All Norwegian Stocks 6 – Nr. 76-90

Lot’s of ships this time plus a little fish. Overall, these 15 randomly selected Norwegian stocks resulted in four candidates for my initial watch list. Let’s go:

76. Klaveness Combination Carriers

Klaveness is a ship owner that operates versatile ships that can carry both, bulk cargo as well as tanker cargo. The 380 mn EUR market cap company has been IPOed in 202 and has done quite well, as a few other shipping IPOs. The ships look impressive but otherwise quite normal:

The company claims that their vessels are more fuel efficient which could make it interesting for clinets interested in low CO2 transport.

The stock trades at 6x 2022 earnings which looks cheap, however margins in 2022 were at least 2x of historic levels. The company is quite optimistic for 2023. Ships are to me equally foreign like real estate, so I’ll “pass”.

77. Inin Group AS

Inin is a 26 mn EUR market cap Holdco that made losses for a couple of years. After their IPO in 2020, they sold their main business in 2022, renamed themselves from Elop into Inin and have bought a few new businesses focused on contruction and inspection of infrastructure. Sounds good in principle but looks sketchy from the numbers.

The company has been and will be loss making but wants to become “Cash flow positive” in 2023. “Pass”.

78. Ensurge Micropower

Fitting to the name, Ensurge is a 5 mn EUR market cap Micro Cap claims to develop Soldi State battery and has just issued new shares. “Pass”.

79. Hyon

Hyon is a 3 mn EUR nanocap that tries to revolutionize something in the Maritime Hydrogen ecosystem, I am not really sure what. They IPOed in early 2022 and the share price since then went only down. They have some sales but overall this company seems to be too small and early to be interesting. “Pass”.

80. Orkla

Orkla is a 6.4 bn EUR market cap company that “is a leading supplier of branded consumer goods to the consumer, out-of-home and bakery markets in the Nordics, Baltics and selected markets in Central Europe and India. Branded Consumer Goods comprises Orkla Foods, Orkla Confectionery & Snacks, Orkla Care, Orkla Food Ingredients and Orkla Consumer Investments”.

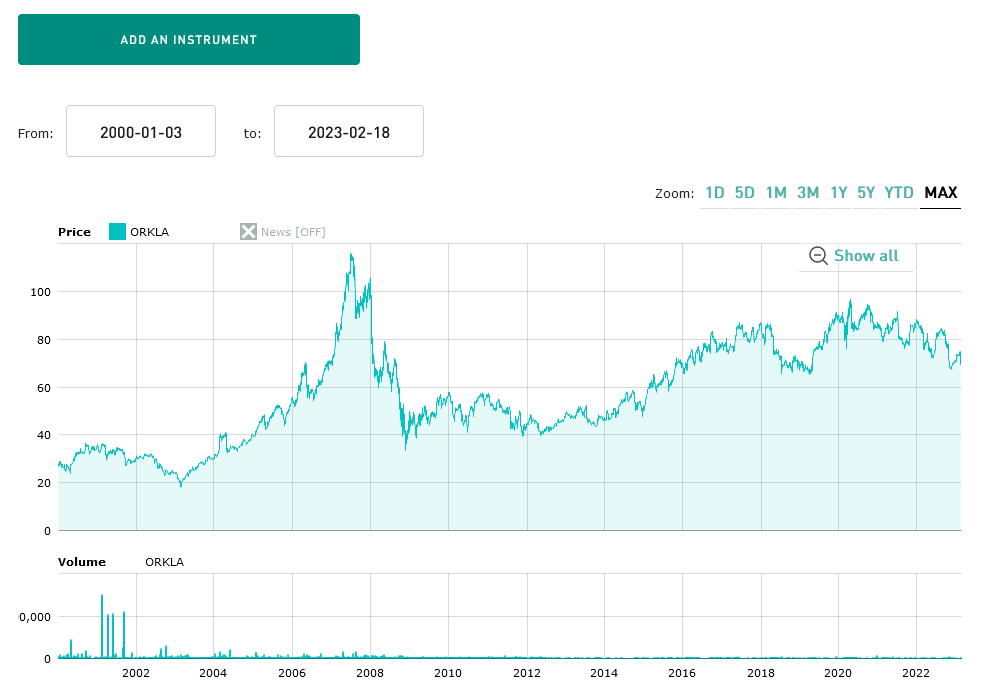

The long term chart doesn’t support a lot of value creation over the years:

However, looking at the fundamentals, it is interesting to see that there was decent growth in the last years and that the stock trades at a relatviely cheap level compared to its past at 13,6x P/E and 12 x EV/EBIT. In 2022 the food division strugged a little bit, however they also have a Hydropower division more then offset that. They also sell food products in India on top of their Nordics focus. Overall Orkla seems to be a very diverse company and a very interesting “animal” that I would want to learn more about. “Watch”.

81. Storebrand

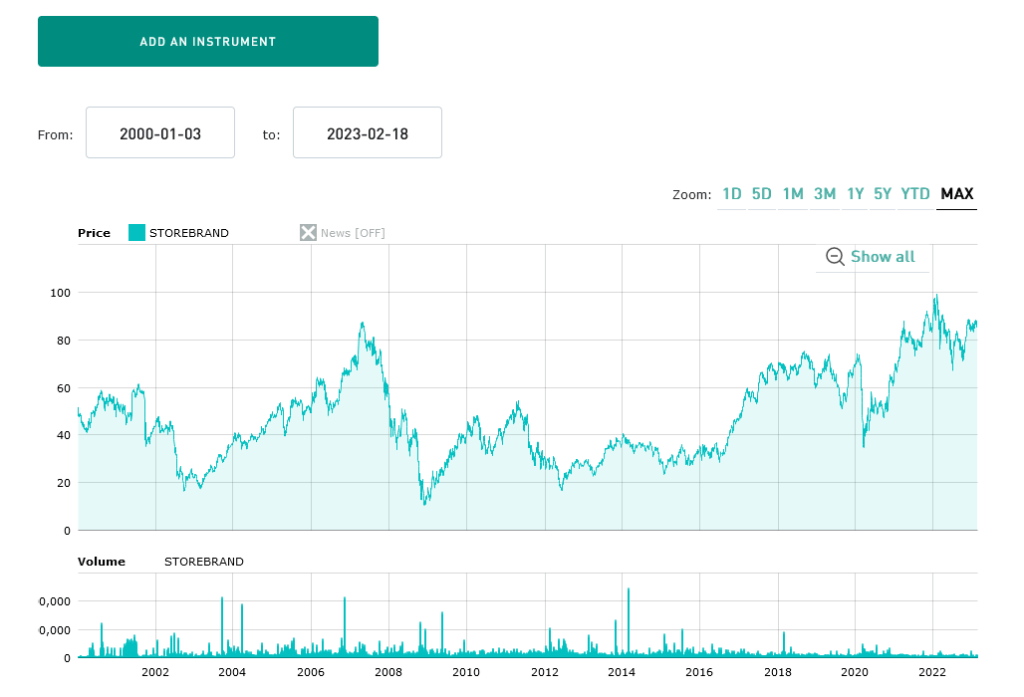

Storebrand is a 3,6 bn EUR financial company that is mostly active in life insurance and long term savings products. Looking at the long term chart we can see that there is no big long term value creation but that the stock is interestingly trading near ATH levels:

This is suprising as at fisrt sight, 2022 reslts were significantly below 2021. However the company announced a decent dividend and a share buy back program. They have actually comitted to buy back 10 bn NOK in shares until 2030. Nevertheless, I see very few reasons to own a Norwegian Life insurer, therefore I’ll “pass”.

82. Statt Torsk

Statt Torsk is a 29 mn EUR market cap fish farmer that for a change is farming Cod instead of the usual Salmon. The company IPOed in early 2021 and has lost -50% since IPO. They actually have sales but very little and are loss making as the fish are mostly in the growing phase. Although I prefer Cod to Salmon on my plate, I’ll “pass” on that.

83. Deep Value Drilling

Despite having a great name for any Deep Value Investor, this153 mn EUR market cap owns a single drillship and rents it out to drilling companies. IPOed in 20221, the stock has more than doubled. According to their company presentation, the bough the ship for 65 mn USD compared to the cost to build it of 750 mn USD. This is what they got (I love to pst ship pictures):

However, cool ships don’t necessarily make great long term investments, therfore I’ll “pass”.

84. Havila Kystruten

Havila is a 71 mn EUR market cap and operates 4 cruise ships that run the Fjord tour between Begen and Kyrkenes. The company was IPOed in 2021 and has done really bad and has lost more than -50% since the IPO. Before quickly passing this however, I saw that one of my “peers”, Paladin owns 6,7% of the company and I kjnow that they have invested successfully in Norwegian Ferry companies before. Again here a picture of one of their ships:

The company seems to be in the build up phase and made losses so far, also because LNG fuel was very expensive. In any case, because of the Paladin guys, I’ll “watch” this one.

85. Kraft Bank

Kraft Bank is a 33 mn EUR market cap Bank that “offers refinancing of mortgages and unsecured loans to individuals that due to a challenging personal economy and/or challenging liquidity cannot refinance at a regular bank.”. So something like a “subprime” player.

The Bank is quite young and has grown fast. ROE’s reched 12-13% in 2021 and 2022. At 8x P/E it looks cheap.

Most of their reports are in Norwegian, nevertheless I really find this one interesting. “Watch”.

86. Petronor E&P

Petronor is a 116 mn EUR market cap oil explorer that is active in very exotic locations like Congo and Senegal. Not my cup of tea and since its IPO in 2022, the stock price did very little. “Pass”.

87. EAM Solar

EAm Solar is a 3 mn EUR market cap company that operates solar plants in Italy or inittially planned to do so. There seems to be a very special story that they have been cheated on their initial purchase in 2014 and are now mostly litigating in Italy. This is how they describe themselves in the 2021 report: “This situation has effectively changed EAM from a YieldCo to a large listed lawsuit”. Not my kind of special situation, “pass”.

88. TECO 2030

TECO is 145 mn EUR market cap company that does develops Hydrogen fuel cells for the shipping industry. The company has little revenue and despite capitalizing a lot of expenses, is making large losses. Interestingly, other than many similar cleantech start-ups, the stock is up 2,5x from its 202 IPO. “Pass”.

89. Ocean Sun

Ocean Sun is a 30 mn EUR market cap “floating PV” company that “has developed an innovative solution to global energy needs. The patented technology is based on solar modules mounted on hydro-elastic membranes and offers cost and performance benefits unseen in any other floating PV system today”.

As another 2020 IPO, the share price intitally took off like a rocket but now trades at less than 1/2 of the IPO price. They do have some slaes and have realized some demonstration projects. Here is an example:

They seem to have cash left for 2-3 years at the current burn rate. In order to have at least a few of the Norwegian Clean techs on the watchlist, they get a (weakish) “watch”.

90. Awilco LNG

Awilco is a 110 mn EUR market cap company that owns 2 LNG carriers. After a few very bad years, things seem to look better. This could be in theory an interesting speculation on LNG imports in the next years. Their ships look like being GTT designs:

Nevertheless, I’ll try to stay clear of ships, therefore I’ll “pass”.

Havila Kystruten (HKY) is indeed haunted by bad luck. In 2018, godfather Odin handed HKY as a gift 4 out of 11 money printing machines called Norwegian coastal mail boat licenses for the period 2021-2030. Thor was not amused and sent a lightning salvo:

– A yard building two vessels went bankrupt end 2019.

– Next Covid: The Turkish yard, which now was building all 4 vessels, claimed force majeure. The delivery of the first vessel was end of 2021 – one year late.

– Next the sanctions to Russia: Financing of the 4 vessels was through a leasing company owned by the Russian Ministry of Transport. The sanctions stopped both the sailings of the 2 boats on the water and the construction of the remaining 2 boats for several months.

– Next the earthquake in Turkey: Again force majeure. At the moment is unclear when the remaining 2 vessels will be delivered.

HKY at the moment looks like a very good buying opportunity. Caveats apply: Look at the current liabilities in the balance sheet of 4Q22.

Meanwhile, HKY is completely bombed out. They had a substantial increase in capital and then problems with their electric motors. 2023 earnings are likely to be worse than 2022.

If they survive this situation, they could become an opportunity in 24/25, but debt is high and up to now it has been a very dangerously falling knife – currently a pennystock.

Orkla is a fascinating company indeed. The have such a huge variety of brands in the FMCG, and not just in Scandinavia, but e.g. also several larger Austrian brands like FELIX. And this is just a fraction of the conglomerate that also has large nonfood activities. I like them a lot and I can’t wait to see more of how you evaluate them.

Interesting – seems like there are a lot of micro caps in Norway!

#83 deep value drilling has a decent Twitter following