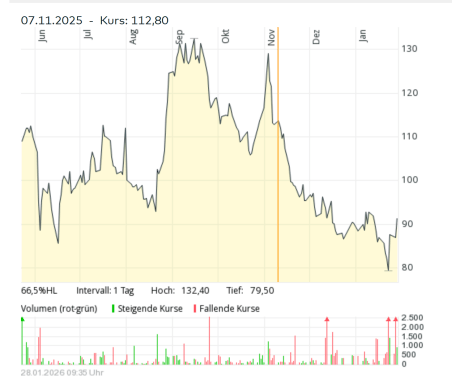

Quick Update Innoscripta (Company Conference Call)

My timing of my Innoscripta write-up was a little bit unfortunate. Just a day later, Innoscripta held a conference call explaining the 2025 numbers. I think I need to better check the calenders of the companies I write about in the future….

The presentation can be found here.

I listened to the Call on Quartr. My main (and of course subjective) take-aways:

- as a relatively new initiative, they develop a “safe storage” for R&D data

- the arguments about LLMs and their limitations did not overly convince me. The arguments rely on today’s abilities of LLMs, but the question is how this will develop in 1,3 or 5 years. Especially I do not see that the LLM in the hand of a client itself is the competitor but competitors (especially other consultants) using AI to rapidly develop (cheaper) alternatives

- Cash conversion (to EBIT) is currently around ~60% but they try to improve cash collection

- They are bullish on the Government increasing the programs in general (regulatory tailwinds)

- They claim that they see increasing revenue from the same clients which I find quite surprising. They didn’t however provide any concrete numbers

- The clarified that the overall proces from application to cash collection is 9-12 months (3 months for innovation approval, 6-9 months for tax credits)

- They claim that the “front loading” of 4 year applications seems not so significant

- There is a clear seasonality that companies hand in filings mostly in Q4 in order not to lose credits for T-4 projects

- Revenue in Q1 2026 should look good (whatever that means, not sure if they compare this to Q4 2025 or Q1 2025)

- The currently do not consider M&A for international expansion but try to grow organically in 4 different countries (UK & US was mentioned)

- The question if the 40% growth for 2026 is relevant was somehow confirmed but very indirectly. A “real” guidance should be expected for the AGM in April

- Interestingly, the overall growth in the German Tax Credit market was +60% in 2025 which means Innoscripta’s growth is in line with the market and they want to grow with the market. More details again shall be provided at the AGM. The analyst mentioned that the market will grow less than 40% in 2026

- The question how big the “4 year front loading effect” actually is, they were quite evasive. They mentioned that there will be growth internationally and through “Software” and Tax Credits is described as a “Milestone” or “trojan horse” to get other business.

- Cash usage: No additional cash is needed for growth. Buy backs limited due to limited liquidity but rather distributions.

Overall my impression is that at least 2026 should look pretty Ok, but further out it gets a little bit vague. International expansion is clearly more risky than increasing market share in Germany.

But overall it remains a very interesting and dynmaic company and I am looking forward to the Annual Shareholder Meeting which I hopefully can attend.