Reply SpA part 3 – Strange cashflow –> RED FLAG ALERT

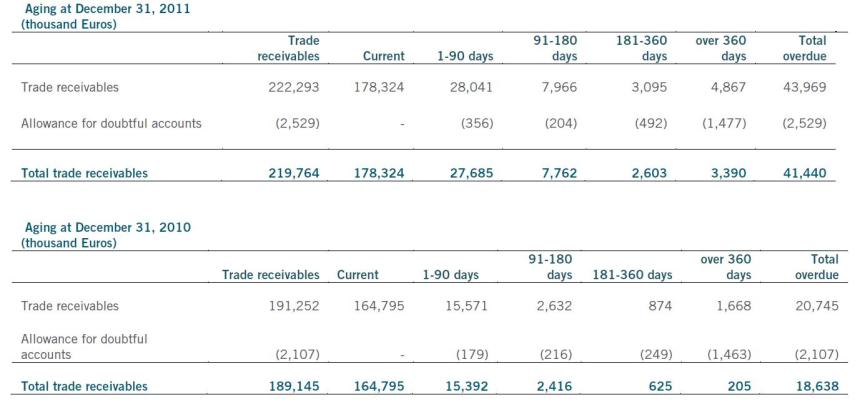

In the last two posts (part 1, part 2) about Reply, I mentioned that there was some questionable provisioning for overdue receivables and that free cash flow generation in general looks relatively weak.

So let’s look at a further example, if and how reliable Reply’s accounting is.

In 2009, Reply made an interesting deal, as stated in the 2009 annual report:

Acquisition of Motorola Research centre

In February 2009 Reply Group, through the subsidiary company Santer Reply S.p.A., finalized the acquisition of the Motorola research centre based in Turin.

The acquisition, accountable as a “net asset acquisition” was purchased by Reply for a symbolic amount of 1 Euro and comprised 339 employees, 20.6 million Euros in cash, 2.9 million Euros of assets and liabilities for 23.5 million Euros. Reply has committed to the operation on the basis of the research perspectives outlined at the time of acquisition and the agreements defined with the public administrations (Region and Ministry of Development).Such agreements foresee that the Piedmont Region finance through a free grant a maximum of 10 million Euros on the condition that the Research centre carries out projects within the research and development of Machine to Machine (“M2M”) and that proof can be provided. Furthermore, the Ministero dello Sviluppo Economico (S.M.E.) has made a commitment to grant the Research centre a loan for a maximum of 15 million Euros of which 10 million a free grant for research and development projects similar to those agreed with the Piedmont Region.

In the last months the Board of directors of Reply Group and Santer Reply S.p.A have outlined and defined organizational strategies of the course of business of the Centre. More specifically costs related to research projects have been quantified and the financial resources necessary for such research projects and means of disbursement have been defined by the Public Administrations.

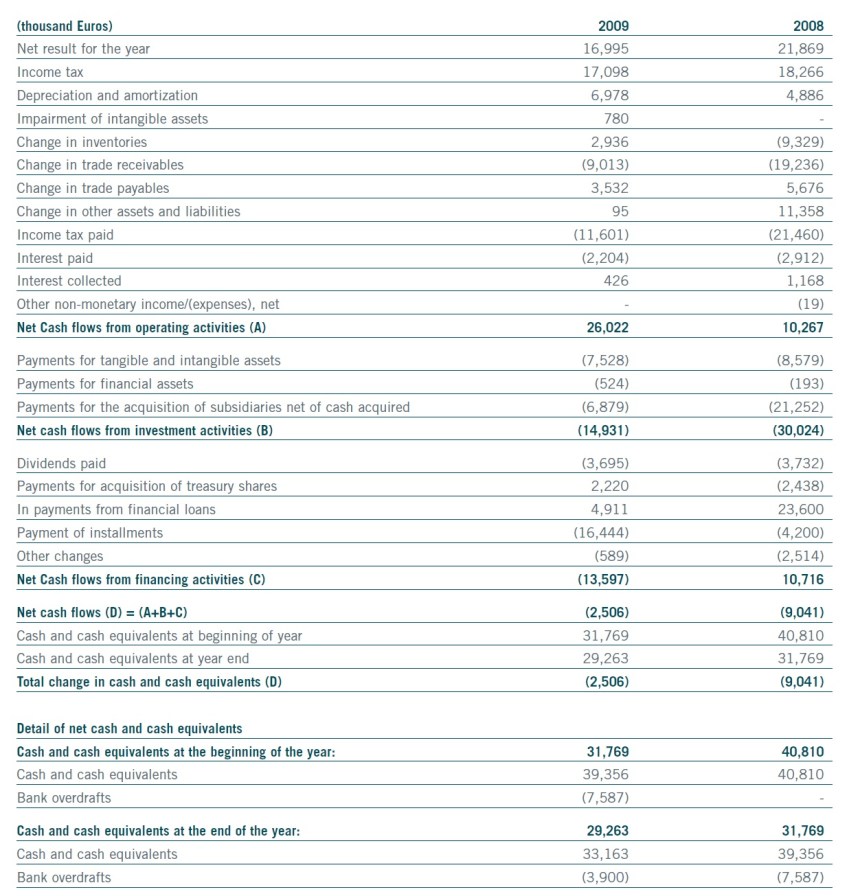

So they “bought” a company for 1 EUR which had 20.6 mn in cash. In theory, we should see this as a positive investing cashflow in the CF statement. Lets look at the 2009 statement:

Strangely, the stated “payments for the acquisition of subsidiaries net of cash received” is negative !! We know that they only paid 1 EUR, received 20 mn and didn’t do other big acquisitions in 2009.

I do not know where they actually booked the acquired 20 mn EUR liquidity, but this is very very strange.

The second part of the puzzle are the Government grants out of this deal.

In their notes, they state the following:

Government grants

Government grants are recognized in the financial statements when there is reasonable assurance that the company concerned will comply with the conditions for receiving such grants and that the grants themselves will be received. Government grants are recognized as income over the periods necessary to match them with the related costs which they are intended to compensate.

So what in theory should happen is the following:

-when they receive the money, the book a liability against the money (P&L neutral)

– then over time they reduce the liability by booking this release as profit

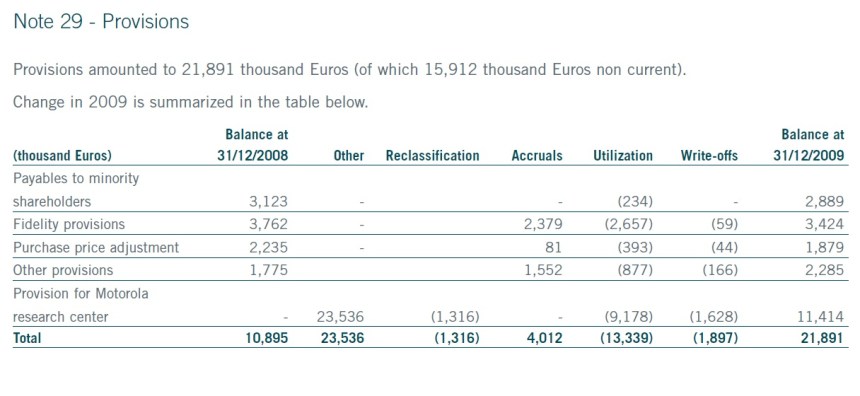

Based on Note 29, Reply booked already such a provision of ~23 mn EUR at the end of 2009, from where they used half of it again. I am not sure why,but again, where is the corresponding asset ? I would assume somewhere in other receivables (as they may not have received the Government money in 2009).

If one of the readers really understands what is going on here, then please help me.

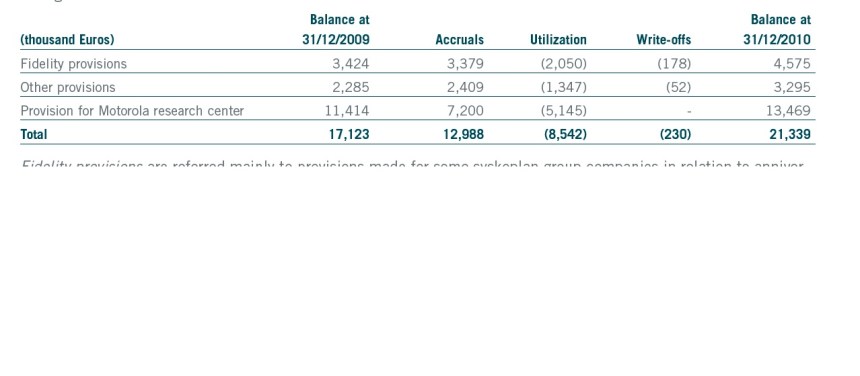

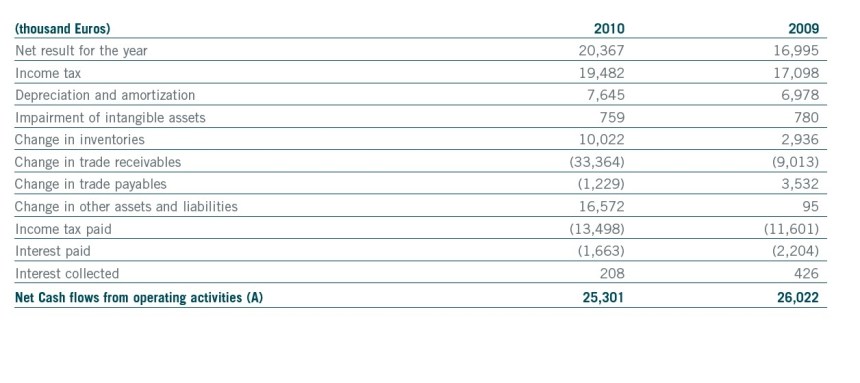

In 2010, the provisioning continues, it looks like the increase and use those provisions as they like to:

This might explain why the very unusual and unexplained line item “changes in other assets and liabilities” makes up 2/3 of Reply’s 2010 operating cashflow.

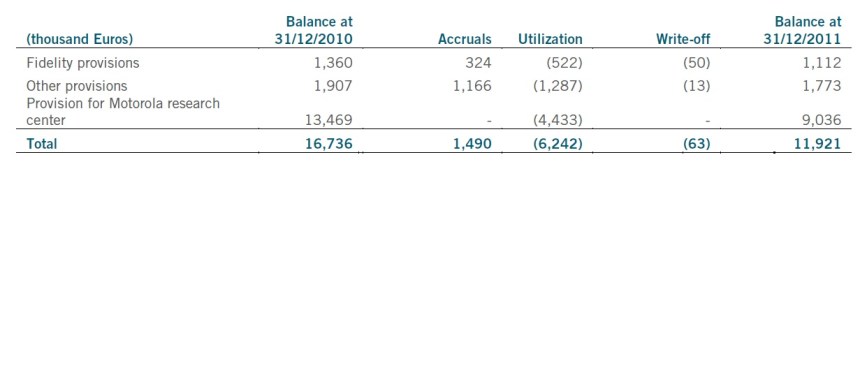

in 2011, the provision is still significant:

So what does that mean ?

In my opinion, there is poor visibility in the accounts and especially in the cash flow statements. We know now, that the Motorola transaction netted them around 40 mn EUR net cash, but didn’t show up in the investment cashflow. As it didn’t show up in financing cashflow neither, it has to be moved into operating cash.

As operating cash in total from 2009-2011 was only 55 mn EUR, basically a large amount of the operating cashflow in this period seems to be non-operating and coming from the acquired Motorola Research center.

At this point it is time to stop and summarize:

– at least to me, the accounting and cashflow treatment of the Motorola acquisition is not transparent

– together with the weak cash flow generation, large goodwill position and a large number of acquisitions this is A BIG RED FLAG

Maybe I am just not clever enough, but my philosophy to avoid companies with large intangibles and non-transparent accounting makes me stop here and not further investigate the company.