“Luxury update” – 4 years later (Prada, Boss)

Almost exactly 4 years ago I pondered shorting luxury stocks in 2 posts.

The only stock I actually shorted was Prada and I gave up 1 year later as the stock strongly went against me.

Back then, I divided (totally arbitrary) a “peer group” of luxury stocks into 2 sub groups, “tier 1” and “tier 2” brands. Let’s look how those stocks performed over the past 4 years:

First of all, embarrassing for me, the “tier 2” basket performed significantly better than the “tier 1” basket. As we can easily see, this is driven by 3 stocks: Adidas, Nike & Samsonite. All 3 I would classify as “mass market” luxury. Interestingly enough, Nike now trades at higher valuations than any luxury brand with the exception of Hermes.

Secondly, both baskets and the 20 stocks in total did underperform all broad indexes over the last 4 years, and the one I actually shorted (Prada) would have been the worst in the whole basket. The stock I considered shorting, TUMI, struggled but then was taken over by Samsonite. So apart from the bad execution, my stock picking was not that bad.

Prada

Interestingly, Prada still isn’t cheap despite the significant decline. Maybe the announced accounting change will help ? Prada had earnings of around 0,25 USD/Share for 2012/2013 which declined by almost -50% to around 0,13 USD/share in 2015/2016. LVMH in contrast managed to slightly increase earnings from 7,15 EUR per share in 2012 to 7,37 EUR per share in 2015.

So yes, Prada has fallen a lot more than the others but the results also deteriorated significantly. I haven’t looked into Prada in too much detail, but my guess is that their aggressive growth in Asia “hit the wall” and now they are suffering from lower sales but still have to pay the expensive leases in their newly opened stores.

LVMH in contrast with their diversified strategy, at least for the time being seems to be able to cope better with the reduction of Asian demand.

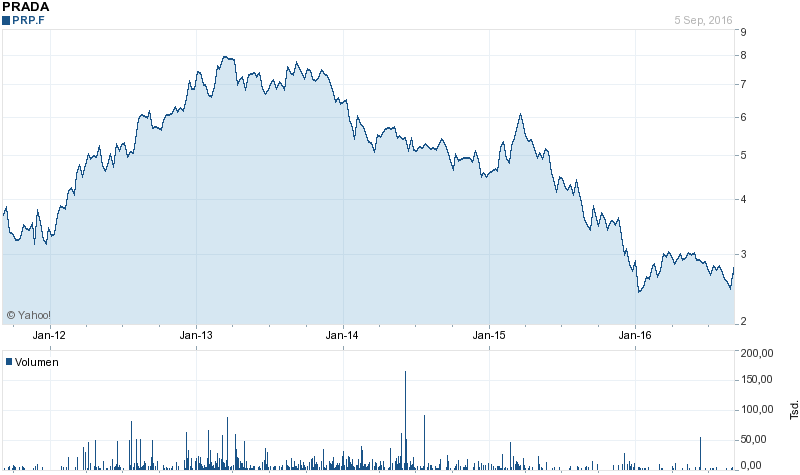

When I look at the Prada chart:

it is pretty interesting to see that when I closed my Prada short in November 2013, it was just before the decline began. Very bad timing indeed.

The most positive aspect about Prada is that analysts are really negative, sentiment is even worse tha for instance Richemont.

Hugo Boss

Hugo Boss is also a favourite of many German investors at the moment. A well-known brand name and the stock trades at ~50% of its peak share price 1 year ago and looks optically cheap at around 10x trailing P/E.

However their 6M report really looks ugly. They seem to have a specific US problem, but also the rest of world is not doing that great.

In general, comparable to Prada, Hugo Boss has transformed itself over the last 10 years or so from a producer/designer to a retailer. In 2005 sold 10% of total sales through its own stores, in the first half of 2016 around 62%. In my opinion however that made them much more vulnerable to sales declines (more capital in stores and leases) and to the change in distribution models (online).

A clothing retailer in decline is hard to turn around, especially if there are fundamental changes going on. It also seems that they are somehow “stuck in the middle” from a strategic point of view. For me this is much to difficult to assess at the moment, so I will stay away from Boss for the time being. Sentiment in my opinion is still to positive, so there might be more pain down the road.

Summary:

Looking back, shorting luxury stocks in 2012 would have created some relative outperformance but no absolute gains. Interestingly, “mass market” brands like Adidas, Nike and Samsonite performed best and are now valued higher than almost all luxury brands.

Fashion oriented brands like Boss and Prada with own stores seem to be struggling most. Overall the sector at the moment is neither cheap nor expensive, so maybe “fairly valued”. My top pick would be still Richemont but at a slightly lower price point.

Somehow, Nike, Adidas and Samsonite look too expensive in comparison, but looking at my experience with Prada, one should only short if the trend is broken.

I cannot see, what is wrong with “mass market luxury”. Do you also see Coca Cola as “mass market luxury” in softdrinks?

Factoring in search cost I even believe Adidas, Nike and Samsonite are good value for money. The high luxury brands in my opinion do not even provide better product quality than those, although I do buy real luxury items. So this is just from reading.

Well, depends on the point of view. I think Coca Cola is different, the better comparison would be somthing like Jack Daniels etc.

“Affordable luxury” is an area where in my experience trends can be quite important (see Puma) and difficult to predict. At the moment, the “trend is their friend”. In “True luxury”, trends are less important. But that’s just my opinion, I am not an expert.

MMI,

what do you think about Bayer – Monsanto? The spread looks attractive, Bayer seems committed (desperate?). The Bayer CEO probably has to leave if he now backs out (other than he is fiercely rejected by MON which does not seem to be the case).

Yes the spread looks attractive and I share your thoughts. The only problem is: This is a very large transaction, every event driven fund looks at this. So what do I know what they don’t know or vice versa ? I think the key is the Monsanto CEO. Does he really want to be taken over or is he just “Playing” ? I think I have an information disadvatage in this regard.

I agree it is difficult to get an edge. One can argue though that there are currently (at least) 3 large (pre-)merger transaction in the chemical/agri space. Dow/DuPont, Syngenta, Monsanto. Maybe the arbs have some sector allocation limits in their funds. And remember Warren: There are no bonus points for complexity. 🙂

There is also a saying used by Buffett: ” If you don’t know who is the idiot in a transaction, then it’s most likely you”.

Why are people selling Monsanto at 106 ? Because they are idiots ?

Let me add one more potential chemical/agri-merger: Potash/Agrium. Note to myself: next time K+S is at 40, sell. You might get it back for 18 a year later 🙂

Boss also has a new CEO since May. So maybe you could be right with “more pain down the road”. I just say kitchen sink 🙂