All Swiss Stocks Part 7 – Nr. 61-70

This time, only one out of the ten randomly selected stocks made it onto my watch list.

61. Alpine Select AG

Alpine Select select is 129 mn CHF market cap listed investment company. The name rang a bell and when I searched my own blog, I found them as one of the “co-investors” in the AIRE KgAA special situation in 2012.

Including their significant distributions, Alpine Select has an Ok track record over the last years. The stock trades very close to NAV. Their portfolio these days seems to consist mostly out of hedge funds and even a crypto fund more recently.

This is not exactly my cup of tea, so I’ll “pass”.

62. Elma Electronics AG

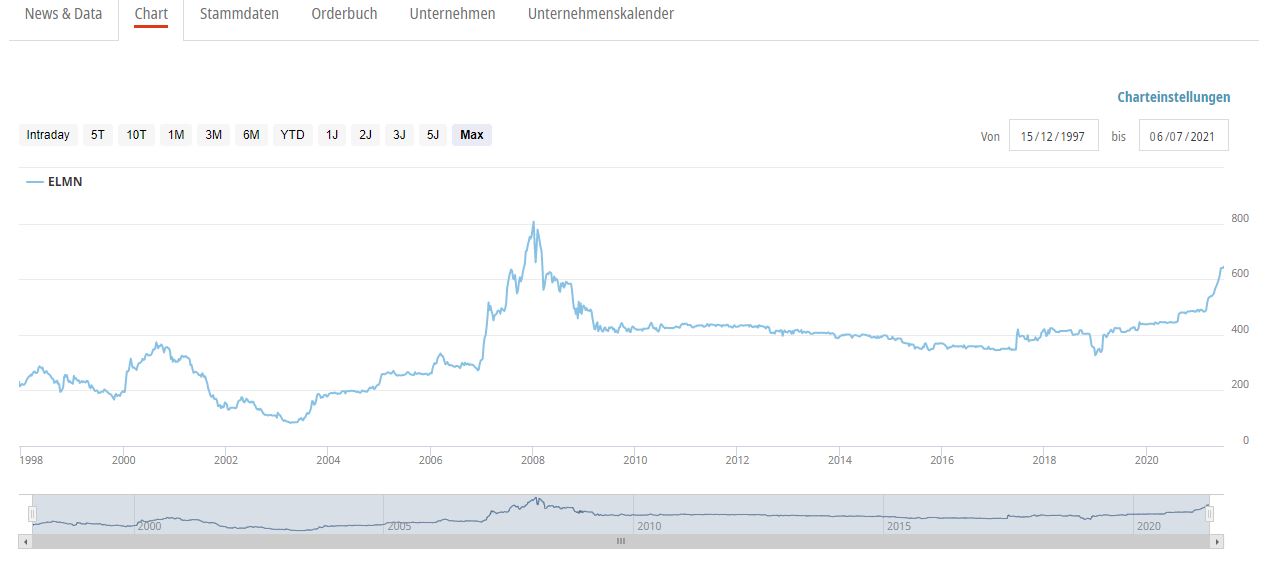

Elma is a 146 mn CHF market cap company that manufactures electronic components. The stock chart looks strange: After effectively flat-lining for around 12 years before increasing by ~+50% in 2021:

The business as such is “medium attarctive” with EBIT margins of around 5%. I did not find out why the share price has behaved like this. As I don’t really know much about this sector, I’ll “pass”.

63. Dottikon ES Holding AG

Dottikon ES is a 3,6 bn CHF market company that I have never heard of before. The specialty chemicals company has been IPOed in 2005 and the stock price did nothing for 11 years before than 12 bagging in the following 5 years:

At A first glance, 2020/2021 year numbers look fantastic: Sales +25% and profits +58%. EBIT margins are fantastic at a level of 28%. Interestingly the company was loss making until 2012/2013 an only turned around in the next year. However already in FY 2015/2016, EBIT margins had reached 14%. Since then profit has increased by 5x, the share price 12x which results in a current trailing P/E of 70 and EV/EBIT of 60.

The company expects further growth going forward and has mentioned that they plan to invest massively in new production capacity. I didn’t understand in detail what they are doing, but it seems to be an essential ingredient for so called “small molecules” pharmaceuticals. However I have no real idea what makes Dottikon so special and if their margins are sustainable.

One factor of course could be that the CEO of Dottikon is the son of EMS Chemie founder Christoph Blocher and that he learned his ropes while working at EMS and then spinning off Dottikon.

I do think the company would make for a great case study how a “mediocre” company transforms into a growth super star but for me the current valuation means that I’ll “pass”.

64. Meyer Burger AG

Mayer-Burger is a 1.4 bn CHF market cap company that is undergoing a radical “pivot”: The former manufacturer of machines for manufacturing solar panels is going “vertical” and has become a producer of solar panels itself.

For that purpose, they acquired the production facilities of the insolvent German Solarworld and started producing solar panels a few weeks ago.

With the current global issues of China based supply chain, this sounds like an interesting idea and Meyer Burger claims to have better and more efficient panels. The stock increased by ~5x since their low in May 2020, however in the long term, Meyer Burger has not been a great investment:

The problem is that I cannot really judge how good their panels are and the current valuation of 1.4 bn for 90 mn in 2020 sales and -65 mn CHF losses already assumes a quite substantial recovery. Nevertheless, I’ll “watch” this to learn more about solar panels in general.

65. Siegfried AG

Siegfried AG is a 4 bn CHF market cap specialty company that mainly produces ingredients for the pharmaceutical industry. I owned the stock with relatively little success in “pre blogging” times. As some other Swiss pharma related specialty chemical companies, the share price has moved up a lot in recent times:

Interestingly, Siegfried is a lot less profitable than its competitors (EBIt margins ~9%), but profitability has been increasing. The current P/E of ~70 seems to imply further increasing margins although top line growth seems rather slow. At first glance, the stock looks less compelling than for instance Dottikon, therefore I’ll “pass”.

66. EFG International

EFG International is a 2,25 bn CHF market cap Private bank / Asset Management company. The company has been growing earnings for the past 2 years but trades at 20x PE. The stock hasn’t done anything for the last 15 years and personally I don’t like the “Private Banking” model as the business still is mostly about dodging taxation for very rich people. “Pass”.

67. Sulzer AG

Sulzer is a quite famous Swiss Industrial company with a 4,3 bn market cap. The company manufacturers pumps, compressors and other heavy industrial equipment.

The company has a good name but unfortunately is majority owned by Russian Oligarch Viktor Vekselberg which moves this automatically into the “pass” bucket.

68. Inficon AG

Inficon is a 2.6 bn CHF market cap company that seems to be specialized on technology around vacuum processes. On the plus side, the company enjoys decent margins, returns on capital (20% plus) and is debt free. On the minus side, sales and profits have been stagnating already in 2019 pre Covid:

![]()

Despite this stagnation in profits, the share price has doubled since 2018, resulting in a P/E of around 50. A large percentage of sales seem to go to the booming semiconductor sector, however at that valuation level I do not think that the stock is attractive. Maybe I underestimate growth opportunities but I still “pass”.

69. Interroll AG

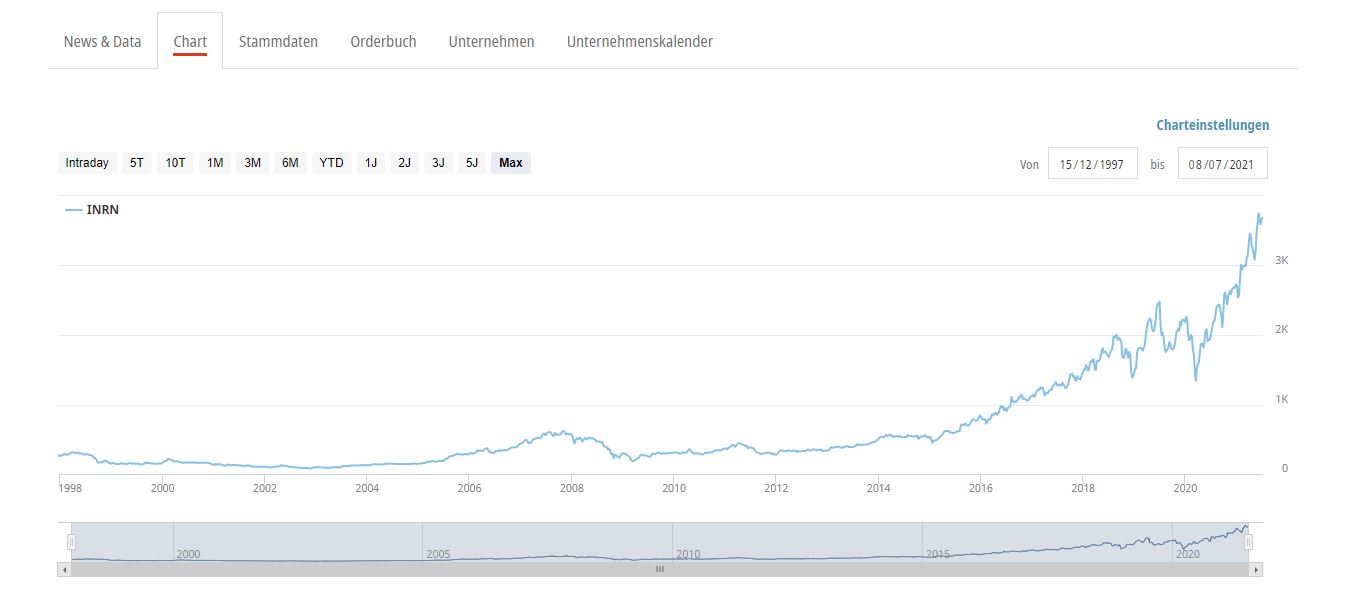

Interroll, a 3,1 bn CHF market cap company, seems to be “just another Swiss 10-bagger” when looking at the chart:

This time it is not a specialty chemical company but active in logistics automation. With the Covid-19 driven E-Commerce boom it looks quite logical that business should be booming, however interestingly 2020 top line is actually below 2019 and 2018 top line. Profits have increased nicely, and have doubled from 2016 to 2020. Margins are very decent (EBIT margin 18%) and Return on capital has been steadily increasing.

With a PE of 43, as almost all Swiss “quality stocks” has priced in some more significant growth. “Pass”.

70. Investis AG

Investis is a 1.3 bn CHF market cap real estate company. The company looks cheap from a P/E perspective but the majority of profits seem to be revaluation gains. “Pass”.

Thanks for the comment. I also hope that my readers in NRW and Rheinland Pfalz are safe.

I guess I speak for an extended comunity of your readers: I hope you and your environment, as well as the Central Europe readership are safe & healthy.