All Danish Stocks part 7 – Nr. 61-70

Looking at randomly selected Danish shares is a nice exercise in order to calm one#s nerves during times like these. here is yet another batch of 10 Danish shares. This time, two of them I found worth to “watch”, for one of them i even started an initial position.

61. Genmab A/S

Genmab is a 18.4 bn Biotech company that manufactures among other stuff antibodies that are used for cancer treatment. The company is extremely profitable, with net margins between 35-60%.

At 50x 2021 earnings and 17x revenues, the stock is not cheap, despite a drop in profits in 2021.

The share price has corrected a little but investors that hold the stock for a few years should be still very happy:

This company seems to be clearly very successful, however Biotech/Pharmaceutical companies are extremely difficult for me to handicap, therefore I’ll “pass”.

62. Trophy Games Development

Trophy is a 17.5 mn EUR market cap games developer whose share price only went down since it IPOed in 2021 with a current loss of around -50% compared to the IPO price. The company had around 5 mn EUR sales in 2021 but is loss making. “Pass”.

63. Solar A/S

Solar B is a 620 mn EUR market cap company that is active in distribution and services mainly within electrical, heating and plumbing, ventilation and climate and energy solutions.

The long term chart shows a very long sideway development with a steep increase following the “Covid dip”:

The comany indeed managed to double earnings in 2021 and still looks cheap with around 9x 2021 earnings. The company is active in the Nordics and the Netherlands. In a March presentation, the company gave a relatively cautious guidance for 2022, however Q1 numbers were very good and far above guidance and management raised the 2022 guidance significantly.

Overall a very interesting stock that ticks a lot of my boxes and that I will “watch” closely. In order to motivate me to look deeper soon, I bought a 2% position at around 722 DKK/share.

64. LED IBOND INTERNATIONAL A/S

LED IBOND is a 4 mn EUR market cap “tech company” doing something with data and light. Sales have been decreasing and losses increasing. “Pass”.

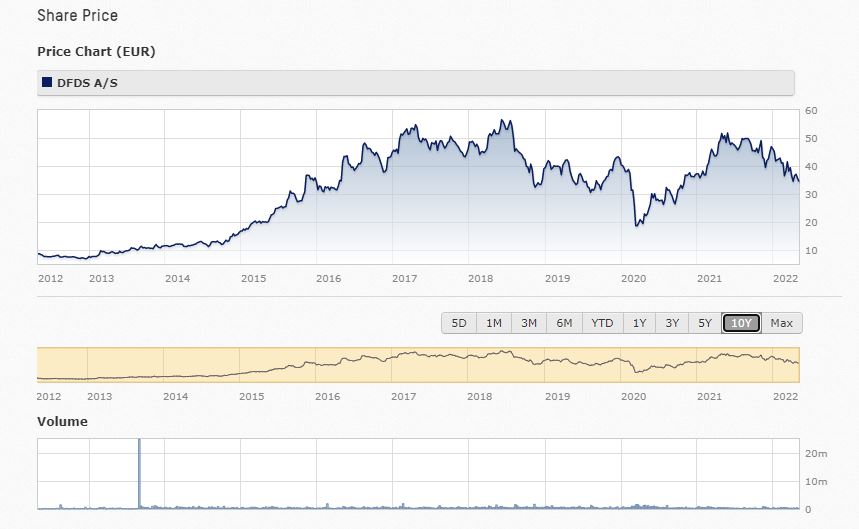

65. DFDS A/S

DFDS is a 2 bn EUR market cap logistics company that operates ferries. The stock looks relatively cheap (10x P/E, 7% FCF yield) but the stock has been going nowhere for quite some time and was negatively impacted by Covid and did not profit from supply chain disruptions:

As marine transport is far out of my circle of (in)competence, I’ll “pass” despite the cheap valuation.

66. Movinn A/S

Movinn is a 14 mn EUR market cap 2021 IPO that seems to manage furnished apartments. the company is loss making and the stock only went down from it’s IPO price. “Pass”.

67. Prime Office A/S

As the name indicates, Prime Office is a 135 mn EUR market cap real estate company that owns property, surprisingly in Northern Germany. “Pass”.

68. TCM Group A/S

TCM Group A/S manufactures and supplies kitchen and furniture products for bathrooms and storage in Denmark and other Scandinavian countries. Market cap is 123 mn EUR, the company IPOed in November 2017.

The stock recovered well from Covid but has been declining for some time now:

Valuation looks very cheap with a p/E of ~9, but margins have been declining already in 2021.The company buys back shares and pays a 6% dividend. I do like Scandinavian style furniture a lot personally, however I do not see any interesting angle for me here, so I’ll “pass”.

69. RTX A/S

RTX is a 170 mn EUR market cap company that offers wireless communication solutions. The stock chart looks uninspiring:

The company had a very bad year in 2020/2021, impacted both by Covid and supply chain issues, reducing profits by more than 2/3. Based on 2019 peak earnings, the stock would trade at around 16-17x earnings which is not cheap. “Pass”.

70. Nilfisk Holding A/S

Nilfisk is a 613 mn EUR market cap company that manufactures and produces cleaning equipment. The product offered by the group includes floor cleaning machines, high-pressure cleaners, industrial vacuum cleaners and outdoor cleaning equipment. In addition, the firm also provides after-sales service for the professional cleaning industry.

Nilfisk has been spun of from cable manufacturer in 2017, the stock hasn’t been a great success since than:

The stock looks quite cheap at 10x trailing earnings due to a very good recovery year in 2021, however it needs to be seen how persistent this will be. According to their capital markets day presentation, they plan with moderate growth and margin expansion over the next few years.

Overall it looks quite interesting as I like boring (and cheap) businesses, therefore I’ll “watch”.

Another quarter, another upwards revision from Solar.

https://www.solar.eu/investor/news/news-page/?pressId=2494471&lang=en

I also increased my position by a further 1% to 4%

Added 1% to Solar, now 3% position.

*pick…

Do you drink a lot of Carlsberg before you “randomly” peak the danish stocks?

He he ge, no, i prefer local BavarianMunich Beer. Favorites: Giesinger, Tegernseer

Hi, thanks for series on Danish stocks. I am curious to see how you compare Solar to its peer A&O Johansen, which you have not covered, yet

We will see when the random generator picks that one 😉

Thanks for these series. Great find in Solar B. Don’t you think Nilfisk just had a post-Corona bumper year in 2021 and now will go back to normal (subpar) performance? The CMD looks like they think it was not just a one-off but I’m not convinced….

Thanks for thr comment. This and other aspects need to be investigated…

Hallo, vor vielen Wochen hatte ich mal gepostet, dass ich die ganzen gelisteten Unternehmen in Dänemark auch durchgegangen bin (Januar 2022). Sehr interessant, unsere Einschätzungen zu vergleichen. Bei den meisten Unternehmen haben wir tatsächlich identische Schlussfolgerungen, sowohl positiv als auch negativ. Bei Solar unterscheiden wir uns tatsächlich. Unter https://financials.morningstar.com/ratios/r.html?t=0P0000C16H&culture=en&platform=sal sieht man, dass die topline überhaupt kein Wachstum hatten in fast zehn Jahren, und die Ergebnisse sind tatsächlich in 2021 gesprungen, die in den Jahren bis dahin waren nicht berauschend. Mein Eindruck war, dass KGV 10 nur auf Basis diesen einen Jahres, v.a. in Verbindung mit nach-Corona Nachfrage-/Preisschwung gefährlich ist. Ich bin dann allerdings nicht viel tiefer eingetaucht. Finden Sie diese Mehrjahresübersicht nicht auch abschreckend? (Sie werden noch ein Unternehmen mit ähnlichem KGV aber viel besseren Zahlen finden in DK, glaube ich. Bin sehr gespannt, ob wir da zum gleichen Schluss kommen). Vielen Dank für Ihren Blog, ich freue mich über jeden neuen Beitrag, wenn Sie die einzelnen Länder durchgehen.

where did u reply? ur analysis anywhere to be found?

Sorry, I posted in German. No, mine is nonewhere to be found. I don’t have a blog or anything. I started one year ago to go through all of the stocks in Europe, country by country. Not finished yet. But finished are Sweden, Danemark, Finland, Netherlands, Belgium, Portugal, Estonia, Latvia, Lithuania, Poland, Swiss, Austria, Germany, Iceland, Ireland, France, Italy, Czech Republic, Hungary, Slovenia, Greece. Currently I am researching Norwegian companies. I would say that my approach is somewhat similar the the one of memyselfandi007. But there are also differences – I generelly don’t invest in Biotech for example. But I also love easy to understand businesses, mainly somewhat boring companies 😉

Hallo, ich kann mir vorstellen, dass aufgrund des Sortiments die Zukunft evtl. Besser aussieht. Ich glaube auch dass due Margenverbesserung strukturelle Gründe haben könnte. Muss aber noch tiefer reingraben. Q1 2022 lief auch sehr gut.

In case you don t know the video: https://www.youtube.com/watch?v=Tsu0zoIwPl4