All German Shares Part 31 (Nr. 676-700)

And again 25 more randomly selected German shares with short analysis for each one. This time, seven (!!!) candidated were worth “wacthing”.

Maybe one remark: I asked last time for suggestions for the next series. however before I move on, I will also need to thin down the watch list to an amount that I can handle going forward. At the moment, the extended watch list comprises 141 (!!) stocks which I want to slim down to something like 25 or so.

676. mwb fairtrade Wertpapierhandelsbank AG

mwb is a 33 mn EUR market cap securities trading company. For some reasons, the stock price doubled in 2020, mabye a result of overall trading activity. As I do not undertand their business model, I’ll “pass”.

677. Bayerische Motorenwerke AG

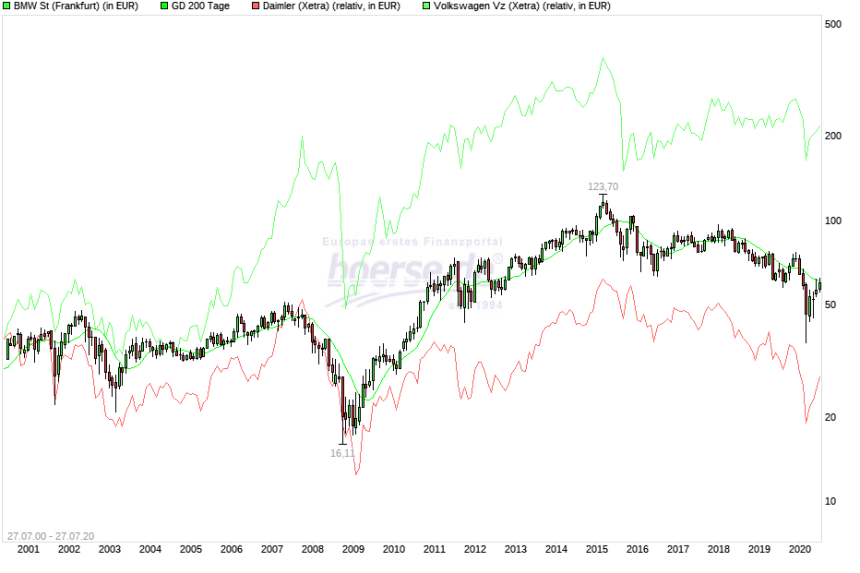

BMW is clearly one of the most famous German brands and one of the most successful car manufacturers in the world. With a market cap of ~39 bn USD, it is valued at a fraction of Tesla and the stock price is on a pretty long lasting downtrend:

We can see that the stock peaked already in 2015. BMW did better over the last years than Daimler, although surprisingly worse than Volkswagen.

As the other German car companies, BMW is relying a lot on China these days and the issues, especially the risks inherent in a shift to EVs are pretty clear. On the other hand, I do think thar BMW is the best managed German car company and it is no coincidence that BMW didn’t get fined in the Diesel scandal. However even 2019 was already challenging and 2020 will be tough for BMW as well.

If someone wants to invest into BMW, the pref shares, that trade a t more than 20% discount to the common shares would be the best instrument. as the majority of the votes lie with the Quant family and a take over is unrealistic.

BMW is the only one of the three German car companies that I put on my “watch” list.

678. Schweizer Electronic AG

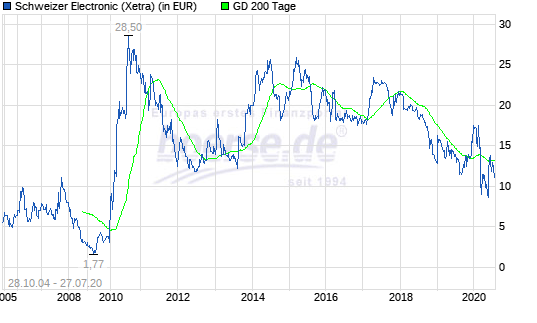

Schweizer is a 41 mn market cap company that has nothing to do with Switzerland but is a manufacturer of circuit boards. A look at the stock shows that for the last 10 years or so the stock is in a downward trend:

A quick look into the 2019 annual report shows already significant losses in 2019 and the first quarter 2020 looked even worse. Nothing to see, “pass”.

679. Solarworld Ag

One of many once high flying, now bankrupt solar stocks. “pass”.

680. Muelhan AG

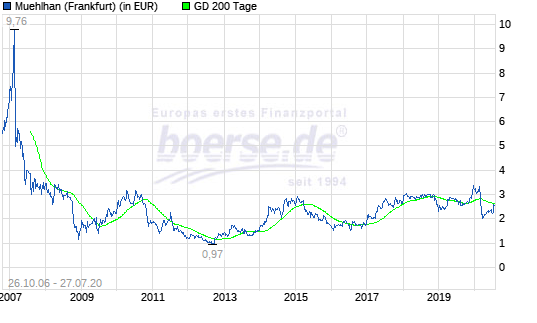

Muelhan AG is a 49 mn EUR market cap company that was IPOed into the pre GFC frenzy and then got hurt significantly:

To its credit, the company somehow survived. The company at its core is providing specialty paint for ships and other high sea going vessels.

They actually had a pretty decent 2019 which was driven by successfully accessing the offshore wind sector. The stock looks cheap, however margins are low and the business is capital intensive. I’ll put them on “watch” but with low priority.

681. Brenntag AG

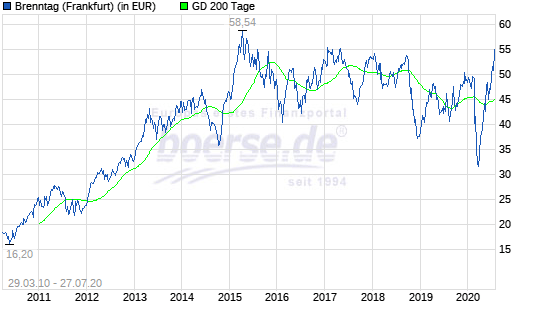

Brenntag is a 8.5 bn EUR MDAX company that has already found its way into the V&O Portfolio during the Covid-19 crisis.

At it’s core, Brenntag is a chemicals trading / distribution/ infrastructure company that makes sure that each product reaches its destination. As such, Brenntag benefits from its dominating position in its respective market.

The business is not hit that much by Covid-19, which shows in pretty good Q1 2020 numbers, although the rest of the year will clearly be weaker. What I don’t understand is why the share price now is higher than pre-Covind-19:

Unfortunately, I didn’t add to the position on its way up, still Brenntag is clearly a candidate to “watch” closely.

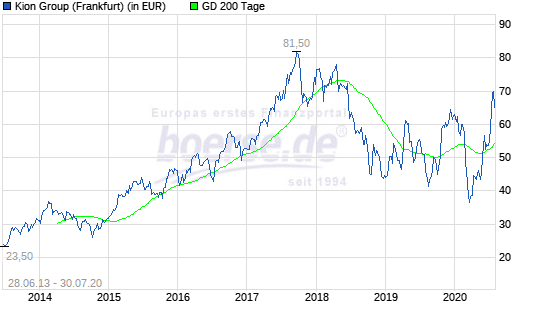

682. Kion Group AG

Kion Group used to be part of Linde and is one of the biggest forklift producers globally. The 8 bn EUR market cap company. The largest shareholder is the Chinese Company Weichai Group which has increased the stake over the years to now 45%. The stock has recovered well after the Covid-19 crisis but the stock is volatile:

As I try to avoid companies with significant Chinese influence, I’ll “pass”.

683. Cyto Tools AG

Cyto Tools AG is a 22 mn EUR market cap company is a loss making Biotech company in the wound care area with relatively frequent capital increases. As Biotech will not be my sweet spot in this investor life, I’ll “pass”.

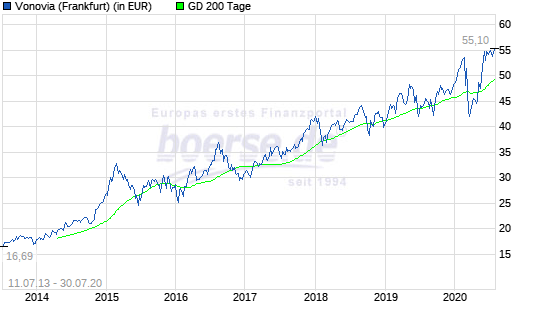

684. Vonovia AG

Vonovia is Germany’s biggest listed real estate company with a market cap of 29.8 bn EUR. In 2017, I was actually very briefly a Vonovia shareholder as result of the Gagfah special situation play, but I sold right after the merger. Looking at the chart, I have missed out quite on the rally:

Vonovia successfully consolidated a lot of players and even Covid-19 could only in the short term negatively impact the stock.

As I don’t really understand listed real estate stocks, I’ll pass, recognizing however that the residential focused Vonovia has created some value along the way.

685. Buergerliches Brauhaus Ravensburg-Lindau AG

The 24 mn EUR market cap company is not a brewery as the name indicates but as many ex breweries, they only manage real estate. As a specialty, the company also runs a couple of gambling machines. The stock is rarely traded and I would have no idea how to value the company, therefore I’ll “pass”.

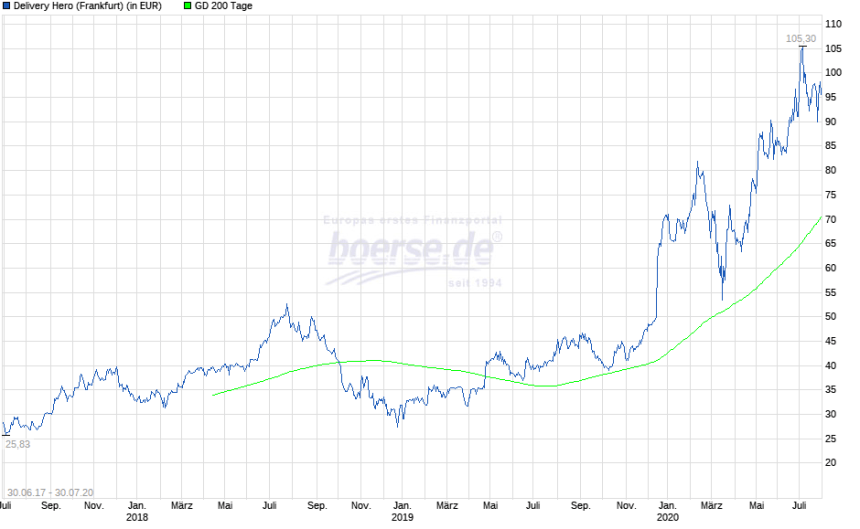

686. Delivery Hero

Delivery Hero, the 19 bn EUR market cap company looks like one of the clear winners of Covid-19.

Ordering food from the safety of the gome is really appealing. For myself I have to say that especially when I do home office, I tend to order more than I did pre Covid-19. In 2019, Dleivery hero sold its German business to competitor Takeaway.com/Just Eat and focused on international business. In December they made a big move in South Korea fro instance.

The stock price has reacted nicely and Delivery Hero can look forward being a member of the DAX maybe soon following the implosion of Wirecard:

What I don’t like about the presentations of DH is the fact that they do not distinguish between organic growth and M&A. A 100% yoy growth rate is nice, but if the majority would be M&A driven it would be less impressive.

As food delivery is clearly an interesting business, I’ll keep them on “watch”.

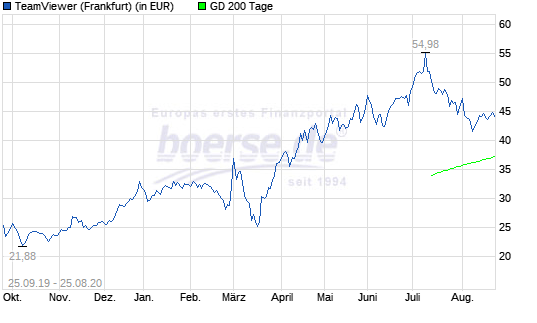

687. Teamviewer AG

Teamviewer AG is a 8.9 bn EUR market cap software company which specializes in solutions that allow secure remote access to computers. The company went public in September 2019 when former owner Permira decided to cash out.

The initial IPO price was 26,25 EUR, but the stock struggled early on. As we can see in the chart, investors now believe that Teamviewer is a Covid-19 winner:

With a lot of people working from home, Teamviewers prodcut clearly have some tailwind.

Based on their Q2 Earnings, the company has a a current run rate of 450 mn in sales and a healthy adjusted EBITDA margin of 58%. Permira left them 600 mn financial debt on the balance sheet, so with an EV of ~9,5 bn EUR, the market values Teamviewer at around 38x EV/EBITDA. These days this is not super duper expensive but clearly also not a “steal”.

Teamviewer is an interesting company but for me not a priority as I don’t understand their products well enough. Therefore I’ll “Pass”.

688. NABAG Anlage- und Beteiligungs Aktiengesellschaft

NABAG is a 0.8 mn EUR market cap company that somehow manages some securities. “Pass”.

689. Telecolumbus AG

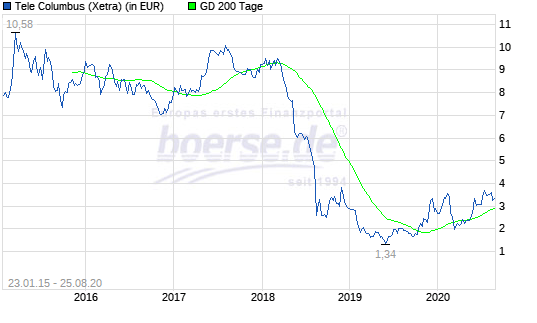

Telecolumbus is a 425 mn EUR market cab cable access provider that clearly has seen better days:

The company went public in 2015 at 10 EUR per share and never really managed to surpass this price.

The company is fighting wit a high debt load (1.4 bn) and shrinking sales from the traditional Cable TV business. On the shareholder side, The largest shareholder of Telecolumbus is Ralf Dommermuth’s United Internet, a big local telecommunication/ISP player who owns 29% which is slightly below the threshold that would trigger a mandatory offer.

In late 2019, Rocket Internet disclosed a 12% position. Both investors seem to push for changes. The company owns a fiber network in Germany which could be sold for a significant amount. Despite the issues, the stock is a “watch” candidate.

690. Holidaycheck AG

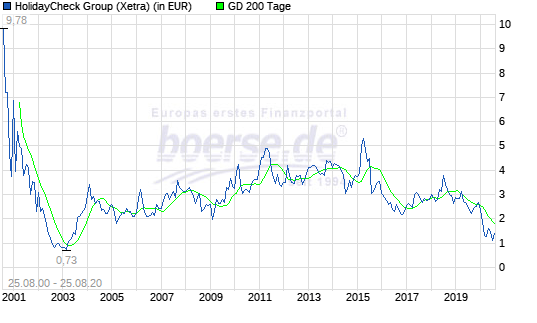

Holidaycheck as the leading online package holiday company in Germany is an obvious victim of Covid 19. However as we can see in the chart, the stock price was trending down even before:

The company is now valued at 74 mn EUR but had basically zero sales in the first 6 month of 2020 (including negative sales in form of reimbursements). In total, the company booked a los of around 67 mn EUR in the first 6 months.

As of June 30th, the company had around 28 mn EUR cash that cover 20 mn short term liabilities plus 20 mn bank debt. With a burn of around 15 mn for the first 6 months, the situation doesn’t look comfortable. After June 30th, they sold 2 subsidiaries for 14 mn. EUR, giving them around 40 mn ER to survive. The company is majority owned by publisher Burda (54%).

The key question wil be when package holiday rebound. If the rebound comes early next year they could survive, otherwise they are in deep trouble. As I have a weak spot for travel, I’ll put them on “watch” with a higher priority.

691. Falkenstein Nebenwerte AG

Falkenstein is a tiny 3 mn EUR market cap holding company that invests into securities. The company used to be owned by Sparta AG but was bought out by its former CEO Christoph Schäfers. The company does very little reporting. “Pass”.

692. mVise AG

mVise is a 22 mn EUR market cap IT service company and claims to be an expert in “digitizing” business models. In 2019, sales declined and EBITDA fell by -50%, so they somehow seem not be able to participate in the current digitization boom. They have a subsidiary which is somehow involved in cloud business. The first 6 month were slightly better than 2019 despite Corona, but overall this doesn’t look interesting at all. “pass”.

693. Cancom SE

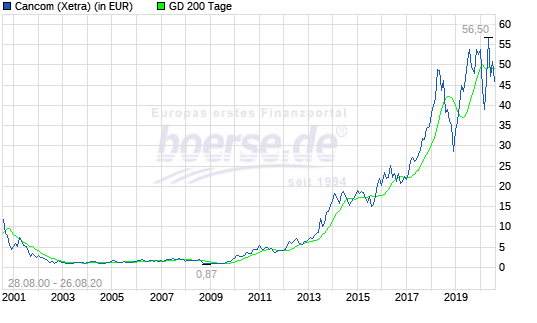

Cancom is a 1.8 bn market cap IT service company based in Munich. Looking at the stock chart we can see that anyone who bought the shares like 10 years ago will be a very happy shareholder, although the stock price has now stagnated for 2 years:

The company has a traditional IT service segment which represents maybe 75% of sales and has been struggloing in Q2 2020 and a fledgling “cloud solutions” segment which grows nicely even (or because) of Covid-19.

With around 15xEV/EBITDA the company is not cheap but also not excessivelky expensive. The company has net cash.. The “Old” business is low margin, cloud looks much better. I will keep them on “watch”.

694. Friwo AG

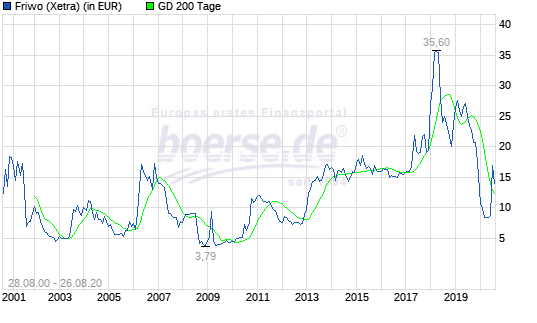

Friwo AG (former CEAG) is a company that manufactures charging equipment for all kind of applications including Electric vehicles. 2019 was a horrible year, with dropping sales and a large loss. 2020 looked better but still loss making. Overall, the company has not managed to create value over the last 20 years as we can see in the chart:

All in all nothing to see here, “pass”.

695. Versandhandelabwicklungsgesellschaft in Neumünster AG

This is an insolvent company that is being liquidated. “Pass”.

696. Hövelrat Holding AG

Hövelrat is a 14 mn ER market cap company that I have never heard of. They are an “independent investment advisor”. The company doesn’t really release useful information, so it is a “pass”.

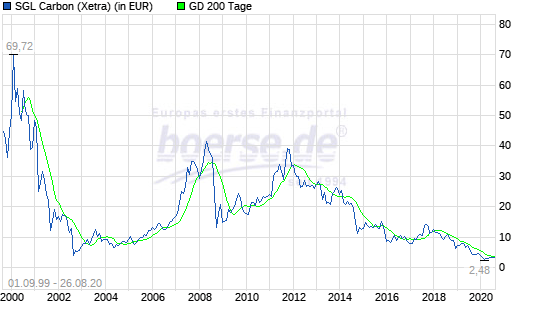

697. SGL Carbon AG

It’s hard to believe now, but in the mid 90ties, SGL, a 400 mn market cap company, was a hot technology stock. Looking at the chart we can see that since then things didn’t went well although there were some comebacks in between:

The company produces carbon based materials that are used mainly in the automotive industry. The company has been loss making in 2019 and Covid-19 didn’t help. The largest shareholder is Germany’s richest womena Susanne Klatten (BMW) but somehow this didn’t help. I don’t see anything here, so “pass”.

698. Einbecker Brauhaus AG

Einbecker is a 30 mn market cap company that is actually a brewery in northern Germany. Unlike many other listed breweries they still actively brew beer. The shown results show a very low profitability and stagnating sales and the value of the stock might be in its real estate, but this is hard to figure out for an outsider. Therefore I’ll “pass”.

699. MPH Health Care AG

MPH is a 113 mn EUR market cap company that invests in health care related companies, holding majority positions Among them is for instance M1 Kliniken, their most valuable asset, which is a chain of plastic surgery clinics and other health car companies. I had looked at M1 Kliniken earlier and put them on watch, however a quick analysis showed serious issues with accounting. So MPH is a clear “pass”.

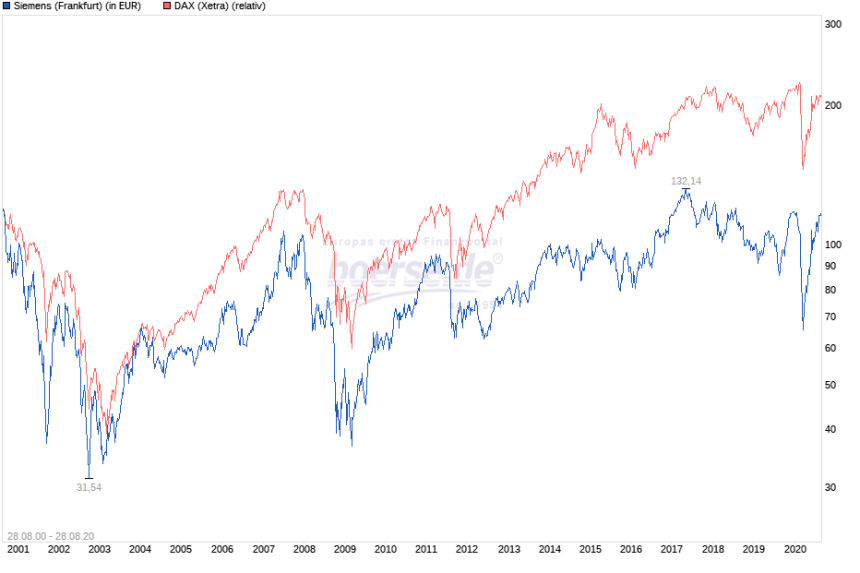

700. Siemens AG

With a market cap of 100 bn EUR, Siemens is one of the largest German companies. Despite a few spin-offs over the years (infineon etc.) the company is still a pretty diverse conglomerate, offereing medical devices (Siemens Healthineers), Windmills (Siemens Gamesa), Powerplants etc.

The stock price has recovered nicely from Covid19, but long term, the stock hasn’t really performed well:

Even the German DAX, which is not a super star performer, outperformed Siemens significantly. The company is really hard to understand and doesn’t look dirt cheap, so “pass”.

You haven’t enabled the comments in your next post above ‘Performance Review’ …

thx. Fixed.

Serious issues with accounting at M1 Kliniken? Do you have more details?

Just read their annual report. Then you’ll find out. I don’t want to waste time on this.

Would be interesting to get your perspectives on MAN GY given recent events..

Top be fair the dax ist a Performance Index and Siemens paid dividends and spun-off e.g. Energy.

Maybe S&T AG ist worth another look. Would be interesting to get your take. There was a Short Report, but the Case ist quite different than Grenke and Wirecard, you wrote about. I think the Report ist bogus, but the price ist still not low enough for me, but upside bro undisturbed price.

…then please tell us why you think the report is bogus. You must have read it and you can discredit every single point, right?

That’s true, although mostly they didn’t really spin-off but IPOed.

S&T: I heard about the short report but cannot locate it. Without that, it doesn’t make sense to start.

Just including dividends for Siemens (without reinvestment gains from dividends) lowers the cost basis per 1/1/2000 from €134.80 to €74.32 source: https://de.finance.yahoo.com/quote/SIE.DE/history?period1=946684800&period2=1609459200&interval=1mo&filter=history&frequency=1mo&includeAdjustedClose=true

Then including Siemens Energy at a price of ~€21 would drop the costs basis of Siemens another €10.50 to €63.82. The price is now ~€109. I am just saying Siemens was not as bad as the chart above implies, not that it was a good investment. Keep up the good work. Taking time to comment on such a minor point, just shows how much I value your blog. As a German I am more prone to criticising than praising.

On the ir site of S&T Source: https://ir.snt.at/Aktie.de.html You can find the following analyst report (

05.10.2020 Hauck & Aufhäuser) which basically is a rebuttal on major points which includes the relevant pages of the 2019 AR. [disclaimer: no affiliation, the above report is from (biased) sell side; no position in S&T AG, I was long Kontron and got squeezed-out of S&T Deutschland AG]

Congratulations to 2021 Nobel Prize winners in Physics, Markus Braun & Jan Marsalek & BaFin, for their groundbreaking work in experimental creation of Black Holes !!

Would be interested for your thoughts on MAN GY given recent developments