Private Equity (Mini) Series 6: Private Equity for the masses – Y2K edition

Previous Episodes of the Private Equity (Mini) Series:

Private Equity Mini Series (1): My IRR is not your Performance

Private Equity Mini series (2) – What kind of “Alpha” can you expect from Private Equity as a Retail Investor compared to public stocks ?

Private Equity Mini Series (3): Listed Private Asset Managers (KKR, Apollo & Co)

Private Equity Mini series (4) : “Investing like a “billionaire” for retail investors in the UK stock market via PE Trusts

Private Equity Mini Series (5): Trade Republic offers Private Equity for the masses (ELTIFs) -“Nice try, but hell no”

Time Machine: Y2K

Some of the older readers of my blog might have active memories about the year 2000. There was the so-called “2YK Scare” in the late 1990ies, the fear that computer systems (and planes) would crash when the year 2000 would start. Of course it didn’t happen, the Dot.com bubble got pumped up once more and the rest is history.

Another event that got less attention was the that back in the year 2000, the now long gone Dresdner Bank issued a Certificate (which is a popular structure in Germany to give retail investors exposure to anything) that was actually a bond linked to the long term returns of an underlying Private Equity Portfolio managed by Swiss PE manager Partners Group. The very same Partners Group that now has teamed up with Deutsche Bank to run an ELTIF.

Although I was not able to locate the original prospectus (Reports on the web page only go back to 2019) , the interesting aspect of this certificate is that it has been traded since 2003 and therefore provides us the maybe longest track record of a true, long term “retail Private Equity Performance”.

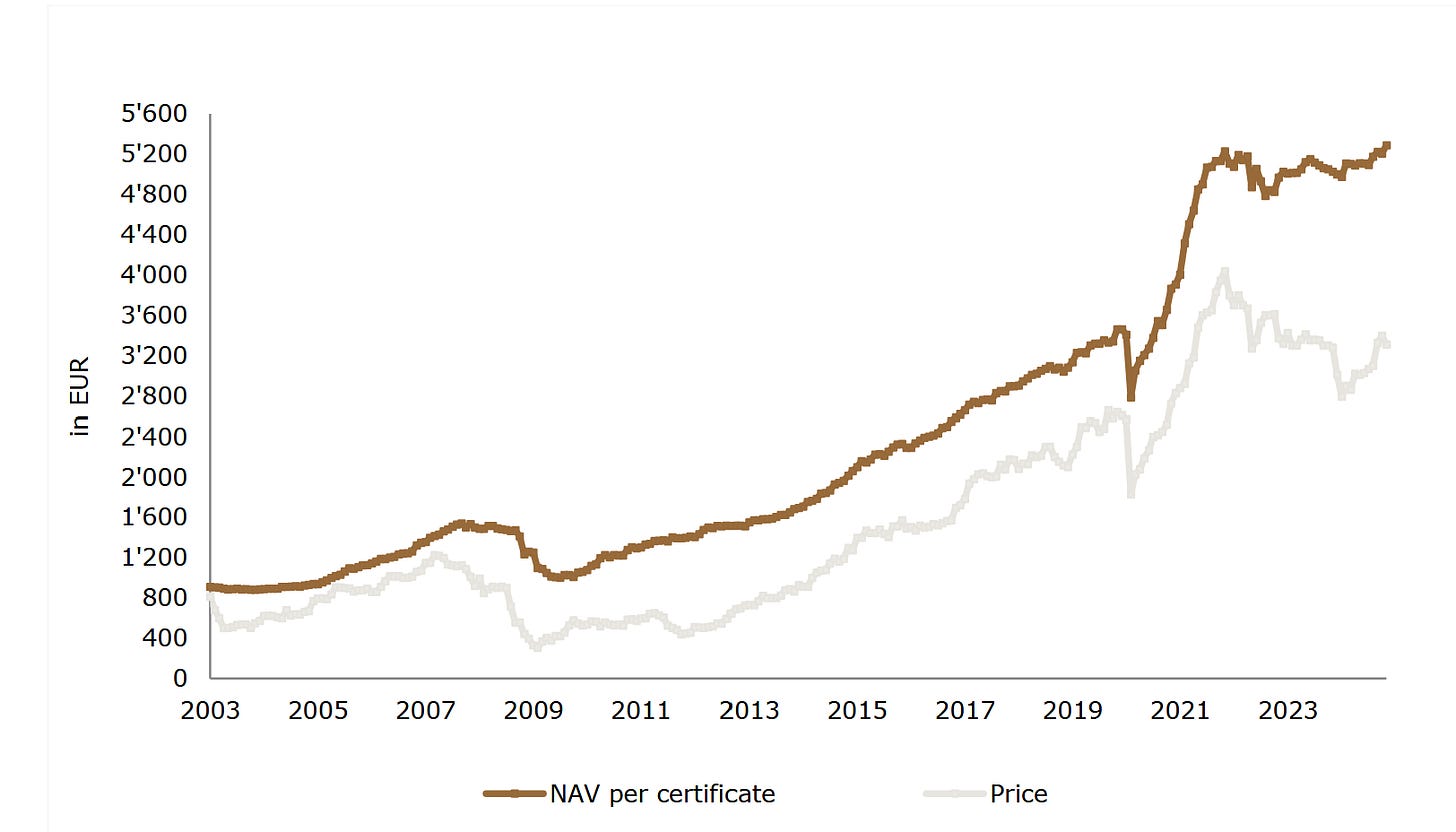

So this is how this 22 year chart looks like:

The traded certificate doesn’t look too bad, but 22 years is a long period of time. So let’s compare it to the DAX and the MDAX and there it gets interesting:

Even the Sleepy DAX and MDAX outperformed that product by a wide margin. Looking at annualized total return, this is what Bloomberg tells us:

So this Private Equity Certificate managed to return 8,31% or -2,7% p.a. less than the DAX in the same 22 years and 6 months. The underperformance to the MDAX which would e a better proxy is even higher.

Even if I take the total NAV performance stated in the 2024 which is 428,8% and annualize it over 24 years, I get only an annual return of ~7,2% p.a. from 2000 to 2024 for the certificate owners.

How does that Certificate invest & what are the fees ?

Looking into the annual report, we can see that the underlying strategy is a global, Buyout focused PE strategy with a portfolio diversified over many asset managers and a high percentage of direct/co investments.

The fee structure is quite similar to what we have seen in many other retail structures: At the vehicle level, a fee of 1,5% flat on PE investments plus a 15% carry (5%) hurdle rate plus the fees of the underlying funds.

We can see in the annual account that the vehicle charged the investors 13,5 mn fees and costs in 2024 based on around 580 mn in total so around 2,6% in a year with low performance.. In 2021, which was a better year, they charged 24 mn on 700 mn, so 3,5% (plus the fees of the underlying funds which are not explicitly disclosed.

There is no annual kickback to the distributor compared to the Trade Republic EQS product.

So why is the performance so bad in comparison to even DAX and MDAX ?

I mean they should have captured the best years of Private Equity and did not even manage to beat the old school, non-tech DAX Index ?

One factor is clearly the current discount of the price of the certificate to NAV, which at the time of writing is a around -35%. Even if we would adjust for this, we would still not be able to beat the Loser indices DAX and MDAX for 22 years.

Another factor is that they seem to have hedged out the USD. The tailwind of a strong USD is often included in past EUR returns stated by PE sales people but will of course not necessarily be repeated. So the hedged performance numbers are better predictors for the future in my opinion.

The starting point of the time series in early 2003 could also be an issue as this was more or less a decade low for the DAX index. But as we have seen, the total return since inception has only been 7,2% and far away from the often mentioned “double digit” returns.

Maybe they have selected the wrong funds ? The names in the portfolio are actually tier 1 household fund names. KKR, Cinven, Vista, Permira etc. Those are all good names. But of course, we do not know what they did in the early years. But Partners Group is a successful PE manager, so I assume that this is not the issue.

What is harder to assess is if they have maybe gotten only the weaker part of the co-Investment pipeline, as a large portion of the current portfolio are co-investments.

But the “hard truth” is:

Without all the IRR shenanigans of Institutional PE funds and the additional fee layers of a retail product, the real performance of a retail PE product is just not very good and will most likely not beat a low cost stock index fund, rather the opposite.

NAV discount

Another interesting aspect of this security is that at least during the last 22 years, the certificate always traded at a significant discount to its stated NAV. This is the graph from their 2024 report:

this mirrors the experience from the UK listed vehicles that often trade at significant discounts, too.

Trade Republic announced that they want to implement an “internal market place” where investors can sell monthly. My bet is that investors will not be able to sell at NAV but if at all, at rather steep discounts of 20-30%. I am really curious if we actually see trades on this internal market place at all.

Once again: Don’t play in the Casino, own the Casino

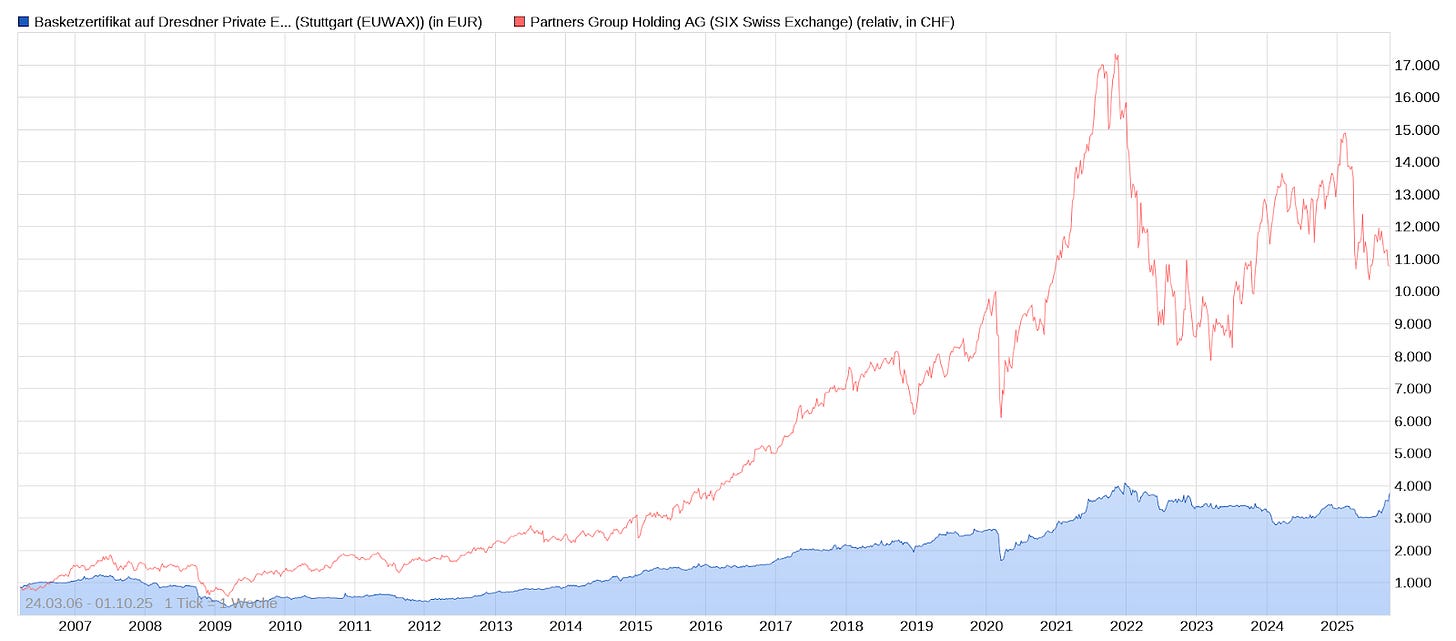

And last but not least, my favorite comparison: Partners Group was one of the earliest PE shops to go public in 2006. This is how the stock of partners Group did compared to the certificate that they manage:

As expected, you would have made multiples of the money investing into the GP instead of the underlying assets. And this is clear: As a partial owner of the GP, you gain from high fees and a potential positive development of the underlying assets, but your downside is limited, as it is not your own money.

As a friend would say: Losers play in the Casino, winners buy the Casino.

So once again, my recommendation is clear: If you believe in the future of Private Equity, buying the GP via their listed stocks will most likely be the better choice than going through high fee retail products.

As a cliffhanger, in the next episode I will look at one example of a security that gives you a relatively fair exposure to PE funds if you really desperately look for it.

Summary:

The Dresdner Bank PE Certificate issued in 2000 gives a very realistic view of what retail investors can expect in “real world performance” for Retail Private Equity offering.

Over a period of 22 years and 6 months (since this product is trading), any retail investors would have outperformed this product with a simple and easy DAX Index fund by a wide margin of 2,7% p.a. Instead of a 6x with the Certificate, good old DAX would have given you a 10x in the same period.

The generally advertised double digit returns (after fees) for Retail PE products are in my opinion a total fantasy and are built upon past, “massaged” IRR numbers that are not a good guide for real world performance.

I am really curious, how many retail investors will get sucked into these traps. Maybe these articles help some of my reader (and their friends) to avoid these products.

Very interesting. However, I note that in the fact sheet of the P3 Fund tranche they compare performance against the MSCI World TR. In that context, the performance chart of the MSCI World TR since 2003 appears to be significantly below the performance curve of the P3 tranche. This seems somewhat counterintuitive: given the strong performance of the S&P 500 over the past 20 years, one would expect the MSCI World TR to outperform comfortably—just as the DAX and the MDAX have done.

Looking forward to the analysis of HgCapital Trust. 😉