Private Equity Series (7): Secondaries – The Magic Money Machine for the PE industry

Previous Episodes of the Private Equity (Mini) Series:

Private Equity Mini Series (1): My IRR is not your Performance

Private Equity Mini series (2) – What kind of “Alpha” can you expect from Private Equity as a Retail Investor compared to public stocks ?

Private Equity Mini Series (3): Listed Private Asset Managers (KKR, Apollo & Co)

Private Equity Mini series (4) : “Investing like a “billionaire” for retail investors in the UK stock market via PE Trusts

Private Equity Mini Series (5): Trade Republic offers Private Equity for the masses (ELTIFs) -“Nice try, but hell no”

Private Equity (Mini) Series 6: Private Equity for the masses – Y2K edition

Background:

Maybe a quick word why I am doing this series on Private Equity:

I have to admit that I am fascinated by the PE industry as such and whatever happens there has a definite impact on the stock market, either through take-privates or IPOs or other more indirect developments (Private Credit boom etc.).

In addition, as Private Equity is now targeting more and more retail investors, I want to provide some background information as currently these products are sold on a very “asymmetric” basis. There is very little objective information available about these products besides the glossy sales pitches.

I am very much afraid that many retail investors will regret putting money into Retail structures in a few years from now.

What are PE “Secondaries” anyway ?

There are two things that I really do really admire from the Private Equity industry: First, that they managed to keep their 2/20 fee schedule since their beginnings in the 1980s and never shared any “scale economics” with investors. And second, that they are very creative in finding new ways to sell their product.

I have been discussing the relatively new retail products already but a similar big trend in Private Equity are socalled “Secondary Funds”.

Secondary funds come in many flavors but the main one is to buy Private Equity assets from unhappy investors and sell them to new investors. There are two different “flavours” of this:

- Secondary LP Fund stakes

Here, existing investors want to sell their Fund stakes (“Limited Partner”, LP) for one reason or the other. As these are illiquid and often intransparent vehicles, buyers will only buy them for a certain discount.

- GP Led secondaries / Continuation vehicles

In those cases, the PE manager (“General Partner”, GP) cannot exit an investment inside a fund via the normal route of an IPO or M&A transaction and is looking for new LPs to which he can sell these company stakes to, also often at a discount to the last valuation in the fund..

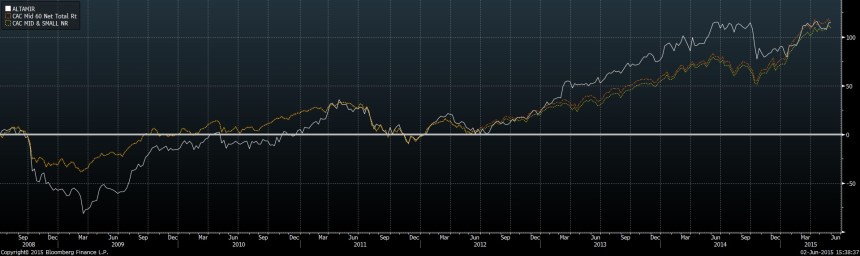

The FT had a recent article that both types of secondary transactions are booming.

The article speculates that in 2026, the total volume of secondary deals could be up to 50% higher:

This is even more remarkable as fundraising for “primary” i.e. new funds has declined significantly in 2025. So secondaries are the only bright spot for PE firms at the moment.

The big question is of course: Who is selling all these stakes and who is buying it ? The first question is rather difficult to answer, as those transactions are mostly private.

The second question is much easier to answer: The Private Equity industry is buying all these stakes and “repackaging them” as Secondary funds and selling them again to institutional investors, quite often to those who were selling those primary stakes in the first place.

But why would institutional investors do this ? The answer is surprisingly simple:

It’s an accounting trick.

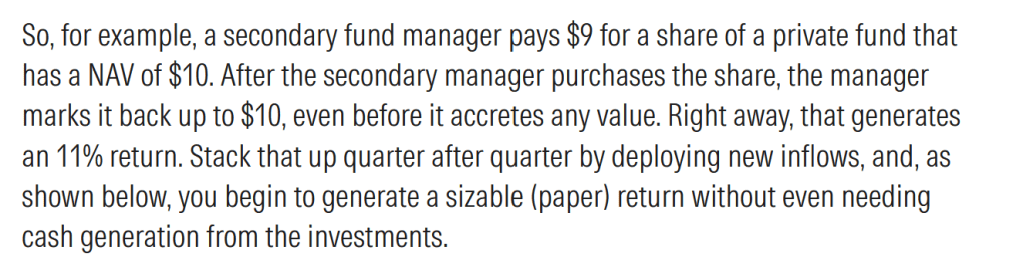

I had linked to a Morningstar post already last year where this was nicely explained:

So just to compare this with a listed stock fund. Italian Holding company Exor SPA (famous for its stake in Ferrari) has currently an NAV of around 180 EUR per share but only a share price of 70 EUR.

If a portfolio manager buys a share of Exor, he might think that the share is worth more than 70 EUR, but the share will be valued at 70 EUR in his portfolio. The actual share price will need to rise in order to be able to show a positive performance.

If he would be a PE guy and Exor would be a secondary stake in an unlisted portfolio company,, he could mark up that share immediately from 70 to 180 EUR and show more than 150% profit without the market price moving a cent. This sounds crazy, right ?

But this is exactly what Private Equity is doing with secondaries:

You buy the asset as a discount and (almost always) on day one, you can actually write-up the asset to the NAV stated by the Fund Manager and show a so-called “day one profit”.

The higher the discount, the better and the better the “performance” of the Secondary fund.

Interestingly, in the current environment, both Private Equity Managers and investors love it.

The PE managers obviously because they can “recycle” their old stuff and in many cases can earn an additional fee layer on top of the existing fees in the underlying funds.

Investors love it because the performance looks so good right from (and especially from) the start. In traditional PE, you normally have to wait a few years until you see significant positive performance as a lot of the initial costs drag down Fund performance (J Curve).

So buying into these secondary funds looks like a brilliant investment decision despite the double layer of Private Equity fees that these investors are often paying.

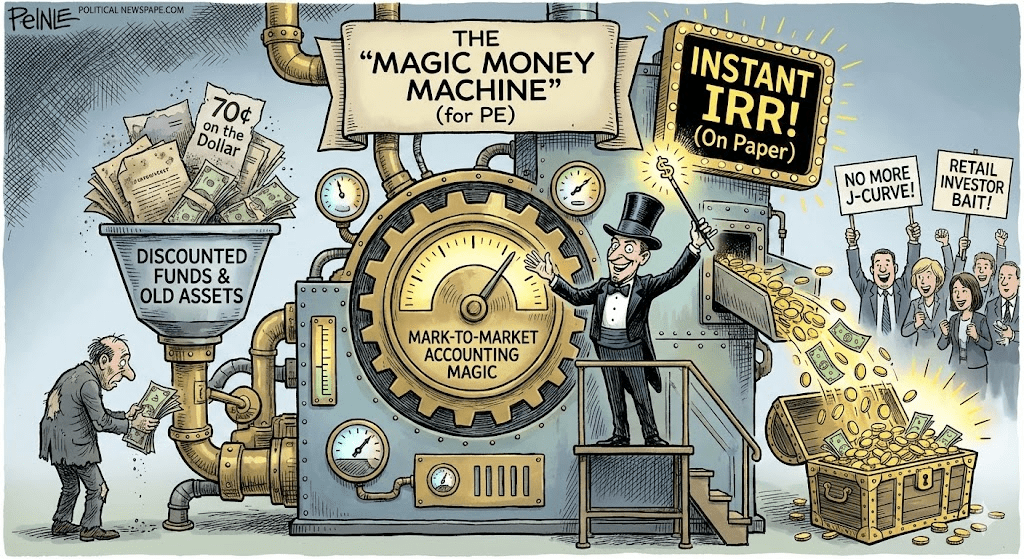

This is wath Gemini Nano Banana came up with when I asked it to illustrate the mechanics and I think it’s absolutely brilliant:

But can it last ?

The main argument and the “story” of the PE industry is that those discounts are purely “liquidity discounts”, i.e. the sacrifice that “forced sellers” of these stakes have to endure and therefore presents more or less a “free lunch” for buyers.

On the other hand, it is no secret that many market participants think that stated NAVs and valuations of most PE funds are not realistic.

I have personally witnessed a situation where the valuation of a PE fund dropped from 130% of invested capital to 60% (i.e. -50%) in 9 months due to “structural changes” at the PE firm.

Personally, I do think that “true” liquidity discounts only represent a small minority of the deals and that a much larger share of those discounts are more realistic assumptions on the actual values of PE funds and their constituents.

Many of the sellers are rather sophisticated addresses that will not sell a really good fund at a large discount.

Maybe a big rebound for “Value” and “Old Economy” stocks will narrow the over-valuations. On the other hand, the current carnage in Saas stocks creates new problems for funds exposed to that sector (Thomas Bravo for instance) which used to be one of the few bright spots.

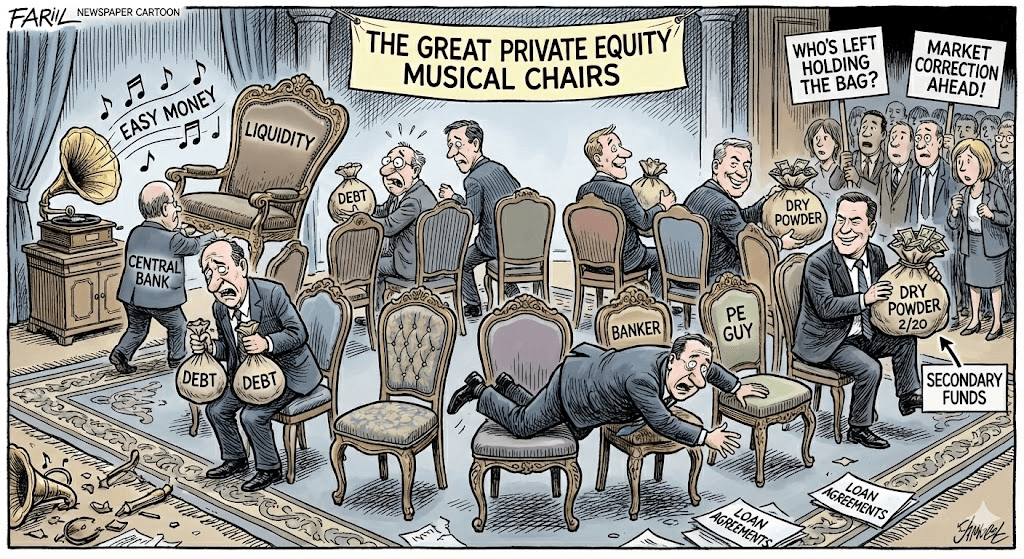

In any case, the “Day one game” only works as long as “fresh money” is coming into a product. Once the fresh money stops, there are no new “day one gains”.

What’s the take away for private investors ?

As those secondary transactions are also quite popular to juice up returns in the short run for retail PE structures (ELTIFS etc.), this is one more reason to stay away from those fee laden, intransparent structures.

This is for instance from the July report of the EQT ELTIF (sold by Trade republic):

Boosting the “performance” just by buying a new asset is a great thing to have if you are a Private Equity retail fund.

And of course, some “smart” people are trying to play this game in public markets, too. Swiss liste company Matador for instance does exactly the same. Buying secondary stakes at a discount and then marking them up right away.

If you are an institutional investor, you should check if the fund prospectus contains information on what percentage of the performance is generated through “one day gains” and what is generated through actual performance.

Especially those secondary funds that contain the most overvalued PE funds might see a very “rude awakening” in the coming months/quarters when those NAVs might be revised downwards and those “day one gains” disappear.

Until then, the music is still playing…..again illustrated nicely by Nano Banana:

Bonus Song: Let the music play – Barry White