Wirecard follow up (2) – BAFIN, sell side analysts, portfolio managers and others

As promised last time, the follow up to the follow up. Let’s look at a few other “actors” in this developing crime story.

A few updates:

Yesterday, the German authorities started searching offices and private homesa second time with a big team of over 50 people. The new CEO in a feature story of Manager Magazin seems to have found out on his first day that the fraud started at least 5 years ago. After the crazy idiot speculator orgy the last two days, the stock seems to approach back its intrinsic value of 0,00 EUR per share.

The local newspaper SZ “discovered” that the escrow accounts were not the only fraud and and a lot of well known clients & cooperation partners leave the sinking ship rapidly, for instance Aldi Süd, Allianz and Softbank.

My new prediction is that not only the stock is a zero but all debt at TopCo level is essentially worthless.

There is also a very good interview with Dan McCrum on finanz-szene.de which covers a lot of aspects that I have been writing about. Most interestingly, McCrum promises to “tell the bigger story”……

The German Regulator BAFIN and what went wrong there

BAFIN is the German regulator both, for banking and insurance, so for the whole financial industry. As such it is actually a department of the German Ministry of Finance (BMF) and the ultimate boss is German Finance minister Olaf Scholz, whereas the currenn boss of BAFIN is Felix Hufeld, a lawyer by training with a private industry background (BCG, Dresdner Bank, Marsh).

Interestingly Olaf Scholz initially said that there were no mistakes made by BAFIN, Felix Hufeld however directly admitted that Wirecard was an absolute disaster for BAFIN. In politics I guess that means that Hufeld’s days are numbered. Which is a shame as I think he actually did ya good job and not only because he wasn’t a life long civil servant.

The role of DPR as BAFIN “subcontractor”

One of the interesting details that came to light is that BAFIN itself seems to delegate ALL balance sheet reviews for listed companies to the “Deutschen Prüfstelle für Rechnungslegung (DPR) “. This relationship has been cancelled following the Wirecard scandal just a few days ago.

According to BAFIN, DPR got the task to look at Wirecard in February 2019 and hasn’t delivered a report yet. Looking at the Website of DPR shows however, that the DPR process is not really well equipped for a forensic review of an internationally active Group. The process is mostly paper based and they do not travel on site or have experts for each and every jurisdiction. Searching for their publication, one can see that they only looked at “chicken shit” so far.

The DPR is a German “Verein”, founded by a number of Assocations, among them tax advisors and …auditors. In 2019,DPR hat a total Budget of 6 mn but only used 5,5 mn. The company seems to have 15 employees and processes 130-140 cases a year.

From my own experience I know that these guys are quite competent but a case like Wirecard was maybe one or two order of magnitude to difficult for them. In my opinion, relying on DPR was clearly one weak point in BAFIN’s general approach. What I find also very inconsistent that BAFIN nevertheless initiated the then unprecedented Short selling ban on Wirecard in mid February without having an idea about Wirecard itself.

Today DPR itself explained that Fraud detection is not part of their statutes which I think is the reality.

The Bank Holding Exception – a potential systemic risk

One interesting aspect is that Wirecard was not supervised as Group, but only their German subsidiary Wirecard Bank was subject to direct supervision. As the oldest trick in the financial sector is to put a HoldCo on top of a regulated entity and do a lot of dirty stuff there, basically everywhere Holding companies with a majority in a regulated entity are subject to the same supervision.

In my understanding, this is also the main reason why they delegated the case to DPR as they did not supervise Wirecard at TopCo level.

There is an interesting Reuters article from one day ago on this issue.

In 2017, officials from German financial regulator BaFin and the country’s central bank, or Bundesbank, considered placing Wirecard on a list of financial companies to supervise but decided against it, the person said.

In the second half of 2019, there were discussions for months, which involved the European Central Bank (ECB), about putting Wirecard on a watchlist to give authorities more power to investigate it, the person said.

But the talks dragged into 2020 and were still inconclusive when they were “overtaken by events”, even though anonymous sources had given the authorities information about irregularities at the company, the person said.

Considering all the warning sign over the year, I do think that this was actually the main mistake of BAFIN. Embarrassingly, the EU seems to probe this aspect as well according to the FT. Supervising only Wirecard Bank created a false impression of a fully supervised entity whereas BAFIN had no idea what these guys were doing outside the regulated entity.

In my opinion, there is clearly also some political angle to it. Markus Braun, the Wirecard CEO is known to have donated to the conservative party in Austria. Personally, I would not be surprised if he has build up very good relationships as local Champion with the Bavarian Government and the ruling party CSU. Just recently an influential member of the CSU requested that everything is done to “keep Wirecard alive”. This could be an interesting starting point for a local investigative journalist…..

Overall I would say that BAFIN clearly has it’s share in the mess, mostly from a structural point of view. I hope that they will improve some things going forward. I am not sure if this “Holding company excemption” for supervision applies to other Fintechs. If yes, this could be a critical systemic issue.

Bank analysts & Investors

In my initial post I singled out Tim Albrecht from DWS as one of the bad examples, absurdly overweighting Wirecard in his public funds even after the KPMG report became public. To his credit, he gave a public interview but with in my opinion pretty lame excuses: Wirecard shouldn’t have been admitted WC into the DAX, BAFIN didn’t supervise, Bank analysts were positive and how can a “poor portfolio manager” like him see a fraud ?

Typical Dart throwers portfolio managers indeed do not have the time to actually read and understand annual reports or bank prospectuses. Especially in large organizations, they rely on analysts, either internal or “sell side” analysts which have the role as the actual experts

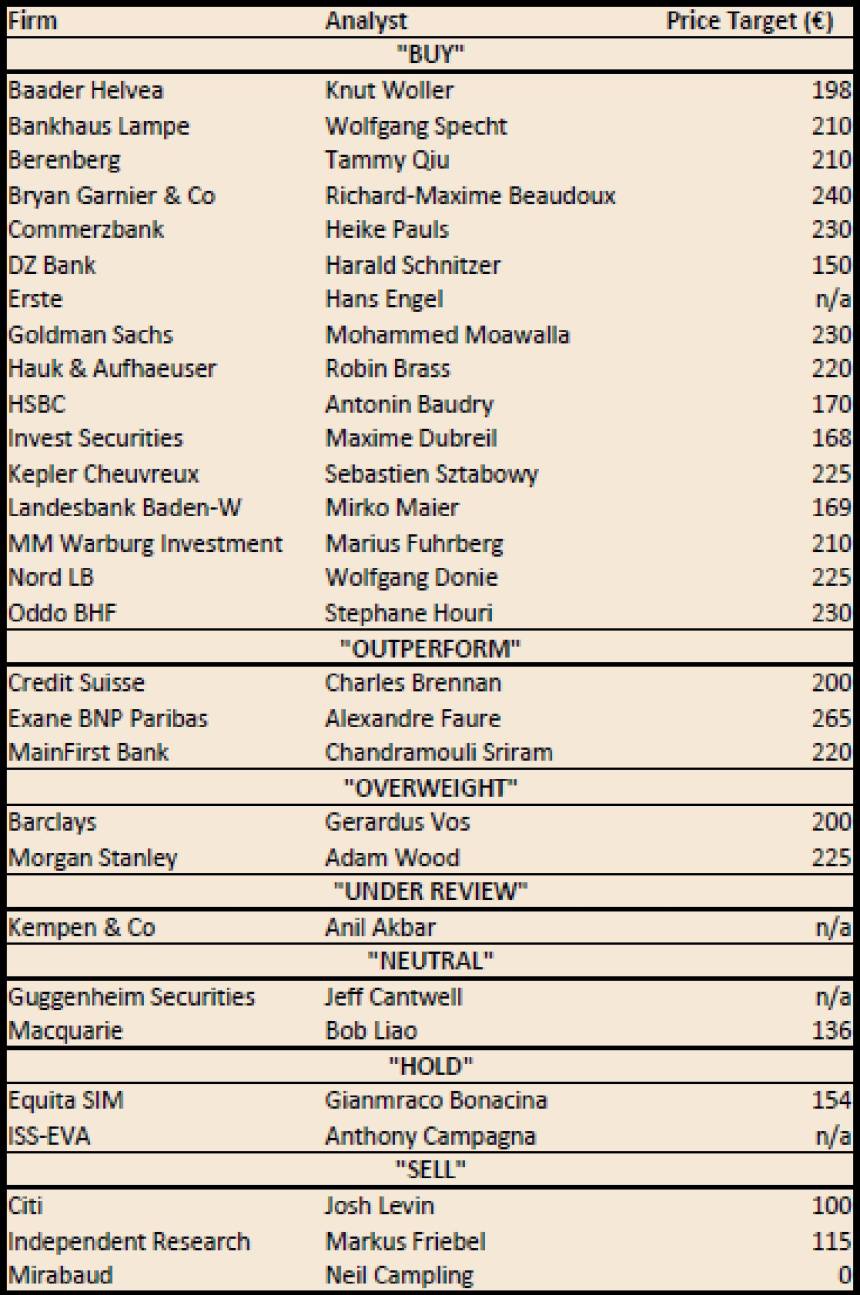

FTAlphaville had a great screen capture of the Wirecard analyst community and their 2019 recommendations here:

Two things stand out: The general very positive outlook and the Price target of 0 of only one guy called Neil Campling (congratulations, a name to remember).

As an example, even after the KPMG reports, both Knut Woller (Baader) and Heike Pauls (Commerzbank) were enthusiastic about irecard’s future.

Especially Ms. Pauls stood out with “Trump like” comments, for instance claiming that the FT is producing “fake news” and other similar cheer leading for Wirecard.

There are many problems with sell side analysts. Few of these analysts have ever seen a company or a finance department from the inside. Few bother to actually read and understand annual reports and only rely on “Investor packages” from IR departments. The main job is usually to update spreadsheets with current numbers and try to predict what the stock will do this year what is a pretty useless exercise anyway.

Almost 5 years ago I summarized my learnings from another smaller UK based fraud case named Globo Plc which had a lot of “fans” in Germany:

Summary:

Most of the principal issues which I see in cases like Globo can be summarized in 3 major points:

1. Don’t outsource due diligence to 3rd parties (auditors, banks, other investors)

2. Don’t believe in what management says, especially when it is on a “privileged” basis.

3. Don’t underestimate potential fraudsters.The best strategy to hopefully avoid such cases in my opinion is to fight the Confirmation Bias and search for opposing opinions wherever you can find them.

I think these points apply directly to Wirecard as well.

Another issue especially for sell side (bank) analysts is conflict of interest. To quote Mr. Campling from a recent interview:

“That is the nub of it,” the UK fund manager said, speaking generally about the industry overall. “Primary fees turn up in big lumps, far larger than any trading commission from a client is ever likely to be. A bank that has received income for doing primary work is very likely to want to have a chance of getting more.”

“Any bank that has not had primary work, but believes it realistically might have in future will not wish to antagonise the potential client,” the fund manager said.

So in order to get primary capital market business (M&A, capital increases, bond issuance). i would be a very bad starting point to have a “sell” rating outstanding. It is as simple as that and therefore I tend to ignore most sell side research.

Finally, both analysts and portfolio managers in my opinion are mostly interested in “stories” that they can easily explain to their investors and bosses. The “digital payments take over the world” story was so easy and convincing that it was just not worth the effort to dig deeper.

In summary, the institutional sector is neither prepared nor incentivised to be critical or detect fraud. To the contrary, as long a stock goes up, everyone has every reason for “cheer leading” even fraudsters like Wirecard.

Short sellers / Journalists

So far, all the players (Management, Employees, Auditors, Regulators, Investors adn Portfolio Managers) either didn’t have the means to detect the fraud and/or no incentive to do so.

That leaves Journalists and Short sellers as basically the only two groups that have an incentive to uncover fraud. A relatively sophisticated fraud as Wirecard is pretty hard to detect for a “normal” journalist, so as often, the short sellers were the ones who blew the whistle early.

Plus, classic investigative journalism is in decline due to the problems of the traditional print media industry. The Financial Times and the WSJ and maybe Bloomberg News are the “last men standing” and I guess it is no surprise that the FT was most active.

German business media is a pretty toothless tiger these days. WiWo and Manager Magazin had a few stories but didn’t digg in the same way like the FT. The best coverage in Germany came from a small outlet called finanz-szene.de which I think is one of the best sources for the financial sector (incl. Fintechs) in Germany these days.

One of their highlight was a pretty good deep dive in 2018 why the margins of Wirecard made no sense if you compared them to competitor Adyen.

Short sellers are clearly the group that both has an incentive and usually the ability to detect fraud. However, most short sellers are happy if they achieve some sort of short term success and then move on. Very few of them are as persistent as David Einhorn or Bill Ackmanin their earlier days.

Especially in Germany, short sellers are seen in the public as pure Villains. Even a week or so ago, Handelsblatt’s main concern seems to have been the profits made by short sellers.

For Germany I would summarize it as follows: With a pretty toothless mainstream press and an aversion of anything related to short sellers, Germany is a very fertil ground for fraudsters running listed companies.

My personal opinion is that there might be a business opportunity for a specialized investigative entity.

Other players, potential Blackmailing

In some of the sort seller reports, some names were mentioned that helped Wirecard in foreign jurisdiction. However the extent of fraud at Wirecard is so big that I speculate that their might be another issue.

One of the under reported aspects of the Bernie MAdoff scandal was, that some of Madoff’s investors knew exactly what was going on and most likely blackmailed him to deliver crazy returns to their accounts, especially a guy called Jeffry Picower seems to have extracted 7 billions from Madoff:

Jeffry Picower and his wife, Barbara, of Palm Beach, Florida, and Manhattan, had two dozen accounts. He was a lawyer, accountant, and investor who led buyouts of health-care and technology companies. Picower’s foundation stated its investment portfolio with Madoff was valued at nearly $1 billion at one time.[113] In June 2009, Irving Picard, the trustee liquidating Madoff’s assets, filed a lawsuit against Picower in the U.S. Bankruptcy Court for the Southern District of New York (Manhattan), seeking the return of $7.2 billion in profits, alleging that Picower and his wife Barbara knew or should have known that their rates of return were “implausibly high”, with some accounts showing annual returns ranging from 120% to more than 550% from 1996 through 1998, and 950% in 1999.[114][115] On October 25, 2009, Picower, 67, was found dead of a massive heart attack at the bottom of his Palm Beach swimming pool.[116] On December 17, 2010, it was announced that a settlement of $7.2 billion had been reached between Irving Picard and Barbara Picower, Picower’s widow, the executor of the Picower estate to resolve the Madoff trustee suit, and repay losses in the Madoff fraud.[117] It was the largest single forfeiture in American judicial history.[118] “Barbara Picower has done the right thing,” US Attorney Preet Bharara said.[117]

My wild guess is that some of the money that was not just invented but disappeared at Wirecard via bogus loans and bogus M&A might have flown to people who knew what was going on and blackmailed Wirecard.

If you deal with “real” criminals, than there is a high likely hood that at some point in time they stop “helping” but turn against you. I think we will see in a few years if something like this happened.

Overall summary

I think it is now time to end my Wirecard coverage for the time being and focus on investments again.

My summary would be as follows: It is not coincidence that such a fraud was so successful especially in Germany.

The combination of structural issues at the regulator, a toothless press and adversity against short sellers took out the only Groups of people who have an interest in uncovering fraud.

From the official side, no one is officially responsible for fraud detection, neither BAFIN, nor the Auditors nor DPR which is clearly a systemic issue.

It will be interesting to see if and what changes but my hopes are not high. It will also be interesting if and who will be convicted, but again, Germany has a bad track record in actually punishing fraudsters. No one was ever convicted for instance for listing and selling shares from obviously fake Chinese companies or equally obvious worthless “Mittelstandsbonds”.

One of the most striking examples is that the Founder and CEO of another big fraudulent company, Thielert AG, never had to serve a single day in jail, despite being convicted to 4 years of Jail in 2017.

This lack of punishment combined with the aspects above makes Germany a very fertile ground for fraudsters and I think one thing is sure: Wirecard will not be the last in a long series of fraud cases in Germany.

Is JOYY the new Wirecard

??www.bloombergquint.com/technology/joyy-shares-plunge-after-research-firm-says-it-s-a-fraud

https://www.muddywatersresearch.com/research/yy/1/

Unbelievable: E&Y was very close to approving the 2019 report despite the KPMG findings:

https://www.ft.com/content/568d5f9f-ebbe-48fc-a7b7-0ebf34c3cb83

Manager Magazin confirms: Former CFO “L.” has been imprisoned as well.

https://www.manager-magazin.de/unternehmen/banken/wirecard-drei-neue-haftbefehle-a-4333e8b4-6e22-43eb-be16-cd0599443da6

Now we are talking: Braun again imprisoned plus two former board members (Ley ?) ?

https://www.sueddeutsche.de/wirtschaft/wirecard-staatsanwaltschaft-muenchen-1.4975746

The allegations are very similar to “real gangsters”.

Very interesting article in “Der Spiegel” on how far the political connections from Wirecard went. Hint: all the way to the top….

https://www.spiegel.de/politik/deutschland/wirecard-kanzleramt-setzte-sich-fuer-finanzdienstleister-ein-a-e5b50a9f-128d-4bda-b7d5-907e2fea9f7c

Very impressive. Thanks!

Pingback: Bruce Packard » Remorseless

While the role of analysts, funds, the press, Bafin, Auditors in the Wirecard disaster has been discussed very thoroughly, the role of German stock exchange has not been covered. The DAX index consists of 30 companies, quite overseeable. Wirecard replaced Commerzbank in Sept 2018: The German procedures for listing a company a quite bureaucratic [ Zulassungsverfahren], the prospectus emissi has to be cleared by Bafin [ again!], Auditors and the management of German Börse. The CEO of Deutsche Boerse T. Weimar [ 5mEuro compensation 2019] has to sign off, and as former CEO of Uncredit he should be able to understand the business model of Wirecard.

Interestingly enough there are NO reports, no press statements about Wirecard on https://www.deutsche-boerse.com/ after June 2020…

Thank you for your excellent summary, once again!

I also was reminded to Globo – where I still thank you for an early sharp eye that helped me avoiding the losses.

I just miss two details in the summary even if you already desribed them in your first part:

– Short selling a fraudster includes a quite high risk as a fraud can easily fake numbers, resulting in a multiplied share price. People who realized the wirecard fraud as early as 2008 and regularly tried to short the share would have been burned several times. Risk control is essentially.

– Intimidation by lawsuit threats (as Armin already wrote): You described how you got intimidated, quite succesfully.

I never forget the first posting in a shareboard discussion about WireCard: “Da die WireCard AG wiederholt rechtliche Schritte gegen dieses Forum eingeleitet hat, sehe ich mich gezwungen, jede Diskussion über dieses Unternehmen zukünftig zu unterbinden. Ich bitte daher jeden User eindringlich, Diskussionen über Wirecard nicht mehr oder an anderer Stelle durchzuführen.”

Which German journalist, which journalistic medium has the guts of FT to continue publishing unveiled critical reports after beeing threatened with lawsuit / “Unterlassungserklärung” by Wirecard or another fraudster company?

Correct, and if you do it anyway via Wallstreet:online your account will get suspended cause Wallstreet:online ist happy to support the professionell pushers in the threads and to make their own users (content creators) to victims. There it is not a matter of guts it is a matter of profits cause w:o ist happy to make business with those people. It is an important part of their business model but no one cares…

🙂

Great Coverage of Wirecard, compliments for this Blog,very good research, I learn a lot, thank you. „FT“ was far ahead the curve, that´s right. To save the reputation of German journalists and some of my colleagues a little bit: WiWo not only had „a few stories“, but very critical reports with new facts about Hermes, TPA , the loans and trustees (and one special law issue with Wirecard).

I personally do not want to praise our work, so maybe you allow me to quote Chris Hohn´s criminal complaint at the public prosecutor’s office in Munich : „…in the view of TCI, the KPMG report published by Wirecard on 28 April 2020 as well as public reporting, including that in the Financial Times and WirtschaftsWoche, reveal anomalies that may have criminal relevance. This relates to the purchase of Hermes I Tickets Pte. Ltd. in India, the so-called „third-party acquiring business“ as well as the granting of loans within the scope of the so-called „merchant cash advance business“.

Thanks for clarification, i maybe have missed them.

Your reporting on Wirecard is the most informed and interesting, right besides that of the Financial Times. Thanks for letting us benefit from your insights and experiences.

Thank you very much !!!

I think this is all nonsense. I still trust Share Wizard and Matthias Linke. And I believe he is good looking.

https://sharewizard.de/wirecard-aktie-ft-skandal/

Excellent covering! As far as the „toothless press“ ist concerned: Journalists and editors are not enough protected by law. In my Geldanlage-Report I always have been trying to protect shareholders since many years and to expose frauds, but often you are muted immediately, you have to sign „Unterlassungserklärungen“ otherwise you’re threatened to pay hundreds of thousands Euros or you have to engage in a costly law suit. And you know probably very good how things work in the biggest German stock market board where you have been writing the first post at all about Wirecard 😉

Thanks. That is a very good point, too!!!

Thanks for the great content. You give great insights and help to understand this fraud. Very much appreciated!

I want to add one aspect in reference to journalism in general: The business became more and more dependent on advertising. So, there is a conflict of interest in reporting facts, that might be a critique for the advertising companies. Furthermore, shrinking revenues and therefore cost cutting for editorial departments mean, that there is low or no capacity to report deeper.

Heute hatte es mich gefreut zu lesen dass Softbank Group kein Geld investiert hatte / oder effektiv nicht mehr hat. 🙂

Anyone would have access to the report by Neil Campling? I am quite surprised to see a TP of €0 in a big company, kudos to him!