Piquadro SpA – Competitors, market analysis and strategies

Normally it is quite difficult for a private investor to get hold of comprehensive market information. One could try to google and try to collect some articles, but “hard data” is usually only available if you pay.

However, many listed companies include some market and competitor info in their analyst presentations. Piquadro provides us with a nice graphic of competitors in its 2011 April Analyst presentation:

Interestingly, in it’s own presentation one can see that the “Premium / Performance” segment is also the most crowded one.

An even better source for market data are IPO filings. In an IPO prospectus, companies usually provide a lot more information than in annual reports, as they have to persuade new investors that this is a exciting market.

Luckily, competitor Samsonite actually was IPOed last year on the Hongkong stock exhange after filing bancruptcy in 2009 (and also in 2002 if I remember correctly). The Samsonite story also shows the biggest risk for those companies: Overexpansion and too much lease liabilites, in this case driven by a Private Equity owner.

Tumi, currently owned by PE firm Doughty Hanson is currently on the path to an IPO and has already filed its documents for an IPO. To make things more interesting, Samsonite already anounced its interest purchasing TUMI.

So we have to additional sources for market information in this case.

For Mandarina Duck, the other major competitor from the Piquadro Matrix, currently no financial information is available. It seems to be owned by a PE shop as well.

Let’s start with the “Competitor” section of the TUMI IPO prospectus:

Competition

We have a variety of competitors in the categories and geographic regions in which we operate. We believe that all of our products are in similar positions with respect to the number of competitors they face and the level of competition within each product category. Depending on the product category involved, we compete on the basis of a combination of design, quality, function, price point, distribution and brand positioning.

Our biggest global competitor in the travel goods category is Rimowa, a German company. We also compete with Samsonite in Europe, the Middle East, Africa and Asia-Pacific. In the premium luggage and business cases category, we compete with Bally, Dunhill, Ferragamo, Gucci, Louis Vuitton, Montblanc, Porsche and Prada. In the business case category, we also compete with smaller brands in specific markets. In the U.S., our main competitors are Victorinox and Briggs and Riley. In Europe, the Middle East and Africa, our key competitors are Mandarina Duck and Piquadro. In the Asia-Pacific region, competition is fragmented. In Japan, our two key competitors are Porter and Ace Brand. We also compete with Coach across the luggage, business cases and accessories categories.

We believe that our primary competitive advantages are favorable consumer recognition of our brand amongst our targeted demographic, consumer loyalty, product development expertise and widespread presence in premium venues through our multi-channel distribution. We may face new competitors and increased competition from existing competitors as we expand into new markets and increase our presence in existing markets.

So again, we do not see any “hard” moats but rather some fuzzy brand recognition and customer loyalty aspects.

Even more interesting is the very detailed IPO prospectus of Samsonite. This is a “treasue trove” of interesting market data.

The “1 million dollar quote” however can be found at page 95:

Barriers to Entry and Benefits of Scale and Leadership in the Luggage Market

Barriers to entry into the luggage market are generally low, which has contributed to the fragmented nature of the industry. Key challenges for an entrant or an existing company are investment in brand awarness, innovation in new products, access to quality producers, and developement of an effective national / local retail network.

So here the “market leader” tells us there are no barriers to entry. So no “moats”. Period.

The Industry overview section of the filing is really interesting and comprehensive (p-90).

The market itself is supposed to grow at quite an attractive overall rate:

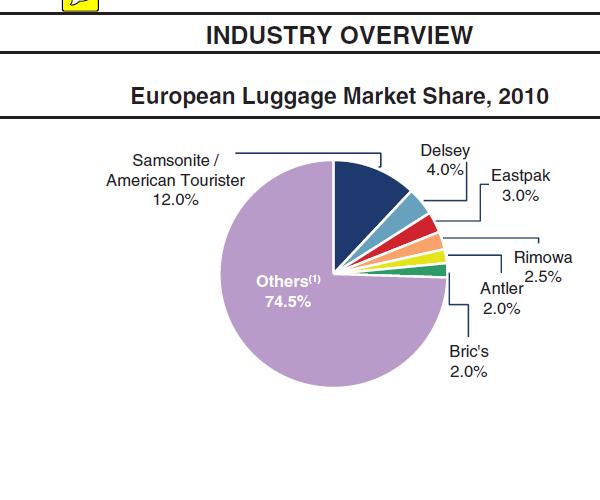

Samsonite itself does not yet realise Piquadro as competitor, neither Mandarina Duck. Piquadro and Mandarina Duck are only mentioned among others which are shown having a combined market share of 74.5%.

Howver, Samsonite places itself directly into the “Premium” category in contrast to Piquadro and Tumi themselves:

Side remark: Anyone who had the problem at an Airport baggage claim to find out which of the 25 identical black Samsonites is the own bag knows that this is more “mass market” than anything else.

The luggage market according to Samsonite can be segmented into 3 product segments:

Samsonite also has an interesting “market share” slide for Europe which shows the high fragmentation:

So the big question is now: Should I stop now with analysing Piquadro because there is definitely no “objective” moat ? I would say, no, because for some reason, Piquadro has been able to grow, maintain high margins and produce free cashflow. When we continue to evaluate the company we should however incorporate a certain “normalisation” of returns anad margins.

Also the whole market segment seems to be quite attractive as even in “good old Europe” some nice growth is expected in the coming years as indicated before which can be incorporated int he valueation to a certain extent..

Strategy

Tumi has a very interesting passage in its IPO filing regarding marketing:

We do not employ traditional advertising channels, and if we fail to adequately market our brand through product introductions and other means of promotion, our business could be adversely affected.

In 2010, we spent approximately 3% of our net sales on advertising and promotion expenses. Our marketing strategy depends on our ability to promote our brand’s message by using store window campaigns, product placements in editorial sections, social media to promote new product introductions in a cost effective manner and the use of catalog mailings. We do not employ traditional advertising channels such as newspapers, magazines, billboards, television and radio. If our marketing efforts are not successful at attracting new consumers and increasing purchasing frequency by our existing consumers, there may be no cost-effective marketing channels available to us for the promotion of our brand. If we increase our spending on advertising, or initiate spending on traditional advertising, our expenses will rise, and our advertising efforts may not be successful. In addition, if we are unable to successfully and cost-effectively employ advertising channels to promote our brand to new consumers and new markets, our growth strategy may be adversely affected.

Interestingly, the “Market leader” Samsonite spent almost 9% of revenues on marketing in 2010(see IPO fact sheet), Piquadro around 5%.

Samsonite focuses basically to almost 100% on the wholesale sales channel, Tumi has reached a 50/50 split between wholesale and single brand stores.

Very interisting is the fact, that Piquadro just hired a seasoned TUMI executive for international brand expansion.

Peer Group comparison

Let’s just make a quick comparison with regard to profitability. As one could expect for PE owned companies, both TUMI and Samsonite show quite a messy capital structure and “real profits” don’t really exist. So let’s work with what they call “adjusted” EBITDA (Samsonite & Tumi in USD, Pqiadro in EUR):

| Samsonite | TUMI | Piquadro | |

|---|---|---|---|

| Sales | 1,215.0 | 252.8 | 61.8 |

| Total assets | 1,665.0 | 321.0 | 29.6 |

| NWC | 372.0 | 80.2 | 16.1 |

| EBITDA adj | 191.9 | 40.6 | 16.4 |

| EBITDA/Sales | 15.8% | 16.1% | 26.5% |

| EBITDA/Assets | 11.5% | 12.6% | 55.4% |

| NWC/Sales | 30.6% | 31.7% | 26.1% |

This is really interesting. Piquadro is the most efficient and most profitable company of this “Peer group” based on “simple” metrics.

Summary: A quick view into the market and competitors show the following:

– the market is quite fragmented, no real barriers to entry exist and therefore no “classical” moats

– nevertheless all companies seem to be able to generate at least currently some decent returns on assets

– Picadro itself seems to be the most efficient of the 3 companies. It is therefore likely that no strong “economies of scale” exist in this market

I will follow up with a valuation approach in the next days.

MOATS : The new book discusses the Competitive Advantages of 70 Buffett and Munger Businesses. These 70 chapters cover the businesses purchased by Warren Buffett and Charlie Munger for Berkshire Hathaway Incorporated. This is a useful resource for investors, managers, students of business around the world. It also looks at the sustainability of these competitive advantages in each of the 70 chapters. http://www.lulu.com/spotlight/4filters

The MOATS book introduction audio mp3 file: http://www.frips.com/moats.mp3

The IBM Chapter from MOATS. Why did Buffett buy into a technology services company after so many years? http://www.frips.com/ibm.mp3

thank you, great work!

Maybe a valuation for Piquadro could be like the following:

– assume, it is certain, that margins of Piquadro will drop to a normal level somewhere in the future (what is “normal”? Maybe industry average of the last decade?)

– how long must Piquadro maintain its current margins, so that the current price level is fair?

– how likely is it, that Piquadro will maintain its margins at least for the computed number of years? If it seems certain, Piquadro may be undervalued.

I can’t wait for your valuation!