All German Share part 30 (Nr. 651-675)

Time flies, it’s more than a month since the last posting of this series. So another 25 randomly selected German stocks. Despite the usual duds, the dices this time brought up 6 stocks that I found in principle worth watching.

With “only” around 100 stocks left, I need to think about another market/area that I will cover in this systematic way. Suggestions highly welcome !

651. IFA Hotel & Touristik AG

IFA is a 242 mn EUR market cap company that has rarity value: I think it is the only remaining listed German stock that represents a “Hotel pure play”. However there are a few specialties to consider: The company is majority owned by the Spanish Lopesan Group. Lopesan did a lot of related party transactions with other Lopesan entities and IFA did a couple of capital increases without real necessity.

So far, there doesn’t seem to be any indication that Lopesan has screwed minorities. Some of the “Trades” were actually quite profitabel. Nevertheless, the stock is on a 2 years downtrend that just accelerated due to Covid-19:

On the other hand, the company has no net debt and trades at less than 50% tangible book value. Therefore I’ll put it on my “watch” list as a potential “deep value” play.

652. Henkel KGaA

Henkel is a traditional German chemical company company with a market cap of ~35 bn EUR. The main business line are washing detergent (Persil), glue and beauty products. The company is still family controlled, both via the common shares as well as the KgAA structure.

The stock had a great run from the end of the GFC to around mid 2017 as we can see in the chart:

Since then the stock is in a downward trend, accelerated by Covid 19. One of the reasons is clearly that especially the glue business has a significant automobile component.

Interestingly, at least in Q1,increases in laundry care sales have compensated for declines in glue and beauty.

The decline in the share price and lack of growth might also be due to the former Star CEO Kasper Rorsted leaving in 2016 and applying his growth talent now at Adidas. The question clearly is how sustainable his growth initiatives were.

An interesting aspect of Henkel is that the more illiquid common shares (only the pref shares are in the DAX) are trading at a significant discount (10 EUR or ~-13%). The common shares are comparably cheap at a PE of around 15,5.

I think Henkel is definitely a stock to “watch”.

653. Sino-German United AG

Sino_German has nothing to do with Sino AG nor is it a football club as the name might indicate. Instead it is a tiny, 0,5 mn EUR market cap nanocap with some cash and some sales but always negative results. Somehow they seem to export beer and mineral water to China but on a nano scale. “pass”.

654. RiPAG

A 0,6 mn market cap “zombie” stock. “Pass”.

655. Helma Eigenheimbau AG

Helma is a 142 mn EUR market cap residential real estate development company. Helma went public in 2006, almost went bankrupt in 2009 and then staged a fuminant comeback while riding the German post GFC real estate boom:

The stock peaked in 2016. Business is stagnating to a certain extent since 2016 with little top line growth. I am not sur ewhy, but as I am not a fan of the sector, I’ll “pass” anyway-

656. The Social Chain AG

“The Social Chain AG” is a 188 mn EUR market cap company that is the result of a reverse merger with the previous owner of this stock listing called Lumaland Ag.

Luckily it is not another Blockchain company but a “social media” media and D2C marketing company initiated by Georg Kofler, the former CEO of Pro7 and member of the German version of Shark Tank called “Die Höhle der Löwen”.

Interestingly so far, there is only an investor presentation available and no annual or quarterly report. When I was still watching DHDL, Georg Kofler was pretty underwhelming to be polite. But somehow the share price managed to come back to the levels of the initial reverse take over.

For me this looks pretty much like a pump and dump, so “Pass”.

657. Advanced Blockchain AG (former Brain Cloud AG)

This is a 7,6 mn EUR market cap company doing something with Blockchain. “pass”.

658. Solon SE

Bankrupt “solar zombie”. Pass.

659. mybet Holding SE

Bankrupt “Betting zombie”. Pass.

660. Hochtief AG

Hochtief was the largest German construction company and has a market cap of ~5,8 bn EUR. It is majority owned by Spanish ACS Group. These days, Hochtief seems to be basically an Asia Pacific player plus a partial stake in Abertis, a Spanish toll road operator that Hochtief took over in 2018.

The stock price had a good run until 2018 but then cratered very similar to majority owner ACS:

As I have no idea how to value construction companies, I’ll “pass”.

661. Aleia Holding AG

Aleia Holding is a 2,4 mn EUR nanocap with frequent name changes. “Pass”.

662. Immovaria Real Estate AG

Immovaria is a 43.4 mn EUR market cap real estate company that according to its website is unique as it doesn’t use debt to buy real estate but only capital increases. For unknown reasons, the stock trades at 4xNAV. “pass”.

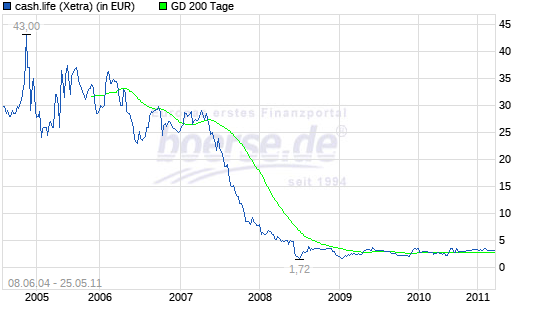

663. Cash Life AG

Cash.life is a company that pioneered the secondary market for life insurance policies in Germany. Cash.Life was insitially a “reverse merger” in 2004 and enjoyed a few good years as we can see in the chart:

Then, however the company was for a long time close to bancruptcy. As far as I understand, the German Tax authorities decided that their business was subject to VAT and sent a tax bill over 240 mn EUR in 2013. Interestingly, a few weeks ago,cash.life won a year long law suite which nullified this treatment which explains the very positive development of the stock more recently:

At the time of writing, the company is valued at ~14 mn EUR which is slightly below the NAV. 75% of the company belong to a financial investor called Augur who doesn’t seem to be very active. At the moment it is not clear what happens with cash.life, but for me it is a stock to “watch”.

664. Salzgitter AG

Looking at the chart, Slazgitter, a 700 mn market company looks like some kind of “Busted highflyier” stock:

In reality ist is one of the remaining German steel companies. As most other steel companies the company is very cyclical and on a long term decline path. Even before Corona, Salzgitter showed a loss in Q1.

For a countercyclical “deep value” investor Salzgitter might be interesting, For me however, the 26,5% Government stake (blocking minority) is a clear sign to “pass”.

665. Dürr AG

Dürr AG is a 1.5 bn EUR market cap company that is mainly producing paint and asembly facilities for the automotive industry. As such it is no wonder that Dürr faces the same problems as the industry which shows in the share price:

On the plus side, electric vehicles need paint, too but the problems of the legacy OEMs hit Dürr as well. For some reason they bought HOMAG a few years ago which is producing machinery for the furniture industry. They still managed to show a profit in Q1 and are conservatively financed, but for me it is a “pass”.

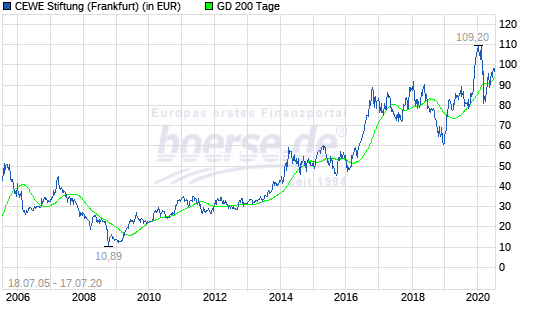

666. Cewe Stiftung KgAA

Cewe is a very interesting case. The 740 mn EUR mn market company used to be a classic printing company which, among others would take your camera films and print and send you your pictures after a few day.

Somehow they managed to transform into a leading online photo(book) printer. The company according to its presentation is now Europe’s leading “photo finisher” and has steadily increased sales and margins.

The result is a very good share price development:

The stock is effectively a 10-bagger since the GFC. Cewe is one of the very few traditional business that seems to have managed a digital transformation. At the moment, the stock looks very valued a ~23x earnigns, but it is definitely a stock to “watch”.

667. Sedlmayr Grund und Immobilien KGaA

Seldmayer is a 2.35 bn ER market cap company is a former brewery that has transformed into a real estate company with holdings in Munich an Stuttgart. With my limited knowledge on real Estate, I’ll “pass”.

668. Carpevigo AG

Insolvent 3,8 mn EUR market cap company. “Pass”.

669. Vossloh AG

Vossloh is a 700 mn market cap company that produces equipment for the railway sector. I looked at Vossloh around 6 years ago as a potential “fallen Angel” investment after Karl-Hermann Thiele, the majority owner of Knorr Bremse bought a 30% stake.

Looking at the stock chart, it was a good decision to stay away from Vossloh:

Mr. Thiele has increased his stake to >50%, but somehow this hasn’t improved things. 2019 was a really ugly year and maybe Mr. Thiele is occupied with his 10% Lufthansa stake. Anyway, I am not in the “Fallen Angel” business as such, therefore “Pass”.

670. Geratherm AG

Geratherm is a 50 mn EUR market cap “medtech” company that produces what I would say mostly “low tech” appliances like blood pressure measurement or medical thermometers. Geratherm went public in 2000 at 9,50 EUR where now 20 years later the stock price is again:

Looking at their results over the last years doesn’t show any kind of trend but rather “random” outcomes. Nothing to see, “pass”.

671. De Raj Group AG

De Raj Group is a German company that is listed in Vienna and has market cap of 106 mn EUR. The company is active in the oil & gas industry, renewable energy and water treatment projects mostly in more exotic Emerging markets (Russia, Vietnam etc.)

The company only shows around around 1,9 mn EUR in sales for the first 6M of the FY 2020 (-50%) and is running at a loss. The share seems to be very rarely traded. “Pass”.

672. Funkwerk AG

Funkwerk is a 174 mn EUR market cap company that is mainly active in rail related technologies, such as secure train communication, displays and video surveillance.

The company has a colorful past as the stock chart shows:

IPOed into the dot.com boom, the company acquired a lot of other companies and then had to undergo a pretty hard restructuring. Only the last 4-5 years, the company got back on track led by the current CEO.

In 2019, Funkwerk bought a stake in another listed company, Euromicron which became bankrupt a few weeks later. This damaged an otherwise super strong 2019 with EBIT margins >15% and an EBIT increase >+40%.

Despite COvid-19, Funkwerk seems to do well in 2020, as investments into rail is still going strong. The company carries a significant cash balance, which should be a good protection against any future issues.

On the negative side, ~80% of the shares are owned by the Hörmann group which seems to be struggling. So far, no related party issues have arisen, but this needs to be watched.

Overall, Funkwerk is a “watch” candidate with higher priority.,

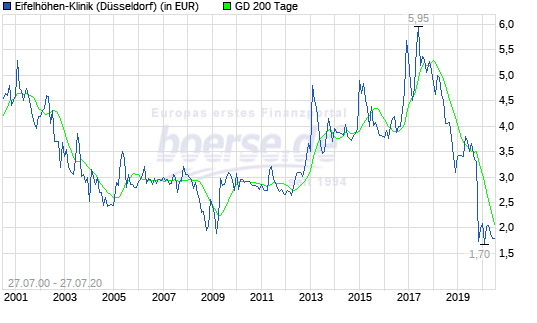

673. Eifelhöhen Klinik AG

Eifelhöhen Klinik is a 6 mn EUR market cap listed hospital that has seen some better times looking at the chart:

Eifelhöhen was one of these stocks that always looked cheap and I have to admit that I owned them in the past for some time, thinking that nothing can go wrong with a cheap stock and a nice dividend. In between some real money could be made, but now it looks like that we will see soon some kind of “game over” as their most profitable hospital went into bankruptcy due to under investment.

The market they are in is tough and Covid-19 does not help. A good lesson for “value investors” and “pass”.

674. Technotrans AG

Another dot.com IPO, Technotrans, a 105 mn EUR market cap company, again has a very interesting past as can be seen in the chart:

The stock has “oscillated” between 3 and 50 EUR in the past 20 years without any real trend. Initioally, Technotrans was mostly active in manufacturing components for high speed printing machines. However with the decline of printing, Technotrans tried to reinvent itself as a broader technology company which looked like a big succes in 2017.

2017 looked like a really successful year. Following some acquisitions, they increased BEIT 4x from 2013 to 2017 and EPS reached 1,76 EUR. 2018 the showed a stagnation on high level, however with issues in cash conversion. 2019 showed a decline in top line and a -50% drop in EBIT plus an additional increase in net debt.

The first quarter 2020 didn’t look that promising either, EBIT again declined, and net debt increased and this was with only minor Covid-19 impact.

Nevertheless I put the company on “watch” as the valuation seems to be quite low.

675. Epigenomics AG

Epigenomics is a 84 mn EUR market cap company that seems to be active in the cancer detection area. The company is loss making with relatively little sales and frequent capital increases. Not my area of competence, therefore “pass”.

2nd try of a comment here: what do you currently think about Funkwerk? Numbers look quite promising in comparison to the price…. and also the outlook is convincing imho…are you still watching here or it the Hörmann risk too big?

Best regards, Malte

In what regard does the outlook look promising?

I don’t actively follow them. Do not understand the business and situation well enough.

Re: Vossloh

Vossloh indeed is a good reminder that restructurings usually take longer than anticipated if succesful at all. Over the last 24 months they sold the US customized modules or turnout systems (Weichensysteme) business segment and sold the locomotives unit. The restructuring of the French customized modules business is still ongoing and there will be cash outflows of additional EUR 10 m to EUR 15 m over the next two years. From my perspective, chances are high that this concludes the strategic shift Vossloh started in 2014.

Today Vossloh offers rail fastening systems for high speed trains (Schienenbefestigungen), concrete / plastic ties (Beton- und Kunsstoffschwellen), turnout systems (Weichen), rail maintenance and stationary welding (lokales Schweissen). Management is increasing efficiency, cross selling opportunities and vertical integration of these remaining business units.

A new factory for fastening systems in Werdohl will be finished by mid 2021. By then, fastening systems for high speed trains will be produced automatically. In addition, they will manufacture additional components around the fastening systems by themselves rather than buying them from suppliers as was the case in the past. Together with a 50/50 JV partner in China, Vossloh is currently entering the fastening market for metro and conventional (non-high speed) trains. In addition, the joint venture partner gives Vossloh access to “clip” fastening systems technology – a technology that has so far been dominated by Vossloh’s competitor Pandrol.

In 2017, Vossloh acquired the North American concrete tie business. So far operations have lagged expectations as North American Class I railroad operators are holding back on investment. In addition, 90% of ties are still made of wood. Concrete has an advantage over wood but the implementation of a new material into the existing system takes time. In the meantime, Vossloh is rolling out plastic ties for the North American market that can be combined with wooden ties. Moreover, cross selling of concrete ties and fastening systems resulted in first time profitability of the fastening unit in North America in 2019. In 2018, Vossloh acquired concrete tie producer Austrak in Australia which is performing well and again offers market access for other Vossloh products (see fastening systems based on “clip” technology for example).

According to the company rail maintenance offers the hightest growth potential of all units. The company owns an excellent market position in track grinding and milling. Vossloh offers their services and also sells maintenance equipment. Vossloh is just in the process of going international by entering the US market this year and starting to sell maintenance equipment for the 30.000 km Chinese high speed rail network.

Thesis: Vossloh offers a recurring revenue business modell in an oligopolistic industry. Current enterprise value is EUR 900 m (350m net debt; EUR 600m market cap). The company’s current published cost of capital of 7% translates into an EBIT of roughly EUR 60 m per annum. Mid term target EBIT margin is 10% over all units translating into EUR 90 m+. Heinz Herrmann Thiele (Knorr Bremse) holds a 50.1% interest in the company. In a worst case scenario he might conduct corporate action to exclude minorities from Vossloh’s likely future operational success.

Disclaimer: no investment advice, do your own research

Thanks for the very nice write-up. Good starting point for further analysis !!!

Great website!

I read it regularly but have never left a comment… until now.

My suggestion for a new series are: Poland, The Netherlands, Switzerland, France and Italy.

Always a good read, thank you. For the next series it would probably make sense to look beyond the border. The easiest would be to limit it to the foreign/european shares you can trade without hassle at XETRA/Tradegate/L+S. Looking forward to the next series.

I think Scandinavian companies interesting, especially Denmark & Sweden

” IFA Hotel & Touristik AG. Nevertheless, the stock is on a 2 years downtrend that just accelerated due to Covid-19. On the other hand, the company has no net debt and trades at less than 50% tangible book value. Therefore I’ll put it on my “watch” list as a potential “deep value” play. ”

Well, They (lopesan) sold so many IFA hotels (From 15 hotels in 2016 to now only 9 hotels in the portfolio, of which one is still to be sold as soon as a buyer is found, good luck with that with the covid events) plus they Lopesan also sold own shares + issued new shares for a €100Mln cash increase (?) to be able to invest in phase I (€200Mln) and then phase II (€180Mln) of a new IFA Dominican Hotel resort complex, therefore ‘betting the house’ on that faraway project ? I also have questions concerning the FCF, it is deeply negative since 2016 at least. The sales per staff figure went from then €71 000 to now €47 000, which is a pretty pathetic amount for any real business. In other words, no wonder that the share price is crashing. But since Lopesan is for 90% owned by a few Spanish persons, IFA is therefore majority owned by a very small number of people who also will be very harmed if they take the wrong decisions. I have IFA on watch too, but the project in the Dominican Republic must first be finished, and I also need to know if the situation is turning around from the now pretty mediocre ‘outlay’ to stay polite, coz this wouldn’t be the first time that a group collapses just before it could get back on it’s feet. Just my two cents. To each it’s own. I value eventual new information that you could have, since they Lopesan/IFA are pretty poor with news releases and such matters.

Thank you for the series! How about a All German Shares season finale of VZ shares?

I would be happy about Polen, there are a lot of good it companies, which are not expensive, but because of the language it it not easy to rate them.

A series on Poland or France would be super interesting. Maybe I could throw in Netherlands or South Africa, where some of the TGV funds found stocks, e.g. TomTom, Prosus, telematics, takeaway.

austria, switzerland, france

a smiliarily structured look into UK companies would be very interesting. Maybe FTSE 250 as basis?

I am sure there are companies that were beaten down based on the Brexit discussions but are actually not or only partially affected.

Absolutely. I was thinking the same thing. I think Austria is probably one of the more overlooked of the more developed markets in Europe. Naturally Switzerland (probably overall too expensive), Denmark (small but strong) or the UK (in light of Brexit are there still deals to be had?) would be good candidates.

Seems there is some common view that PIGS are mostly uninvestable. Countries where companies flourish thanks to corruption and not to competitivity, are long term non-investable.

UK and Switzerland are both interesting. Austria in my opinion is not “deep” enough.

But let’s see. Poland would be interesting, too.

Thank you for the great insights! In addition belongs to the value-play Salzgitter their 1/3 stake in Aurubis (one of the worlds largest copper producer, 2.6 bn market cap), which alone already covers easily the entire market cap of Salzgitter. On top of that the value of the co2 certificates held exceeds the book value by 300m (about 35% of Salzgitters market cap). The central business of Salzgitter is thus obtained for free, of which 44% have nothing to do with steel. In my opinion, its worth a look 🙂

#Lars,

I always have to smile when I hear such arguments because it is a “Milchmädchenrechnung”.

What about the 2,3 bn pension liabilities and the financial debt which adds up to around 3 bn ? If you sell the Aurubis stake, there would be still 2bn financial liabilities that have to be serviced by the loss making and cash burning steel business. Maybe it is a deep value opportunity but it is not as easy as you think it is.

And add to that that they will have to invest €3Bln of which €1.5Bln by 2025, to reduce CO2 emissions to comply with EU regulations. From where will that money come? New issued shares diluting existing shareholders, or debts increasing further? Better sell some 1 year puts on this outfit while they are quoting at a low rate.

You`re absolutely right, of course we should not forget about debt and maybe I’ve presented it too boldly. As I said, Salzgitter is in the process of expanding the non-steel areas to a 50% share. But i’m sure you are right that it won’t be easy. Thank you for your assessment!

Austria would be a natural extension to continue this interesting feature ;).

I think Dürr is a good business, they have made decent acquisitions (I also like Homag) for a company their size, they’re balance sheet is more solid than that of most automotive suppliers and they’re robotic technology is probably more valuable and yet they show a similar valuation compared to revenues or profit.

I’m convinced they’ll be able to earn profits well above 200mln after taxes once the economy recovers.

Maybe I should increase my position in Dürr.