Carvana: The Armchair Investor’s perspective & Could Auto1 become the “German Carvana” ?

Background/Introduction:

For some reason I ran into a “Twitter battle” about Auto1, with the main Bull case being that Auto1 is the German Carvana. In addition, some good investors that I follow have revealed Carvana as a position.

Time to have an “Armchair investor” look into Carvana. The goal here is two fold:

- Understanding if Carvana as such is a good business (and maybe even interesting as investment)

- Finding out if Auto1 could indeed is or can become the “German Carvana”

Full disclosure: the guy who is writing this, lost significant money with investing into Cars.com, another US online car company. So as always: PLEASE DO YOUR OWN RESEARCH !!!

The Carvana Business “Bull Case”

important: Just as I was about to finish the post, Rob Vinall has released his 2021 letter to investors with a very convincing pitch for Carvana. I highly recommend to read it first.

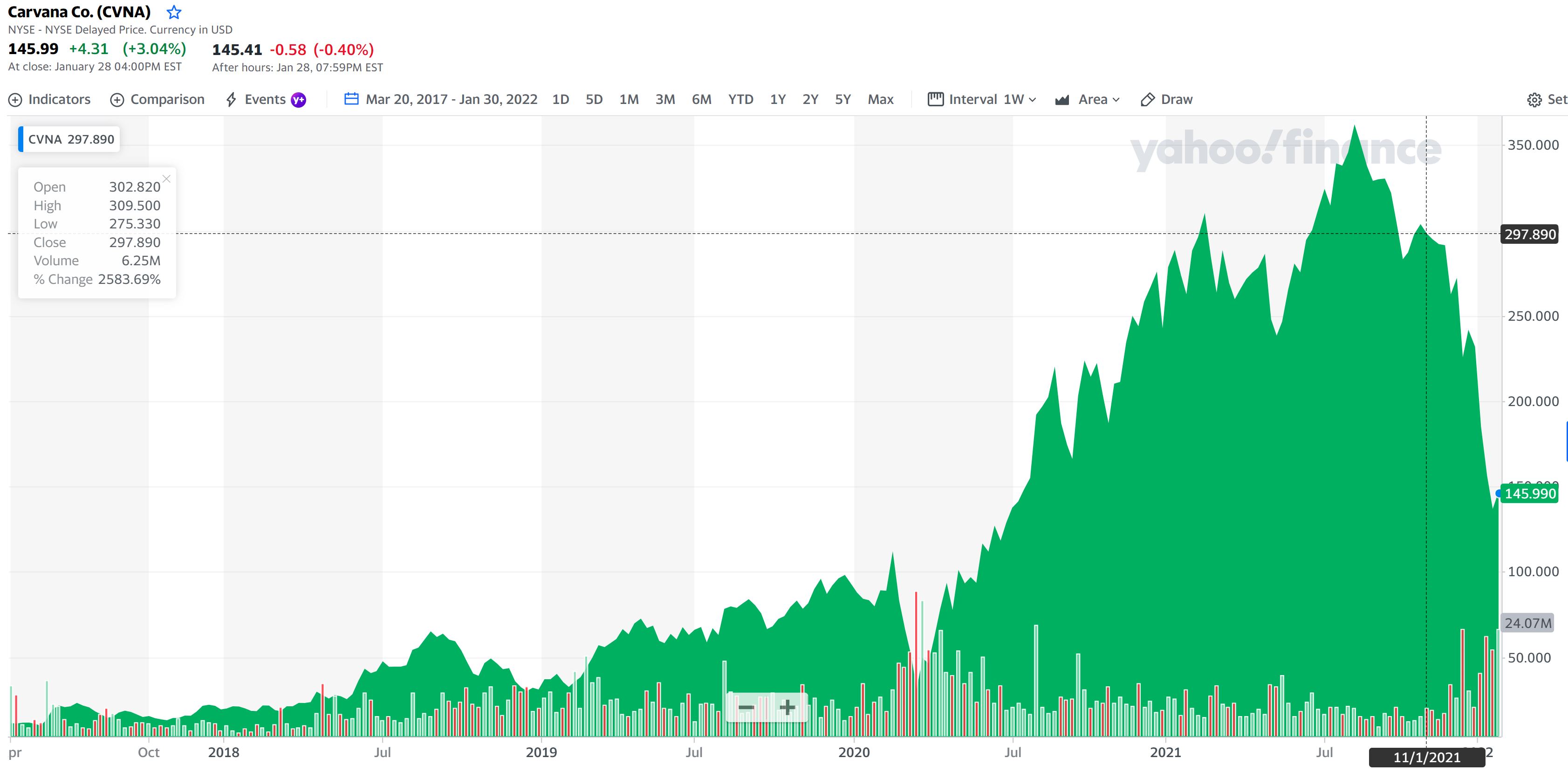

Carvana is a 25 bn USD market cap company, that similar to Auto1 is buying and selling used cars online. The share price has been suffering lately:

A big difference to Auto1 is that Carvana historically mostly bought wholesale (i.e. from rental companies and the well developed US auction market) and then sold directly to Consumers (B2C) whereas Auto1 still mostly buys from consumers and sells to businesses (C2B).

Carvana is famous for its “24 hours used car vending machines”, but customers can also get their cars delivered to their home with a 7 day “no questions asked return” period. An introduction to the business model of Carvana can be found here.

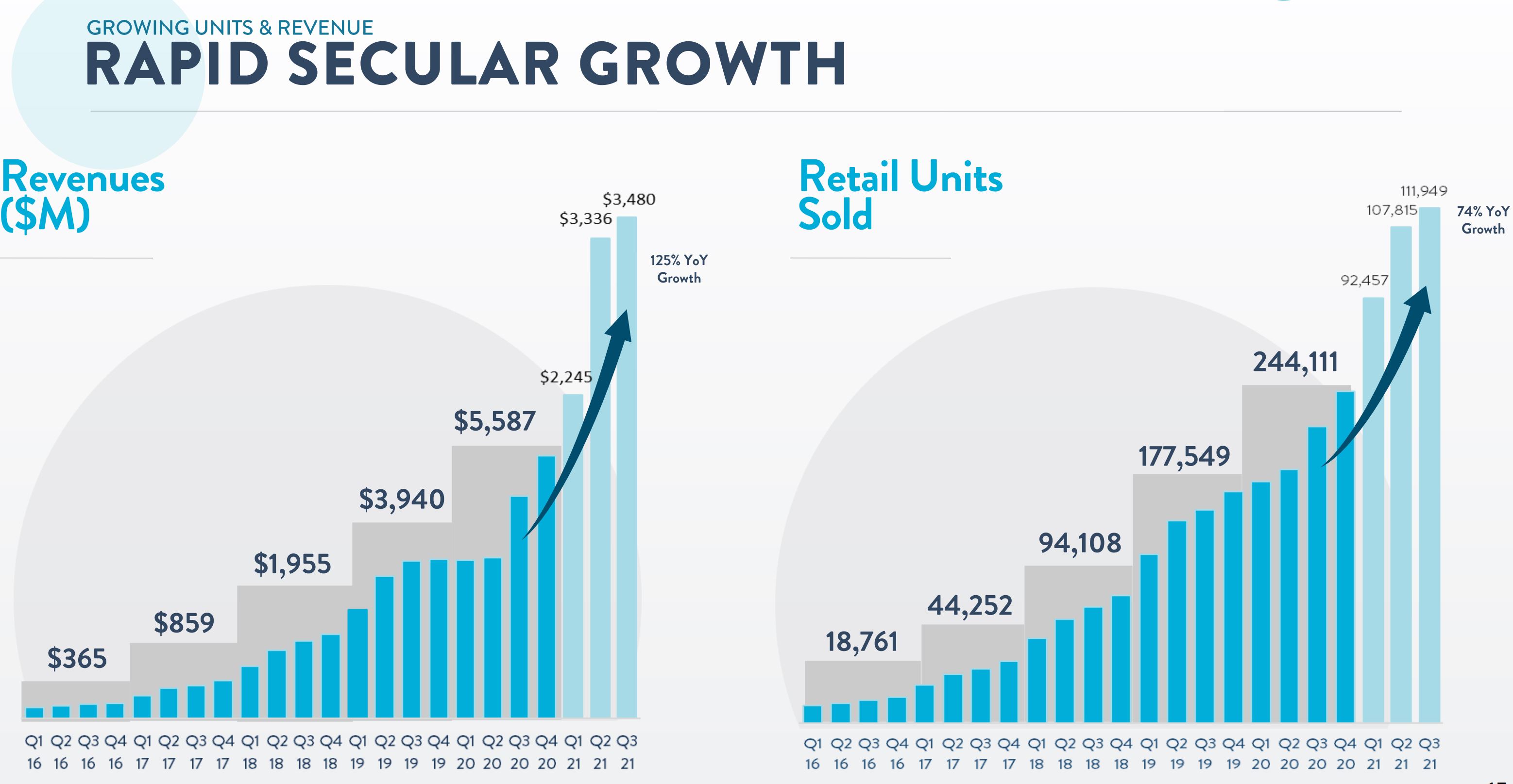

The company has been growing like crazy, from 130 mn USD sales in 2014 to 5,6 bn in 2020 and most likely more than 10 bn in 2021. These charts show the impressive growth:

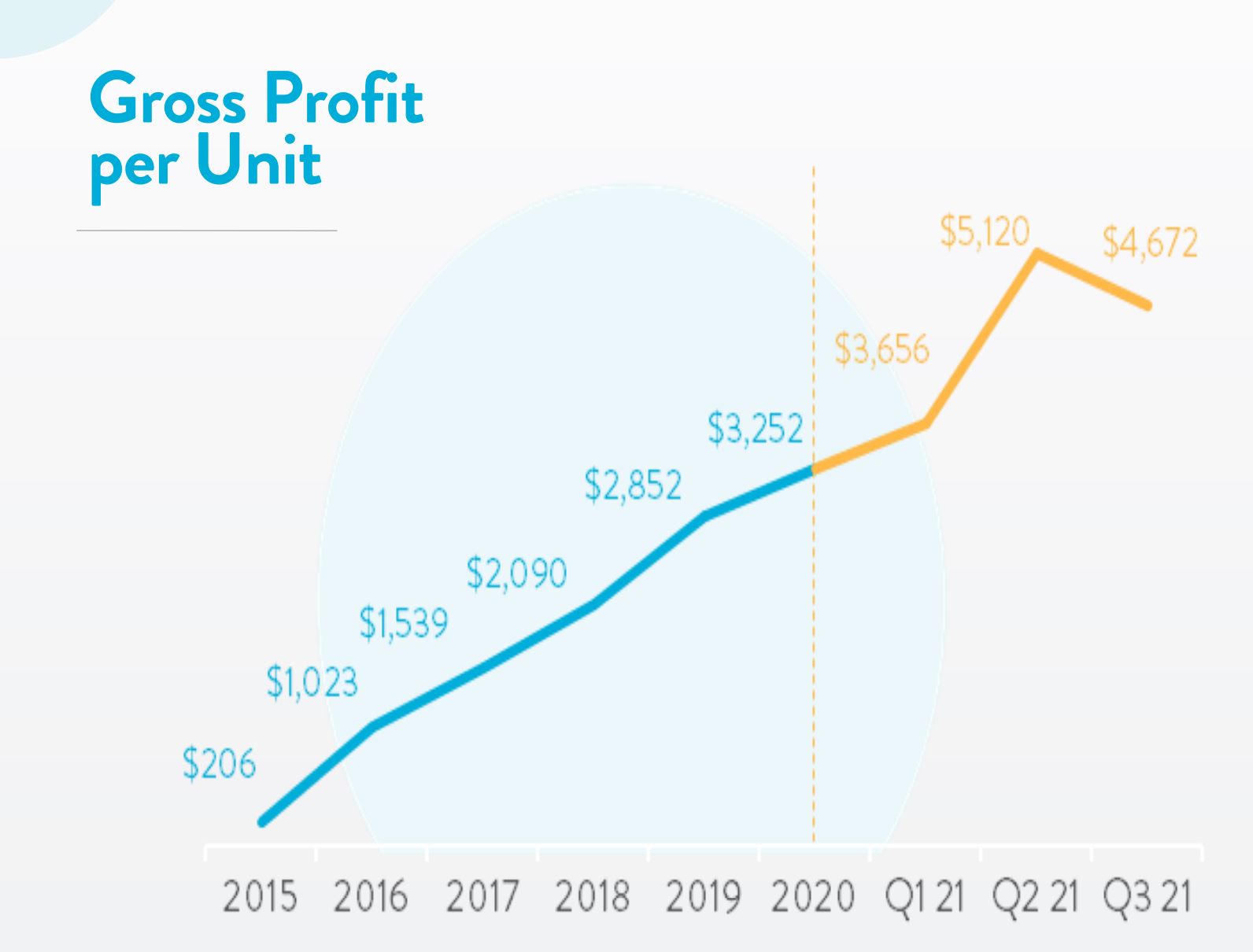

Even more astonishing is the gross profit per unit:

Despite the growth, Carvana still only is about 1% of the 900 bn USD US used car market, so there is a lot of room to grow for them based on TAM.

The company turned EBITDA positive in Q3 2021 and in the long term plans to have much higher margins:

So let’s assume that Carvana will eventually reach 10% market share (not much) and 10% EBITDA margins, this would mean roughly 90 bn in sales and 9 bn EBITDA which compared to today’s valuation of 25 bn looks like a steal, depending on when the reach it.

Some observations:

- The number of vending machines hasn’t increased since 2020. It seems that these machines are more a marketing gag than an integral part of the business model

- They operate a small B2B vehicle selling business with much lower GPUs and average ticket size. The GPU for Retail is really substantially higher.

- By its nature, the business is capital intensive. Carvana had to raise capital several times since is IPO and is carrying net debt of around 3,3 bn USD. More sales mean more inventory which means more capital required.

- Free Cashflow in the first 9M 2021 was minus 1,8 bn USD. It needs to be seen when and if they can fund the growth from internal CF

- The business had extreme tailwinds from the increase in used car prices over the past months. This helped to increase sales as well as GPU. It needs to be seen how these KPIs develop when the market is normalizing

- more than 50% of the GPU are not from selling vehicles but from providing financing (and insurance) to customers

- Carvana originates car loans but sells them on and records an upfront profit. They seem to keep a portion of the securitization vehicle on balance sheet.

Related party transactions

Here it gets kind of interesting. The father Ernest Garcia II of the current CEO Ernest Garcia III owns a company that also sells used cars and provides auto loans. This company is called DriveTime and used to be a listed company called UglyDuckling. The company IPOed in 1996 and then was taken private at a much lower value in the early 2000s. DriveTime seems to have focused always on clients with a “problematic” credit rating.

To make things even more interesting, Carvana sells the loans to a company owned by the father Ernest Garcia II (who is a convicted felon). This has arised interest from the press a few times and articles can be found for instance in Forbes and the WSJ. Carvana is actually a spin-off of DriveTime, which itself seems to sell mostly B2B.

To make things more complicated, Carvana also buys cars from DriveTime, buys and leases back inspection centers from another Garcia company and Ernest Garcia III seems to own a significant stake in DriveTime.

To top off things, Garcia II has sold around 3,6 bn USD worth of shares already. Not surprisingly, short sellers are circling the company and claim that Caravan is a big fraud.

One other aspect to be considered is the following: It seems that most of Carvana’s business comprises sub prime auto financing. This is from a comparison site:

Carvana considers working with consumers regardless of their credit history — although there are age and income minimums. Because it doesn’t require people to have minimum credit scores for a car loan, you might qualify for a Carvana loan even if you have low credit scores.

and

Since there are no minimum credit score requirements or prepayment penalties, it could also be a good fit if your credit history has a few dings or if you plan to pay off your car loan early.

Carvana is not disclosing a split of how much of their loans is subprime. However selling cars to people who would otherwise not get any vehicle or a comparably expensive vehicle can explain the growth achieved to a certain extent. One question that would be interesting to look at is the following: How large is the sub prime market and how would GPU etc. look for the Prime market ?

Assuming a 10% market share overall for Carvana doesn’t seem much, however if that would be 50% or more of the subprime market, then it might be already a “stretch goal”.

Limits of Armchair Investing

For me as an “armchair” investor, both, the related party topics and the subprime angle make Carvana uninvestable. However, for professional investors who know the US market and can judge how long the arms of the Gracia’s are when they transact between themselves, things could be different.

A quick look at the share price shows that similar to other highflyers, Carvana’s stock has suffered and is (almost) back to pre pandemic levels, without being cheap based on my understanding of the business:

However competitor Vroom has been hit much harder by the recent selldown than Carvana, similar to Auto1:

And this despite Vroom’s effort to mimikri Carvana by buying a non-prime auto lender recently.

Auto1 vs Carvana

The current bull case for Auto1 is that Auto1 is actually the German Carvana and should be valued accordingly (i.e. more like 2,5-3 times sales vs the current <1 multiple.

As mentioned above, this is very questionable, as Carvana is mostly a B2C business whereas Auto1 is exactly the opposite, i.e. buying retail and selling wholesale (C2B).

This is why the avg selling price for an Auto1 car is only around 1/3 of Carvana, and the GPU only around 700 EUR which in my opinion maybe just covers marketing cost.

With Autohero, Auto1 has now added a copy of the Carvana model and tries to sell retail. The segment grows relatively quickly but is currently only around 14% of sales and GPUs are even lower at around 400 EUR. And this is before marketing costs.

The main problems in my opinion with Autohero are the following:

1) They had to create a separate brand which makes advertising very costly. The original brand says “we buy your car” and is obviously not a good fit for this business model. So they are now in the strange position, that they need to advertise separately to buy and then to sell a car which in my opinion is not sustainable at all.

2) My main issue with Autohero is that the used car market is very different in Europe and Germany compared to the US. The used car market in the US is ~900 bn annually, Germany is around 100 bn EUR annually and Europe seems to be 400 bn EUR, so roughly half of the size. Rolling out across Europe is much harder, due to different languages, preferences and cultural differences compared to the US (and in some countries, the steering wheels are on the wrong side).

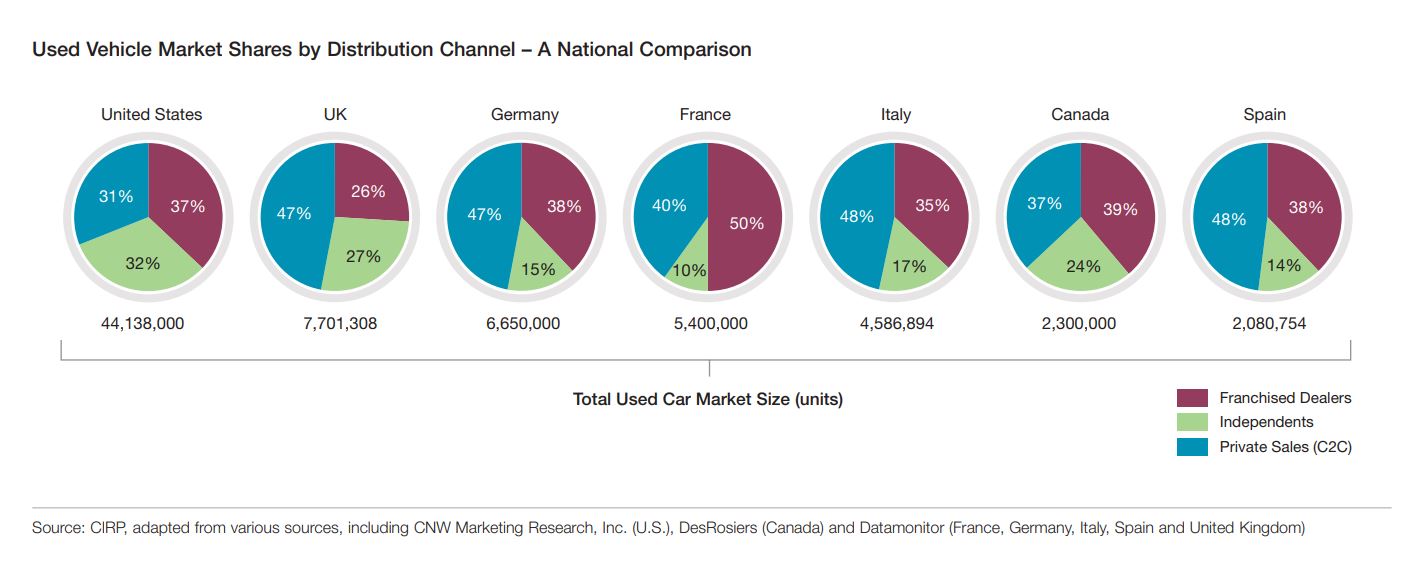

Another big difference is that the market as such is structured very differently from the US:

Germany for instance has a very developed C2C market (see above) dominated by the big portals Autoscout and mobile. the share in value of the C2C market is much higher than in units. This makes the market quite transparent. Both, Autoscout24 and Mobile have already started to create and sell their own inventory online (smyle for Autoscout, mobile vs. Instamotion).

Another difference is that in Germany the share of independent dealers, who might struggle to offer an online channel is very low. Most dealers actually belong to OEMs and they are rolling out online business models at large scale as well.

So even if Autohero would become a success, its TAM and runway would be a lot shorter than Carvana’s in the US, but looking at the competition, this will be really hard and expensive.

On top of all this, I think it will be very difficult for Auto1 to pull off an equally profitable car financing business. The subprime market as in the US doesn’t really exist like in the US and in general financial institutions are not getting away in charging interest rates like in the uS.

Auto1 has bungled Auto1 Fintech via a series of shady deals that forced co-founder Hakan Koc to step out form the Management. All the other competitors (portals, OEM) offer cheap and easy financing, so I think with regard to the subprime part of Cravana, this can not be replicated in Europe and Germany.

Finally, Auto1 will face much more dilution than Carvana which was able to raise the required capital at a much higher valuation.

Wrapping up Auto1 vs Carvana:

Overall, for me the answer to the initial questions look as follows:

- Carvana itself is hard to judge for me as an “Armchair investor”. From the outside, there seem to be many question marks. However I have to acknowledge that Rob Vinall’s pitch sounds quite convincing.

- No matter how good Cravana’s business is, Auto1 will most likely not be able to follow the trajectory of Carvana, as the German/European used car market is very different, much smaller and Auto1 has a very different starting position. To me, Auto1 rather looks like the German version of Vroom than Carvana.

What is Vinall saying now? 2500 job cuts is not something you read about a “moat”.

I rest my case : Vinall was lucky with his timing.

Holysh*t !! Adding insult to injury Vinall doubled down on Carvana during 1st quarter…. https://wallmine.com/fund/3op/rv-capital-gmbh (better see w desktop version).

.https://youtu.be/AHEHEKHUO9Q

I don’t think you are disadvantaged at all as an ‘armchair’ investor, I generally find a detailed analysis of an annual report to reveal more about Management’s character than anything they have to say to me in person. Joel Greenblatt saw no need whatsoever to meet with management and even saw it as a negative because of the charm offensive.

I believe Carvana’s business model is the right one, but that Motorpoint in the UK represents a much better investment. Much of the enthusiasm for Carvana is because it is a disruptor. However, Clay Christensen also showed that incumbents have a far higher chance of winning when an innovation is a sustaining one. An example is Dell. Dell’s business model was direct-to-consumer via telephone so the internet was not disruptive to it, but it was for Compaq because Compaq sold via physical retailers. So given the choice between investing in a so-called ‘disruptor’ or an established business adopting a ‘sustaining’ innovation, I would always choose the latter. And that is Motorpoint.

Motorpoint has been operating for 25 years in the UK, gradually entering new local markets with car supermarkets. As it has grown and as more volume has migrated online, it has consolidated its reconditioning facilities and moved towards more of a hub and spoke model. Inventory is national and cars are delivered to local Motorpoint branches or directly to the customer. It search and selection user interface is the same as Carvana’s – this is becoming pretty standard across the industry – and purchase and financing can be completed digitally, by phone, or at branch. They continue to hold inventory at their branches but as volumes migrate online, their individual branch footprint will gradually shrink. They also have internalised a fair degree of inventory through trade-ins and have their own auction platform, and they use their scale and high stock turn to source a significant proportion of inventory directly from commercial sellers, bypassing auctions.

Like Carvana, Motorpoint also has a low single digit national market share so plenty of room to grow. However, unlike Carvana, Motorpoint’s penetration of its local markets is much higher. Unfortunately, Carvana decided in 2021 to no longer disclose this very useful information, but in its 2020 10-K, its largest penetration was just over 2% in its first market, Atlanta, which it entered in 2013. By contrast, Motorpoint has a double-digit market share in many of its older markets (‘cohorts’) and these generate profits which can be reinvested to enter new local markets.

This is as I see it the big question mark with Carvana, and its UK imitators Cazoo and Cinch – when will it actually make a profit? Unlike other internet retailers, it will not get the same leverage on its SG&A because this includes logistics and advertising costs which are specific to local markets. Last mile logistics requires local, not national scale to achieve route density. I am also not convinced that Carvana will be able to avoid having a greater physical presence in those markets, including allowing test drives, to achieve that scale. As for advertising, I am not convinced that advertising spend is non-recurring. These are occasional, high involvement purchases, not for eg a subscription you are getting locked into.

So while Carvana has grown revenue a lot, that mainly has been from entering many new markets per year. For that revenue to fall to the bottom line, it needs local scale. If this local scale advantage does not turn up soon for Carvana as it has for Motorpoint, then the capital markets will have to continue to be believers in the end destination and who knows how long this era of ultra low-cost capital will last.

Motorpoint is an extremely well run business. They turn their inventory 10-12x per year and their ROCE is 100%+. Their NPS is in the 80s. CEO Marc Carpenter has been with the business for many years and has 10% of the equity; his previous boss has just retired as Chair and also has 10%. They buy back shares at sensible prices and stick to their knitting.

Motorpoint has always been profitable and should do 20-25m in net profit this year. Marc Carpenter’s goal is to double turnover in the next 4 years or so. Its market cap is currently 270, which puts it on 10-13x current profits. Yes, profits, as in net GAAP reported profits. And I think those will double in the next 3-5 years from growth and operating leverage as newer markets mature.

This was a great IPO trade that I missed. I’ve heard about the idea from a few investors but at least one big one said a few months ago that “the easy money has been made in this one.” I tried $CVNA as a customer and had an excellent experience. It’s clear that this is something customers want and will come to expect. The dealer model is pretty crappy. The two big questions for me are 1) margins and 2) competition. There is probably also a “spike effect” from the current disruption in the car market – no new inventory. That’s why I ended up buying used. When new car volumes go back up we may see some tough comparisons for them. I’m not saying it’s going to be another $PTON but the used car market right now is off the charts and will return to more normal levels over time.

I will save all of you from taking the bait. As a subprime, expert….. When you see subprime, without the 30/60/90 day deliquesce being properly reported to investor. It’s simply moving the shell with a counterfeit dollar bill on the counter. BHPH. Buy Here Pay Here, works when you collect 50% of your true net investment in the collateral at delivery. Eliminate skip, and keep terms short. Made a great living, then watched everyone jump on the wagon. That was a disaster , that flowed to real estate. In short, when the corporate accountants conspire to shift funds between various internal companies, this guy is selling chicken crap as chicken salad.

Thanks. I don’t even like chicken salad !!!

Caesar at least ?

To start with: I must say that I do admire Rob Vinall for his analytical skills and his performance. As to Carvana: I had heard of this idea roughly one year ago and thought about investing myself. The business idea (as outlined superbly by Rob) is absolutely convincing and my initial thought was “this could really work out” because the company promises to deliver something that many people want, but is missing on the market (transparency and ease when it comes to used cars). However, I then scanned through user feedback as part of my research and was quite surprised how much negative feedback I found. It seemed to me that maybe the company can’t deliver what it promises. If that was true, the company can still grow for the time being (marketing works), but at some point the truth will surface. I have no idea if my doubts were justified, but that’s why I decided against investing in Carvana.

Thanks for the comment. Looking at the share price volatility of Carvana, one would really need conviction to see this through. I couldn’t build up the required conviction either.

The real question is: How can be that in todays age, people in some countries are manufacturing the steering wheel on the wrong side? It is not that difficult!

Agree… And worse: while some manufacture it on the wrong side, then others they go and drive on the opposite side !!! At this time in history !!! Unbelievable !!!!

Indeed. Maybe this is the result of living on an isolated Island for too long ?

Greetings to all readers from the UK…..

Maybe Rob Vinall’s luck will soon be over. He launched just when growth started to outperform value… His last inspirations were passable: Grenke, Tencent, now Carvana…

Rob has outperformed very consistently. In my opinion, he is one of the guys who know what he is doing. He also has US auto subprime experience with Credit Acceptance. Not every investment works of course.

Great write-up. Thank you. Also think the Credit Acceptance (CACC) investment could be a key in answering why he has been choosing Carvana. If I remember correctly, CACC with its subprime focus also was a preferred target of the shorts some years ago. And Rob got it right with CACC and the stock is one of his biggest holdings. So clearly in his circle of competence.

For transparency, Nasdaq100, performance has been 22.7% (10yr), 21.4% (since Jan.2010). RV was 19.1% (since Oct 2008).

Yeah.

Actually he hold and helds many positions in IT, so a Tech-Index is a more appropriate measure for performance comparison.

Imho RV is one of the most overrated investors.

Actually he had/has stocks of big elefants (Alphabet, Meta, Tencent (Prosus), Alibaba, Salesforce, usw.) which drove part of his performance – but honestly one does not need to pay a stockpicker for that, a retail investor can come up to buy such companies by himself, RV also won’t have better access to such large corporates than a small retail investor anyway.

Engaging a stockpicker could become interesting to find interesting companies from the „second line“. I am not sure if RV outperforms in this respect:

check out his current YTD performance. It is really awful.

WIX -45% (YTD) – I never understood that investment, check out eg. https://ma.tt/2021/04/wix-dirty-tricks/

Addlife -45%

Carvana -42%

and so on…

Thanks for the comment. However I would disagree with some of your conclusions.

One of the biggest misconceptions of private investors is that you just need to “pick the right stock”. It is much much harder to hold a stock long term through all up and downs. I think this is what Rob has proven so far: He is able to hold through these stocks.

It should also be clear that you don’t achieve 20% p.a. without risks. Evry portfolio that performs like this is subject to significant drawdowns. Again, the trick is not to sell out when things look bad.

We will see in 3-5 year how things work out.

I appreciate his general approach to investing, I also enjoy to read his letters (also in the hope to get some interesting ideas), however I really doubt that he was that exceptionally successful in picking interesting companies:

1) There is a more than 10 year history to judge. He likes to compare his performance against DAX in his letter, but that is not a fair comparison given his engagement in global/US IT companies. He did not outperform Nasdaq100.

2) It is a highly concentrated portfolio (I do like that myself) so it is obviously more risky (also associated with a higher upside potential than an index).

3) His AuM aren’t that big like Warren Buffet’s so that he would be “forced” to invest in this huge corporates like Apple, Alibaba or Meta. For me this is rather boring. However, I guess/understand one reason is to stabilise his portfolio against volatility since it is quite concentrated.

4) I like your approach with your international series to find smaller “hidden gems”. This “hidden gems” is where the fun begins.

We will know in 4-5 years whether there are hidden gems in RV portfolio at the moment.

In general I don’t think “value investors” are good Tech-investors:

The stock price of Wix is below the March 2020 level. Of course the stock price developement can be completely decoupled from the performance of the company, but there are really not that many IT companies “achieving” this.

Salesforce? I wouldn’t touch it. Google for eg. “salesforce user hate it”

I don’t know Ryman Healthcare, but check out and compare the recent stock price with the stock price 5 years ago. It is on the same level.

Baba wasn’t also very succesful play by Rob. Someone suggested he (and others) should benchmark with technology indices, as they are more representative.

Yet, Rob is supersmart. For example he portrayed Carvana with a 3.8x upside (at the time of publishing) somehow concealing that he bought at significantly higher prices (lowest price was 210 usd in 2021, avg 4q21 price was 250usd), which renders his actual upside anywere below 2.6x. This still is a good opportunity, yet also shows you how smart Rob is.

Another interesting feature is “Ressonance”. V&O and Rob have an Erdös number of 2 (or maybe 1?), which more than explains the “coincidence” of the simultaneous publication of both essays. Let’s call it “ressonance”. Yet, the more independent (less ressonance) investment thesis are, the more likely they turn out well. But hélas, we are on planet earth and things cannot be perfect.

Above all, though, both V&O and Rob look very decent investors and guys, I would trust my money to.

Thanks, didn’t know the Erdös number concept. In this case, the post was triggered by my Auto1 Twitter activities.

Thanks for the trust, but I don’t manage other people’s money ;_)

And : DO YOUR OWN RESEARCH 😉

I did not say how much of my money I would let you manage !! 😛 !

Krtek, you state that “V&O and Rob have an Erdös number of 2…” .My question is who are V & O and what report are you referring to?

Sorry..i get it …its value and opportunity

Holy mole-y ! That was another hit to Business Owner portfolio ! :-S !!

Many thanks for sharing your thoughts! Got also very interested in Carvana because of Rob Vinall, but fully agree with you. Especially 10% Margin seems very unrealistic, how should one reach such a high margin with offering all the services connected with car deliveries and guarantees? Car retail market is very transparent, especially if it’s online and I wonder if you can earn more than USD 500,- on a USD 20.000,- car; that’s 2.5% margin. And if you want to earn more margin, than you have to provide subprime loans.

Absolutely, future margins are hard to determine in this business. Especially when the used car market “normalizes”.

Very surprised to see Rob Vinall in Carvana, and that he keeps saying: “This is why “people” is my first investment criterion (though not the sole one).” Especially in relation to the Garcias…

Well, Rob has been more right than wrong with his judgement of people. For an “armchair investor”, judgement of people is much more difficult to implement as a consistent criteria.

You are right about subprime. If you look at current securitizations about 50% is subprime & the margins on both & loans can be high. The open question in my mind is how CVNA would do in a recession? With COVID, $ were sent to folks so the impact on subprime customers is less than in other recessions. If Rob has a good feel for US subprime customers then this could work out. CVNA has built a great customer experience.