Handelsbanken Update & Annual Report 2016 -(almost) on track

Already a couple of weeks ago, Handelsbanken issued their 2016 annual report. On the surface, the numbers look like a small disappointment with flat profit and a slight decrease in EPS.

Behind the surface however, some things happened. The CEO was fired in 2016 for “too much centralization”.

Some highlights of the annual report from my side:

- the number of branches in Sweden went down from 474 to 435

- the 4th quarter was very weak, but most likely driven by cost for branch closures in Sweden which happened in Q4. I liked this comment:

During the year, continued adjustments were made in branch operations, not least as a result of changed behaviour resulting from digitalisation. Several of the Bank’s major city branches left premises at street level to move to more fitfor-purpose premises a few floors up. At the same time, several of the Bank’s branches in small towns have moved to new less centrally located premises. The business operations of nine inner-city branches in Stockholm, Gothenburg and Malmö, together with that of 30 branches in other locations were merged with large branches nearby

- Denmark had a relatively bad year

Loan losses rose to SEK -716 million (-299), chiefly due to an increased provision made on a single customer exposure. The loan loss ratio increased to 0.85 per cent (0.37)

- UK profit was slightly lower than in 2015, most of that is due to FX rate depreciation

Operating profit went down by 5 per cent to SEK 2,094 million (2,203). Exchange rate movements reduced operating profit by SEK -220 million, but expressed in local currency, operating profit grew by 6 per cent.

- The Swedish regulator increases (countercyclical) capital requirements by the end of the year. Handelsbanken’s reaction: The did not pay into the employee pension fund:

OktogonenThe decision not to make a provision for Oktogonen for 2016 was due to the sharp increase in the Bank’s capital requirement announced by the Swedish Financial Supervisory Authority in early 2016. During the year, the Bank continued to generate capital. Taking into account the outcome of the Supervisory Authority’s capitalassessment, the Bank’s assessment is that provisions for Oktogonen can resume during 2017.

I found this very remarkable. Any other bank would either have lowered the dividend or issued some form of capital. In my opinion this clearly shows the very unique alignment of bank, shareholders and employees.

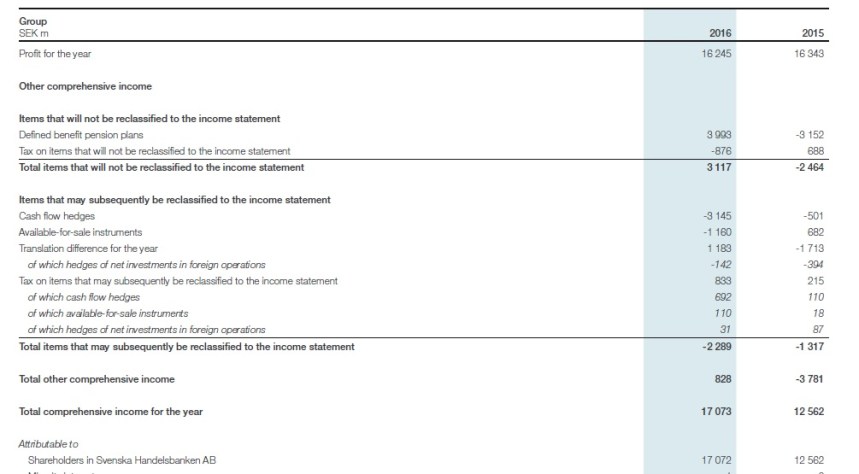

Comprehensive income

Readers of my blog know that for banks I consider Comprehensive income as much more important than net income. Why ? Because the ability to write business and distribute dividends depends fully on the amount of capital available. For most banks net income does not capture the full change in capital. This is the comprehensive income statement for Handelsbanken:

We can see that comprehensive income for 2016 is actually ~36% higher than in 2015. In 2015 there were a couple of negative effects which reversed in 2016. So from a capital generation point of view, 2016 was a much better year than 2015.

Valuation update:

This was my original valuation model back in early 2015 (before the 3 for 1 stock split)

| Current Price book | 2,1 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| ROE | 15% | ||||||||||

| ROI | 7,1% | ||||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | ||

| Book Value | 200 | 218,8 | 240,1 | 264,4 | 292,1 | 323,9 | 360,4 | 400,9 | 446,0 | 496,2 | 552,0 |

| ROE | 12,5% | 13% | 13,50% | 14% | 14,50% | 15% | 15% | 15% | 15% | 15% | 15% |

| EPS | 25 | 28,44 | 32,41 | 37,01 | 42,36 | 48,59 | 54,05 | 60,13 | 66,90 | 74,43 | 82,80 |

| Implicit P/E | 16,8 | 16,2 | 15,6 | 15,0 | 14,5 | 14,0 | 14,0 | 14,0 | 14,0 | 14,0 | 14,0 |

| Retention ratio 75% | 0,75 | 0,75 | 0,75 | 0,75 | 0,75 | 0,75 | 0,75 | 0,75 | 0,75 | 0,75 | 0,75 |

| Dividend | 7,1 | 8,1 | 9,3 | 10,6 | 12,1 | 13,5 | 15,0 | 16,7 | 18,6 | 20,7 | |

| Target Price | 459,4 | 504,2 | 555,2 | 613,5 | 680,2 | 756,8 | 841,9 | 936,6 | 1.042,0 | 1.159,2 | |

| NPV CFs | -409 | 7,1 | 8,1 | 9,3 | 10,6 | 12,1 | 13,5 | 15,0 | 16,7 | 18,6 | 1.179,9 |

| IRR | 12,9% |

So for 2016 (year 2) would expect (adjusted for the split)

- a book value of ~80 SKK

- EPS/CI of 9,48 SKK

- a dividend of 2,7 SKK for 2016 and 2,4 for 2015

This compares to the following actuals:

- book value 12/2016: 70,1

- CI of 8,81

- dividends of 5,7 SKK in 2015 and 6 in 2016

So this looks like that I am behind my assumptions although not that much. the 10 SKK difference in book value are explained by around +7 SKK more dividends paid.

In terms of CIROE (CI/ Equity) 2016 looks OK with 13,2% although 2015 clearly was weaker than I had projected.

On the other hand, with a P/B ratio of 1,78 and a trailing P/E of 14,8, the stock is cheaper than back in early 2015. Plus, most other stocks are much more expensive than 2 years ago. So relatively speaking the stock is more attractive. I still think that at the current stock price one can expect to earn 12-14% p.a. in the long run.

Some reader will think: but hey, it is clear that they cannot reinvest as assumed so this clearly is not a compunder. But here kicks in the philosophy of Handelsbanken: Their whole system is set up to be countercyclical. In hot markets like right now in Sweden, they grow less than they could, only to then really grow strongly after the next cyclical down turn. I still belive that in the long run they will be able to compund at a higher rate that they did last year and the year before.

Analyst consensus

One fun fact: Analysts never really liked Handelsbanken. This is now almost at an extreme: Among the Stoxx 600 constituent, Handelsbanken now ranks number 593 in terms of analyst consensus. Among the 33 analysts following Handelsbanken, 21 say “sell”, 9 “hold” and only 3 think the stock is a buy. The average target price is 118 SEK.

I can only speculate at the reason but I would assume that the major reason is that the stock looks “too expensive” compared to other banks and analysts who usually have short time horizons prefer cheaper banks because they think the have more short term upside (if nothing bad happens).

Summary:

Despite the unspectacular results, I do think that Handelsbanken is on a good track. Clearly a lot of other banks promise potentially higher short term returns, but as the future is always uncertain, I think chances are good that Handelbanken will beat them (again) in the long run.

I also like the fact that this unique company seems to be totally misunderstood by analysts. Instead of comparing Handelsbanken to badly run banks like Deutsche Bank or Commerzbank, I think the right comparison would be other high quality non-banks which trade at significant higher multiples.

But even without any multiple expansion, I do think that Handelsbanken will be a good but unspectacular long-term investment, exactly what I am looking for.

For the portfolio, I will in a first step increase the allocation by ~0,8% with more to follow.This is a company where I want to be a long-term owner because I think it is one of the best run financial institutions in the world.

P.S.: I do like the letter from the new CEO. Already the start is a very nice change to anything I read from a new CEO before:

My name is Anders Bouvin, and last summer I became President and Group Chief Executive of Handelsbanken. I have worked for the Bank for 32 years, most recently as Head of Handelsbanken UK. This is my first time to comment on the year as Group CEO, so let me say right from the start that anyone expecting a grand declaration of new, exciting corporate goals, bold strategic shifts and radical changes in our business model may well be a bit disappointed. Our corporate goal stands firm. That is, we must deliver a better return on equity than the average of our competitors’. We will achieve this by having lower costs and more satisfied customers than the other banks.

What do you think about the 2017 numbers?

Comprehensive income went down by 12% — you were happy about a rising comprehensive income in 2016.

UK business seems to go well, as long as you do not wonder why they give loans to companies like Carillion.

The market does not seem to like the numbers though…

Hi MMI,

I am regular reader of your blog and find it really educative. I just checked handelsbanken again and saw their stock is stagnating. I guess that is due to turnover and profit still not moving north?

I recently read that Handelsbanken, unlike their local competitors SEB/Nordea/Swedbank, have not announced to cut further down on their branches nor employee numbers. I fear that this will be more a financial burden than a comperative advantage.

What is your recent picture on Handelsbanken?

Thanks for your comment. My thoughts on Handelsbanken look like this: I wait for another 2,5 years and then I will decide if I keep them for another 5 years or not. With a company like handelsbanken it doesn’t make a lot of sense to focus too much on recent quarters. Plus, Handelsbanken has always done things differently than the others which explained their longtime success. That’s exactly why I bought them.

MMi

Hi,

This is a very interesting post, thanks.

I’ve looked at Handelsbanken myself and very much like it, for largely the same reasons as you. I do think the fact it’s hated/misunderstood by analysts is encouraging as well.

One thing I don’t understand, and it may be a feature of the Swedish banking system that I’m missing, is the funding structure of Handelsbanken. Most Anglo Saxon banks are largely deposit funded. For example I own Metro Bank in the UK which has a target loan to deposit ratio of 80%. (It’s currently only at 70%.) And I’ve looked at various US banks, like Cullen/Frost, Prosperity, Bank of Hawaii, Wells Fargo and US Bancorp. And again they are all deposit funded. Even the big UK banks, which have higher loan to deposit ratios, are still primarily deposit funded banks.

I much prefer deposit funded banks, for two reasons. Firstly, deposit funding is stable, cheap, and reliable (assuming it is core deposits and not rate sensitive “hot money”). Secondly, if an institution is primarily funded out of core deposits and it doesn’t have a high loan to deposit ratio, it is highly unlikely that it is taking big risks in lending, because that is a conservative funding structure. And a reckless or risk seeking management won’t adopt a conservative funding structure.

Handelsbanken ticks a lot of boxes for me. But, the last time I looked, its loan to deposit ratio was about 200% (i.e. it has twice as many loans as deposits). It is a well capitalised bank. But this funding structure made me uncomfortable.

Is there something I am missing here?

Dear Philip,

thank you for the post. This is indeed a Skandinavian issue. Especially in Sweden, people do not invest into bank deposists, especially now with negative interest rates.

Technically speaking, capital market funding if done right (i,e, long term) is not rikier than deposits in my opinion.

MMI

Thanks, that is useful. I suppose negative interest rates are a strong incentive not to keep your money in bank accounts. Although I went back and looked at a few of their historic reports. From recollection, I looked at the report from 2001, for example. And in that period Sweden did not have negative interest rates – but SHB still had a very similar funding structure.

Also, SHB’s UK bank has the same funding structure. So I think that they must have made a positive choice to fund in this way.

You might be right that it is not risky to fund in this way (though it’s not just about risk – it’s also about a funding costs). It does cause a problem for me though in that I assess banks primarily by reference to deposits, because it is (some) banks’ ability to obtain very cheap deposit funding that makes them attractive investment candidates to me.

For example, one of the main ways I compare different banks’ valuations is to look at their market cap as a % of their deposit base. But that doesn’t work for SHB, obviously.

So, it may just be that I’m not looking at the company in the right way.

Thanks for your comment. Honestly, these days I do not think that the deposit base has a big impact on the value of a bank. In my opinion other factors are more important. I think that company culture is the driving factor.

If you go back to the S&L crisis in the US for instance, the S&Ls all had a lot of deposits but screwed up anyway because they were doing stuff that they didn’t understand.

The obvious risk for the whole Swedish banking sector is as you say the very strong housing market. There are also signs lately that speculation has increased in the property market, signing up for new developments (double exposure) and through company structures. Although it is hard to speculate in “bostadsrätter” in Sweden, since you are not allowed to own and just rent them out in a normal case.

I have fairly good insight “inside” Handelsbanken (SHB) from knowing people that work there. I agree they have a very special culture and do a lot of things right. I would say the risk you miss with Handelsbanken is their IT systems. The culture of SHB is to never (or rarely) be a first mover, because it costs too much money to be innovative and that is not SHB culture. Sweden and the Nordics is one of the more tech friendly regions in the world, people love electronic solutions. This can also be seen from the popularity of brokerage firms like Avanza and Nordnet stealing market share. I’m a big believer in that this trend will continue (I owned Avanza, but sold due to very lofty valuation, hoping to buy back cheaper).

Back to SHB, they have realized that the train is kind of leaving the station on the IT development side. SHB has never paid high salaries and struggle to retain or higher skilled IT staff. My opinion is that it iis boring being IT in SHB in comparison to working at a hip Spotify, game-developer or even the other Swedish Banks. So they have far from the best IT staff. This is a huge challenge for the bank now that they are stepping up IT spend. I see a big risk for failed IT projects in the future for SHB and with that falling further behind on delivering new type of services.

They will have a loyal customer base that values “old school” banking service, but I do not believe the younger generation will be that impressed with this.

#globalstockpicking,

you have raised an interesting point. With the Fintech waive in full swing, everyone thinks that the “new guys on the block” will take over sooner or later. Clearly, competition in some areas becomes bigger (payments etc.) but in my opinion it is far from certain that the Handelsbanken business model will not persist in the future. Peer-to-peer subprime lending is not Handelsbanken’s business, rather the opposite.

Although I do my own banking business purely online I do think there is a market for Handelsbanken’s model in the future. How big that is ? We will see. But I think they will adapt but as you say it will be rather boring. And I like boring companies.

Good points! Now that Avanza’s stock price has dropped signifcantly, would you consider investing in them? I’m looking for an analysis.

Based on historic expereince (Swedish Real estate crisis), Handelsbanken should not have a big problem with this. Interestingly, Sweden is the only country I know which has actively increaesd capital requirements significantly for banks for this very reason.

Thank you a lot for this very informative update about a very interesting company!

As the real estate bubble in Sweden is my only, but really big concern against Handelsbanken, I would be glad if you (or anyone else with knowledge about it) may discuss this detail more in detail or spend me some explaining links.

– How did the Swedisch government react?

– Are there historical records wich methods worked well to get a soft landing on real estate bubbles? How should the methods established by Sweden work?

– How did the swedish real estate prices and the swedish economy develop in the last two years?

And, last but not least: Do anyone know what are the main arguments of “the analysts” for proposing a sell on Handelsbanken?

semantically and for its very own nature, bubbles PLOP !

Else they would not be using the term ‘balloon’ (own suggestion).

… Have you ever seen any different ending for a bubble than implosion?

*they would be using

Well, a bubble can only bee identified in retroperspective when it has “plopped”. However there are also many long term growth stories which looked like a Bubble in the beginning. One example was the recently mentioned Genentech IPO and the Biotech “Bubble”. Some companies went bust but in total the sector is still growing strongly.

I could like Handelsbanken IF AND ONLY IF there would be no immo bubble in the nordics.

…It is somewhere up there that powerful explosives were invented right? 🙂