Special Situation: 3U Holding – Sale of WeClapp Subsidiary with Net cash proceeds > market cap

Disclaimer: This is not investment advice. Never trust any anonymous dudes on the internet. DO YOUR OWN RESEARCH !!!

Background:

Readers of my blog know that I like Special situations where a company, that has been flying under the radar, (unexpectedly) sells an asset that is worth potentially more than the market cap of the whole company. In these cases, it often takes some time until the market fully realizes what has happened.

Sapec was a good example, Exmar is a recent case that is still ongoing.

3U Holding – Weclapp

The current case is a small cap from Germany called 3U Holding. 3U was IPOed in the bubble days of the Dot.com boom in 1999. Other than many of its peers, its core communication business was quite solid. They sold their Communication business in 2007 and since then acted like mixture of Holding company and Family Office for the founders who own ~34% and effectively control the company.

Among others, they invested into renewable projects, real estate development, an E-commerce business and other activities. Shareholders didn’t really think much of these activities and the share price went sideways for 15 years or so:

Among these other activities is/was a SaaS company called WeClapp that offers ERP software for SMEs. There were always rumors that this is a very good Saas company and that they might IPO the company which explains the run-up of the share price last year. However, as it looked more and more likely that the IPO would not happen, the stock dropped back to a level of ~2,50 EUR. As of Friday, Sep. 2nd, 3U was valued at ~88 mn EUR (35,3 mn shares at 2,50)

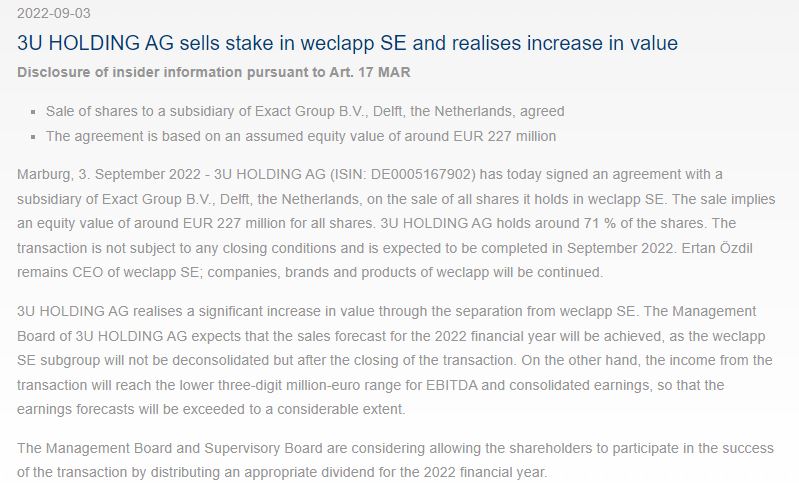

The bombshell: Sale of WeClapp to a PE buyer

On the weekend, 3U then dropped this bombshell:

So a 227 mn EUR sales price with an ownership of 71% translates into gross Cash proceeds of 161 mn EUR or roughly 4,56 EUR per share, or 1,83x Friday’s share price. They buyer, Exact Group is owned by PE behemoth KKR, so financing should not be an issue. To be conservative, I estimate 10 mn total costs for the transaction, leaving net proceeds (and profit and cash) of 4,28 EUR per share for WeClapp (no taxes on these kind of profits in Germany).

Just for the record: 3U managed to sell WeClapp at ~14,4 6M 2022 sales, which is remarkable. I don’t think they would achieved this via an IPO.

The “stub”:

Now the interesting question is of course: What other assets are there and how much could they be worth ? This is my best guess after looking at the annual and 6M report:

| EUR mn | per share | Comment | |

| Net cash | 10,0 | 0,28 | 6M report |

| Gold | 3,0 | 0,08 | annual report, other fin assets |

| Renewables | 62,0 | 1,76 | valued at 10xEBITDA (peers) |

| Debt for Renew. | -15,0 | -0,42 | debt net of Innohub and Weclapp |

| Net sales price Innohub | 8,3 | 0,24 | (Assets for sale – liabilities for sale) x0,75, no profit assumed |

| Selfio | 10,0 | 0,28 | 0,5x sales |

| IT&Comm | 15,0 | 0,42 | 5x EBITDA (2021: ~ 3 mn EBITDA ) |

| Holding | -10,0 | -0,28 | wild guess |

| Total | 83,3 | 2,36 |

One quick remark with regard to Innohub: This was a real estate development they had on their balance sheet that has been already sold. I used the book values, although management mentioned that they made a “satisfactory profit” that will be booked in Q3. I also assume that the value of the E-Commerce business (Selfio, run rate 30 mn EUR sales, slightly EBITDA negative) is 0,5x sales and the remaining communication business (10 mn EUR run rate sales, 3 mn EBITDA) is worth 15 mn.

So all in all we end up with an NAV of ~6,6 EUR per share, thereof EUR 4,80 will be in “net” cash.

Compared to the price at the time of writing (3,70 EUR), this would mean a potential upside of ~75% to fair value.

Of course, the share price doesn’t have to go to fair value and will most likely never do so, as a discount to fair value in such cases is quite common. Assuming a 30% discount, the price target would be “only” 4,60 EUR per share.

Potential dividend

The last sentence of the press release was quite interesting:

The Management Board and Supervisory Board are considering allowing the shareholders to participate in the success of the transaction by distributing an appropriate dividend for the 2022 financial year.

I have no clue what they consider an “appropriate” dividend, but similar to Exmar, a large dividend would have a positive effect on the price target assuming a constant 30% discount for the remaining part. Here is a table showing the impact of different dividend amounts on the price target:

| Dividend | 1 | 1,5 | 2 | 2,5 | 3 | 3,5 | 4 | |

| “Stub” | 5,6 | 5,1 | 4,6 | 4,1 | 3,6 | 3,1 | 2,6 | |

| “Stub” at 30% discount | 4,0 | 3,6 | 3,3 | 2,9 | 2,6 | 2,2 | 1,9 | |

| Total value | 5,0 | 5,1 | 5,3 | 5,4 | 5,6 | 5,7 | 5,9 | |

| Upside vs. current price | 3,7 | 33,8% | 37,8% | 41,9% | 45,9% | 50,0% | 54,1% | 58,1% |

The table reads as follows: In the case of a 1 EUR cash dividend, the expected value for an investor would be the 1 EUR dividend (pre tax) and a “stub” at 4 EUR, generating an expected return of ~32%.

In the case of a 4 EUR dividend, the stub would be estimated at 2,6 EUR and the total return would be +58%. My expected return would be somewhere in the middle. Not bad in my opinion for a holding period of maybe 9 months.

Catalysts:

The stock already has jumped by +50% but in my opinion is still undervalued. Further catalysts in my opinion could be:

- Closing of the WeClapp sale

- Release of the Q3 report including Innohub results and revealing the large cash balance

- Announcement of a detailed dividend number in 2023

Risks:

- There is clearly a residual risk that the WeClapp deal doesn’t close, however I consider it as small as the buyer seems to be very willing

- The major risk is clearly what 3U is doing with the money. This is the same risk as in the Exmar case. However over the years, 3U has allocated capital quite well and they promised a “suitable” dividend

- The final risk is of course the valuation of the stub. the lower the dividend, the higher this risk

Summary:

I think this one is quite comparable to the Exmar case from a risk/return perspective, with the main difference being that there is more relative net cash compared to market cap and that they already announced a dividend in principle. The main negative is the fact that the stock is a lot less liquid than Exmar. At the moment, with Exmar already up +17% since purchase, I find 3U slightly more attractive in relaative terms.

Therefore I allocated ~4% of the portfolio into this special situation at a share price of ~3,72 EUR per share into this special situation investment. Target return would be ~+40% over the next 9-12 months.

Disclaimer: This is not investment advice. Never trust any anonymous dudes on the internet. DO YOUR OWN RESEARCH !!!

Management is proposing a dividend of €3.2/share, which is much more than what I was anticipating. All three remaining businesses realised solid, organic revenue growth in FY22. At the current share price of €4.9, the NAV of the remaining businesses is €1.7/share. Based on your previous valuation, this is still a 40% discount to the true value (€4.8 net cash per share – €3.2 dividend per share + €2.36 per share for the remaining businesses). Again, a great analysis and tremendous result!

Sold 1/2 of the position at ~4,20 EUR/share.

I was lucky to receive by email only your “buy” and not your “sell”. Now with 3.20 Euros dividends do you think it makes sense to cash out after receiving the dividends, or is the long term perspective of the stock too uncertain ?

You are lucky then. You need to check yourself how receiving the dividend looks on your tax returns. I am out and stay out.

It is pretty offensive that management decided to use shareholder capital to buy gold and leave it on the balance sheet : /

I guess these things don’t get cheap for no reason.

It is unfortunate that the renewables business is so small, given the recent favorable pricing it has likely participated in.

Centrotec (Handel in Hamburg nach delisting) könnte nach dem Verkauf der wichtigsten Sparte für ca. 1Milliarde in cash und Aktien auch in diese Spezial-Kategorie fallen.[long centrotec]

Im Prinzip ja, wobei fraglich ist ob es da eine Dividende geben wird.

you are absolutely right. There probably will not be a significant dividend.

Centrotec will become a family holding company with the usual discount to NAV. Time will tell if this will be a value creating or destroying holding. Investing in development real estate does not look good in my opinion. On the other hand you get the chance of a buy-out with lower than current discount to value. I will simply hold this for years without such an immediate catalyst. Good luck. I like your approach.

Not sure about this dividend as the key shareholder seems to have kept this structure to avoid paying taxes on dividends, why shroud this change now? They sold the holding 95% tax exempt but would have to pay 25% on any dividend. And then the founder would have to invest the funds received (and taxed) while he could just keep investing through the holding.. much better for him to keep the funds in the company which appears to be his personal investment fund. At 25% tax a divided would indeed to some extent be value destructive if they can invest the funds smartly through the holding.

In Germany, anyone who owns more than 10% of a company is effectively exempted from paying tax on dividends if he structures his holdings accordingly (via a GmbH).

The Inohub deal is closed: https://www.3u.net/investor-relations/ir-news-und-presse/news-details/verkauf-der-anteile-an-der-innohubs-gmbh-an-mitgesellschafterin-vollzogen.html

Thanks for sharing the idea! I do have a comment. I believe you are not taking into account potential dilution. They have had an option plan since 2018 with a vesting period of 4 years and an exercise price of €1.24. These are ITM and the vesting period ends in December of this year. Considering all outstanding options (~2.2mln), proceeds per share decrease by ~30 cents. I also have a question, are you sure there are no taxes on these kinds of sales in Germany?

Hi,

Good point with the share options. I am not 100% that indeed all of them vest at year-end. NAV per share indeed drops by 40 cents (assuming~2,2 mn additional shares). With regard to the taxes on the sale: Yes, I am very close to 100% sure although I am not a tax expert. But in general, gains on the sale of a Majority stake within a AG or GMBH are tax free.

To the upside, there could be a gain on the sale of Innohub that I have not considered yet, that might give a small upside on the NAV (5-10 vents per share)

Thanks again, “crowd sourcing” these write-ups really improves the quality.

Thanks for your reply! I am also not entirely sure if they all vest at the end of the year, but I assume it to be conservative.

About the taxes, I actually contacted their IR department about it two hours ago and the guy over there told me that, because they are a management holding company, they get exemptions on transactions above 200mln (so this includes Weclapp). When this is the case only 5% of the transaction value gets taxed. They expect net proceeds (so post tax/fees etc.) to be a bit above 150 mln. He also hinted that ~50% of it will be used for dividends, so that would be ~75 mln. Maybe you can use that for your stub expectation;)

Have a nice weekend!

Interesting, I have never heard about this 200 mn threshold. 75 mn would be exactly 2 EUR dividend per share on a fully diluted basis.

There is no 200mln-Rule in german taxation.

The 5 % are correct.

Hey Guys, how do you calculate the drop by 30 or 40 cents – can you please explain the math to me

Hi Theo, the option plan basically just leads to an increase in the amount of outstanding shares. As an example: a company that is worth €100 mln and has 100 mln shares outstanding is worth €1 per share (100/100). If the amount of shares increases to lets say 110 mln, the value per share drops to ~€0.91 (100/110). So although the value of the whole company remains equal the value per share declines.

„The Management Board and Supervisory Board are considering allowing the shareholders to participate in the success of the transaction by distributing an appropriate dividend for the 2022 financial year.“

Such silly statement only allows 2 conclusions: 1. mgmt thinks shareholders are stupid or 2. mgmt has no clue about capital allocation. Both not good. Not the first time German companies come up with such a blunder.

What exactly is your criticism here ?

There is an unknown guy sitting in Omaha who never paid a dividend. Hence his investors never participated in his investments, right? Poor shareholders of him.

Still not sure what you mean. 3U is not a Berkshire. This is a special situation where a Dividend could act as a catalyst.

What’s the issue exactly in your view?

How is that dividend taxed in Germany? WHT?

26.375% I think.

I don’t know if it’s better for German taxpayers to realize a capital gain or the 26.375% WHT?

In the latter case, you’ll be able to sell your shares before ex-div date easily.

Most likely as any dividend in Germany.

Normally, Dividends and stock gains are equally taxed in Germany – as Jockey said around 26,375%.

The only difference will occur, if you have realised stock losses from other trades – than stock gains can be “tax free” (meaning netted with your stock losses), while dividends are still taxed at 26,375%. Here, a trade around dividend day could make sense. But I guess, this case relates to a small group investors and will not influence stock movements like in other countries, e.g. Belgium.

I like Jockey’s idea of trading around the dividend record date. Do you think the div. value will be captured in full by the bid size of the market price at that date?

This is a bad idea. Sino paid a large didend this year. Some smart investors had probably the idea of “trading around ex day”. The ex day, sino appreciated I think 25% in value… I bought the stock (3U) today in my son’s portfolio. He does not have to pay taxes on capital gains (if gains <6000€). So I can sit and wait and he gets some nice dividend.

I don’t understand your point. How is it a bad idea?

Thanks for another great post!

Did you set yourself a threshold for selling earlier if a specific price level is reached without much news / just confirming the investment case?

No, no “early sale” target.