All Swiss Shares Part 6 – Nr. 51-60

Another 10 randomly selected Swiss shares with very short “High level” analysis. This time, I actually identified three companies that are worth watching. Enjoy !!!

51. Sika AG

Sika is a 43 bn CHF market cap specialty chemical company that produces material for the building sector. What makes the company especially interesting is the fact that despite being very dull at the surface, the stock went up by 10x over ther last 8-9 years. Even Covid-19 could not stop Sika:

The company has been growing double digits in 2018 and 2019 according to the IR presentation and EBIT margins have surpasses 14% in 2020. The company predicts 6-8% growth going forward and EBIT margins of 15-18%.

The company claims to be very active in CO2 reducing solutions like concrete recycling which might explain why the Gates foundation owns 5% of the company. The company has been controlled by the Burkard family which owned 16% of the shares but controls 51% of the votes via a typical Swiss A/B share structure.

Interestingly, Sika was the target of a long running take over attempt by Saint Gobain which ended unsuccessful in 2018/2020. So it seems that Sika currently is not controlled by anyone.

The flip side is that the valuation currently is around 50x 2020 earnings. even with the envisaged earnings growth, this looks like “fully valued” to me. So unfortunately this is a “pass” due to valuation issues. However Sika is a good example how even a super boring company can transform itself into a highly interesting “quality growth” stock.

52. Ascom Holding AG

Ascom is a 560 mn CHF market cap company that is active in the healthcare and telecom IT sector. On the plus side, the company had relatively stable 2020 sales, had a very nice uptick in cash flow generated and doesn’t have financial

debt. On the minus side, Ascom’s stock price has been stagnating for a very long time:

The business seems to be very project driven (recurring revenue ~25%) . Comparing 2020 with 2016, it is pretty clear that they haven’t made a lot progress over the laust 5 years or so. With a target EBIT Margin of 10% in 2021 and a single digit sales increase, Ascom still trades at ~17xEV/EBITDA which for such a business looks fully valued. “pass”.

53. Rieter Holding AG

Rieter is a 850 mn CHF market cap “old school” industrial company producing machinery for the whole value chain of textile production.

The company got hit hard in 2020 because of Covid, experiencing significant losses to the extent of a negativ net margin of -16% and a decline of sales by 1/3, indicating the clearly cyclical nature of the business. The stock price has recovered since then to the level where the stock has been trading for the last 10 years or so:

Personally, I am somehow missing a perspective how this company can create a lot of shareholder value going forward, therefore I’ll “pass”.

54. UBS AG

UBS is Switzerland’s most famous Bank / Asset management group with a market cap of 55 bn CHF. On the surface, it looks like a “value” stock with a trailing P/E of ~8. On the plus side, returns have increased significantly in 2020, Return on Equity is with around 10% quite acceptable for a bank and in contrast to local competitor Credit Suisse, UBS avoided to be drawn into most scandals (Greensill, Wirecard), although Archegos cost them almost 800 mn, which however is only a fraction of the 4,5 bn hit to Credit Suisse. In addition, with Ralph Hamers they have a new CEO who not only has a pretty cool name for a CEO but he also has a great track record of shaping ING into the leading European Digital Bank.

On the minus side, UBS business model, combining investment banking with High Net worth Wealth Management is clearly related to positive capital markets. The current environment with lots of IPOs and strong performance of esp. Alternative asset classes is a “Goldilocks” environment for UBS.

The stock market doesn’t believe that UBS can continue its recent trajectory. If I would be forced to invest into a bank, UBS would be clearly on my short list. On the other hand one could argue that the market seems to have priced in future risks to a certain extent which could make UBS interesting, especially if a wave of consolidation in the European Banking sector would happen. Nevertheless I am not a fan of “Big Banks” and “pass”.

55. Glarner Kantonalbank

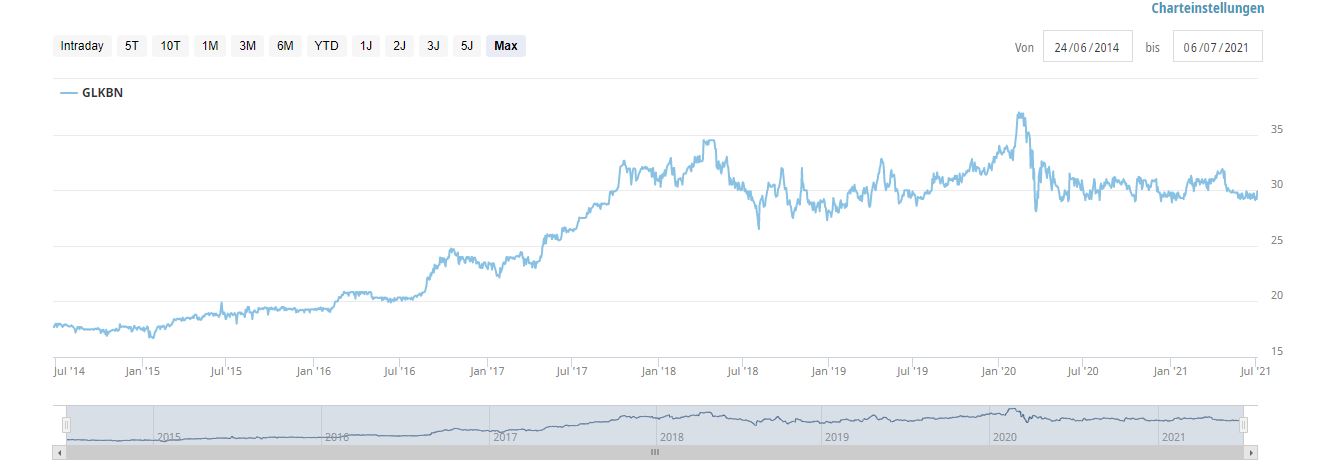

Glarner Kantonalbank is a 340 mn CHF market cap regional bank located in the Kanton Glarus. With a P/E of 13 and a dividend yield of around 3,7% it represents one of the cheapest Swiss stocks, What I find remarkable is that the bank has manged to increase profits significantly over the last 10 years despite the negative interest rate environment in Switzerland. Since 2014 for instance they more than tripled EPS from 0,60 CHF to >2 CHF in 2020 which is not really reflected in the share price:

From what I read in the most recent annual report, local governments still hold ~85% in total of the shares but it seems that it is intended to “decouple” the bank further from the Kantons.

Overall I find the situation quite interesting and I want to learn more about them. “Watch”.

56. SIG Combibloc AG

SIG Combibloc Group has been IPOed in 2018 and has been held by a PE investor before. The share price since then has been slowly by steadily appreciating:

The 8.4 bn CHF market cap company is mostly active in (paper) packaging and has performend quite well in 2020 with slightly increasing sales. Adjusted EBITDA Margins look very healthy at around 28%.

“Adjusted” net income is at around 230 mn CHF, similar to Free cashflow, resulting in a P/E multiple of 36, actual net income was a lot lower at 68 mn CHF. As a former PE company, they also carry around 1.3 bn CHF in debt debt.

Overall, SIG looks like a solid high quality business, however the share price looks like “fully valued”. Therefore I’ll “pass”.

57. Adval Tech Holding

Adval is a small, 129 mn CHF market cap company that manufactures metal and plastic components.

The company has been stagnating for some years before Covid-19 hit and profits dropped by around -50%. This shows in the uninspiring chart :

At a first glance it doesn’t look like something will change to the better in the future, therefore I’ll “pass”.

58. Datacolor AG

Datacolor is a 109 mn CHF market cap company that specializes in colors and printing. Their 2019/2020 business year (ending in September) was negatively impacted by Covid, resulting in a loss. The first 6M 2020/2021 clearly looked better.

Looking at the long term chart, there seems to be some value creation but with a lot of ups and down.

On the plus side, the company seems to have been able to grow at least in the low single digit for some time and they seem to sit on significant net cash which according to their half year report stood at 49 mn CHF or almost 50% of market. Assuming a continued recovery, this makes the stock super cheap (6M profit at around 5 mn CHF).

On the minus side, the stock is super illiquid. ~83 % are owned by a pool of shareholders.

However, this might be a stock to look a little bit deeper into. “Watch”

59. Meier-Tobler AG

Meier-Tobler is a 211 mn CHF market cap company that specializes in heating, ventilating and cooling of buildings. The company is the result of a merger between Walter Meier AG and Tobler 4 years ago which didn’t really work out well as it can be seen in the stock chart:

Interestingly, main shareholder UK based Ferguson Plc sold its 29% stake last year for 8,75CHF/share which as of now doesn’t look like a smart move.The majority owner Silvain Meier offered all minority shareholders to participate at the same price which I find very shareholder friendly.

In the meantime the shares have more than doubled. With currently around 500 mn CHF in sales and assuming that Meier & Tobler will get back to its previous profitability (~8% EBIT margins), Meier Tobler could become really interesting.

I also think that their business could be positively impacted from the ongoing Decarbonization and Energy transition, as buildings are a major factor in CO2 emissions and a lot needs to be done (and modernized) to lower the Carbon footprint of the sector.

Therefore I put Meier Tobler onto my “Watch” list for deeper analysis.

60. Calida AG

Calida is a 300 mn CHF market cap textile company active mostly in underwear and lingerie. The business has been low margin before Covid-19 (~8% EBITDA margin) and hasn’t improved during the pandemic.

The company has net cash but sales have been stagnating for some time in line with the share price that has been doing nothing over the last 10 years. “Pass”.

Apologies if you have answered this before, as it has been a long since you have started with the series on German stocks… but how long on average (or a range of time) do you spent on these quick overview? Many thanks.

Between 1 and 30 minutes per stock I would say….

On WIRECARD article >> of course the company was filled with assholes ! What do you expect from a company whose headquarters are in “Arschheim” ?

Well, the company was actually founded in Grasbrunn and only moved to “Arschheim” in 2011. The main assholes were already onboarded before that,

The whole Bank consists of the main office + 6 branches. And a 15? of bankautomats…

Maybe the have a really BIG mailbox….

You are missing the important aspect that Calida AG offers free pyjamas for their (registered) shareholders. At least they did in the past (for a minimum of 20 shares held). This may change your view but other than that the fundamentals do not look very promising.

oh, I missed that one. The pyjamas might look funny in my tax returns though….

I would guess that GlarusKB is one of the less sustainable K-banks in CH. The Kanton itself is, at most, stagnating economically, and the Kanton’s economy is very small in order to keep running a KB bank.

Anyone knows about the Cyberattack to Omya in 2019?

Thanks for the comment. I was just surprised by the steady increase in earrings and the relatively low cost ratio.

I am not an expert in Swiss Banking. However, have you looked at their leverage? It seems pretty high. In addition, I find a pe-ratio of 13,4 not exactly cheap for a bank. Nevertheless, keep the good work up.

The whole Bank consists of the main office + 6 branches. And a 15? of bankautomats…

Some comments :

– Rieter : Luc Tack from Picanol took a 10% stake recently. Picanol buys the machines from Rieter so there is interesting vertical synergies potentially. 2 other major holders include the owner of Stadler Rail. So there might be a fight for control or collaboration between great business people.

– Meier Tobler was hacked badly in 2018. Still recovering from it. It is more of a chain of plumbers which has therefore interesting economics

– SIG is the smaller rival of Tetra Pak.

thx for the insights !!

SIG Combiblock is the competitor of TetraPak. SIG alone is not !

Sorry, but for what is Picanol buying Rieter machines? This is a different part of the Textile value chain.

Rieter’s customers are spinning mills (smaller local companies) present in Turkey, India, China, Uzbekistan.

The share acquisition of Picanol and Luc Tack from Pieper was clearly well timed.

Key driver for the share price is the order book and profitability. Customer end-markets (financing, subsidies, cotton-yarn spread) drives end-markets and the utilization and machine mix drives the profitability (e.g. Rotor and Air Jet > Compact > Traditional Ring on the actual spinning machine)