Coface SA (ISIN FR0010667147) : Ultimate death spiral or contrarian opportunity in an attractive industry ?

Executive summary:

Coface SA is a relatively simple contrarian “mean reversion” case:

- the company at the moment has some specific issues which in my opinion can be solved

- the industry as such is attractive (within the generally problematic insurance space) with significant barriers to entry and little exposure to interest rates

- Even in a bad case, the downside at current depressed levels is small. A conservative “mean reversion case” would indicate ~75% upside without assuming any growth

- no hard “catalyst” and fundamentally it could get worse before it gets better

- For exposure management reasons, NN Group will be sold and replaced by Coface

- As always the reminder DO YOUR OWN RESEARCH. THIS IS NOT INVESTMENT ADVISE !!!!

The company:

Coface SA is a French “Trade Credit Insurance” company and one of the Big 3 players of this industry which together have 80% market share.

Coface interestingly went public twice. For the first time they went public in 2000 but were then taken over by French Bank Natixis in 2002. In June 2014, Natixis then sold the majority of the shares in a new IPO and is currently still the dominant shareholder with a 41% stake.

Some numbers (at EUR 4,55 per share)

Market Cap : 715 mn EUR

P/E 2015: 5,7

P/E 2016: 16,9

P/B 0,41

Perf. YTD: -47,8% (incl. dividend)

The stock chart looks really ugly, very much like a “death spiral”:

Trade Credit Insurance – high barriers to entry & network effect

A trade credit insurer insures a company against a default in any of its receivables, so “claims” come up when a customer of the insured gets into trouble, not the insured himself. In general, Credit insurers do not insure single risks but the whole receivable portfolio. Different to banks, the underlying exposures are very short-term, typically up to 90 days.

Underwriting a trade credit policy therefore is different from normal insurance. In normal insurance, you “only” have to assess the risk of your contractual partner and match this to a historical pattern. In a typical trade credit insurance contract however, for instance if you underwrite a policy for a German exporter, you will have to understand and price hundreds of different potential risks on a global basis. So if you start at scratch and have to analyse every counterpart, the cost for this first contract will be prohibitively high. If you have the all the names already in your database, the cost is however negligible.

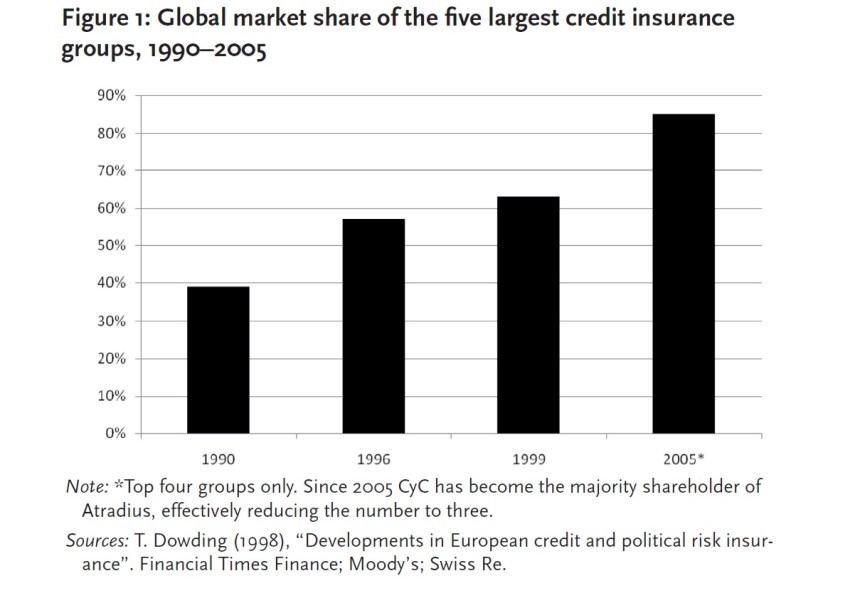

Therefore Trade credit insurance is one of the most concentrated insurance markets. 2015 global premium volume is ~6,5 bn EUR. The largest 3 trade credit insurers account for ~81%. I found an interesting report which shows the concentration process over the last 2 decades:

The current market shares are as follow:

Euler-Hermes ~36% (Cost ratio 2015: 27% , CR 2015 80,1%

Atradius 25% (Cost ratio 2015: 34%, CR 2015: 75,6%)

Coface 20% (Cost ratio 2015 29,5%, CR 2015: 82,5%)

Coface is the smallest of the “Big 3” but the numbers I have shown above make clear that there doesn’t seem to be a systematic size/cost relationship within the top 3.

So overall I would say that Trade Credit insurance is a quite interesting market with significant barriers to entry.

Credit Insurance, diversification and investment risk

Another Trade credit insurance specific factor is the following: In normal property and casual insurance, claims are independent from capital market developments, so it can make a lot of sense to invest their money backing insurance reserves (Float) into riskier type of assets. For a Trade Credit insurer however this is a little bit more tricky. Claims normally increase when there are many defaults, which in the same time could hurt the investment portfolios. Therefore, Trade credit insurers have only a limited capacity of taking investment risk, especially credit risk as they are already exposed on the insurance side.

Additionally, claims in Credit Insurance have naturally less diversification then for instance earthquake insurance. For this reason, Credit insurance is relatively capital-intensive for a “short tail” P&C insurance business. Coface for instance has around Equity of ~2 times net earned premium, a “normal” P&C insurance company would have rather a ratio of around 1:1.

I think the combination of restricted investment activities and large capital requirement is the main reason why trade credit insurance is structurally much more profitable than most other insurance sectors. In contrast to other insurance companies, the trade credit insurers could never rely on making their all money solely with investments. They always had to make sure that they earn money in insurance.

Additionally, the correlation of the technical insurance results with capital market makes the sector less attractive for “alternative sources of capital” which is a big issue at the moment for “traditional” P&C insurance.

That’s why I think Credit Insurance is structurally a very interesting business with overall very attractive economics despite the inherent volatility.

Coface specific issues (1): Loss of the French Government contract

For 70 years, Coface administered the French Government Export Guarantee program. In 2015 however, the French Government decided to move the program to another supplier BPI France (state owned entity).Coface will receive compensation (~80 mn EUR pre tax) but lose ~20 mn net profit per year. The effective transfer will happen at the end of 2016.

Although this is not fresh news, it seems to have some effect on the share price as investors in general don’t like a reduction in profits.

Coface specific issues (2): Emerging markets exposure

This is from a JPM research report in July 2015 when EM troubles started brewing:

We downgrade Coface from OW to N and reduce our Dec15 SoTP-based TP from €13.39 to €12.1. We do this for three reasons:1. 2Q15 earnings miss due to higher claims in emerging markets;2. relatively low compensation to be paid by the French state for the loss of the state guarantee business;3. 1.4pct lower pro forma return on average tangible equity, as a result of the loss

Interestingly, the 3rd reason is a direct consequence of the first 2, but anyway….

The next leg down came then in February 2016 after the 2015 numbers. Again JPM in February 2016:

The Coface earnings were inline but the outlook was relatively prudent. The newCEO arrived on the date of the results and highlighted only that the 8.3% reported return on average tangible equity reflects current market conditions.We believe the new CEO will cut costs aggressively and we therefore believe that the full €51m net of tax compensation payment by the French government for the loss of the state guarantee business will be used to fund restructuring. In addition, as the group stressed that the benefit of volume reduction in China would be fully reflected 2H16, we believe that the group’s combined ratio will be higher than we originally forecast FY16e. We therefore cut our earnings and dividend forecasts, and reduce our Dec16 sum of parts based target price to €7.7 from €11.3.

The last “leg down” so far then came in July after a profit warning. Again, JPM in early July:

Coface published a profit warning after COB on 4 July: Coface guided that its loss ratio in FY16 would be 63-66% up from 52.5% FY15 and vs our forecast FY16e of 51.5%. Coface noted that this was due to higher claims in its Emerging Markets units in Asia and Latin America, and higher claims from exporters in mature markets (mainly Europe) to Asia and LatAm. Coface sees an increase in the number and cost of mid size claims of €500,000 or more in these emerging markets. We now cut our forecast net profit by 64% for FY16e, -35% FY17e and -31% FY18e. We revise our SoTP -based Dec16 target price from €8.3 to €5.5, and downgrade the stock to UW from OW.

If we look at this we can see that JPM reduced the price target within 12 months from 13,39 to 5,50 EUR based on information which was maybe not that unexpected.

Analyst consensus according to Bloomberg is pretty bad, from the 7 analysts, 3 have a “sell”, 2 are neutral and only 2 rate the stock “buy”, although the consensus price target still is 6 EUR per share.

Coface has traditionally a relatively high “overseas” exposure. This is a result of the administration of the French Export guarantee program which traditionally led to many contacts thorough out the world. At the moment this is clearly a disadvantage for them, as those markets, especially China, Brazil anD Turkey suffer.

However, as always in insurance, high claims are also often an opportunity, both to sell more coverage and ask for higher prices. So I do not see this as a structural issue but rather a cyclical one. No or very little claims for a long time is actually not good in the long-term.

New Management & other factors

The board of Coface is still dominated by Natixis. The CEO of Natixis, Laurent Mignon is actually Head of the Supervisory board. Obviously they were not happy with the performance of Coface, so they replaced the old one with a new one in January 2016.

Natixis does not plan to hold the shares forever, but in a recent call Mignon mentioned that they plan to hold the stock langer than they initially planned.

Xavier Durant, the new CEO is French but worked for GE Capital mostly in Asia.

A new CEO clearly has an incentive to “kitchen sink” everything in the first year and I think that is something we already see at Coface as well. He already announced a significant cost reduction program with significant one-off costs. This should have been compensated by the payment from the French Government for the loss of the export program, but as it looks now, the gain might materialize only in early 2017. So it is not unlikely that we see more bad (accounting) numbers within 2016 and only a small profit if at all for the current year.

Nevertheless, I do think that this also presents a potential opportunity for the contrarian investor. IF Coface manages to return to “Normality” which I think is not unlikely, then investing at a high P/E during a “kitchen sink year” could be potentially attractive.

As a side remark: I do think that Coface has “best in class” reporting in the insurance industry. For instance this detailed explanation how the calculate cost and combined ratio from the half-year investor presentation is something I haven’t found in most other Insurance presentations:

Valuation

As my readers know, I try to keep it simple. The two traded peers Euler-Hermes and Atradius (Catalana) both trade at P/E ratios of around 10 (10,2 and 9,8), so aI assume that for Coface 10x P/E is a fair multiple.

Further I do not assume any growth, so I assume stable 920 mn net earned premiums and 2,5 bn total investments. Then we can do a relative simple valuation grid how profits and valuation per share behave assuming different long-term Combined ratios And investment returns:

I have marked 3 boxes which to me are most relevant:

The green one at 89% Combined ratio and 1% investment yield would be my base case. Why ? 89% is the long-term average Combined ratio of Coface (including the financial crisis) and I see no reason why they shouldn’t achieve this level again in the future over the cycle. A 1% yield on the portfolio should be achievable in the current environment, especially considering that part of the business (and subsequent reserves) is done in high yield countries like Brazil or Turkey. The base case therefore would imply an upside of +75% against the current share price.

The orange box would be my “bad case”. There I would assume that they would earn only half a percent on investments and the CR structurally deteriorates by 5%. Interestingly, this is very close to the current share price.

The blue box basically would be the upside case. In all cases, no growth is assumed and no multiple expansion either. Of course I haven’t considered a rerun of the financial crisis either.

Overall to me this looks like an extremely attractive risk/return scenario. Very little downside risk but significant upside opportunity. Of course timing is difficult and it could get worse before it is getting better but again, I do not see a structural issue with Coface but rather a temporary / individual issue.

Why not buy Euler-Hermes or Catalanea (Atradius) ?

Catalana in my opinion is difficult because you get a lot of Spanish exposure on top of Atradius. The problem with Euler Hermes in my opinion is that despite it looks optically cheap and is the market leader, I do think that the current combined ratios around 80% are not sustainable. On a normalized basis Coface is a lot cheaper than Eurler Hermes. From my own market research I learned that none of the big 3 seem to have specific advantages vs. each other. Coface is seen as the most aggressive player of the big 3. Coface is also the only of the Big Three who could be a potential M&A target at some point in time.

Risk management

As my exposure to financial services now has reached almost 30%, I am hesitating to put another position on top of that. I do like the financial services sector, but I don’t want to bet the house on it. So I decided that one of the existing positions has to go. When I look at my financial stocks all of them are relatively cheap and have in principle good upside::

| Van Lanschot |

| Svenska Handelsbanken |

| NN Group |

| Citizen Financial |

| Lloyds Bank |

| Dt. Pfandbriefbank |

| Ashmore |

| Admiral |

At the end of the day however I decided to take out NN Group. Why ? Because I think NN Group, despite being in my opinion one of the better managed European Insurance groups, has the biggest fundamental issues with continuous low interest rates.

With current interest rate levels, Life insurance is not a viable product anymore. Yes, you could run off the company and realize part of the book value, but in my opinion the life insurance industry currently is where banking was 3-5 years ago. I think the market hasn’t realized how bad the situation actually is for life insurers. I expect increasing pressure from regulators and significant capital raising rounds in the next few years.

So Coface will replace NN Group in my portfolio as I see better visibility of a “mean reversion” here.

Summary:

As outlined above, I do think Coface at current levels represents a very decent risk/return proposition and looks like an attractive “contrarian” investment. The market currently seems to take the “downside case” as given. A likely base case already offers significant upside.

Therefore I have allocated 2,8% of my portfolio into Coface at a price of around 4,65 EUR per share. This has been financed by my ~2,8% stake in NN Group which i sold fully at around 26,50= EUR/share.

Edit: At the time of writing, the stock hovered between 4,55 and 4,70 EUR, all my calculations are based on that level. I know it is kind of unfair to post a purchase price which is now, at the time of publishing, already a few % higher. But I usually buy when I have finalized my analysis but before I have “fine polished” my write-up, which takes me ususally 3-5 days. Those kind of delays are inevitable. This also goes into the other direction. For instance I did sell my Hornbach Shares without publishing yet at around 25,50 EUR and now the stock is at 28,50……

I reinstated a small position (1,5%) in Coface at around 5,70 EUR/per share. Especially the German “Umbrella” for Credit Insurance limits the downside. FRance has also creates a similar schem and maybe other countires will follow.

It is clearly a “bet” but I think risk/return looks decent from here.

4.7 is cheaper than 5.7. Nothing has changed. Are you topping up?

Not yet. It is still unclear how insolvencies will develop. Interestingly, so far no uptick at all in Germany.

I made a few comments before. At the time, I tried to push for a substantial investment in Coface (E100-300m) which ultimately didn’t happen. Anyway, I started to write a blog now and my first blog is about OneMain (OMF) and you can check it out at seresglobal.wordpress.com.

Sold another 0,8% positon today.

Sold some Coface today (0,5% of portfolio). Stock price is approaching my price target fast.

NN Group Offers To Buy Delta Lloyd For EUR 2.4 Bln

Will be interesting. Delta Lloyd has a nice Poison Pill on hand if they want….

What do you mean?

That it is not a done deal:

Thanks for sharing your information!

Actually Coface did report the net reserve release number (annual report page 89). However, the quality of report is still not very good and 2014 and 2013 numbers in annual report don’t match the 2015 full year result presentation (a small negative for me and it doesn’t mean the stock is not a good investment, especially at your entry price).

I agree with most of comments but think the quality of the business is less than what you think:

1). Coface reported expense ratio of 30.5% in FY15, which is normal. However, it is hugely under-reported as it works down from 713.2m to 281.1m (slide 35 on full year presentation). If you use company definition, you can see that all the fees/factoring/government guarantee generate a combined loss of 12.1m in FY15, which I can guarantee is not the case. As such, the true expense ratio is more like 40% (close to half of profits are generated by these other activities). You might say that it points to the great potential.

2). I have to disagree that Coface has one of the worst disclosure in insurance space. For example, it reports gross reserve release but we need net numbers etc.

3). The industry will have a credit cycle every few years so the company is forced to hold a lot more capital than normalized needed, thus generally lower ROE than peers.

I am not sure if you made a typo. I said “best in class”, not worse. With regard to the combined ratio I would reiterate that this is “Best in class”.

And yes, the cost ratio includes service fees which have been netted against the cost, but the competitors most likely do the same (although they don’s disclose it).

Any yes, there is a credit cycle every few years. On the othewr hand that is part of the “barrier to entry”. So yes, ROE is not that great but pretty “safe” over the cycle in my opinion.

I wouldn’t say combined ratio is best in class. I think loss ratio is very good but expense ratio is very high. If you use company definition of 83.1% combined ratio in FY15, it means underwriting profit is about 155.6. However, fees and services should have a margin of 30%, factoring generates 2.2% pre-tax ROA (pre-tax profit 65.9-14.1 over average receivable) and government guarantee has a profit of 12.6m. So these account for more than half of these profits. In another words, real combined ratio is more like 92-94% in a slightly high 83% reported combined ratio year. I did these adjustments as there is no disclosure from the company, which is why I said company report is pretty bad or low quality. Another example, we have no idea what the net reserve release is in each year. Even initial loss ratio pick is different from annual report: on page 12 of presentation, it shows initial pick in 2014 and 2013 are 72.5% and 72.6%. However, in annual report’s loss triangle, it shows loss ratio is 0.2% higher in each year. 0.2% is not a huge number but I would prefer management to be more inconsistent in their own report. With that said, it doesn’t mean the stock investment would not work.

sorry for the misunderstanding. What I meant is that their Combined Ratio REPORTING is best in class. My case is simple: at ~0,4 P/B the company is relatively undervalued compared to Euler and Catalana/ATradius which trade above book value. Even at a discount to those 2, there is still upside. A certain part of that upside has however already realised in the last few days….

I have agreed with you only partially: their report is very clear but logic is a bit confusing. Euler seems to report in the same way but all of their reported combined ratios are artificially depressed due to all of these adjustments. Coface’s true combined ratio should be higher (8-10 percentage points) if we adjust to use insurance industry standardized way.

Think about this way, the best in the industry, Euler Hermes, has a 10-year CAGR return of 2.85% with dividend included. That is hardly encouraging. However, buying Coface at 4.80 level is a good entry point. Said it differently, it is a bit of time arbitrage but the stock will not generate attractive return once it is properly valued or even slightly on the cheap side.

Steve353145: out of curiosity, which credit insurer iis your favourite in the competitive set?

Tony

Probably Coface as I do have my unique situation regarding this company (which I hope I could disclose if situation allows). In my prior life, I wouldn’t be interested in them at all as trading volume is not there to take any position. In general, I like strong underwriting companies as that is the core skill you buy and financial companies (especially insurance companies) tend to cheat. Coface reported numbers differ from its own (in a minor way though), which leads you to question its data integrity to some extent. However, Euler’s underwriting is definitely better: in 2008, Coface strengthened reserve by 10.4% (thus later reserve policy reflected this deficit), Euler by 3.0%. In 2014, Euler actually started to add to reserves which probably means they saw the risk coming and took precautions. That probably explains why their combined ratio is still around 80% in 1H16. With that said, I still don’t understand why the best industry player has only 2.9% returns in a 10-yr period, I would think of 8-10% makes more sense given its +12% ROE (I haven’t done any work on it to list P/B over 10-years, book value growth, etc.).

Thanks for your write-up, it saved me time as I planned to look at the company myself. I think it’s a relatively straight forward cigar butt situation. I just disagree on your asssessment of this being a relatively attractive niche with significant entry barriers. This assessment is inconsistent with the historical returns on capital achieved by Coface and Euler Hermes. As such they deserve to trade at a low multiple and with Coface losing the French government contract I struggle to see large upside here.

Can you back your comments with any numbers ? Otherwise its difficult to discuss this.

Plus, I don’t think that this is a “cigar Butt” case.

Well, Euler Hermes’ 10-year average ROE is 12.3% acc to Bloomberg, Coface did average of 7.2% in last 4 years. Euler’s EPS is still lower than it was in 2006 and 2007. I know, everyone might have a different assessment of “quality”, and the sector itself is not known for high returns. But for me these metrics don’t suggest any moat. Therefore my cigar butt assessment. Can’t see this ever being something that will structually grow and create a lot of value.

Well, we do have different understanding what a “Cigar Butt” is. A Benjamin Graham type of “cigar Butt” is a company which is going to die in a few years and has a “last puff” in it. I don’t think this is the case for Coface.

I don’t know if you have read my blog before, but for me a business with a ROE in the low teens and a modest valuation is an almost perfect investment. As I mentioned, I do think Coface can manage to earn those returns and if this is true, then it justifies a (much) higher valuation.

Final point: if you read the post carefully, I haven’t mentioned the word “Moat” anywhere. I have only said that there are significant barriers to entry, high capital requirements are one of them. If you look for “moaty” companies, this blog might not be the best place to do so.

“If you look for “moaty” companies, this blog might not be the best place to do so.”

@ MMI: I think that depends on the definition of “moat”.

If one thinks (as I do) that special kinds of corporate cultures, which strongly differ from “mainstream corporate cultures” and hence are quite hard to copy and that enable these “special” companie to regularly produce outstanding results, are a kind of “cultural moat”, than your blogs offers a nice collection of “moaty” companies and interesting articles about “moaty leaders”.

Your “different” section with companies like Admiral, TGS Nopec, Svenska Handelsbanken, Thermador and perhaps also Silver Chef offer a quite superb list of companies with “cultural moats”. And some of your other companies may also qualify.

#Roger,

I would call this rather “competitive advantages”, not moat. I don’t like the word moat anyway….

mmi

Great analysis and overview,

you mention that they are the most aggressive player. So it makes sense to have a structurally worse normalized combined ratio than Euler Hermes, doesn’t it?

Do they incur currency risk? I would assume that most trade claims are in hard currency anyway..

Hi,

good observation, this is what currently is happening. In a “steady state” there shouldn’t be much difference.

Currency Risk: I think that is not a big factor. As you point out, most is in hard currency to my knowledge.

mmi

Hi MMI,

great analysis. I guess I have to take a look at them because the situation reminds me of Admiral. There I read your post and didn’t have a clue about ‘car insurance’. Took a look at Admiral afterwards to learn more about their business and didn’t regret buying them 🙂 I think you might be right in regards to life insurers. I recently terminated one of my contracts and I think I’m not the only one who will do it.

Also interesting to see that you sold Hornbach and didn’t mention it yet 🙂 But I know what you mean when you say that price movements during the writing of articles can sometimes be annoying.

Just to manage expectations: Not every new insurance investment will be the “next Admiral”….

Hornbach: I wrote a long post why I will sell them but unfortunately forgot to update when I sold….

I am s bit surprised that you let NN go, since this company has performed fairly decently, since being spun off. I would have thought that Pfandbriefanstalt would be a natural stock to trim, since their business model is vulnerable to dislocations in credit, and their operating results have been quite poor.

as I mentioned in the post: At current interest rates, NN Group doesn’t have a business model anymore. Of course that doesn’t mean that I am right or that the stock goas up.

Pfandbriefbank also has issues but in my opinion less than NN. Plus their credit exposure is mostly geared towards real estata, not corporates.

mmi,

thanks for sharing your thoughts on Coface. I own some shares aswell, though I was less patient than you and therefore in hindsight bought too eraly, at levels slightly above 6 EUR/share, i.e. before the most recent profit warning.

I am also highly intrigued by the Credit insurance business with its oligopoly-structure and companies earning combined ratios other insurance companies dream of. Having worked in corporate bonds/CDS before, Credit Insurance reminds me somewhat of writing CDS on corporate risks, with the specific attribute that the corporate risks are difficult to price (unless you have what you call “the database”) and therefore should structurally be attractive.

There are two aspects I could not fully grasp so far, maybe you or some readers have some input here:

1) Geographic specifics of oligopoly: I find it very interesting that this is a financial services sub-sector which is dominated by three European companies (operating globally). Why are there no Americans active here? Trade insurance appears to be a business globally, even though historically probably has been more relevant for export-oriented countries. Both EulerHermes and Coface have used to have important parts of their business backed by the government, so would it be possible that other countries supporting their exporters “create” competitors?

2) Solvency II: Coface have mentioned that they are about to get their SII model approved by the regulator for some time but it appears the final approval is still pending. Ideally, post-approval it may turn out that Coface has more capital than they need (they have set a certain SII target range). Do you have any views on this topic?

Best

lathinker

Sorry, I did miss your comment.

1) I think you are right here, the European companies in my opinion had the advanatage that they could create their network funded by the government. In the US, that function had been performed by EXIM which didn’t seem to have developed a “private arm”.

2) Yes, I think they are well capitalized. I am not sure if an internal model for Credit Insurance really gives a big boost vs. the Standard model they are using now, but it should help.

mmi

Thank you for presenting this very interesting case!

You’re welcome. Less sexy than Novo Nordisk but maybe more interesting….

Much more interesting for me!

Novo Nordisk is a company valued as a growth stock in a growth industry with some problems with the groth story. If the industry comes out of fashion or the company shows more failings, the stock has still a huge potential to falter. By far not enough safety belt for me.

Coface is a company with a consistent business modell in a actually very unpopular industry, valued at less than half book value. A lot of bad news seems to be valued in the share, so more bad news may not much move the needle, while no bad news for some time shall be enough to start a new turn upwards.

That are situations I like much more, beeing a value investor with an anticyclical impact.

As I am not good in insurances, your thoroughly analysis really helps me learning and understanding company and industry.

Tom,

the competitors currently perform better as they have less EM market exposure. As I have mentioned in the post, I think the profitability of the competitors are currently better than the sutainable average.

For Coface, in my opinion the opposite is the case. The peak losses especially in Brazil and China could already be behind them.

In general, losses in Credit Insurance hit earlier in the economic cycle than for instance at banks, but then again the problems are also solved quicker. Banks have more possibilites to hide their losses by just “rolling over” non-performing loans but then suffer for a long time. In Trade Credit Insurance, this doesn’t work.

But again, without losses there is no insurance (premium). For the Euorpean business, the picture is a mixed one.

mmi

Thanks, very nice description of the trade credit insurance business and the attached oligopoly. I was not aware of these.

Since the business is clearly dependent on the business cycle and has to deal with the business cycle as a consequence of the business model (insuring trade credit), I could imagine the stocks and the operating activities of the businesses in this sector to be some kind of business cycle predictor? And if they were in the past, how do the competitors perform currently, do they also have issues with their loss ratios currently? Can one draw any conclusions from this?

Very interesting anyway, keep up the good work!

Tom