All German Shares part 22 (Nr. 451-475)

Another batch of 25 randomly selected German stocks. This time I identified 5 candidates for my watch list amongst them.

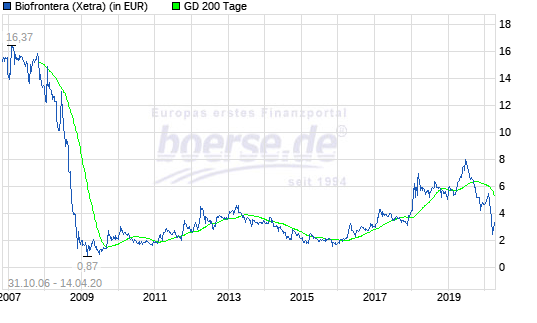

451. Biofrontera AG

BioFrontera is a 151 mn EUR market cap specialty pharma company in the field of dermatology (skin cancer). The company actually has a product in the market and shows decent grows, especially in Germany and the US. The company is still loss making in the first 9M 2019, but the loss narrowed significantly. The “Corona Crash” pushed the stock price back to before sales went up:

Unfortunately, Dt. Balaton is invested significantly here so a “pass”.

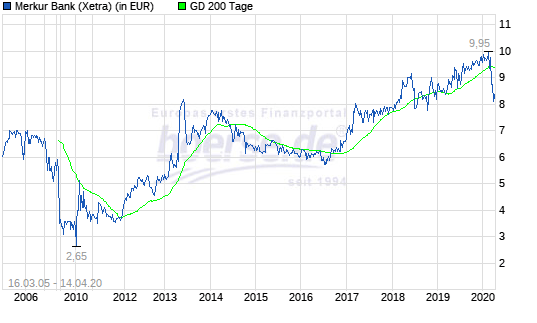

452. Merkur Bank KgaA

Merkur Bank is a small private bank with a 55 mn market cap located in Munich. Unlike all other German listed banks, Merkur has actually created some value since the GFC as can be seen in the stock chart:

Merkur Bank took over another private Bank called “Bank Schilling” in late 2019 which led to somr Badwill which will increase reported profits significantly. Operationally, the bank trades at around 10-11 times PE. However Merkur Bank seems to have been quite active in financing real estate developers. Nevertheless a stock worth to “watch”.

453. Fritz Nols AG

2.7 mn EUR insolvent holding company. “Pass”.

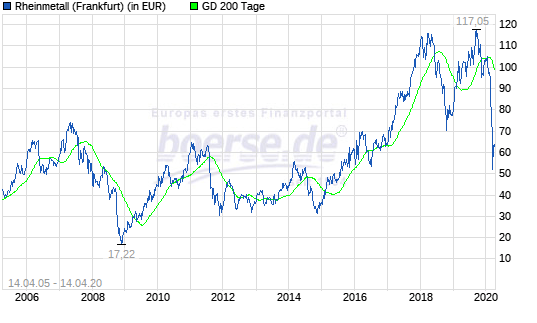

454. Rheinmetall AG

Rheinmetall is a 2.7 bn EUR market cap combined automobile supplier and defense group. Sales wise, in 2019 the two segments were almost half/half. As in other examples, the automobile supplier segment is struggling, but still profitable. On the other hand, the defense segment grew nicely and overcompensated the decline in automobile.

The stock price got hit really hard during the Covid-19 crisis and didn’t recover that much:

The stock looks relatively cheap with a P/E of 8, but clearly the current trend towards ESG investments which mostly excludes defense companies is a long term headwind. The Nevertheless one to “watch”.

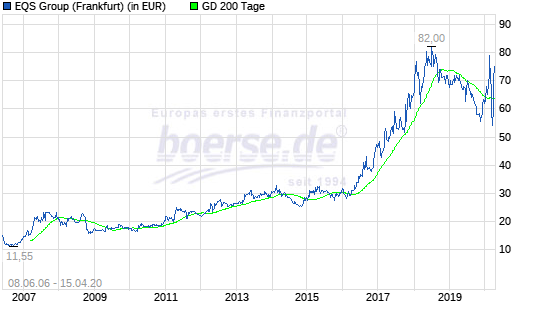

455. EQS Group AG

EQS Group AG is a 108 mn EUR market cap company active in the the area of investor relations and compliance as a service for listed companies.

Interestingly, the company is close to an ATH even after the Covid-19 crisis and despite turning a loss in 2019:

The explanation sees that EQS is migrating its offering into a cloud bases SaaS product which clearly is still a hit with many investors. EQS sold a subsidiary in 2019 which explains that top line did not grow in aggregate. This also seems to have led to a significant Goodwill writ edown that explains the overall loss in 2019.

A negative factor is for me that they seem to capitalize R&D to a comparably large extent. On the positive side, the CEO owns 20% of the company.

All in all the stock doesn’t look cheap but is definitely one to “watch”.

456. Müller Lila Logistik

Müller is a 65 mn EUR logistics company. I am not sure why they call themselves “purple”. Optically the stock looks cheap (2019 P/E of 9x), but that seems to be a result of a real estate transaction in 2019. The company has significant exposure to the automobile sector which doesn’t show so far in the stock price. Overall, I do not think that the company is so interesting, therefore I’ll “pass”.

457. Turbon AG

Turbon AG is a 7 mn EUR company that used to be a small cpa investor favorite a long time ago. The company produces third party cardridges for Laser printers. However the business seems to be in decline and loss making for some time now. “pass”.

458. OekoWorld AG

OekoWorld AG is a 105 mn EUR market cap Asset Manager and Insurance broker specializing on “sustainable” investments and products. The company clearly seems to be one of the pioneers of this kind of investing. Their flagship fund has been started in 1996. On the other hand, as every fund manager now hugging this trend i think it will be more difficult for them going forward.

The company is not very transparent with regard to reporting. They do not show consolidated numbers. It seems that they manage around 1.5 bn, of which 1 bn is in their flagship fund taht charges around 2% fees and seems to be successful.

Despite its limited disclosure policy, I’ll put them on “watch”.

459. SPOBAG AG

4 mn EUR market cap shell company with no active business. “pass”.

460. Daimler AG

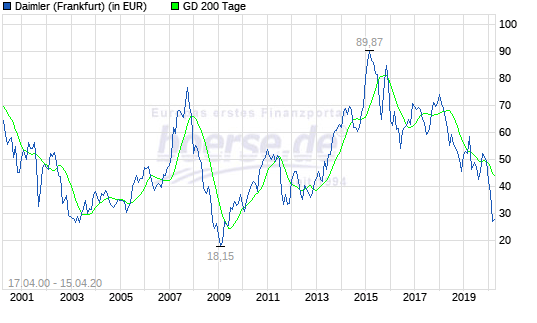

Daimler is clearly one of the most famous German brands, especially their iconic Mercedes luxury cars are sought after globally. However, similar to other car makers, Daimler has had a really hard time lately as we can see in the chart:

The market cap now is 30 bn EUR, only 1/3 of the value a few years ago. In 2019, despite a slightly increasing top line, profits fell by 2/3. This seems to have been the result of the Diesel scandals but as well problems in the van segment (X series). Daimler claims that one offs were almost 6 bn in EBIT. However, even before these one-offs, economics had deteriorated in 2019.

Other than Adidas, Daimler announced to increase their “normal” credit lines as a first reaction on the Corona crisis. Due to their financing arm, Daimler has significant debt. As of end of 2019, Daimler had 162 bn financial liabilities. Although they had close to 30 bn EUR in liquidity at year end, in 2020 they had 65 bn maturities which clearly could create a problem if markets freeze.

For me, Daimler is a similar story to GE: Great industrial company but made the mistake to go to deeply into financial services. Daimler is a “pass” for me.

461. Pyrolyx AG

Pyrolyx is a 14.5 mn EUR market cap company that seems to recycle old car tires into a substance that can be used to build new ones. For some reason they IPOed in Australia (!!), but are also listed in Germany. The company doesn’t really have an operating business yet but seems to be building a production plant in the US. Not my area of interest, “pass”.

462. Heidelberger Beteiligungsholding AG

Another listed holding company with 15 mn EUR market cap. The company invests in listed German stocks. Nothing to see here. “Pass”.

463. Maternus Kliniken AG

Maternus is a 33 mn EUR market cap company that operates 20+ nursing homes in Germany. The company is loss making and has negative equity. Not sure if the real estate value compensates for this. A short research shows, that unfortunately Maternus patients have been victims of Covid-19. All in all nothing for me. “Pass”.

464. Nucletron AG

Nucletron is a 17 mn market cap importer and distributor of electronical components. The company hasn’t grown much over the last 10-20 years which results in a pretty flat stock price. 2018 looked better, but in the first 6M 2019 business went back to “usual”. They seem to occupy a niche which however is not growing. This stock is too boring even for me. “Pass”.

465. The Grounds Real Estate Development AG

A 25 mn EUR market cap real estate company with 11 mn EUR equity/NAV. Controlled by Deutsche Balaton. “Pass”.

466. Advides AG

0.6 mn EUR nano cap that develops real estate. Last report from 2017. “pass”.

467. Sixt Leasing AG

Sixt Leasing is a 382 mn market cap car leasing company that was IPOed from Sixt in 2015. Sixt remained the dominant shareholder until February 2020 when they luckily sold to a consortium between Hyundai and Santander. Currently, they is a tender offer outstanding from the consortium at 18,90 EUR but the discount at the time of writing is quite small. “Pass”.

468. Adva Optical Networking

Adva used to be one of the superstars in the dot.com boom in the early 2000s. These days, the 270 mn EUR market cap company looks quite boring. The stock has been hammered and almost not recovered by the crisis, but I do not understand enough about the technology in order to determine if the stock is now interesting or not. “Pass”.

469. Eyemaxx Real Estate AG

Another 49 mn EUR real estate company with an English name. The company develops real estate. They use significant leverage and create profits by revaluing their projects. Not a great combination going into the crisis. “Pass”.

470. Accentro Real Estate AG (Former Estavis)

Accentro is a 279 mn EUR market cap residential real estate company. The company specializes in buying large residential buildings and selling single units to renters or investors. This busienss will clearly be impacted by the crisis, and has been impacted by rent control measures already. “pass”.

471 Hamburger Hafen und Logistik AG

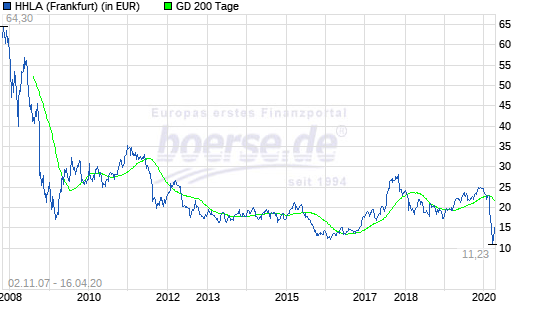

HHLA was IPOed in 2007 at 53 EUR per share and was a big hit at first. However these days, the shares trade around 14 EUR with a market cap of 960 mn EUR:

The city of Hamburg still owns 68% which reinforces my mental model to stay away from stocks with a significant government shareholding. However, based on historical numbers, the stock now really looks cheap, despite the expected effects from the crisis.

Therefore I will put them on the “watch” list together with Eurokai. My feeling says that I would prefer sea ports to air ports.

472. MAK Stoffe AG

0.1 mn EUR company in liquidation. “Pass”.

473. Linde Plc

The current Linde is the result of the merger between Linde AG and Praxair in 2018. With 88 bn market cap, the company has surpassed Air Liquide as largest Industrial gas player globally. The company has a dual listing in New York and Frankfurt.

At first sight, the 2 bn net profit for 2019 do not look very attractive based on the current valuation. Maybe they had a lot of integration cost, but for me at this stage, Linde is a “pass”.

474. Reederei Herbert Ekkenga AG

Strange stock with no observable trading. “pass”.

475. Nexway AG

Nexway is a 4 mn EUR market cap stock that does something with E-Commerce and payments. The business is low margin and the company is loss Making. “Pass”.

Hi, I don’t know Daimler closely but most of the big auto OEMs (BMW, Ford, GE, Toyota, etc.) own financial units in order to help consumers buy cars (either with direct loans and/or loans to dealers), as it’s a really big one off expense. Therefore, I think that the comparison between Daimler and GE isn’t the right one

It doesn’t matter which kind of assets you finance, you always have to roll over the debt somehow and hope that the music doesn’t stop.

dt. balaton…please elaborate (no clue here). thx!

Take care (it’s been a while)

Let’s put it that way: I’ll try to stay away from whatever they do. Maybe I’ll miss out a winner, but “safety first”.

blapshemy! Reederei Herbert Ekkenga is one of the most famous companies in Germany thanks to its prophet Wilm Dietrich Müller :o)

Oh, shux, I forgot !!!!!

Isn’t Hamburg Haffen a concession, or am I mistaken?