Update Cars.com & Kanam Grundinvest

Kanam Grundinvest

Kanam Grundinvest was a special situation liquidation investment I made around 2 years ago. After 2 years, the position returned ~13,5% and is therefore on the upper range of my estimated return range from 4-8% p.a.. From the initial purchase price of around 16,17 EUR/unit I received back ~ 9,50 EUR in tax free distributions, resulting in a 2,5% remaining portfolio position.

However the current price of the units at ~8.85 EUR is very close to the intrinsic value of 9,24 EUR. So there is not that much juice left and Warburg will not liquidate super fast as they keep earning their fees as long this vehicle exists.

For that reason, I exited my remaining position at EUR 8,85/ unit.

Cars. Com

Cars.com was a spin-off special situation that I bought in November 2017. The idea was that after the spin-off, management could improve business quickly despite the relatively stiff competition in the US with 3 other major players in the car classified market.

At first things looked good and the stock price went up. The company even made an acquisition for around 165 mn USD. Then a reputable activist investor (Starboard) came onboard with a 10% stake and started pressing for change. They send a pretty detailed public letter to the CEO and for some time now there are repeated talks about the company trying to sell itself. But so far nothing happened.

However the underlying performance of the company was quite disappointing. The 2018 earnings presentation contains a lot of positive spin on nonsense KPIs like website traffic, however costs increased far quicker than revenue and income dropped significantly. The acquisition clearly did not add anything to profitability and organically most likely Cars.com would have shown declining revenues in 2018 already.

Q1 results 2019 were even worse. Besides the nonsense KPIs, the presentation clearly shows that sales are declining and cost is still increasing. Debt has increase to around 700 mn USD. Looking into the details, the main issue seems that they cannot convert the old wholesale model (sales of ads via media partners) into direct sales. The wholesale segment is breaking away but the direct business is not catching up fast enough which results in a loss for the quarter,

Without knowing any details there seems to be a lot going on behind the scenes. The annual sharholder meeting is not yet scheduled and the nomination of directors to the board has been postponed a second time. I guess Starboard is pressing for change and the newly independent managment wants to stay independent.

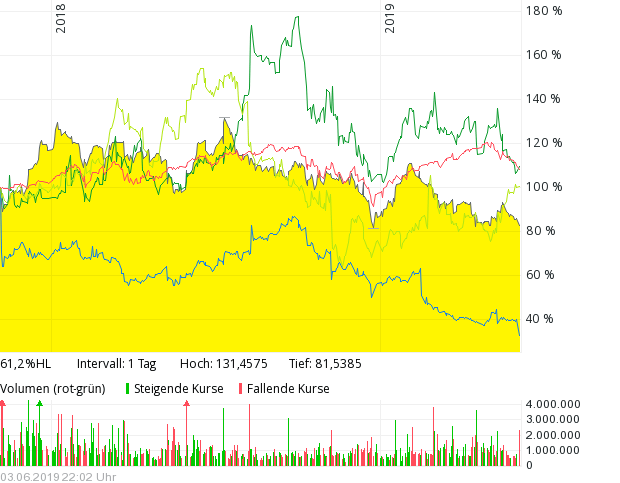

Stock Performance:

Sorry for the busy chart but this chart shows Cars.com (solid yellow) against Cargurus (dark green), Nasdaq (red), Truecar (blow, at the bottom) and Zillow the real estate portal (beige).

So clearly cars.com did not well, although still better than Turecars whose business model I highly doubted in the original post. But Carguru again performed much better so it is clear that Cars.com in relative terms has not been doing well.

Cars.com: Lesson learned and what to do now ?

One of the main lessons from Cars.com is that I am not a very good spin-off investor. I didn’t do the “ugly ducks” like Uniper and Osram which would have performed great. I always end up doing stuff like Mtro and Cars.com which somehow looks Ok but doesn’t work out. If a want to continue to invest in spin-offs I really have to refine my method.

In cars.com’s case I think there is still some chance for a shorter term catalyst. So I will not throw in the towel yet but keep the position for the time being and review by the end of Q3.

Cars.com: Uff! Maybe there is a lesson in here (of course with benefit of hindsight): Once the thesis shows a crack it is better to sell and move on?!

Yes, looks like it.

I really appreciate the work you have done, you explained everything in such an amazing and simple way. This is best practiced for using user generated content and having right article to see you here and thanks a lot for sharing with us.

Wish there were more updates

With there was more time

It’s a matter of implementing the concept of quadratic time.

Indeed seems like a thorough portfolio review…