Post Mortem Nabaltec AG – Beware of the “Short term fundamental Bull trap”

Background:

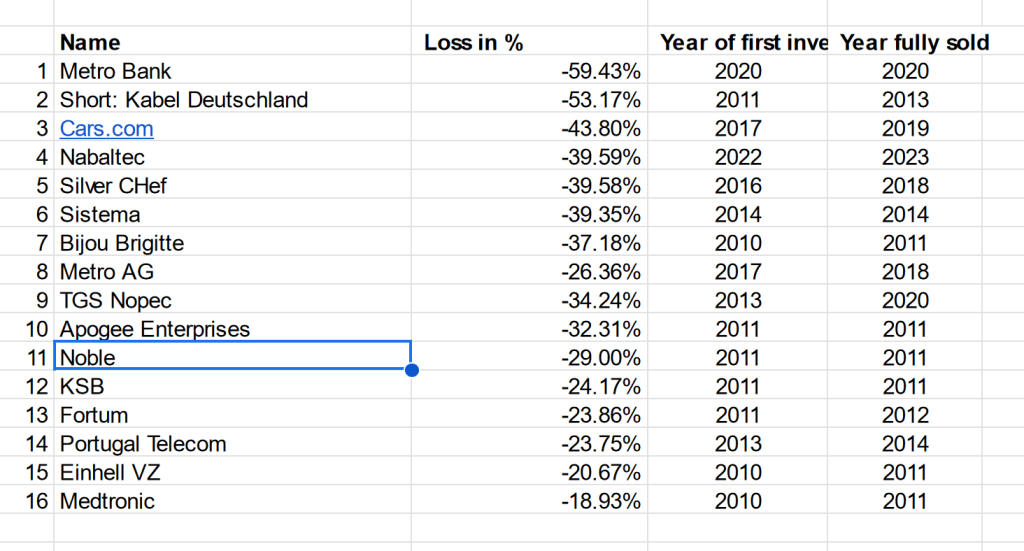

As mentioned in the comments of the original post, I exited Nabaltec a few days ago, in order to fund a new position. There is no way around the fact that it was not a good investment. Actually, in the 13 years of this blog, it qualified as the 4th worst investment with regard to overall percentage loss within my “hall of shame” that I proudly present in this table:

Of course, there will be always bad investments but I think it is important to analyze what I could have been doing better in order to avoid making the same mistakes over and over again.

So what went wrong ?

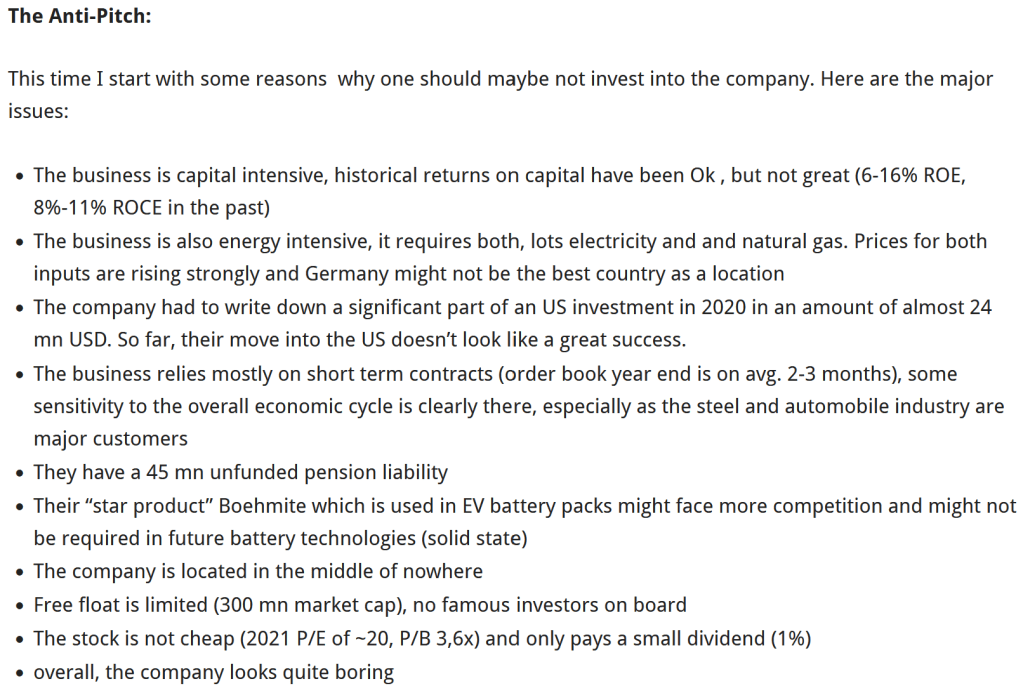

The initial thesis on Nabaltec was that it was a boring old school specialty chemicals company that had a decent track record and a interesting story with regard to EVs and batteries (The “Boehmit story”).

- Bad timing / Ukraine Invasion

The first thing that went wrong was timing: I published the post on February 3rd 2022, 3 weeks later, Russia invaded Ukraine and the whole landscape with regard to energy prices clearly changed forever. This however in my opinion was clearly bad luck. Very few people have seen that coming back then, although the run up in Natutal gas prices in the months before was quite strange.

In the initial write-up, I included the “anti-pitch” which clearly indicated that this would create issues:

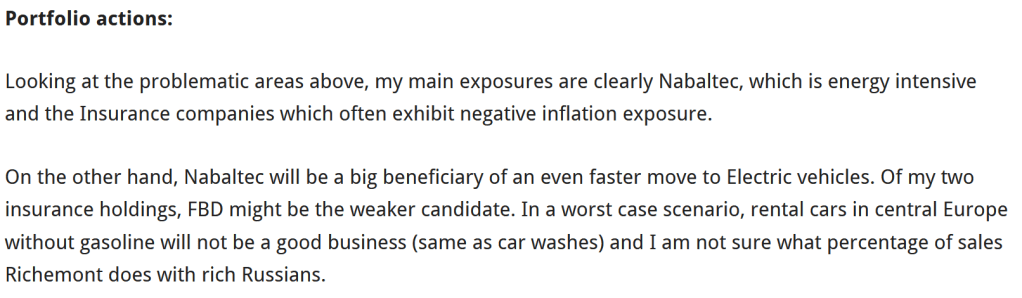

In my first “Panic post” after the invasion, I correctly identified Nabaltec as a potential critical position, but I also assumed that this might be balanced by better traction on the EV side:

With regard to EVs, one of the clearly unexpected outcomes is that gasoline prices are now pretty low again, which makes ICEs from a cost perspective clearly more competitive for the time being. And it doesn’t help that the German Government just killed the EV purchase subsidy. There is now clearly a risk, that especially in Europe, EV adoption will progress slower than I have expected.

2. The “bull trap”

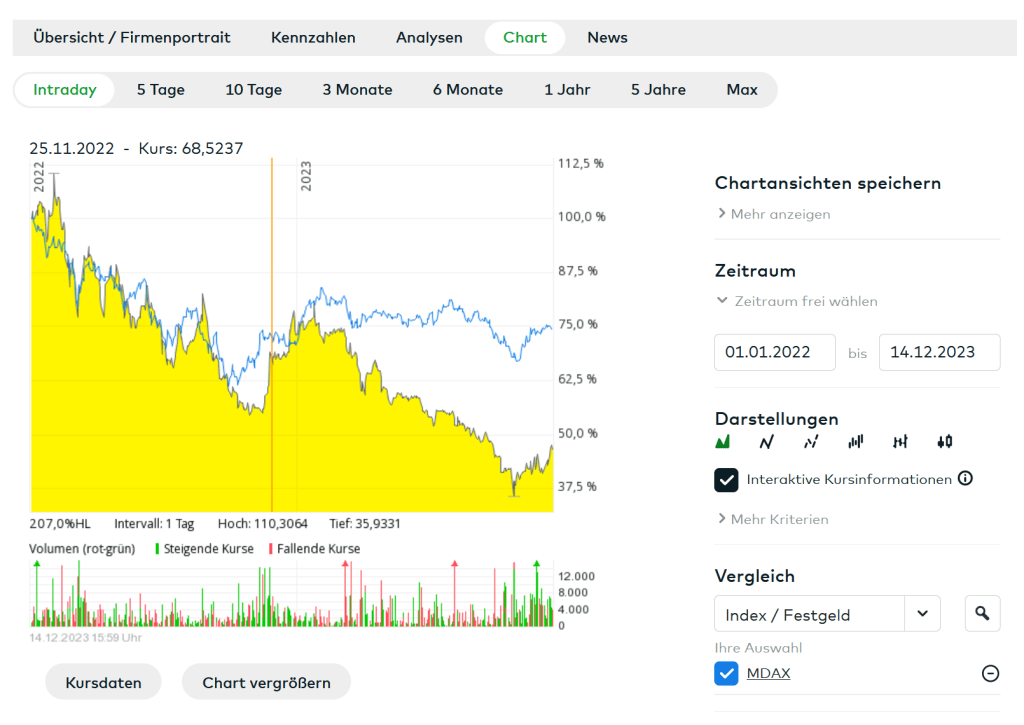

Looking at the chart, we can see that at first, Nabaltec moved in line with the market, the real gap only opened up in 2023:

One thing that was very unique was the fact that initially, Nabaltec seemed to benefit from the whole trouble as I lined out in a post June 2022. Back then, I interpreted the Q1 results as proof of pricing power for Nabaltec and increased the position to “full”, however at a significant lower price than the initial position. Back then, I didn’t even consider that this would be only a very short time effect of “panic restoking” of the clients.

In the Q2 2022 review in July, I mentioned that a potential stop of Russian Gas could be an issue for Nabaltec:

Looking through the comments, I traded the position much more than I usually do. Initially I sold on the way down like in June 2022:

But then I bought back in which was driven by continuing good earnings throughout 2022, as in November 2022:

I think the first tangible hint for this bull trap was the very cautious outlook in March 2023:

In any case, after Nabaltec warned for 2023 it was clear, that 2022 was realy only a shrot term exception and that they will struggle for some time.

3. The “Boehmit Story” broke early

One topic that I clearly didn’t pay enough attention to was the fact that the “Boehmit story” failed to materialize. The increase in profits observed in 2022 was based on short term gains in the traditional business, but the Boehmit ramp up did not materialize and as things look now, EV adoption might be slower than previously thought.

Also a lot of potential Battery manufacturing projects were delayed and/or moved to the US where Uncle Sam garnted very generous subsidies in the IRA.

In my opinion, this creates the problem that also the runway shortens for this application, as for instance next generation batteries (Solid state) don’t require Boehmit. Toyota now plans for solid state mass production in 2027/2028 and normally, the Japanese are not known to exagerate like Elno.

4. Putting it together

With the new situation (no Russian gas) Nabaltec has a VERY different risk profile than before. Maybe things turn out better if LNG prices stay low, but Nabaltec will be subject to LNG price volatility. From what I heard, they have fixed gas prices for 2024 but after that, they need to buy at the market, wherever the price will be.

It also doesn’t helpt that in the area where they are located, there is very little renewable energy development. With increasing CO2 prices, they might be subject to some hits there as well. Combine this with very short order cycles, you get a much more volatile business model than in the past. So assuming that the past is a good predictor for the future might not be applicable here.

Considering all this, I should have sold earlier from a fundamental perspective as my initial case is not valid anymore. Psychologically, one always hope for a reversal. Currently things look better for Chemical stocks, but that could change quickly. In any case, I sold now because I needed the money to fund a new position and my process is to sell the one where I have the lowest conviction.

Interestingly, one of the positions I sold to finance Nabaltec was Agfa. I sold Agfa at 3,65 EUR per share, because back then it was my lowest conviction position. Now it trades at 1,34 EUR. One could argue that I avoided an even larger loss by byuing Nabaltec. The point is that over time, process dominates outcome.

So as a summary, the two main mistakes from a fundamental perspective were not to react more quickly on the changed fundamentals (Natural gas) and the failed Boehmit story.

The main learning for me is that one really needs to understand that a short term positive developments could be a “bull trap” in an overall detariorating environment.

Well, you did not exactly sell at the bottom, but not very far away from what might look like one later this year.

I’m quite certain that you are not into chart analysis, but there are a few things that can be observed, each of which not particularly significant per se, but adding up nicely:

– higher highs and higher lows

– Prices above 200 EMA with a large green candle and contrary to previous times (8/22, 12/22, 1/23, 3/23) NOT immediately turning back again

– Volume increasing with the OBV consistently driving higher, contrary to previous rise where OBV flattened out around 1/23

– Washout 11/23 overshot the 61,8% Fib retracement of the whole boom since 2008, satysfying a correction and setting up a possible new uptrend

– Elliott-wave-wise the two downward waves since ATH can be counted as a zigzag correction of aforementioned boom, and the upward movement can be counted as half an impulse consisting of a 1 in 11/23 and the 1 till 3 of the 3 in 12/23.

Nabaltec could be in the starting impulse of a new, nice upward trend. If it rises up to 25-26 and then drops back again below 20 in autumn, this could turn out to be a wonderful buying opportunity.

Don’t know what’s going on today but in general their electricity seems to be mostly provided by a waste burning plant, so not so dependent on energy prices?

https://nabaltec.de/unternehmen/nachhaltigkeit/oekologie

They need lots of natural gas for heat, too.

Thanks for the post-mortem! I can understand your reasoning, but have a slightly different view.

Sales of EV in Europe are today below 12%: https://www.isi.fraunhofer.de/content/dam/isi/dokumente/cce/2023/2023-12-20_Strategy_Fraunhofer%20ISI%20-%20Fleet%20Electrification%20Study.pdf

Sales of Böhmite have been growing for Nabaltec until 2021 and had a pullback in 2022. A behaviour you can see in many industries, which has nothing to do with mid-term or long-term electrification trend, but was due to Corona and supply chain issues (Suez channel) leading to over-stocking:

https://nabaltec.de/fileadmin/user_upload/04_investor-relations/nabaltec_investorenpraesentation_2023_de.pdf

In 2 years from now, this will be considered „noise“. Even, if 2023 would bring Böhmite sales at a stagnating level as compared to 2022, the trend is not dead, but has just started. And you can see in the link above, that Nabaltec will supply also „viscosity tuned hydroxide“ into the same market (2nd product, I’m sure there is more to come). Soon markets will look ahead, at 2024 and beyond.

Böhmite was and is just the „icing on the cake“ for the stock. It may attract growth or story investors for some periode of time, but it can not change the numbers by a large amount as long as sales are only double digit millions. Nabaltec remains a „buy“ in my opinion, precisely because of it’s business and low market capitalisation: the value reasons you have laid out before. 🙂

I like a post mortem principally since it makes the investment process better.

Having said that, I was a bit surprised to see Nabaltec leaving your portfolio so soon. It remains to be seen if the risk profile changed that much – NG prices came down to the level where they were 2-3 years ago and even if there is volatility going forward that’s what everyone on their markets will have to deal with. As far as the Boehmit story is concerned its potential may have weakened but I wouldn’t write it off yet.

I’m looking forward to the new addition to your portfolio and at the same time holding the Nabaltec shares for the time being 🙂

Thanks for the comment. I wish you the best with your Nabaltec position. One remark: to my knowledge Nabaltec currently is not paying NG prices from 2 years ago but lower ones. We will see how that works if they need to pay higher ones

Very interesting summary and analysis.

As automotive expert, it is interesting to see how you (I assume not an industry expert) draw conclusions on trends and impact on small caps. a lot of dangerous halbwissen – but well, that is just confirming your belief to only buy what you understand.

great blog!

Thanks for the comment. With regard to “gefährliches Halbwissen”: there is o e sector where I would consider myself an expert, however especially in thst sector, I never manage to pick the winners because I focus too much on the downside.

Interesting. I agree. Especially with regards to “how crazy the stock market values certain businesses”

+10% today… maybe you are just too active trader on this one.

Congratulation to you. Most of my Readers are a lot smarter than me. Makes me proud.

Very impressive how modest the historical losses are for that long in a portfolio with a small cap bias. Not a single zero!

Excellent post-mortem!

always good to look at the things that did not work out!

one thought: your #4 hall of shame investment (-40% in 1yr) seems much better than #9 (-34% in 7yrs) due to opportunity costs or avg expected returns in 6yrs

Good point, but I like to keep it simple. I could also weigh it by portfolio share or other things, but in that way it works for me.