Gaztransport & Technigaz (GTT.FP) – Wide Moat at a bargain price ?

Imagine you could invest into a company with the following characteristics:

– Global market leader with 70-90% market share (95% new built)

– Net margins after tax of 50% or more

– business protected by patents

– almost no capital requirement, negative working capital

– a potentially huge growth opportunity

– conservative balance sheet (no debt) and “OK” management

– at a very reasonable price (11x P/E, 7,8% dividend yield)

At a first glance, Gaztransport et Technigaz (GTT) from France seems to be the ideal cheap “moat company”. What do they do ?

Gaztransport is the global leader for “LNG containment systems”. LNG is liquified natural gas and is the predominant method to transport natural gas over long distances. In order to become liquid, natural gas has to be really cold,at least -162 degrees celsius. GTT’s technolgy is required to safely store and transport LNG on ships.

Problem Number 1

Before going into more details, it is pretty clear that GTT is an energy related company. But looking at this chart from their investor presentation we can clearly see what the real problem for GTT is:

Ultracyclical sales. We can see that within 4 years sales dropped -75% only to quadruple again in the next 4 years. Although the overall strength of the business model clearly shows in the fact that even after a -75% drop in sales, they still earned a 30% net margin.

So what do they actually do (The Moat) ?

Gaztransport has been IPOed in 2014 in France (although it was technically more a “carve out” as the company itself did not need any money. They have extremely good English language investor material, for instance the Q3 2015 report.

I try to summarize their businessin my own words:

– if you want to build ship to transport LNG, there are effectively only 2 technologies available to ensure that the LNG is contained safely, one of them is owned and patented by GTT. From inside it looks like this:

– there is a relatively large moat with regard to technology. GTT has developed that technology over the last 50 years or so and it is superior to the only competitor (“Moss”), both in price (for the total ship) as well as in utility (ships are lighter, easier to maneuver, overall cost is cheaper)

– GTT charges royalties, both, for the technology and “consulting” during the building of the ship. After the ship is finished, there are no royalties. Service is currently only a single digit percentage of sales

– Sales therefore directly depend on the number of LNG tankers being build

So the future of GTT clearly depends on the future of LNG. More LNG means more ships and more money for GTT and vice versa.

The Moat vs. new competitors

There are potential new competitors, mostly the handful of Korean companies who actually build the ships. The Koreans for some time now try to develop or copy their own version of the technology. I assume that they clearly know how much money GTT makes with the patent and that they woul love to cut GTT out of the process.

GTT themselves think that the threat is not so big in the near future. The ship certification companies would need to approve first as well as the oil companies who are finally responsible for the LNG tankers and the administrators of any harbour or docking station.

So far in the 50 year history both, Moss and GTT have a 100% safety record with no accidents. The cost for GTT technology within the overall price of a LNG tanker is around 4-5% of the total constructon price. So the question is really why should any energy company take on the risk for a new unproved technology when the potential cost savings are pretty low ? LNG Tankers do carry the equivalent “firepower” of dozens of nuclear bombs, so risk aversion is pretty high especially in developed world harbours.

The LNG market

There is a lot of material on LNG but most of them are very optimistic, some links:

BG LNG Global market outlook

McKinsey LNG study

Again in my own words my thoughts on LNG:

– LNG is considered “clean fuel” compared to oil and coal and should benefit from climate issues

– Natural gas is abundant and in many cases cannot be transported via pipelines

– A lot of the natural gas comes from “stable” countries like Australia and the US and is therefore strategically interesting

But clearly, low energy prices take a toll on LNG as the liquification, transport and regsification are expensive. A year ago I looked at Seth Klarman’s investment Cheniere Energy and I was not convinced. However a lot of money has been now invested into liquification facilities especially in the US and Autralia, so it is not unlikely that the amount of LNG to be transported might rise as projected and the need for transport and storage increases.

So just some rosy LNG projections alone would not be enough to make GTT interesting for me.

The “carrot on the stick”: Bunker fuel

Big Ocean going ships burn a fuel called “bunker” which is extremely filthy:

As ships get bigger, the pollution is getting worse. The most staggering statistic of all is that just 16 of the world’s largest ships can produce as much lung-clogging sulphur pollution as all the world’s cars.

Because of their colossal engines, each as heavy as a small ship, these super-vessels use as much fuel as small power stations.

But, unlike power stations or cars, they can burn the cheapest, filthiest, high-sulphur fuel: the thick residues left behind in refineries after the lighter liquids have been taken. The stuff nobody on land is allowed to use.

In the meantime however, stricter requirements for ship fuel have been installed. Current caps are mostly effective in Europe and North America, but starting 2020, globally much tighter rules will come into effect.

There are several possible solutions to the problem:

– using cleaner fuel which is however more expensive and limited

– cleaning the exhaust with expensive technology

– use LNG as alternativ fuel

If LNG would become popular in the future, GTT’s technology would suddenly be required everywhwere, from every port and every big ship, which would mean much more steady business than in the past and a strong structural growth over many years.

However, at current prices this is far from a sure thing, so in any case as an investor I would not want to pay for this at the moment.

Click to access 213-35922_LR_bunkering_study_Final_for_web_tcm155-243482.pdf

Stock Price

For an energy stock, GTT has held up quite well since their IPO until late 2015 but then got hammered, howevr as we can see less than TGS for instance:

How to value GTT ?

The problem is the following: GTT is a cyclical company and we are most likely at or near the top of the cycle with regard to the “core” business. One could argue that with an overall size increase of the LNG tanker fleet, the replacement requirement increases but with an expected life of around 40 years, the replacement cycle for the current fleet is a long way off in the future.

So using current profits and saying” Wow the stock is cheap” clearly doesn’t help. Comparing it for instance with a less cyclical stock like G. Perrier and saying: 11x PE is better than G. Perriers 15x PE is nonsense.

As I said before, I would not be willing to pay for the “Option” of LNG powered shipping so I need to come up with a way to value the company based on the cyclicality of earnings.

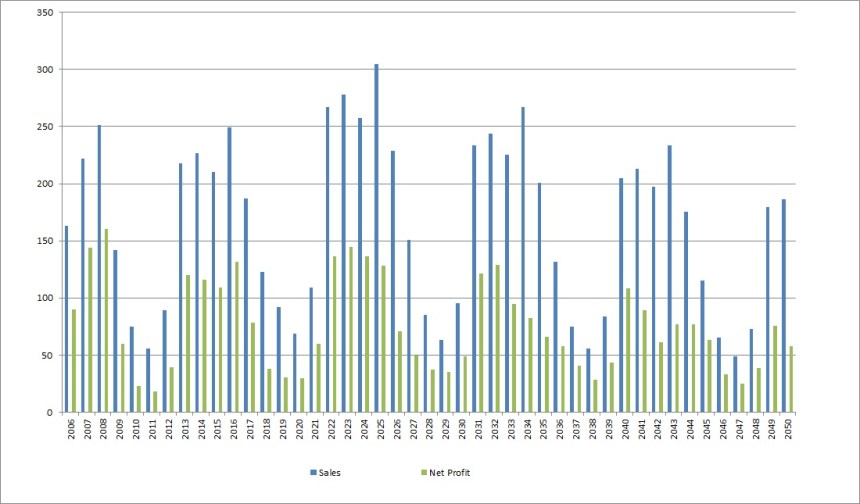

So what I did is that I tried to “simulate” future earnings with roughly the same kind of cyclicality that we have seen in the past 10 years. This is the resulting “Model” for the next 35 years:

I have “modelled” somehow similar cycles as the current one, with the peaks increassing first and then trailing of somewhat in the future.

We can then discount this cyclical earnings stream by our “required rate of return” to see if GTT is a real bargain or not.

Under those assumptions my results were the following:

10% discount rate: 20,80 EUR per share

15% discount rate: 14,26 EUR per share

So now one could clearly challenge my “model” and tweak it somehow, but in general it looks like that GTT is not a bargain at current prices (34 EUR). To me it rather looks like that the current valuation already implies a certain value for the LNG ship fuel “option”. Therefore GTT at current prices is not interesting to me as an investment.

One important learning experience for me is that I guess one should value all cyclical stocks like this, i.e. really model the cycles and discount those cashflows instead of just looking at current multiples and say “wow that’s cheap”. I think I made that mistake to a certain extent with TGS Nopec.

Summary:

Overall, GTT is a very interesting, unique company. It combines a “wide moat” with regard to technology and patents with a very cyclical business.

Although the company looks cheap at current multiples, over the cycle there is more downside than upside at current prices in my opinion.

If LNG will become the dominant fuel for ships in general, than the investment case might change significantly to the upside but for me this is not given at current energy prices.

In the future, I will need to analyse and value cyclical companies the same way as I did here: With actually modelling cycles instead of (implicit) constant growth assumptions.

http://shipandbunker.com/news/world/329029-new-coalition-aims-to-support-adoption-of-lng-bunkers

GTT is now 26€ vs 32€ 1 month ago. I can’t find a news to explain this fall

An interesting entry point ?

I guess you haven’t looked at their 6 month report:

Click to access gtt_-_first_half_2016_presentation.pdf

They have cut down the 2015 outlook from 260mn revenue to 240 and started talking suddenly about acquisitions.

but isn’t it overreacted ?

Revenue will be well above your historical cycle revenue pattern (graph of your analysis):

– 240 m€ for 2016

– backlog : “2016 – 2020 = 636 millions d’euros : 229 millions d’euros en 2016, 213 millions d’euros en 2017, 155 millions d’euros en 2018, 35 millions d’euros en 2019 et 4 millions d’euros en 2020”

+ there are developping complementary services : 7,5% of revenue, 50% net margin and room to grow

ahm actually no, my “Model” estimated 250 mn EUR in 2016 and it seems to be we are getting less (240mn). If you look at the comments, many readers were of the opinion that I was too pesimistic. Actually it looks like that I was too optimistic.

In any case please remind that I calculated a fair value of ~20-21 EUR for a 10% p.a. required return. Anyway i think short term the stock price will be a function of the oil price. If Oil goes down, stock price will go down and vice versa.

Fundamentallyö Based on current numbers, for me GTT would be interesting below 20 EUR.

I couldn’t resist and bought a 1% position at 22 EUR/share

and another 0,5% at around 21,80 EUR

You value the business between 14 and 20€ and you bought it à 21,80€. i don’t understand . thanx you for the explanations!

he he he, this was a trick….

No, the reason is the following: I made a mistake in my last post. I said that the stock had become riskier after the announcement with regard to the Korean inquiry. However the opposite is true, it has become less risky as a large downside with regard to this specific risk has now been priced in. I agree that I bought it slightly above my stated entry Level, but it is a first step, not the full Position.

So I guess that your dry powder (cash reserve) is now down to 7% (excluding the Greenlight sale) ….

what will you do if you see more opportunities down the line? Sell your current holdings at a loss or fund the account?

Cash is actually around 10% after the first GTT purchase as I “funded” the Handelsbanken position with a partial sale of the HT1 bond, I mentioned that in the post. The remaining HT1 position (2%), MAN (2,5%) and Gagfah (4,5%) can also be considered as an alternative form of cash which can be deployed. Additionally, dividend season is coming soon and will add another 2% or so cash.

So all in all I have around 20% “disposable” funds which should be enough.

For my virtual portfolio “funding the account” is not an option.

Edit: And by the way, only 8 positions are negative, but that doesn’t matter anyway.

I also took half position at 21.8€…could not resist either. I have to recognize that the trading pattern was almost an invitation after 3 days of heavy losses…

I am attaching GTT CEO transcript after FY’15 results. Really interesting. It seems the guy is quite outspoken and knows the business:

http://finance.yahoo.com/news/edited-transcript-gtt-pa-earnings-165114566.html

Important things to consider:

a) Mr. Philippe Berterottiere indicated one important feature of the LNG “new” market: as prices will become divergent (US based on Henry Hub -not linked to oil- and Asian prices relying on oil -14% of oil price as a rough calculus according to CEO-), trading will grow and will distort current/classic itineraries for LNG cargoes, which could potentially cause a significant increase in LNG shipments. This could help to break the cyclicality of this business. To what extend? I don’t know but it is something that could help on the demand “pendulum” effect.

b) The former has clear implications for the other LNG “star” project…Cheniere. As already commented on a different post, 15% of the liquefaction capacity could be potentially sold at market prices. Mr. Market, among other things, has been really worried for that trading possibility disappearing at current market prices. Truth is that Cheniere would need approx. oil 45-50 US$/barrel by 2021 to allow for that possibility.

c) In terms of competitors: “When it comes to Moss systems, which are — you know the systems, the LNG carriers with spheres, well, the price in terms of CapEx, Moss systems end up with a higher CapEx, with more expensive LNG carriers than ours. And looking at the actual prices as we can — with the information we can have access to, we are talking of a difference of 18%, which is, we believe, material”.

d) In terms of LNG as a fuel for ships: “Philippe mentioned this bunker barge in the US. So it’s really the first of its kind and that’s important. It’s a new product, a barge like this. It’s a new market, LNG as a fuel in the US, and with new industrial partners. Conrad Shipyard is a new licensee of GTT. So it’s really for us a very significant achievement.”

Really interesting. It is worth reading.

By the way, talking about marine gas engines I think it is interesting to have a look at Rolls-Royce Holdings (before is too late). It is cheap by no mean (PEx22 FY’16) but it has a really interesting potential beyond 2017 with new engines for the aerospace division and the much expected oil bounce back (marine division).

Take care,

Thanks. Yesterday was w aild ride. GTT management sounds very bullish. Let’s see how this goes, but on further weakness, i might buy more.

Wow. Stock -22%

http://www.gtt.fr/en/news/press-release-0

2016-01-29

Paris, 29 January 2016 – GTT (Gaztransport & Technigaz) announces that it received today a notification from the Korea Fair Trade Commission informing the company that an inquiry has been opened into its commercial practices with regard to its Korean shipyard clients.

GTT affirms that the opening of this enquiry should not lead to any kind of prejudgement as to its outcome.

The company will cooperate fully with the relevant authorities and does not wish to make any further comments at this stage.

Any idea why they chose to IPO in 2014?

Yes, they had a Private Equity investor on board who wanted to get out.

Thanks again for sharing this analysis. Couple of points on GTT which I found interesting:

1) LNG bunkering on non LNG ships is still very small: 63 in 2015, with an additional 67 under construction. SocGen estimates total market in 2020 at 600 units.

2) As of November 2015, GTT had only 1 (one) order for their LNG bunkering solution, which means someone else is eating their lunch. So I agree with you that paying for this option is really not worth it.

Hi, thanks for the comment. Allow me to ask: Do you know what technology is used in those other cases ?

mmi

At the moment, it seems that most marine LNG Engines are dual fuel, which would explain the high barriers to entry for GTT which is not a diesel engine manufacturer.

https://en.wikipedia.org/wiki/Marine_LNG_Engine

It looks like Wärtsilä has a dual fuel solution :

http://www.wartsila.com/media/news/09-11-2015-w%c3%a4rtsil%c3%a4s-antriebsl%c3%b6sung-f%c3%bcr-neues-lng-bunkerschiff-ausgew%c3%a4hlt

And so does MAN Marine

http://marine.man.eu/docs/librariesprovider6/technical-papers/me-gi-dual-fuel-man-b-amp-w-engines433833f0bf5969569b45ff0400499204.pdf?sfvrsn=18

“As the drop in oil prices makes gas less competitive, orders for new LNG ships have tapered off somewhat, said Anders Mikkelsen, a business development leader for maritime advisory at DNV GL in Oslo. However, he believes the slowdown will be short-lived.”

http://www.bloomberg.com/news/articles/2015-09-23/lng-powered-ships-gain-as-rising-output-answers-oil-price-tumult

hmm, GTT is not an engine manufacturer anyway, they only provide the Containment Technology for storing LNG and I think they don’t plan to actually start this Business.

So th question is: Which Technology for Containment is used for instance if someone installs a Wärtsilä engine ?

Here is an interesting paper published in 2014

Click to access 213-35840_CD3611_LR_Gastech_Catalogue_2014_AW_LoRes_v7.pdf

“The industry has taken two principal alternative paths: either the independent type ‘B’ spherical Moss-Rosenberg tanks concept or membrane tanks – as designed by GTT.

In recent years membrane ships have comprised the vast majority of gas ship orders, with GTT systems being used in all the Q-Flex and Q-Max ships delivered. However, the Japanese market has preferred Moss tanks. And recently it was confirmed

that Petronas has ordered 4 +4 Moss ships using the IHS design referred to in depth overleaf.

But in early March 2014 it was confirmed that a consortium of Japanese owners had chosen the SPB tanks, a prismatic independent type tank, not used in 25 years, in an order for two 165,000 cbm ships from JMU. With orders for membrane ships healthy, Moss orders growing and now SPB in the frame, it seems the industry is going for a healthy mix of containment sytems.”

So there are 3 competing technologies in LNG containment, and membrane seems to be losing market share.

“Wärtsilä has supplied a significant share of the gas engines sold to the marine market, including to benchmark projects such as Viking Grace. In addition they have been providing the gas tank and piping arrangements to many gas-as-fuel projects”

“Wärtsilä’s scope of supply includes four Wärtsilä 8L50DF main engines, the transverse bow and stern tunnel thrusters, as well as two stainless steel fixed pitch propellers with propeller shaft lines including environmentally sound shaft line seal systems, the LNG tanks and fuel supply and handling equipment with safety and automation systems.”

http://www.wartsila.com/resources/customer-references/view/viking-grace

If I understand this correctly, engine manufacturers also provide tanks (LNG containers) to ship builders in an integrated power plant package. Maybe they are using GTT licences, or they have developped their own version of membrane tanks, or are using a different tech.

Overall, I think engine manufacturers have a much stronger position in LNG bunkering than GTT which only provides one component of the whole system, with 2 alternative technologies available, and possibly internal capabilities at Wärtsilä.

I am not so sure. GTT has a market share of 90% in newly built LNG tankers. The Moss Technology is clearly inferior.

As I mentioned in the post, the LNGship engine issue is something I wouldn’t value at all.

I haven’t looked into the LNG ship engine market, but clearly Wärtsilä could be an interesting Company.

tx for write-up – How many patents are there overall and whats the avg expiry? what is the methodology behind the 35y model, ie cycle peaking in early 20s I see. Also, considering 10% vs 15% discount rate makes a 50% in entry stock px level – what rate do you tend to and why?

Patents: You need to check yourelf. The “trick” is that they are continiously developing new and better versions. As the market leasr, they can dedicate 200-300people full time to do so.

Cycle model: This is my secret 😉

Discount rate: I guess the fair rate is somewhere in between. Why ? 10% is to low because of the “one product” risk. 15% too high because of the wide moat.

I had a quick view on this company. What strikes me is a 5.5 P/S especially in light of the cyclicality of the business and of the growth rate that I suppose for this industry. Thank you for your interesting posts.

Wellthe P/S Ratio (Price sales) is not a very good comparison basis if a company has net margins of 30% even in a recession 😉

This is a very good write up, but surely you should use a substantially lower discount rate as you’re controlling your risk by assuming a cyclicality?

I am not so sure. You also have to account for the risk of Samsung & Coare comingup with a competitor product. GTT is a one product company, that is risky.

Hello

Usine a DCF I han dound an intrinsic value around 70€ (discount 9%, growth 20% during 5 year a then 2%, EPS = 2.26). The revisited Graham formula (PER = 7 + 1.5* growth rate) have me about the same value.

How do get your intrinsic value please? I would like to see the full hypothesis.

Thanks

Lionel,

my assumptions can be viewed in the post. Personally I think your assumptions are very optimistic. History shows clearly that assuming a constant growth rate for GTT would be a strange thing to do.

Using any formula on such a stock will always lead to wrong rsults. Near the peak of the cyclce, the stock looks cheap,at the bootom it looks epensive. That’s why I modelled the cyclicality.

Thanks MMI

What is the TGS NPV at 10% and 15% discount rates if you were to follow the same model?

Tony

good question…..need to work on it…..

Happy to help if you can upload a working spreadsheet of some sort….

Great article – thanks.

When you wrote about Cheniere Energy in February 2015 you valued their stock for a set of different scenarios (discount rate / eps) and your most negative scenario gave you a price above the current market price:

Now: 30,01

Worst Scenario: 30,84 (eps = 4 and discount rate = 11,5%)

Is Cheniere Energy a good buy now or not enough margin of safety?

Would be great if you’d consider writing on it again .

Cheers

Hi,

Cheniere is an interesting Topic. One of the issues is clearly that they didn’t manage to start production within schedule. Secondly, I am not so sure how fix their contracts are. Jim Chanos made some interesting comments about Cheniere a while ago.

MMI

LNG engines technology is definitely something that shipbuilders think about, for instance : http://www.rolls-royce.com/products-and-services/marine/lng.aspx#section-overview

But when does that enormously lucrative patent (family) expire? The competition probably can’t wait to provide the generic.

As far as I understand, they do improve the technology continiously and then get a new patent for every “evolution”. But I think the combination of patent and approval of verification companies is the key (so far)…..

Can you expand on your method of modeling the cycles? How did you forecast sales & margins? Would be great to see the spreadsheet if you are open to sharing. Thanks!

The “Model” is relatively simple. I just used past growth rates and past margins with little modifications. Nothing gancy.

Interesting post. Thought you might enjoy this – http://harveygulf.com/green.html

Stricter env. regulations and low gas prices are driving the trend. The coast guard just approved the first launches, so there’s definitely a growing market.

thanks for the link. The big market would be if really all the big container ships would switch….