All Swiss shares part 19 – Nr. 201-213

Finally I made it, below you find short summaries of the last 13 randomly selected Swiss stocks quoted on the SIX, three of them are potentially worth watching.

Just one remark: There are many smaller Swiss stocks quoted outside SIX, but as I am not able to trade them via my brokerage accounts, I will omit them in this series.

Overall, I have identified 45 stocks out of these 213 as potentially worth watching. The final post of this series will condense this to maybe 15-20 stocks that I think I can handle going forward.

201. CS Group

CS Group has a market cap od 23.6 bn CHF and clearly has seen better days. They managed to be part of all the big blow ups in the last few years, from Greensill to Bill Hwang or Wirecard, not to mention ugly infights of the previous management.

So it is not a surprise that the chart looks ugly and the market cap is less than 50% of arch rival UBS:

The shares trade at around 50% of book value, but profits are slim. The only interesting angle at CS is that the former CEO and Chairman of Lloyd’s Group António Horta-Osório has joined as Chairman of CS not long ago. I consider him as one of the best managers in banking (not a high benchmark though), but what he can achieve at CS is not clear.

If I would need to invest in a big bank, CS would be one of my best bets, but as I don’t have to, I’ll happily “pass”.

202. Comet Holding

Comet is a 2,65 bn market cap Tech company that I have never heard which, looking at the chart is unfortunate, as the stock went up by 20x over the last 10 years:

The company seems to be active mostly in X-ray and “plasma control” and the machines they produced are used in the chip industry. The company has decent margins (15% EBIT) and is growing fast, at around 35% for 6M 2021, however the company did shrink between 2017 and 2019 pre Covid. However the current chip boom seems to have driven Comet’s business and share price a lot.

If they would keep growing at 30%+, the current pE of around 50x 2021 earnings could be justified, but I have no way of verifying this. “Pass”.

203. Clariant AG

Clariant is a 6,1 bn CHF market cap chemical company that has been a potential take over target for as long as I can remember. Currently, around 32% seem to be owned by the Saudi SWF. Looking at the share price, not a lot happened over the last 20 years despite some volatility:

Historically, Clariant is the product of the former chemical divisions of Sandoz AG and Hoechst AG. Over the years they have acquired a lot of businesses but in many cases, these acquisitions did not work out. In 2017, there seems to have been some activist pressure to prevent a merger with US based Huntsman, however stand-alone Clariant clearly did not shine.

The recent investor presentation at first made me quite exited, with a lot of “green” activities and ambitious margin expansion targets. However a few things put me off a little bit: 2/3 of the margin expansion is based on increase in volumes and ROIC is very low at around 8%.

Based on 6M 2021, the stock is not cheap, with around 30x 2021 earnings or ~18xEV/EBIT is quite expensive for a company which such a low return on capital. Therefore I’ll “pass” without going deeper.

204. OBSEVA SA

OBSEVA is 165 mn CHF market cap Biopharmaceutical company that specializes on Women’s fertility. Their pipeline seems to be mostly in different clinical trial stages, but looking at the share price, there doesn’t seem to be a blockbuster in sights. The company burns quite some money. “Pass”.

205. Adecco AG

Adecco is a global, 7,65 bn CHF market cap temp working agency. The share price looks uninspiring to say the best:

Covid-19 was not good for business, resulting in a loss in 2020. Based on 2019 earnings, the stock would look quite cheap. Overall, the business is low margin (20% gross, net margins 2-4%), but also low capital requirements.

Looking at 2020 however also shows that the general cost bases is relatively fixed. Interestingly, operating CFs seem to be more stable as the net result had been impacted by impairment and realized gains on divestitures. The company distributes significant dividends and is buying back shares. I think this could be worth to dig deeper. “Watch”.

206. Achiko AG

Achiko, a 21 mn CHF market cap small cap according to its homepage seems to be at the forefront of fighting Covid-19, but somehow the company has no sales and only big losses. It looks like that in Switzerland even purely promotional companies are valued higher than in germany. “Pass”.

207. Molecular Partners AG

Molecular Partners is a 407 mn CHF market cap Biotech/Biopharma company that claims to have some proprietary technology. The share price has been very volatile lately because Molecular Partners seems to have developed a treatment against Covid-19 that however doesn’t work that well.

As most Biotechs, revenues are small (8 mn 9M 2021) and losses are big (-45 mn 9M2021). Overall too speculative and not my cup of tea. “Pass”.

208. Geberit AG

Geberit is a 26,1 bn CHF market cap company that is a supplier to the construction industry. this sounds boring but a quick glance at the long term stock chart shows that their business seems instead very exciting:

Geberit is indeed a high quality Swiss “money machine”, clocking in 20-30% ROIC s and EBIT margins back at 30%. The company is active mostly in Europe, 1/3 of the sales are in Germany. I think it would be very interesting at some point in time to dig deeper as why Geberit is such a good company and why these construction suppliers in Switzerland (Sika, Belimo) are so much more profitable than their European counterparts. From a valuation perspective, Geberit’s qualities are well known and the stock trades above 30x 2021 earnings, which, based on somehow relatively slow top line growth over the last few years looks expensive.

Nevertheless, Geberit is clearly a candidate to “watch”.

209. Orell Füssli

Orell Füssli is a 178 mn CHF market cap company that according to Google has been established in the year 1519. Since then, printing seems to have been part of its business. These days, the company also is active in book retailing as well in banknote printing and security documents.

The company sits on a lot of net cash (70-80 m) and looks very cheap for a Swiss company. However top line and profits have declining for some time now which might explain the very uninspiring share price:

The biggest shareholder of the company is the SNB with around 33%, which might relate to the banknote printing.

Overall this is clearly an interesting story and maybe a nice target for “stock collectors”, but for my purposes it is a “pass”.

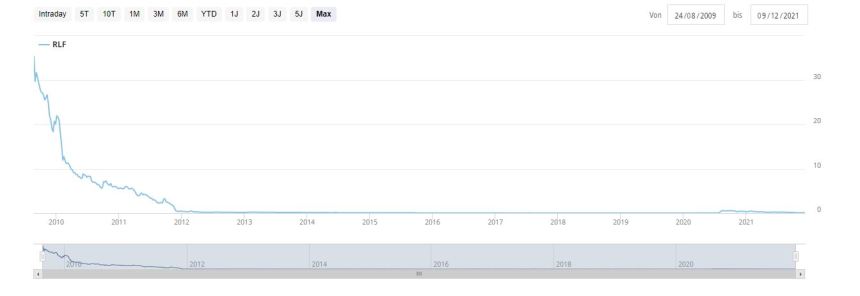

210. Relief Therapeutics

Relief Therapeutics is a 287 mn market cap CHF Biotech stock which has a very strange stock price. I’ll show both the long term and the short term chart here:

Long term it clearly looks like the worst Swiss IPO I have seen. The stock price tanked right after the IPO:

Short term there was an interesting move in August last year before the stock lost most of that increase since then:

The company has no sales and also has only little cash left. The jump from August was based on the hope that one of their pipeline products could help hospitalized Covid patients, which obviously didn’t seem to work out.

Overall nothing that is of interest to me, “pass”.

211. Schlatter Industries

Schlatter is a small, 29 mn CHF market cap company that clearly has seen better days according to the long term chart:

The company seemed to have struggled already in 2019 and Covid hurt them significantly. According to their website, they are a machinery manufacturer who manufactures industrial welding machines etc. for welding rails.

Although the stock looks cheap and they don’t have debt, I’ll “Pass”.

212. Vontobel AG

Vontobel is a 4,5 bn CHF market cap Wealth/Asset Manager that is active globally. The stock has recovered decently since the GFC but still hasn’t passed previous heights:

Especially 6M 2021 looked quite good for them and the stock is not very expensive (13-14x 2021 earnings). Total AuM are 244 bn, therefore “discretionary” managed 162 bn.

The ROE of Vontobel is actually quite low for an Asset manager which might be the result of running a bank within the Group. Overall the business is clearly benefiting from still booming capital markets, but I think Vontobel might be actually worth to “watch”.

213. Santhera Pharmaceutical

Santhera is yet another 73 mn CHF market cap Biotech company with little sales and large losses and limited cash on hand. The share price looks similar to other speculative Biotechs with some ups but mostly downs:

Nothing to see here, “pass”.

Just my two cents on Geberit from a customers perspective. It is the only brand I know of in its class that provides spare parts for its products even some thirty years after. This is something I would not expect anywhere outside aerospace industry. There may be lots of competitor products that look better in a bathroom than Geberit’s, but are just too short lived. If you have gone through the hassle and built a bathroom yourself once, you want it to last.

thanks for this insight. However these days I do think that bathrooms rarely last for more than 15-20 years before they get torn down and remodelled,at least here in germany.

Geberit was mentioned in Edward Chancellor’s book “Capital Returns”. Plumbers are the ones who are installing but home owners end up paying. Thus plumbers have incentives to push for higher price products to receive a big cut. Geberit also spends efforts on training the plumbers to be familiar with their product offering.

Howden Joinery (UK) and Reece (Australia) also have a similar business model.

No, plumbers have incentive to install stuff that can be installed quickly and works flawless.

From my own experience, I also know that plumbers have an interest in installing stuff that only can be repaired by plumbers.

As anyone else…

I had to wait till the very end to see my employer featured :). Good surprise. 🙂

C.

Relief Therapeutics ? 😉

Nope. We are more noble…

Adecco / remp work agency:

Do they pass through salary, which inflates top line and depresses net margin?

I recently read somewhere (UKVI?) that some of these businesses do book it that way, others probabaly don’t or do not have this business.

Yes; I think they book it “gross”. However in my opinion that is the only way.

Reading ‘many contractors’ … I believed there might be some deviating from booking it this way.

First find of ‘margin’ in https://www.ukdividendstocks.com/blog/selling-sthree

I see Geberit a bit like Harvia (Finland). Best-in-class by a wide margin, quiet but goes constantly up. Just a keep forever stock.

Great work on this series. I’m curious what you’ll choose next.

Haven’t heard of Harvia yet, thanks for mentioning.

Good moment to buy it now because it’s been going sideways for 4-5 months after a +700% run. Pretty much flawless management, solid balance sheet, dominates the sauna market in the Nordics and is constantly expanding.

Now it’s an excellent time to analyze Harvia… War in Ukraine dampens high-end sauna market in Central Europe and Harvia’s numbers were hit. But the firm is still in a leading position in industry with plenty of white space and service&maintenance is 15% of revenue, gives you a bit of stickiness.