Performance:

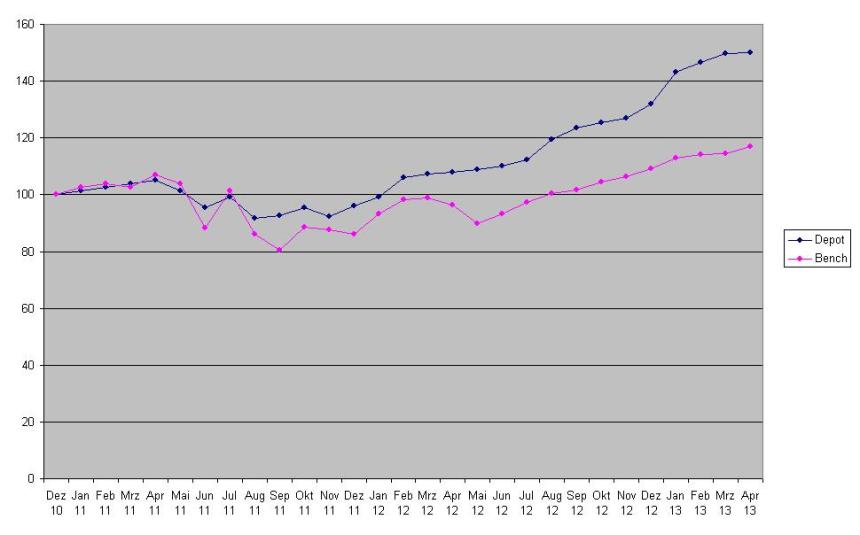

May has been s surprisingly good month for the portfolio. Despite ~15-20% cash, the portfolio gained +4.9% against +4.5% for the benchmark (50% Eurostoxx, 30% Dax, 20% MDax). YTD this results in +19.6% against +12.0% for the Benchmark. Since inception (Jan 1st 2011), the score is now +57.7% against 22.1%. As I have said many times, this is still highly unusual if the portfolio outperforms in such a strong month, especially now with the high cash percentage.

Main drivers were: EMAK (+27%), Dart Group (+22%), April (+16%) and Tonnellerie (+13%)

Portfolio activity

May has been an unusual active month. As discussed, the following transactions took place:

– sale of IVG convertible with a total loss of -16,3%

– sale of Buzzi with a total gain of +34% (incl. dividends)

– Sale of KPN shares & rights with a gain of 11.1%

– Purchase of IGE & XAO

– Purchase of EGIS

Edit: – Short Position Focus Media has actually been bough, exit with a loss -11.9%

Portfolio as of May 31st 2013:

EDIT: Buy out of Focus Media updated

| Name |

Weight |

Perf. Incl. Div |

| Hornbach Baumarkt |

3.7% |

3.4% |

| AS Creation Tapeten |

4.3% |

49.3% |

| Tonnellerie Frere Paris |

5.7% |

83.3% |

| Vetropack |

4.1% |

9.7% |

| Installux |

2.7% |

10.1% |

| Poujoulat |

0.8% |

6.4% |

| Dart Group |

4.7% |

171.2% |

| Cranswick |

5.4% |

33.8% |

| April SA |

3.6% |

19.4% |

| SOL Spa |

2.7% |

35.8% |

| Gronlandsbanken |

2.1% |

23.2% |

| G. Perrier |

3.0% |

11.3% |

| IGE & XAO |

2.0% |

4.1% |

| EGIS |

2.5% |

0.4% |

| |

|

|

| KAS Bank NV |

4.6% |

27.6% |

| SIAS |

5.5% |

59.5% |

| Bouygues |

2.4% |

7.0% |

| Drägerwerk Genüsse D |

9.2% |

186.2% |

| DEPFA LT2 2015 |

2.7% |

64.1% |

| HT1 Funding |

4.6% |

58.2% |

| EMAK SPA |

5.2% |

64.9% |

| Rhoen Klinikum |

2.2% |

10.8% |

| |

|

|

| |

|

|

| |

|

|

| Short: Prada |

-1.0% |

-20.4% |

| Short Kabel Deutschland |

-1.0% |

-5.7% |

| Short Lyxor Cac40 |

-1.2% |

-15.5% |

| Short Ishares FTSE MIB |

-2.0% |

-14.0% |

| |

|

|

| Terminverkauf CHF EUR |

0.2% |

7.9% |

| |

|

|

| Cash |

21.0% |

|

| |

|

|

| |

|

|

| |

|

|

| Value |

47.5% |

|

| Opportunity |

36.4% |

|

| Short+ Hedges |

-4.9% |

|

| Cash |

21.0% |

|

| |

100.0% |

|

Comment “Position sizing”

One topic which constantly bugs me is how to size positions.

There are two extremes:

On the one side, Modern Portfolio Theory (MPT) says that the only kind of “free lunch” available is diversification. Adding additional positions means more or less the same returns but with lower risk.

On the other side are very succesful investors, including of course our heroes, Warren and Charlie, argue that one should concentrate on the big ideas only as those are the ones which drive the returns. Similar results come out of the “Kelly criterion” which says that you should bet overp proportionally more if the odds ar in your favour.

Personally, as a “part time” investor, I have the following problems:

1) I can oversee only a limited amount of companies&investments, my max is around 25-30 based on experience. So further diversification on a single investment level does not make sense

2) As I am in general very sceptical and commit only a limited time per day on research, I never really came to a stage where I was 100% sure about any investment. Even if I am 95% sure I have the nagging feeling that I missed something

3) I usually find my “edges” only in small cap stocks or smaller special situations. Small companies have much more unique risk factors than large caps. It is a real difference in risk if you invest lets say 40% into a small French software company than investing 40% of your portfolio into an international company like American Express

Point 2) is really the major issue why I hesitate to commit more than 10% of my portfolio into a single stock. I am just not confident enough in any company or investment to do so.

Looking back, my historical best investments, like for instance German bank hybrid in 2009 was made under a lot of uncertainty and I didn’t really know for sure if it plays out the way it did. The same goes for Draeger. Yes it was a multi bagger, but at least for me I was never really sure about it.

On the other hand, some small ideas where I didn’t really have a lot of conviction, performed outstanding, like Dart Group which was rather a kind of “mechanical” buy. Also sometimes a basket approach to risky or very illiquid small caps (France) makes sense.

In general, I think that there is no single optimal strategy for postion sizes. As every part of the investment process, this has to fit with the overall character of the investor, including risk tolerance, investment style and time available. With regard to the “kelly formula”, I have the fundamental problem that I neither determine the payouts nor the probabilities, so this is not a big help eithet.

For the time being, I do not have a better system for my personal situation than my current one which looks like this:

–> Full positions at 5% (increase via peformance until 10%)

–> half positions at 2.5% if I buy into a stock

–> plus a basket approach for my illiquid French small caps.

–> occasionally small position for “half baked” ideas

IMPORTANT: Weed out weak conviction positions if overall numbers of investments get close to 30 single stock investments (long & short, ex index hedges)

So far it has worked quite well, but there is always room for improvement.