All Swiss Shares part 10 – Nr. 91-100

Another 10 randomly selected Swiss stocks, this time with 3 candidates to potentially “watch”. As this is part of my pre-scheduled “Gone swimming” break, please do not expect quick reactions on any comment from my side.

91. Bellevue Group

Bellevue is a 570 mn CHF market cap asset manager that in contrast to many other listed asset managers seems to be doing quite good over the past few years, with the stock doubling since the beginning of 2020 after trading sideways for years:

That development seems to have been driven by the sale of their banking business in 2020 and the transition to a “pure” Asset Manager. With a trailing PE of 25x, they are relatively highly valued, considering that they are not an alternatives specialist. They managed to grow in 2020, but for me this looks like a “pass”.

92. Emmi AG

Emmi AG is a 5,3 bn CHF market cap dairy group that has a very nice stock chart which shows that the shares have gobe up 4x in the last 5 years:

In the same time, profit has increased by >=50% (190 mn vs. 120 mn in 2015), so the majority of the share price increase resulted from a dramatic increase in valuation multiples. Personally I think it is a decent business but paying a 28x PE multiple for an “OK” business does not make that much sense fro me. “pass”.

93. Partners Group

Partners Group is a 40 bn CHF market cap global alternative asset manager with around 110 bn USD under management. As many Swiss stocks, the shares are trading significantly higher than pre-pandemic:

Although I do think that Alternativ Asset managers are the most interesting players in AM, I am not sure if I want to pay 25x revenues or 50X earnings for a business which will be very negatively impacted by negative capital markets. Therefore I’ll “pass” on this company that is no doubt a merket leader in an interesting sector, but as many other Swiss companies just looks too expensive (or I am to cautious on the future outlook….).

94. Dufry AG

Dufry is a 4,5 bn CHF market cap company that mostly operates Duty Free shops in airports. I actually owned Dufry as part of my Corona-Travel basket for a few months. Looking at the chart we can se that the company had already problems before Covid-19:

Dufry’s P&L is hard to understand due to significant Goodwill depreciation. However already in 2018, business stagnated. There is also a large minority interest that makes EBITDA numbers useless. In 2019, a net profit before minorities translated into a loss after minorities.

As long-haul travel will require some time to go back to “Normal” and the company has significant net debt (3,3 bn CHF net), Dufry for me is a “pass”.

95. SFS Group

SFS Group is a 5,1 bn CHF market cap company that I have never heard of. the company went public in 2014 and seems to produce a variety of metal fasteners and other small parts for a variety of use cases and industries

The stock chart shows that as for many other Swiss stocks, Covid-19 seems to have been a “catalyst” to reach new highs in the share price:

SFS 2020 numbers were solid, top line decreased by only -4% and EPS reached 4,90 after 5,47 CHF in 2019.

The business as such looks decent, with EBIT margins of 13-14% and ROCEs of 20% or higher in the past. By the way, their Financial report overview sheet is “best in class”.

However, as all other Swiss stocks, a PE of 25 based on 2019 and 28 based on 2020 is again not cheap, especially as growth and EBIT have been stalling already in 2019 which might explain the weak stock price before COvd-19.

Nevertheless, this could be one to “watch”.

96. Nestle AG

Nestle, the 321 bn CHF global food company doesn’t need much of an explanation. For a long time, Nestle could be found in almost any “quality Value” portfolio. Looking at the stock chart, Nestle is clearly not a spectacular growth stock but a “slow and steady” compounder:

With a PE of around 25x 2021 earnings, the stock doesn’t look super expensive, on the other side there also might be limited opportunities to grow. If I would need to invest into Mega Cap stocks, Nestle would clearly be a candidate, but as I don’t need to, I’ll “pass”.

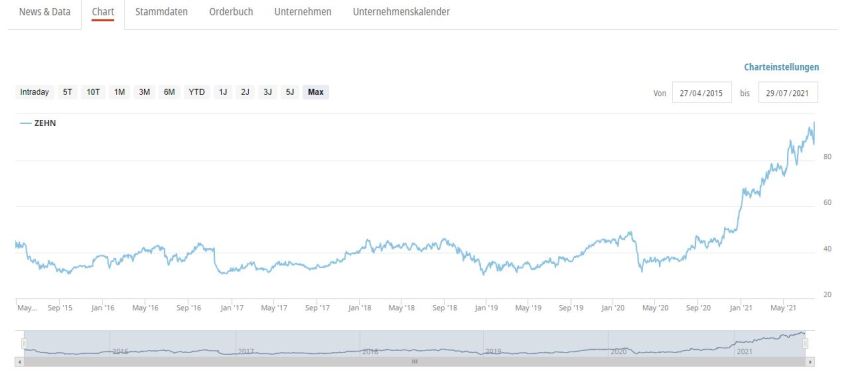

97. Zehnder AG

Zehnder is a 850 mn CHF market cap company that specializes in ventilation and radiation. As such, it might explain the fact that the Stock ist now >+100% against pre-Covid levels:

Interestingly, top line went down in 2020 (-4%) but profit went up by +25%, I guess they were able to sell their ventilation solutions at a premium following Covid. The first 6M 2021 looked even better, with sales up +23% and profit up +160%. EBIT margins reached double digti, profit margin 9%.

The big question is of course how sustainable that development is. Extrapolating 6M profits, Zehnder would trade at a P/E of around 13-14 (even cheaper when deducting net cash).which would be cheap if this level of activity would be sustainable.

That is a good reason to put Zehnder on “watch”.

98. Kardex AG

Kardex is a 1.9 bn market cap manufacturer of automated warehouse solutions for industrial companies. In 2020, they saw a decline in slaes but EBIT margins are still decent at 13% and ROCE was still >40%. However, as for any Swiss quality stock, valuation is an issue. As we can see in the chart, again investors seem to see Covid-19 as a catalyst to push the stock to new highs:

With a trailing PE of 45×2020 profits and flat top line in the first 6M 2021, it doesn’t look like an interesting stock.

What I like about the company is that they have a great “investor Handbook”. This is something I haven’t seen elsewhere and makes it much easier to understand the company than a more complicated annual report. Another interesting aspect is that Kabouter seems to be an investor and if these guys show up, there is often something structural going on. At first sight, Kardex could be an interesting target for someone like ABB or Siemens.

Although the stock is really expensive, I’ll keep them on “watch”.

99. Addex Therapeutics

Addex is a 73 mm CHF market cap company that is developing “Small molecules” pharmaceuticals. Revenue is around 3 mn, net loss has been -13 mn in 2020 and -15 mn in 2019.

They had ~20 mn in cash by the end o 2020 and raised another 10 mn in early 2021.

They seem to have a pipeline of 5 or 6 potential drugs but at very early stages, As I have no idea how to value this, I’ll “pass”.

100. Phoenix Mecano

Phoenix Mecano is a 445 mn CHF market cap company that clearly has seen better day. 2020 profit has been 9,30 EUR per share, down 37,6 EUR in 2018. The Company is a B2B supplier of industrial and electronicla components.

The stock has been doing almost nothing for the last 20 years:

Debt has been increasing year after year with little improvement in cash flows. “Pass”

Pingback: SFS Group AG (ISIN CH0239229302) – Tremendous boring however horny “Hidden Champion” from Switzerland - MyBuywire

Pingback: SFS Group AG (ISIN CH0239229302) – Tremendous boring however horny “Hidden Champion” from Switzerland – Digital Shivam Sharma Blogger

could you explain more upon Kabouter ????

Kabouter is a fund that turned up a couple of times on my radar over the past years. They seem to have a very fine nose for situations where something structurally is happening.

That’s a great series. Lastminute.com looks interesting and cheap, unlikely travel is entirely dead the next couple years.