All Swiss Shares Part 11 – Nr. 101-110

Again 10 randomly selected Swiss stocks with 2 watch candidates. As I am still on holidays, please do not expect quick reactions from me on any comments.

101. Bank Cantonale Vaudoise

BC Vaudoise is with around 7 bn CHF market cap one of the bigger regional banks. As the other regional banks, business is stagnating since a couple of years, however with an ROE of 9-10% they achive one of the highest ROE’s in the industry.

However I am not interested in the shares of such a bank, therefore I’ll “pass”.

102. Stadler Rail AG

Stadler Rail is a 4 bn market cap company that manufactures “rolling stock” railcars and went public in 2019. Currently the stock price is pretty much where the stock started:

Looking at their annual report, on can see that 2020 was not a good year. Cashflow got very negative. On the plus side, the order book is huge an covers more than 4 years of sales.

Peter Spuhler, the main shareholder and previous CEO for 20 years kicked out his successor in 2020 and assumed the CEO role again. However, profit margins already declined in the IPO year 2019 and Gross margins are very low at around 10-11%. The company seems to finance itself mostly through prepayments.

The current valuation is still rich at ~30x PE. “pass”.

103. LEM Holding

LEM is a 2,6 bn CHF market cap company that I encountered for the first time during this exercise. Looking at the stock chart, I should have looked at them earlier (if I had known them):

The stock went up 10 x over the last 10 years and 40x over 20 years. That what one could call “compounding”. The company seems to be active in producing sensors to measure electricity. In theri corporate video they claim to be an essential part of EV charging, battery management and renewable energy.

At a first look, this seems to be a very profitable business: EBIT margin is around 20%, Sales for the 2020/2021 financial year were slightly below 2019/2020 and profit as well, so it is not clear why the stock price more than doubled to its new heights. Especially as 2019/2020 was again below the previous year. At 50x PE, again, this is a very expensive stock. However Q1 was super strong (+25%) and mabye some people expected this. Another interesting aspect is that they do almost 40% of their business in China.

Nevertheless I put this on watch, as I would want to understand what kind of role LEM play in the “electrification scenario” that I am building. “Watch”.

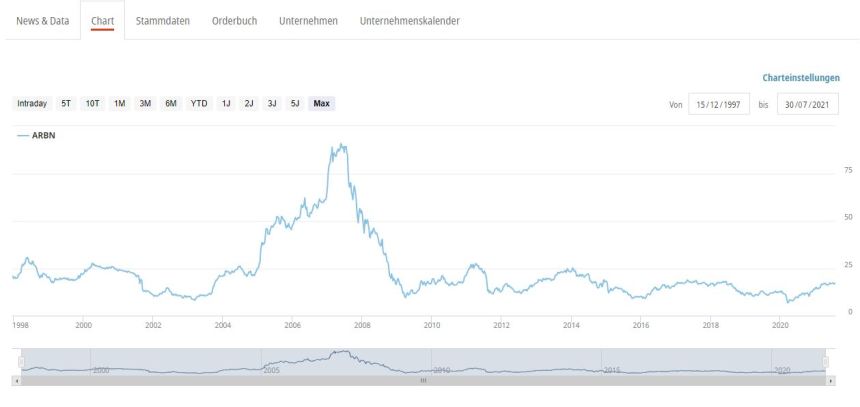

104. Arbonia Holding

Arbonia is a 1,2 bn CHF market cap supplier for the building and construction industry. Their mein products are windows and doors, but also heating and ventilation.

A quick look at the chart shows that for some reason they had a big peak in the stock price pre GFC but since then very little happened:

The business looks Ok, with EBITDA margins slightly above 10% and a decent increase in net profit despite flat sales in 2020. However, at around 40x normalized profits and very low returns on capital, I’ll “Pass”.

105. BB Biotech

BB Biotech is a 4,8 bn CHF investment company that invests as the name suggests into Biotech companies. The company is doing this for a very long time and has a decent long term track record:

In pre-blogging times I was invested into BB Medtech, the sister company but it was taken private. Interestingly BB Biotech trades at a significant premium to NAV (+16%).

Their largest position in the fund is Moderna, but hey also own for instance CRISPR technologies, a next level gene editing company. I think it might make sense to follow the company in order to see what they are investing into. Therefore a “watch” candidate.

106. Kuros Biosciences AG

Kuros is an 85 mn CHF market cap company whose stock price has been flatlining for many years. They seem to develop technology for bone graft among others. The company has a few millions of revenues but burns aroun 11 mn CHF per year and therefore issues shares on a regular basis. “pass”.

107. Forbo Holding AG

Forno is a 3,2 bn CHF market cap that produces floor coverings and a range of other construction related products. Looking at the share price, it si interesting to see that the stock reached new all time highs despite sales going down -10% and profit dropping by -25% in 2020:

Sales in the first 6 months recovered as well as profits which almost doubled. Forbo has net cash and the business looks surprisingly attractive (Double digit EBIT margins, good ROICs). For a Swiss company, a PE of ~25 (for 2021) seems to be really cheap and Forbo claims to have 70% global market share in linoleum flooring.

However even in 2019, top line and profit stagnated, so it looks weird that Covid-19 has pushed the stock to new heights. Overall I do not really find anything that really interests me her, so I’ll “pass”.

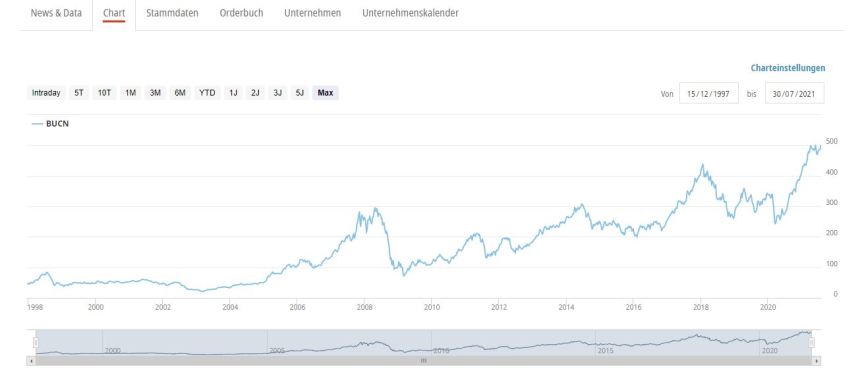

108. Bucher Industries AG

Bucher is a 5,2 bn CHF market cap machinery company that operates in a variety of sectors. This description is from their 2020 annual report:

The Group’s divisions are focused on specialised agricultural machinery, municipal vehicles, hydraulic components, manufacturing equipment for the glass container industry, equipment for the production of wine, fruit juice, beer and instant products, a Swiss distributorship for tractors and specialised agricultural machinery, as well as control

systems for automation technology.

As many similar Swiss companies, 2020 saw a -10% decrease in top line and a -33% decrease in profits, but nevertheless the share reached new highs:

It seems that investors have correctly anticipated the huge bounce back in business in the first 6M, with sales up almost +20% and 6M profit reaching almost the full amount of 2020.

Again, 2019 has been already a stagnant year, so to me it is not clear how sustainable this 6M growth spurt will be.

Bucher has ample net cash and the business delivers solid EBIT Margins and return on capital. Nevertheless, based on a P/E of 23 for 2019, the stock is not cheap unless somehow Covid-19 has triggered real growth. At this stage however, Bucher is too difficult for me to understand, therefore I’ll “pass”.

109. Implenia AG

Implenia is a 440 mn CHF market cap. Implnia showed a big loss in 2020 (~7 CHF per share) and also made losses in 2018. In good years, they achieved 2-3 CHF EPS.

I understand very little about the construction industry with the exception that it is super cyclical. As I do not like super cyclical stocks, I’ll “Pass”.

110. Novavest Real Estate AG

Novavest is a 357 mn CHF market cap real estate company that focuses mainly on residential property in Switzerland. The stock trades ~20% over year end NAV. “Pass”.

There’s something really weird about all these Swiss stocks indiscriminately going to the moon post-covid. It looks as if there is a (class of) investor(s) buying the whole market, that is large enough (maybe amplified by momentum types) to move the market.

Maybe an algo ?

what did you think of the NKT results

Haven’t looked at it yet ..what’s your take ?