Metro AG – Post mortem

As I mentioned in the comments a few days ago, I sold my complete Metro position at around 12,30 EUR /share. Including a 0,70 EUR dividend, this translates into a -26,6% loss and is a new entry into my “flop 10” list.

So what went wrong ?

Looking back at my initial post, my original idea was to buy the “ugly” part of old Metro which was supposed to be Ceconomy. This was clearly influenced by missing out on Uniper when it spun off from E.On, which was a similar ugly duck but performed very well.

One observation that I made back then was the following:

Looking at the stock chart we can see that Metro didn’t create a lot of shareholder value over the last 20 years.

When the split actually happened, Ceconomy traded far above the level that I thought would be interesting:

Interestingly, Ceconomy had a very good start, opening around 9,40 EUR and has gone above 10 EUR per share, far above my buying threshold.

Even more interestingly, the “good business”, the Metro Cash & Carry opened at ~20 EUR but then dropped quickly to a low of around 17,70 EUR as we can see in the chart:

Looking back, I think this was where I made a big mistake: I thought that the “Good Metro” then as a consequence must be undervalued if the other part was so overvalued. Combined with the 1 mn insider purchase of the CEO, I bought the shares without doing a real analysis.

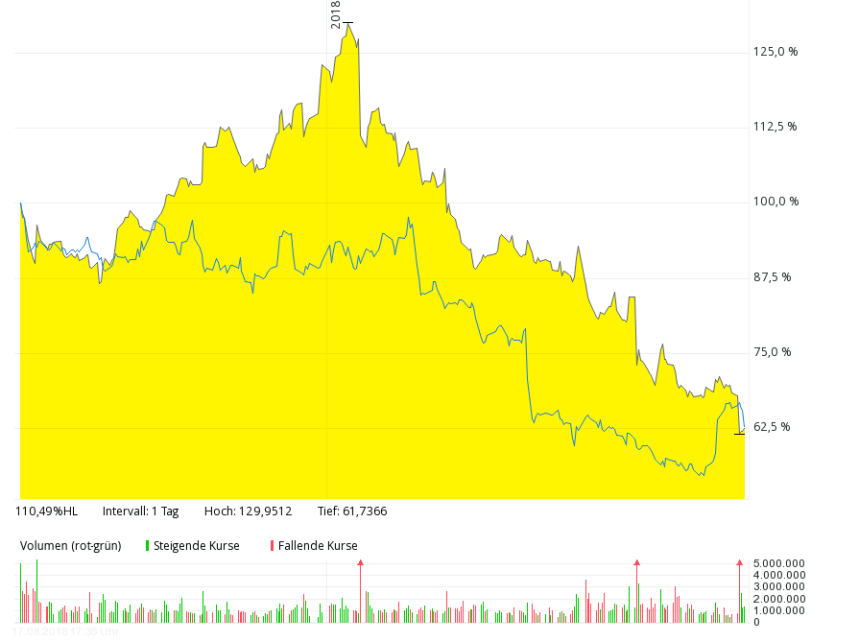

As it looks now, Metro as a whole seems to have been overvalued significantly before the spin-off. Interestingly enough Ceconomy has now reached my initial price that I thought was interesting, however in between the shares almost reached double that level. The chart also shows that both parts of the old Metro have now lost almost the exact same percentage since the split up (yellow: Ceconomy, blue: Metro)

Ceconomy had similar issues in Russia and had to actually pay up in order to get rid of their Russian stores. Interestingly, Freenet thought it is a good idea to buy 9% of Ceconomy at EUR 8,50/share but so far it doesn’t look like a smart decision.

Another mistake I made was to assume that the remaining Metro business would actually be a “good” company. The 20 years of non-performance actually included Media Markt/Saturn which for many years was THE growth engine of the Metro Group.

It’s pretty clear that Real will never make money and the only hope is to sell Real at some point. On top of that, the fact that they don’t make money with Metro in Germany is also a sign that the C&C concept doesn’t seem to work in saturated markets.

The 9M numbers were maybe better than expected but clearly not good. Real is really struggling and also Cashflow and net debt do not look encouraging.

I also was not completely aware how significant the EM exposure of Metro is. The many short sellers were clearly aware of this and made money as the Russian issues would have been not that difficult to detect with some deeper research on the Russian competition.

A final mistake in this case has been that I didn’t have any specific insights into (Food) Retail. My few attempts at retail (Hornbach, Bijou Brigitte) showed very little success and I never dug deeper into the sector. Especially the currently still attractive margins in Eastern Europe seem to be shrinking

Summary:

In short, my investment was a combination of mistakes:

- Assuming that Metro was cheap because Ceconomy was trading too expensive was a mistake

- Not understanding the EM exposure was an additional mistake

- Not knowing a lot about food retail was a mistake

- Sizing the position as large as I did was the final mistake

Just being a spin-off clearly is not enough to justify an invetsment without deeper research.

Maybe now, both Metro and Ceconomy are cheap enough ? I don’t know but for me, once an initial investment thesis is broken, I find it better to exit the position and focus on more interesting opportunities.

Pretty huge net cash position for Ceconomy now (plus probably a nice book profit on the P&L for the Metro stake, though they might not have received the full 16€ on their options). I suspect them to be next on the trading block, I would neither be surprised if Convergenta took it private with the help of a PE house nor if Freenet made some sort of merger offer.

Offer for Metro from the Eastern European investors for 16 EUR /share:

https://dgap.de/dgap/News/adhoc/metro-investoren-kuendigen-uebernahmeangebot-auf-alle-metroaktien-an/?newsID=1162787

Rejection of the current offer from Metro follows right away. Will be interesting to watch. If the Czech win, Koch can look for a new job pretty soon.

Koch new job could be finding how to spend the obscene amount of money he cashed in. As many other senior managers.

Got rid of my Metro position at 14.20, with a ~ 10% loss. Not happy about it, but hey!… better timing that my admired MMI. Probably will set that in GOOG if price goes down to 1100 USD.

Seems like there will be takeover from Daniel Kretinsky and Patrik Tkac, as they might take over 30 percent. I established small position.

Thanks for you comment. very valid arguments. However it looks like that the main shareholder doesn’t think that there is much upside left:

http://www.manager-magazin.de/unternehmen/handel/metro-haniel-verkauft-aktienpaket-a-1224885.html

Haniel seems to sell down at current prices.

Such transactions rarely work without a buyer of the stake. So these two Eastern European guys “think that there is much upside left”. The transaction is at least neutral and not negative as you picture it (in my mind).

Everyone can interpret this as he/she likes. I personally don’t think it is a good sign when the long term family shareholder suddenly sells to two “eastern Euorpean guys”, Maybe these guys are super smart, who knows ? The current Metro shareholders will find out.

So far the current shareholders enjoyed a nice ride that you did not…

Well, as I have mentioned before: I guess 99% of the readers of this blog are much smarter than I am, including of course you.

Dear MMI,

allow me a few comments. First of all, your decision to exit the Metro position makes sense, since your investment thesis did not work out (after roughly a year). But maybe it is just a matter of time.

1) Real will never make money. That is most likely true. Which retailer does actually make money in Germany nowadays? Retail in Germany is brutally competitive. I think it cannot go on like this forever. But you are right, the best outcome for Metro is if Real can be sold.

2) Just because Metro in Germany is loss making doesn’t mean that the C&C concept does not work in saturated markets. Look at Western Europe (without Germany). The margins there are even better than in Eastern Europe. I don’t think the C&C business model doesn’t work anymore. To me the problems in Germany are just country specific and can be solved.

3) EM exposure: Well, EMs are basically where most growth should come from (at least in general and in theory). There are good times and there are bad times. Russia and Turkey are clearly a problem for now, but I think, like in the past, the tide will turn again.

4) Metro doesn’t need to be a good business. In my opinion it is already interesting that the C&C business remained stable over the years when basically no one cared about it. There were many other issues for the management like Kaufhof, Kellerhals, MediaMarkt/Saturn and so on. The question is: what might be the potential of Metro C&C now that the management actually has the time and focus to care about the business?

All the best,

Adjustment