All German Shares part 15 (Nr. 276-300)

The next 25 stocks. 4 of them made it onto my watch list.

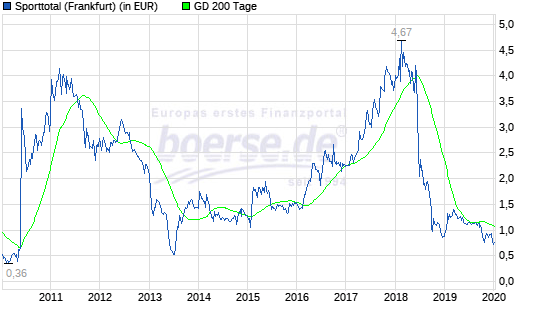

276. Sporttotal AG

Sporttotal is the rebranded “Wige Media” company that changed its name in 2017 and has a market cap of around 20 mn EUR. The positive effect of the rebranding however didn’t last that long if we look at the stock chart.

The company is currently loss making and raised capital in early 2019. Nevertheless, for some strange reason, I put them on my “watch” list.

277. HPI AG

1,8 mn EUR nanocap that went thorugh a restructuring in 2016. “pass”.

278. Amatheon Agri NV

Paris listed company that needed to do a debt/equity swap in 2019. “pass”.

279. Deutsche Biotech Innovativ AG

An 87 mn market cap company which is very thinly traded. The company has 2 mn EUR book value and no sales. They seem to play the “biotech story”. The company tried to IPO in 2015 already but now seems to have been successful with a kind of “back door” listing. “pass”.

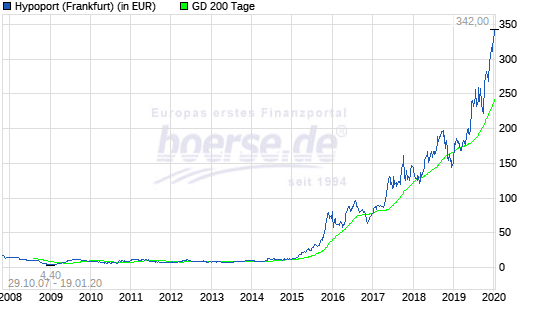

280. Hypoport AG

Lite CTS Eventim, Hypoport is a big lesson in “Missed Opportunities”. If I remember correctly, I looked at the stock in 2010 but didn’t find it exciting. Some kind of platform for real estate loans or so. Little did I know that Hypoport morphed into one of the most succesful German Fintechs. Their core product is a mortgage loan platform which is used mainly by German Cooperative banking and the dominating Sparkassen.

Back then, the main business of Hypoport was a deposit broking business branded Dr. Klein, but the real growth driver was the credit platform. The stock price chart shows the successful transformation.

These days, the company is valued at 2.2 bn EUR, which represents around 15x sales and 70x EBIT. Although I would not buy at this levels, it is still a stock worth to “watch”.

281. Odeon Film AG

Another “child” of the Dotcom boom that produced a lot of much hyped media rights companies back then. With a 13 mn market cap, the company clearly has seen better days. The company is currently (6M 2019) loss making. “pass”.

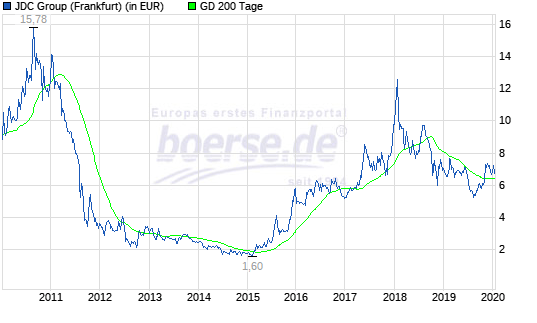

282. JDC Group AG

JDC is a 89 mn market cap financial services company which is part (insurance) broker and part “Fintech”. A few month ago, Great West LifcCo, a subsidiary of Canadian Power Financial bought a 28% stake which was sold by management. The fintech part has a lot of traction (topline +30% yoy) but is not yet profitable.

The stock used to be very volatile in the past as we can see in the chart:

Although there are some things that I don’t like at first sight, it is still a very interesting stock to “watch” and analyze more deeply.

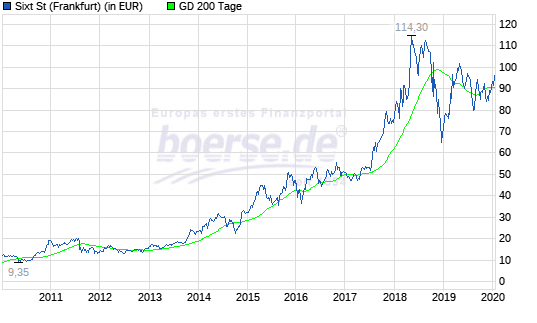

283. Sixt AG

Sixt AG is a 4 bn car rental company which is currently moving into all kind of new mobility areas (car sharing etc.). It is also one of my biggest “Missed opprotunities” blunder. I used to own a participation rights more than 10 years ago, attended annual meetings but didn’t follow on when the security expired, despite knowing that the founder/owner Erich Sixt was a uniquely gifted entrepreneur.

The stock was more than a 10 bagger (incl. dividends) over the last 10 years.

The stock now seems to be not too expensive, hwoever sooner or later the second generation wil take over and one will need to see how this works out. Stil a stock to “watch”.

284. Quirin Privatbank AG

Quirin Privatbank AG was a very early version of a German “challenger bank”. The 67 mn market cap bank was the first bank promising not to take any “Kick backs” or commissions from product providers, but only charge a service fee for managing investments.

However, since going public in 2006, the stock price went nowhere and it is not clear if the business model really works. Interestingly, one big shareholder sold last year (Oddo, 27%) and it looks like that the CEO and the Head of the supervisory board have been buying.

For me a stock at least to “watch”.

285. Value Holdings International AG

This is a 10,5 mn EUR market cap stock that seems to be a kind of closed end trust of traded small cap stocks. The stock seems to trade more or less at NAV. Reading their 2018 report it is interesting to read that they were invested in the Greek Fraud Follie Follie which doesn’t really create a lot of confidence into their investment process. “Pass”.

286. Berliner Effektengesellschaft AG

Berliner Effektengesellschaft is a 256 mn EUR market cap Holding company that owns as its major asset a 56% stake in stock listed Trade Gate AG, a 25% stake in Qurin Banl (bei coincidence number 284.). The trade gate stake is worth around 300 mn, plus around 16 mn for Quirin Bank, so in theory there is a decent discount. However I didn’t find quickly the stand alone accounts of the HoldCo and I don’t really know much about the major asset, Tradegate. After a quick look, below, it is a “pass”-

287. Tradegate AG

This is actually the exception to my random order as I wanted to tackle Tradegate after Berliner Effektengesellschaft. I found this interesting story on Trade Gate where it is explained how 592 mn market cap Trade Gate makes money by market making an alternative stock exchange, especially in off times. However, especially in 2019, business is not doing so well. The company is owner operated, but as the valuation is quite high (PE 20-25), this is a “pass” for me. Fr both stocks, the stock chart looks strangely “managed” in 2019:

288. Arcandor AG

The former Karstadt was one of the biggest insolvency cases in Germany. The market cap is 2 mn, the company is in liquidation and a “pass” for me. Update: Just a few days ago, Scherzer AG, a specialist for “empty shells” on the stock market has bought a controlling stake. Doesn’t change my assessment though.

289. Deutsche Effecten- und Wechsel-Beteiligungsgesellschaft AG

This is a 18 mn EUR market cap listed VC/PE company. The company seems to be leveraged, the book value is around 8 mn EUR and the reporting not transparent. The companies in the portfolio look randomly selected. “pass”.

290. BayWa AG

Baywa is a 1bn market cap a goods trading / wholesale company, trading all kinds of stuff like agricultural stuff, energy and building supplies. The company just had to pay a 70 mn EUR anti-competition fine and in general looks like a company that is not run for the benefit of shareholders, nor clients. Reporting is not transparent, they run on significant debt plus pension liabilities and I’ll “pass”.

291. Elanix Biotechnologies

A 5mn EUR market cap “Bio technology” company. Company seems to get repeated fines from German authorities for late filing. “pass”.

292. Windeln.de

One of the early E-Commerce “stars” on the German stock market when IPO’ed in 2015 at 18 EUR per share. Now, only 5 mn EUR market cap is left. The company was almost down to zero but they claim they have new investors that want to invest at 1,20 EUR/share. Not my kind of stock so “pass”.

293. Good Brands AG

A 11 mn EUR market cap company where I couldn’t find any recent financial report. “pass”.

294. MS Industrie AG

A 59 mn EUR Holding company, activities mostly as supplier in the automotive industry. They sold some activities in 2019 but in general the company doesn’t look that interesting to me. “Pass”.

295. Froehlich Bau Ag

Company in liquidation. “pass”.

296. Frosta AG

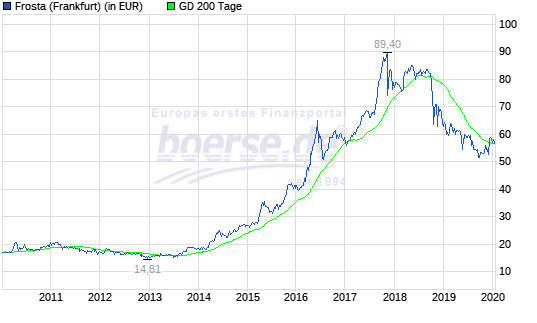

Frosta is 378 mn EUR frozen food specialist company that is majority family owned and run. I used to own Frosta in the blog portfolio until early 2012. Looking at the chart, it would have better to keep owning the share as the stock went up on its peak to ~90 EUR from 20 EUR back then:

What happened between 2012 and 2018 ? A quick look into the 2011 annual report shows sales of 385 mn EUR (-2% yoy), EBIT of 14.8 mn EUR and net profit of 8,7 mn EUR (-10% yoy). In 2018, Frosta had sales of 510 mn, EBIT of ~30 mn and Net Incom of around 20 mn. So yes, profit has doubled but a significant part of the stock price increase came from multiple expansion. In the first 6M of 2019, profit almost halfed, so that the stock now trades most likely at high 20 2019 P/E. On that basis a “pass”.

297. B+S Banksysteme AG

16 mn market cap service/software company for the banking industry. Business seems to be in decline and company turned into a loss making position in the last financial year. “pass”.

298. AlzChem Group AG

Alzchem is a company I never heard of before. The 212 mn market cap company is a specialty chemicals company that went (somehow via a reverse IPO via the shell company Softmatic) public in 2017. Although the stock looks quite cheap (~P/E of 10), the business seems to be very capital intensive and the company has significant debt. “Pass”.

299. Vivoryon Therapeutics AG (ex Probiodrug AG)

Vivoryon Therapeutics is a bio-pharmaceutical company that has been IPOed in 2014 with a current market cap of 137 mn EUR. As many of these companies, the company doesn’t have any sales, only costs. As I am not an expert in this field, it is a “pass”.

300. Demapharm AG

Demapharm is a 2 bn market cap pharmaceutical company that went public in February 2018. The company specializes in non-patent pharmaceuticals as well in “parallel import” of pharmaceuticals. The company does a lot of M&A and trades at around 25x earnings and 20x EV/EBIT. “pass”.

Quirin Privatbank AG is involved in many Lars Windhorst deals (Mr Windhorst who is also behind Amatheon agri). Not a good sign IMO.

Thank you. This is a very valid point. Windhorst is someone to stay away from as far as possible

A little more colour on Dermapharm:

(numbers taken from the 2019 Q3 report: https://ir.dermapharm.de/pdf/d_Dermapharm_Q3_191120_web.pdf page 13)

Dermapharm has 2 lines of business: production and distribution of otc drugs and parallel import of drugs.

OTC products clocks in at 278 m revenue (+10,7%) and 39,4% EBITDA margin.

Parallel imports generates 185 m revenue (+3,1%) and 3,9% EBITDA margin.

While these numbers only cover 9 months of a business year they are a good representation of business development over the last years.

My conclusion is that the steadily growing and continuously high margin business is is hidden by a low margin and stagnating business line.