Softbank & Masa Son – Mad Genius pumping the Start up bubble or Visionary Capital allocator ? (Part 1)

In the comments to my Kinnevik post some weeks ago, a reader recommended me to have a look at Softbank, the famous Tech conglomerate built by Masa Son. Well sometimes I indeed take suggestions…..

Masa Son – Founder and “Godfather”

In Softbank’s case it makes sense to start with its founder, CEO and major shareholder (21%) Masayoshi (“Masa”) Son.

I had linked already some months ago to this excellent interview from David Rubinstein (Carlyle) with Masa Son which is a good summary of his path from child of Korean immigrants to multi billionaire including his near bankruptcy after the dot.com crash,

There is also a very recent article from Bloomberg on how Son makes his deals. I found this passage most intriguing;

More surprising given the numbers is that SoftBank is largely a one-man show when it comes to deals, despite its ranks of bankers from Deutsche Bank, Goldman Sachs and Morgan Stanley. Lieutenants pitch Son ideas, but he makes the final decisions – and he generates plenty of his own. Tellingly

In many modern organizations it would be unthinkable that one person yields so much power. However this is exactly the way Berkshire Hathaway has been operating now since a few decades and quite successfully.

Another telling example of his style is the ARM 30 bn USD “taking private” which is described in this article:

“The time horizon of Masa and his team is way beyond the shareholders I used to have. It used to be one to two years; they could hold that in their heads. Maybe sometimes we thought about what would happen in five years. Masa has no interest in that short-termism. Ten years is the shortest unit of time he can think in. It is stepping-stones of decades.”

Again this is a similarity to Buffett: Taking companies private in order to give them the freedom to develop longterm outside the pressure of quarterly earnings calls.

One hit wonder or great capital allocator ?

The main critics of Softbank and Masa Son have 2 main points why Softbank is not comparable to the really great capital allocators like Buffett and Liberty’s John Malone:

- most of his success comes from a single investment (Alibaba), so it was mostly luck

- he went almost bankrupt after the Dotcom crash where most of his investments were wiped out

Just to get a perspective on the significance of Alibaba position:

Son invested 20 mn USD in 2000 into Alibaba which as of now has turned into a 29% stake or ~140 bn USD. This is a return of ~44% over 18 years and after Nasper’s Tencnet stake (~170 bn USD) the second best investment in the history of investments in USD terms. The Alibaba stake is worth around 1,5x Softbank’s market cap but more on that later.

But without taking Son’s side too early, I would use three counter arguments against the “one hit wonder” claim:

- He made several very good deals like Yahoo Japan, the purchase of Vodafone Japan and the Supercell transaction. Clearly, the incredible success of Alibaba overshadows those deals but he has allocated capital relatively smartly especially after the dot.com crisis. He also seems to be a good operator of acquired businesses. If I calculated the numbers correctly, for instance the operating profit of his Japanese Telco “empire” has roughly quadrupled since taking over Vodafone Japan in 2006.

- Secondly, many people underestimate how difficult it is to ride a position like Alibaba all the way up. Many people always dream of the next Google or Bitcoin which they buy cheap and then ride to thousands of percent of gains but in reality they start selling after the first 20% gain. In Son’s position, many investors would have sold a significant part of Alibaba’s share during the IPO, but Son didn’t sell any shares for a long time and he only sold a relatively small stake some time ago to fund new investments. This “Holding power” should not be underestimated in my opinion. I think it is also quite obvious that Son saw the potential of the Chinese Internet market much earlier than anyone else. This is a comment from the 2007 annual report:

From Japan to the World

In the past, our growth strategies focused mostly on the Japanese market.

Now we are also directing our attention overseas and steadily making strategic

moves towards growth. For example, in comparison to Japan there are

extremely large latent business opportunities in Asia, in China in particular, accompanying the realization of a ubiquitous society. In China, Alibaba.com Corporation, SOFTBANK CORP.’s affiliate, is developing the C2C auction site Taobao.com, which has grown to have a bigger customer base than Yahoo!JAPAN. - Thirdly, I think there is a good chance that Son learned something from the Dot-com “near death experience”. In my opinion the Vision Fund is maybe one effect of this by using a more sophisticated version of leverage.

Also it looks like that Son is not just simply building up a Conglomerate but thinks in networks. This is from the ARM article above:

Likewise, SoftBank taps into Arm to time investments in Internet companies. “Arm Holdings has an insight into the future,” says Mitsunobu Tsuruo, a credit analyst at Citigroup in Tokyo. “When Arm makes a contract with a new business venture, providing the Internet of things for automobiles or farming, Arm will know what is in the pipeline for the Internet of things two years ahead.” SoftBank, in turn, gets a head start on funding companies for a market that doesn’t yet exist.

His overall vision is that of a world of the “internet of Things” where every item on the planet is connected and sends data to each other and is then analyzed by some sort of AI. Therefore he acquired the Chip maker, he owns already the data transportation grids (Sprint, Japan Telco) and is investing into data generators like Uber and Didi as well as robot companies and satellite companies. The only acquisition which didn’t really fit was that of alternative asset manager Fortress Group.

I don’t know how realistic this vision is but there seems to be a plan behind his many purchases. Although I have to admit that some of the corporate vision statements sound kind of crazy:

The SoftBank Group’s aim to contribute to people’s happiness through the Information Revolution, and to become “the corporate group needed most by people around the world.”

To continue to grow as a corporate group for the next 300 years, the SoftBank Group strives to develop over the long-term by forming partnerships with the most superior companies at the time in the information industry, without adhering to particular technologies or business models

I guess not everything should be taken that seriously in this 10 year Vision plan from 2010. However reading this interview with Son from 1992 one has to admit that there seems to be some consistency in his thinking (or madness….).

All in all, I think one could summarize Son as “unique but controversial”. He is certainly not a “Warren Buffett” of Japan. Maybe more a “John Malone on Steroids”….

The Softbank Vision Fund – A different kind of moat ?

Son’ latest project, the Softbank Vision Fund is quite interesting. In essence it is a ~100 bn USD “Venture & Growth fund”.

Around 28 bn USD will come from Softbank itself, thereof around 8 bn as an “in kind contribution” of 25% of the ARM stake. Most of the rest of the money comes from Saudi Arabia (45 bn) and Abu Dhabi (20 bn) plus smaller tickets from among others, Apple and Foxconn.

Success in Venture Capital is all about access to deals. The most successful VCs get access to the best deals and this in turn makes those VCs more successful. In the past, funds like Sequoia or Draper Jurvetson were the “Big Kahuna’s” for most interesting deals.

Now however Softbank seems to be a preferred partner especially for later stage transactions:

While some question the wisdom of giving entrepreneurs more cash than they’re looking for, there’s another way to look at Son’s 2017 Blitzkrieg. He’s gotten SoftBank big stakes in more than a dozen of the most prominent startups in the world, including the two most valuable (Uber and Didi). In the process, he’s shown he can help entrepreneurs chase ambitious, expensive dreams with a single check. “For all of the founders I work with, he is now the first name on their list,” says Mark Tluszcz, who co-founded the venture firm Mangrove Capital Partners.

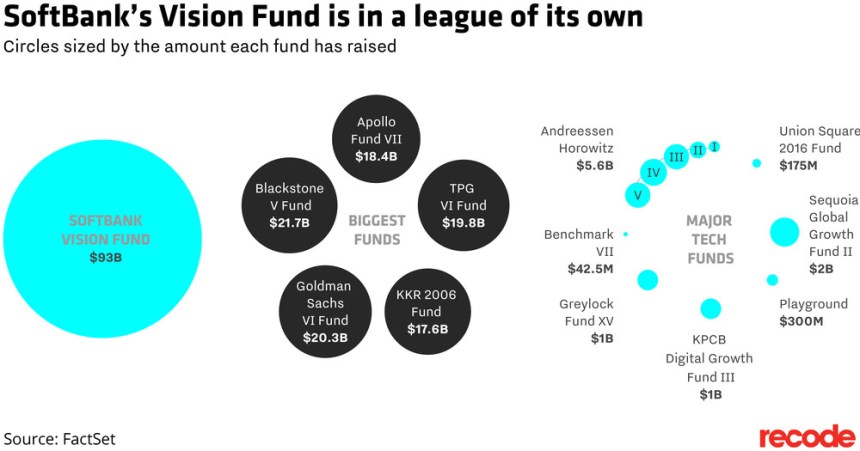

So why is that ? First of all, Son has the biggest pile of money, Just how big this pile of money is can be seen in this comparison graphic:

The biggest single VC fund so far was the 2 bn Sequoia Global growth fund, so the SVF is 50x larger than its next competitor.

As described above, in my opinion Son via his vision fund has a few strategic advantages:

- he can make decisions quickly (no committees)

- he can invest more than anyone else and is currently the only one who could do a 10 bn Uber investment

- with this currently unique ability he can force himself into the top Start-ups

In fact, his Vision Fund seems to change the dynamics of how strongly growing companies are funded.

It is quite obvious that right now for instance oil rich countries like Saudi Arabia and Abu Dhabi want to invest for the future. With normal VCs they maybe can deploy 50-100 mn per fund if they even get in. Softbank’s vision fund gave them the chance to invest a meaningful amount in one go.

Structure of the fund, management fees etc.

According to different sources, the Vision Fund has some interesting features:

- it has a 12 year total period before closing

- There will be a 20% carry after an 8% hurdle fee

- The management fee will be between 0,7% and 1,3%

- outside investors will commit 62% of their funds via 7% preferred shares and only 38% will be “Pure equity”. The preferred shares have no further upside

- Softbank’s share will be only equity

This quite unique structure leads to an interesting outcome: Softbank’s equity stake is significantly leveraged via the preferred structure.

If the overall fund earns less than what is required for the roughly (64.2 bn * 0,62) = 40.4 bn Prefs, the difference has to be compensated by the equity holder. When my calculations are correct, the fund has to earn at least 2,9% p.a. (after fees) in order for the fund to at least pay the equity back.

However if the fund performs well, Softbak gets a double boost: As the equity is levered, for instance without taking into account the carry, a 15% gross return on the fund would turn into a 17,6% p.a. return for the equity holders.

Things get however more interesting if we include th carry into the calculation. For “Normal” equity holders, this will reduce the yield to around 15,6% p.a. after carry. However for Softbank, the return would go up to 18,8% p.a. if we include the carry. So overall, this structure clearly makes Softbank’s equity more risky but also provides for a better upside if things go well.

The biggest risk

This is from the Venture Beat article I had linked above:

Of course, these big bets come on the tail end of an era that has led observers to caution that too many startups are already overvalued. Other VCs have been carping that SoftBank is driving valuations up even further with such large bets. And CB Insights cited SoftBank’s large checks as a factor that is keeping a lid on the tech IPO market.

Given the long horizon that Son claims he has, it could be many years before we know for sure whether such wide-ranging bets gel into some kind of cohesive whole, or whether these investments are justified by the eventual returns produced by individual companies.

But for the next couple of years, it would seem that SoftBank has the artillery and the reserves to grab just about any deal it wants. And Son is carving out a legacy as this decade’s high-tech wild man. We’ll see whether he’s remembered as a fool or a prophet.

This captures the two most often cited issues with Son’s vision fund:

- Start-ups are too expensive anyway

- and Softbank is driving up these overvalued prices

To be honest, I don’t have an answer for this issue. Yes, it looks like that the Venture Capital market is over heating at least in some areas.

On the other hand, there are really a lot of companies that grow like crazy and create potentially significant value for some time to come.

Take Uber for instance. Softbank “only” paid around 70% of the valuation of the previous round, which in VC circles is called a “down round”.

But clearly, Softbank is taking some risks here and if it really pays out is something we will see in 5 or 10 years.

Summary part 1:

As the post has gotten quite long, let’s make a quick summary here:

SoftBank & Masa Son is clearly a very unique company with a very unique CEO. Over his whole career, he always took significant risks and not every project worked out. But overall he created a significant amount of value for his shareholders, however clearly with a lot of volatility.

With his Vision Fund he has now put himself into a very interesting situation: He is now globally the only guy who can deploy “several bn USD” tickets in into “Venture like” investments and has therefore changed the landscape of Tech VC and IPOs within a few months. It remains to be seen if and how succesful he will be with this, but is definitely unique.

For me, Softbank looks interesting enough to go deeper and do a valuation in a second post about SoftBank.

To be continued soon……

Pingback: SFTB: Softbank Group SOTP Valuation – Searching4Value

Lets say Vision fund did not invest well, and end up losing a lot of money. What got worst for Soft bank? losing 28 billion that invested in Vision fund? so downside is protected, but upside can be huge?

Well, after losing 28 bn USD, the banks might want some of their loans back. And then the real problems begin. And no, the downside is not protected if you have 80 bn or more of debt.

Good post. I think there is a huge pools of PE capital waiting for investments. Not sure Softbank Vision Fund is in an unique position to fund multibillion transactions

To my knowledge, Softbank was the only one able to put 9 bn uSD into Uber.

PE companies so far have not been active that much in this area where Cashflows are still not priority.

I have a special question about SoftBanks Alibaba stake. When I remember right, BABA was restricted to IPO in Hong Kong becoause of the Shareholder rights there. They IPO’ed in USA then. The Value Investing community warned of BABA shares because of the structure … you owned nothing.

“And, thanks to the byzantine rules that govern foreign investment in China’s stock market, no one who bought stock during the IPO actually owns a single share of Alibaba.”

https://thediplomat.com/2014/09/no-one-who-bought-alibaba-stock-actually-owns-alibaba/

Is there any risk for SoftBank to “own nothing”? Do they have some special stock?

Myself, I’m not a believer. The issue is that the longer termed the bet, the more complexity comes in and makes it hard to know whether you’re making a good bet or not. At some point complexity overwhelms and it becomes pure luck. If I make an extreme example, imagine I told you “Here’s a 100,000 year bet which I guarantee will pay out 1trn/1”. Would you believe me? Would you use the bet’s performance in the 1st year as a good guide as to whether I’m a good betmaker or not? Massa’s done well with Alibaba, but how many Alibabas were there in China in the late 90s? The idea that he correctly foresaw Alibaba will be the one is fantasy IMHO.

On the other hand, the investment style of Son has changed over the years. He now invests in later stage startups with a probability of success of more than 50%, in other words, industry leaders of emerging business models (WeWork, Uber, Flipkart…). He also kind of has a chrystall ball now with Arm – the most recent example is the 5% Nvidia stake he bought for the vision fund last spring. That position is up almost 100% by now.

It is true that looking back there were many opportunities in China. But very few actually managed to get a foot into the door. He was one of the few. Clearly there was some luck involved, however if you are lucky many times, then there might be skill as well.

probably goes in too hard pile. Have you heard Munger’s comment on excesses in venture capital markets?

Given their non-existent track record in tech, I would take Buffett’s and Munger‘s comments in that area with a grain of salt. Isnt this explicitly not within their circle of competence according to their own words?

Good points to both. I think there are certain bubbles in venture (ICOs) but also a lot of value generation.

Softbank könnte interessant werden nach dem Platzen der IT-Blase.

Ich weiß nicht, ob diese in 2018 oder erst in 2022 platzt, aber sie wird eines Tages platzen.

Bei einem so langfristig planenden Unternehmen wie Softbank kann man m.E. auch mit dem Einstieg länger planen.

I think it is much easier in theory than in practice to put a share on the watch list and then buy “after the crash”.

Definitely!

I am quite curious if I will come back to this discussion in some years.

I think anybody who subscribes to the the preferreds of the Vision Fund is crazy. You invest in VC for the huge upside which is necessary for the risks involved. 7% fixed and nothing else seems to make no sense to me.

Masa is certainly a genious for pulling that off!

Well, if you look at the Crypto currency space, there is much crazier stuff going on. Plus, they get a package deal: Equity & Preferred, But I agree that not many people manage to pull off something like this.

7% fixed returns for USD 40 bn preferred is more than a reasonable return ( with guaranteed return of capital).

Very glad you decided to have a detailed look at Softbank.

Regarding the “weird” 300-year plan, there is a good article that provides more insight. In fact, this is another aspect that I really like about Softbank:

“About seven years ago, SoftBank’s strategy team conducted a unique study and reported the implications of their findings to Son. Their research focused on one question: Why did the U.K. stop winning at horse racing at a certain point in time?…

…When people are asked in the future to name one thing Masayoshi Son has invented, I want them to say not chips, software or hardware, but an organizational structure that can continue to grow for 300 years.”

https://asia.nikkei.com/Features/Inside-SoftBank/Horse-racing-salmon-roe-and-Masayoshi-Son-s-300-year-thoughts?page=2

Another view about Softbank and its deals from the (in my opinion) excellent deep throat blog: https://deep-throat-ipo.blogspot.co.at/2017/02/softbankthe-art-of-self-dealing.html

I agree that Softbank is indeed controversial. However I do not fully share all issues raised in this post. Goodwill for instance is not automatcally worthless etc.

“Secondly, many people underestimate how difficult it is to ride a position like Alibaba all the way up. Many people always dream of the next Google or Bitcoin which they buy cheap and then ride to thousands of percent of gains but in reality they start selling after the first 20% gain. In Son’s position, many investors would have sold a significant part of Alibaba’s share during the IPO, but Son didn’t sell any shares for a long time and he only sold a relatively small stake some time ago to fund new investments. This “Holding power” should not be underestimated in my opinion.”

“Holding power” could go either way. In the end it does indeed amplify your good results if you are correct. But it could be quite hazardous if you turned out to be incorrect. You make an implicit assumption that he is currently correct because the market says so. We may find this to not be the case as has been shown so many times throughout history.

Exactly. Only history will show.

adaptable123, that is an A+++ comment! Can’t agree more.