A few thoughts on Banking Stocks (Lehman 2.0, Deutsche Bank)

History repeats itself, at least it looks like this in the banking sector at the moment.

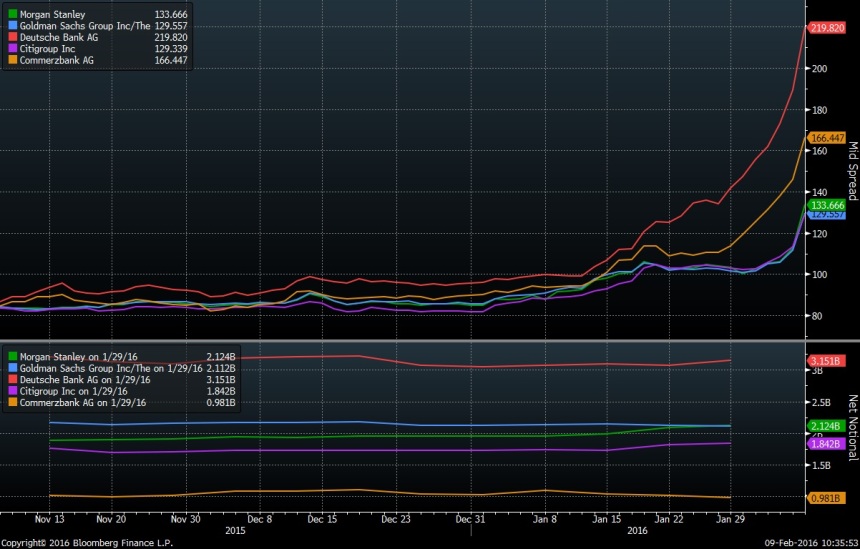

Stock prices are dropping like stones and CDS spreads are “exploding”:

Everyone it seems is looking for the next “Lehman”. So far the “favorites” within the group of global banks for “Lehman 2.0 – the sequel” seem to be Credit Suisse and Deutsche Bank. Here a quick overview on 1 month returns for a selected group of banks:

| 1 Month return | |

|---|---|

| DEUTSCHE BANK AG-REGISTERED | -30,3% |

| CREDIT SUISSE GROUP AG-REG | -29,1% |

| COMMERZBANK AG | -24,3% |

| SOCIETE GENERALE SA | -22,8% |

| DEUTSCHE PFANDBRIEFBANK AG | -21,2% |

| Citizen Financial | -19,4% |

| UBS GROUP AG-REG | -18,5% |

| BARCLAYS PLC | -18,5% |

| CITIGROUP INC | -18,0% |

| BNP PARIBAS | -17,5% |

| LLOYDS BANKING GROUP PLC | -12,9% |

| HSBC HOLDINGS PLC | -11,2% |

| VAN LANSCHOT NV-CVA | -3,2% |

| SKANDINAVISKA ENSKILDA BAN-A | -0,9% |

We can see two things in this table:

- German listed banks are hit hardest as a group

- Local banks (Van Lanschott, SEB, Lloyds) in general look better

Both, Credit Suisse and Deutsche Bank have new CEOs who of course, try to put everything bad into the old year which led to significant write-offs at year end. The majority of those write-offs were however Goodwill positions of acquisitions from long ago which have no impact whatsoever on what business they can write.

Additionally, and that was part of the thesis for my own bank investments, I do think that banks are now a lot less risky than for instance in 2007/2008. Let’s look at Deutsche for instance and compare 2007 vs now:

| 2007 | 2014/2015 | |

|---|---|---|

| Book value of equity bn | 37 | 68 |

| Total balance sheet bn | 2.020 | 1.626 |

| Equity/total balance sheet | 1,8% | 4,2% |

| Tier 1 Ratio | 8,6% | 14,7% |

I am well aware that this could be my “famous last words”, but I don’t think that Deutsche Bank will be the next Lehman. Deutsche Bank is now clearly better capitalised than before the financial crisis, plus the US and the EU have now all the rescue mechanism in place to prevent a disorderly failure of any bank.

Don’t get me wrong: I am not proposing to invest into anything with a large investment banking business. For me, investment banking is very similar to investing in a European Soccer team but without the television revenues. As in football, the bankers themselves still manage to get the biggets slice of the pie and the shareholder is almost always the idiot. From my personal contacts I heard that compensation across the industry in 2014 and 2015 was already at the same level or even better than before the crisis in 2007-2009.

Example for panic reactions: The “CoCo issue”

A good example how the current panic drives even Bloomberg to issue absolute misleading headlines are the socalled “CoCo” Bonds, issued by Deutsche BAnk 2 years ago.

The headline of the Bloomberg article/interview was as follows:

Deutsche Bank Says It Has the Cash for Riskiest Debt Payouts

This of course made many investors even more nervous. Whenever you hear a bank assuring the public that they have enough cash, then most likely they haven’t.

But what was wrong about the headline ? Well, the question is not if Deutsche Bank has enough cash to pay those instruments, but if it can fullfill the “covenant” of the bond. In order to qualify as Tier 1 capital, those bonds do have certain conditions attached.

In the “CoCo” case, one of the triggers is the local GAAP result of the holding company which could be a constraint. The important point however is: This has nothing to do with cash, only with Accounting and in this case some relatively “easy to influence” German accounting rules. The chart of the CoCo clearly doesn’t look nice:

I think Deutsche Bank made the mistake to call it “Payment capacity”. Only in the last sentence they somehow explain that it doesn’t has to do anything with liuidity:

The final AT1 payment capacity will depend on 2016 operating results under German GAAP (HGB) and movements in other reserves.

However I guess that few pundits actually read those announcements until the end.

Again, I am not saying that anyone should buy those bonds. I don’t think that the risk/return relationship of CoCos is attractive, but it clearly shows how people do not really pay attention to details at the moment.

CDS liquidity and “true refinancing” costs

Another aspect is often overlooked by people who show those scary CDS charts (like me before):

The single name CDS market has become very illiquid, partly because the banks themselves do not make the markets anymore.

Before the crisis, the CDS market was very liquid and CDS spreads were a good indicator on how banks could refinance themselves in the capital market. However a few years ago, theat connection “broke”. In the process of determining bond yields at issuance, CDS spreads don’t play a big role anymore. It is quite common that bonds price well “inside” CDS spreads theses days.

This is for instance an overview at current trading level for a 5 year Senior Deutsche Bank bond (12/2020, 1,75% ISIN DE000DB7XLP5):

What we can see are 2 things:

- Yes, the spread for the bond increased from ~50 bps over swap to currently 100 bps.

- But also the basis of the CDS increased by the same amount. The “basis” means that CDS markets require a much higher credit spread (at the moment 100 bps) than the cash market where the real bonds are traded.

At least form me this shows, that the CDS spreads seem to be driven by market participants which obviously try to “replay” the “Big Short” to a certain extent.

Summary:

As I said before, this could be my “famous last words”, but in my opinion, at least for the moment, I don’t see a Lehman 2.0 scenario coming.

I clearly would stay away from investing into global investment banks anywhere in their capital structure because I think their business model is permanently challenged.

You can surely try to trade them but that is not my kind of investment style (anymore).

However I still think that there are opportunities for smaller, focused and well run banks. By the way, I am not buying the whole “Blockchain / Peer-to-Peer” hype but that is something for a seperate post….

For my own positions, I will keep all of them for the time being. I think Pfandbriefbank is a victim of the suspicion against Deutsche. I am not sure why Citizen dropped so much and the others (Lloyds, Handelsbanken, Van Lanschott) so far seem to be insulated to a lrage extend from the current panic.

My 1 penny comment to this post:

http://blog.argonautcapital.co.uk/articles/2016/02/19/argonautica-january-2016/

I believe the best I have read on that matter.

zyx,

thank you. A very thoughtfull post indeed.

mmi

Very interesting article. In your opinion, what is the reason, that the banks are performing so pourly recently?

Hey, did you see Commerzbank’s results? Seems like they are slowly turning into a solid, investable bank. Another few quarters like this and they may even head for 10% RoE. Any thoughts?

not really. My take is that Blessing put everything they had into the 2015 result and the next CEO will not have a lot of fun…

Thanks for the input, thats interesting

Commerzbank still has 63 billion Euro of loans in its bad bank, the majority of it for ship loans (down from 160 billion in 2012).

Indices for freight rates like the Baltic Dry Index are continuously deteriorating, actually marking new record lows day by day.

The value of the ships and the ship loans not directly rises that way…

sorry for double posting – due to my bad internet connection (yes, there are still some white spots on the German map 😉

feel free to delete one!

As a big fan of your blog I’m happy to finally be able to contribut a detail:

The bond shown in the chart is A0TU30 which is originally tier 1 and cannot be converted into equity. DB7XHP is CoCo bond which counts as additional tier 1 and is more “dangerous” (from an investor’s view).

Above, you never know which risks lie ahead in this huge and obscure balance sheet…

thanks !!

Any comments on Aareal bank vs. Dt. Pfandbriefbank? It lost more on a 3month basis,but a little less in the past month.

Financial Times published an article today, that DB intends to buy back a large amount of seniors … which kickstarted the DB stock temporarilly.

hmm, i think short term prcie moves are pretty arbitrary. I wait for annual reports….

Good article and points well made. I would argue though that a lot of COCO’s have been dragged down with DB, and unless you really predict another systemic crisis, there is now good value in some of the less risky coco names.

Finally, having worked in investment banking for 17 years (no longer), I can tell you as a matter of fact that pay has gone down from 07/08/09 markedly. Base salaries have increased but no one is getting 10x base salary bonuses anymore, so total compensation is much reduced from those days and the deferral is significantly more onerous. Further, most inv banks are de-skilling their businesses by reducing the number of MDs. So whilst employees further down the management structure might be getting paid better, that is by virtue of the fact that they never saw the large pay of days gone before and are benefitting from higher base salaries, but overall compensation on a like for like basis is lower.

Hawkeye,

thanks for the comment, very interesting…. I guess my investing banking contacts are below MD level 😉

mmi

On the DB CoCos: what is the exact covenant that they confirmed to hit? Would argue publicly confirming to hit a covenant is anything but a regular market update. Why is DB most under pressure apart from past fines and mgt turnover?

The covenant is simply that the local GAAP result has to be high enough to pay the cupon (after dividends).

” It is quite common that bonds price well “inside” CDS spreads theses days.” In Europe. It is the opposite in the US.

DB was talking about their MDA (https://www.eba.europa.eu/regulation-and-policy/single-rulebook/interactive-single-rulebook/-/interactive-single-rulebook/article-id/366). It can easily happen that the regulator would not allow them to pay their coupons. Regulators have an incentive for Cocos to be sucessful (European Banks have to issue a lot of those to satisfy requirements) so they would likely be accommodative. But I would not dismiss the possibility of a coupon skip. A fine due to litigation could easily reduce the MDA to 0.

A sovereign default with a breakup of the euro could be worse than a bank going bankrupt. Actually letting banks go under would be healthy. This has nothing to do with deposits, which can be separated.

For commerzbank I understand shipping is bad. Deutsche has unknown legal liabilities. What could be the problem for Pandbriefbank? Real estate stocks are just down some percent. I can just see sovereigns.

Some banks do have negligable commercial loans on their books but share price falls. This means a sovereign haircut/default is a scenario. An the credit side for companies big bank defaults are no problem long term.

Euro break up would be of course bad, but in my opinion very unlikely. Personally, I think people look at the wrong guys this time…..

For Pfandbriefbank I don’t see that many issues. Real estate prices are up and the bad stuff is with the Governement.

But we will see. I don’t think one need to hurry here.

Thanks for this timely and level-headed post on DB and European banks, and I enjoyed your witty comparison of Investment Banking to Soccer teams. In addition to an undesirable business model, European investment banks have also been caught up in a perverted interest rate environment and their idiosyncratic issues, which make them lousy investments. Yes, the banks are better capitalized vs. 2007 and the regulators are better equipped to deal with another potential crisis, nonetheless many people have been asking “is there a hidden bomb in DB?” If we could stretch the analysis a little further, I would love to hear your thought process on where else to look for these potential risks…energy, another round of EU debt crisis? Just throwing a few right off my head. Thanks!

hmm, I think at least with regard to Commodities/Energy, Deutsche Bank was never that strong. If you look into the old league tables, for instance here:

Click to access 4Q2014_Global_Investment_Banking_Review.pdf

you can see that Deutsche was not in the top tier. They also seemed to have done less loan underwriting and do not show up on Emerging Market league tables:

http://www.globalcapital.com/data/all-league-tables

But you never know with those guys, but my guess is that with regard to those items you mentioned, there are much more exposed banks out there.

From the viewpoint of equity holders, it’s not obvious that banks are better capitalised, in that what matters to them is the spread between the capital and the regulatory minimums, and the latter have gone up significantly (which is obviously good for everybody else). So if you have the equity, you may be diluted at a discount in an emergency rights issue…

(It’s a bit similar to the “are stocks expensive” issue: they look expensive in nominal earnings yield terms, but not when seen as a spread over risk free.)

You are correct and that is another reason why I wouldn’t invest in bank equity. You don’t even need a rights issue as the CoCos automatically convert into shares at some point in time. However my argument is that the systemic risk is less than it was 6-7 years ago.