 years we will see the midpoint valuation of 4,4 EUR, this translates into the following IRRs as an investor (including dividends) based on the current 3,15 EUR::

2 year IRR: 24,2%

3 year IRR: 17,8%

4 year IRR: 14,8%

5 year IRR: 13,1%

Not bad, but clearly depending on a “multiple expansion” and the longer it takes the lower the annualized return. However, if we assume a 25% probability for each case, the expected return would be something like 17,4% which looks interesting.

This does not take into any growth opportunities due to the change in legislation. Management hints that they could increase RAB by 2 bn over 3-5 years. If we assume that the market value the RAB at 1,25x than this could add at least 0,60 value per share.

The biggest risk: Regulation

The general business model is relatively “risk free” itself:

+ the business has a natural monopoly (Moat) as it is not commercially viable to have more than one Natural Gas transmission net

+ there no volume risk (they can charge their fee whatever the underlying volume looks like)

+ no commodity price risk

+ certain interest rate sensitivity but mitigation via adjustments of rates (every 6 years)

+ RAB is inflation adjusted

+ compared to electricity networks, the structure of the gas network is not challenged by innovation like Wind farms etc.

The biggest risk with regard to regulation is the issue, that concessions are always limited in time and that the Government might just change the rules of the game.

Expiry and renewal of concessions – Special case Italy

One of the major risks of regulated businesses is that they lose their concessions at expiry. Depending on the sector, the old operators then get either nothing (roads) or some kind of compensation which usually is less than market value.

For gas distribution, the current status of Italian concessions is pretty well summarized in the initial listing document (from page 35). At first this sounds scary:

As of 31 December 2015, the above-mentioned concessions, which are held by Italgas Reti and its Subsidiaries (Napoletanagas S.p.A. (“Napoletanagas”), AES Torino S.p.A. (“AES Torino”)10 and ACAM Gas S.p.A. (“ACAM Gas”), come to a total of 1,472, of which 1,183 have expired. The average remaining life of the concessions still in force is equal to 7 years. During financial year 2015, 74% (i.e., €756 million) of Italgas Reti’s income for carrying services was tied to expired concessions; during the first half of 2016, this percentage is equal to 73%. In the Italgas Strategic Plan, the Italgas Group assumes that the expired concessions are re-assigned to the winner of the tenders provided for by the applicable legislation during the period 2016- 2020.

But this expiry of concessions is the result of a country-wide restructuring of concessions:

For the sake of completeness, it should be noted that the issue relating to the expiration of concessions concerns not only the Italgas Reti Group, but all operators active in the gas distribution sector in Italy. In this regard, from the moment the gas distribution service is qualified as a public service, the companies of the Italgas Reti Group – also following the expiry of the concession – continue and should continue with the management of the service (and be remunerated), limited to the ordinary administration, until the start date of the new concession (Art. 14 of Legislative Decree No. 164 of 2000).

So clearly, Italgas is at risk losing concessions, on the other hand they have also the uprise of winning additional ones. Interestingly, in the complex code of how concessions are awarded, the technical ability seems to score highest which is of course an advantage for already active (and large) companies.

Management is optimistic that they not only keep their concessions but that they are gaining market share from currently around 30% or so to up to 40%.

As this is Italy, this process seems to take longer than expected and clearly leads to uncertainty. On the other hand, I do think that the current overall uncertainties will limit the amount of competitors especially from outside Italy. All in all, my subjective impression is that this is at least as much opportunity as risk for Italgas.

Summary:

Italgas SPA looks like an interesting Spin-off situation combined with a contrarian aspect as Italy at the moment is very much out of favour especially just before the referendum

From a fundamental point of view and using RAB as a basis, the downside seems to be limited (-10%) whereas the upside looks good even without taking into account potential growth opportunities, with expected returns in the 15-20% p.a. assuming 2-3 years until the “Normalization” takes place.

There is clearly risk involved and reasonms why the stock is cheap with regard to the current status of the concessions, but as this is an uncorrelated (or even fundamentally negatively correlated) risk to the overall market risk, I have no problem with this.

On top of that I am not so pesimistic about Italy as many other investors; I do think that currently a lot of pessmism is already priced in.

I have therefore established a 2,7% position at ~ 3,15 EUR per share.

Have you looked at ADMIE (IPTO) Holding S.A.? The Company is a power transmission operator in Greece, trading below RAB (77,35 %) if I am not mistaken. It is hard to analyze the company because the prospectus from the IPO is only available in Greek and the IPO is just a couple of months ago. It could be an interesting case, because investments in Greece are completely out of favor and it was a forced IPO regarding the obligation of a privatization.

I must disclose that I initiated a small position.

Thanks for the tip. One remark though: Greece is one of the best performing stock markets over the last year……so it seems they are already back in favor.

I completely agree from a performance perspective. Maybe my wording was a little bit strong. What I meant is, that there are many companys who seem te be under the radar if you look at their valuation compared to peers from other countrys, especially mid- and smallcaps.

Thanks for the very interesting write-up and idea.

Two things that concern me with this one, that I would be interested in hearing your view on:

1/ The management seems to have no equity package in Italgas, so no skin in the game

2/ The pf financial performance appears to have been poor, with anemic revenue growth. It appears that the tariff was recently reset from 6.9% to 6.1% – is this a future risk?

On the positive side, I’ve just noticed Bin Smaghi is Chairman of the board. Likely one of the most credible italian Chairmen you could hope for.

Many

Pingback: Spinoff Links – December 4, 2016 – Stock Spinoff Investing

The Return on RAB is before tax and independant from the capital structure ?

Yes, before tax and independent of actual leverage (p. 25).

Click to access 2016_Italgas_capital_market_day.pdf

What about the risk of Italy leaving the Eurozone for Italgas? The assets and cash flows would suddenly be worth a lot less, but the outstanding bonds might have to be at least partially paid back in EUR and later refinanced at a much higher ITL-interest rate, for which the regulator might or might not have sympathy. Even if Italy does not leave the Eurozone, it seems not a remote risk that at least some country will leave the Eurozone and make investors more aware of the risk of holding southern European debt or securities.

* OR some southern country split into two and a chronic debt pile… that would be wonderful ! 🙂 For real…

Italy leaving the Eurozone has clearly a “Higher than zero” percentage of happening. The question is however what probability do you assume for this ? This is not an exclusive insight between you and me, so the market has priced that in to a certain extent. I think that in Italgas case this risk is adequatly priced in, but of course I could be wrong. For my investment horizon (Special situation, 1-5 years) I can live with it.

Would I want to bet 25% of my portfolio on this ? Clearly no, but 2,7% is O. And I might increase my “Italy is not leaving” bet further if there is some panic around the referendum.

A very interesting article why a “No” vote in the referendum might actually positive for Italy in the long term:

http://www.economist.com/news/leaders/21710816-country-needs-far-reaching-reforms-just-not-ones-offer-why-italy-should-vote-no

There are also other comments in the room: https://www.gwinvestors.com/2016/10/29/eu-together-apart-long-italy-short-germany/

No comment – just wanting to stay in the loop and receive updates by email.

The low rate environment has pushed private valuations up to 1.5x RAB. Before the crisis, going above 1.2x was a stretch.

This is what could limit the upside I think.

Well, I think the low rate environment has pushed up all assets prices and multiples. For Europe, i don’t see significantly higher interest rates. Do you ?

Curious why you have so much faith that RAB or EV is the floor of valuation? It seems a decent assumption, but if ROE’s or ROA’s compress due to regulation or anything really, I don’t think the “rule” holds. Thanks.

Well, as described, the renumeration on the RAB is fixed, that’s why the yield just doesn’t “compress” and the valuation for these kind of assets is based on them. In my opinion, the valuation already assumes (significantly) lower profits.

But you are right, “consensus” seems to be that it can only go south. But I am happy to be outside the consensus in this case as I have described in the post.

Is it fixed? BAA operates Heathrow on a ROA on RAB basis, but there is a periodic review of the regulated % ROA. Nice piece btw, excellent blog.

It is fixed (6,1% on pipelines, 6,6% on metering) until end of 2021. The next review is in 2019 (I guess than any changes will be effective after 2021).

They explain it quite well in the investor day presentation (from page 22)

Click to access 2016_Italgas_capital_market_day.pdf

Compared to other countires this is quite attractive (on paper)

RAB is the standard for this kind of assets (regulated). I think you clearly nailed this one.

Congrats!

This could be interesting for “the other Dave” too. He seems to like spin-offs and European utilities.

😉 energy infrastructure is my field…