All Norwegian Stocks part 7 -Nr. 91-105

To keep the running gag going: No fish this time and only a few ships, but a lot of other stuff in this random selection of 15 Norwegian stocks. 4 out of these 15 qualified for my prelimiary “watch” list. Let’s go:

91. Wilson ASA

Wilson is a 270 mn EUR market cap shiping company that operates ~130 smaller vessels. As other shipping companies, they trades at very low valuations, in this case 3,5x 2022 P/E. Operating margins have increased from 2,5% to 40% in 2022. I have no idea how sustainable these margins are, but historically the peak has been around 20% and on average maybe 10-15% with a high volatility. Interestingly, the share price hovered around 20 NOKs for 20 years before going up more than 3x in 2021:

Nevertheless, volatile shipping stocks are not my area of expertise, “pass”.

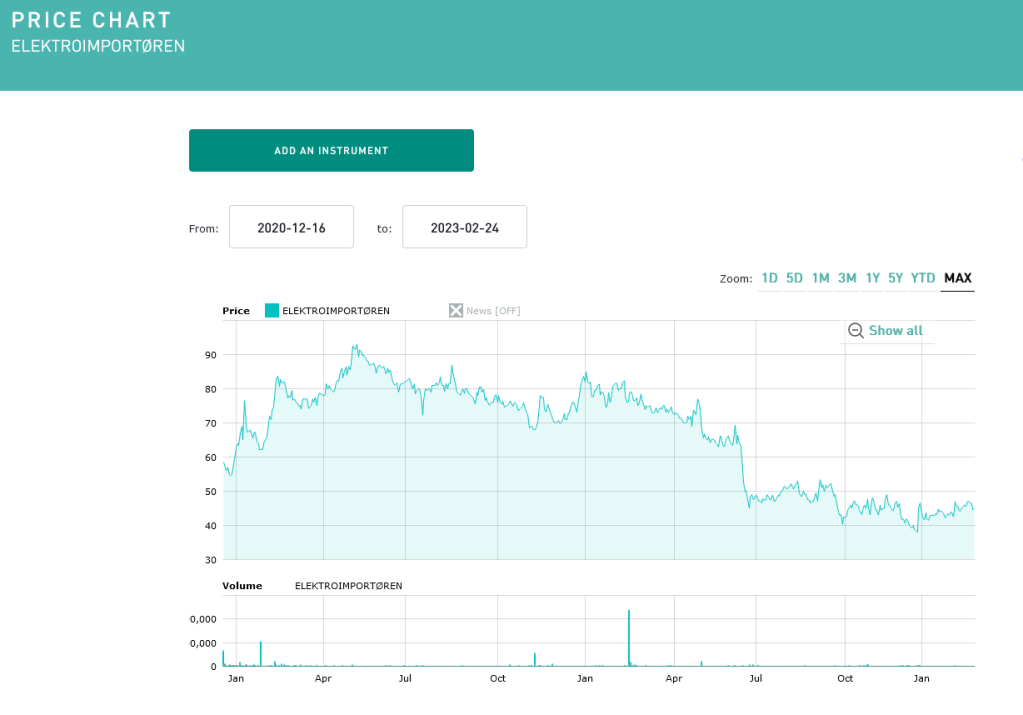

92. Elektroimportoeren ASA

As the name indiactes, this 84 mn EUR market cap company retails and distributes equipment for electrical installations (light, electricity etc.). The company has grown nicely over the past 5 years, however EPS halfed in 2022 which led to a significant drop in the share price below the level of the IPO in 2020:

They seem to have entered the Swedish market in 2022 but overall, Gross margins and like-for-like sales struggled and interest expenses increased, leading to a big reduction in profits. At 19x trailing p/E and 15x trailing EV/EBIT, the stock is not cheap and the IPO seems to have been “well timed”. “Pass”.

93. Entra

Entra is a 1,9 bn EUR market cap real estate company that mostly owns office buildings in Norway. The stock lost almost -50% from its top, similar to many other real estate stocks. I always find it hard to understand the commercial real estate KPIs like EPRA NAV and this stuff, their P&L is quite messy as the show mark-to-market gains and losses in the P&L. Real estate is something I would only consider in very specific circumstances which this is not. “Pass”.

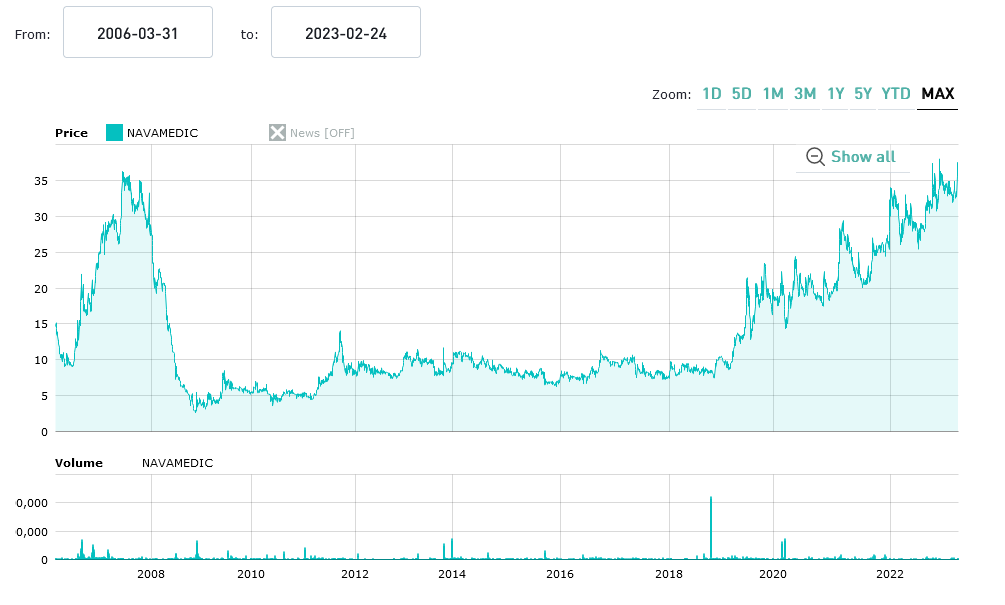

94. Navamedic

Navamedic is a 57 mn EUR market cap “Nordic pharma company supplying hospitals and pharmacies with pharmaceutical and medical nutrition products”. The company has been loss making for many years but, surprisingly, became profitable in 2022. This is reflected in the share price which is now close to ATH:

The company seems to have a wide protfolio of OTC and prescription drugs as well as “medical nutrition” with some focus on obesitiy, but also antibiotics and other stuff. At less than 20x P/E, the stock is not too expensive and the company plans o grow via M&A etc to 1bn NOK in revenue and 150 mn NOK in EBITDA. For the time being, I will put them onto the extended “watch” list

95. Cyviz

Cyviz is a 44 mn EUR market cap “global technology provider for standardized conference rooms, control rooms and experience centers.” The company was IPOed in December 2020 and is loss making, but based on TIKR at least cash flow positive.

If I understand their business correctly, they establish control rooms for the defense sector as well as high quality board rooms atc around the world:

Somehow I find this company quite interesting, especially as it is still growing quite quickly (+50% full year, +80% q-o-q). This seems to be one of the better 2020/2021 IPOs, therefore “watch”.

96. Elliptic Laborator

Elliptic is a 160 mn EUR market cap company that does some “”sexy” things like “AI Based 3D gesture Software sensors”. However, Revenue is only 5 mn EUR, stagnating and they are making losses. One of the weaker 2020/202 IPOs, “Pass”.

97. ATEA

ATEA is a 1,2 bn EUR market cap “leading Nordic and Baltic solution provider of IT infrastructure with over 7,000 employees. Atea is present in 85 cities in Norway, Sweden, Denmark, Finland, Lithuania, Latvia and Estonia. “

With operating margins of 2-3%, the bsuiness model seems to be more of a reseller or distributor. The company is relatively moderately valued at 14x P/E and return on capital/equity is currently at around 20% or more.

Atea has net cash, is paying a rather generous dividend (~5% yield) and has been growing nicely over thy past few years. The share price however does not fully reflect this:

Although similar IT distributors are equally cheap, I put ATEA on “watch”.

98. Green Minerals

Green Minerals is a 5 mn EUR Nano Cap that claims to be the ” pioneer in marine minerals on the Norwegian Continental Shelf”. The company has little revenue and is burning money, with a runway of less than 2 years left. “Pass”.

99. Norwegian Block Exchange

This 10 mn EUR market cap 2021 IPO runs a Crypto exchange. Of course they are burning cash and they have raised addtional money in Q3 2022. “Pass”.

100. Questback Group

Questback is a “leading platform for conducting Employee and Customer Experience surveys”. The market cap of only 5 mn EUR indicates that business is not so great. They have been growing in 2022 but are CF negative and have substantial debt. Further equity financing is likely required as they have less than 1 year runway left. “Pass”.

101. Exact Therapeutics

Exact is a 31 mn EUR market cap stock that IPOed in 2022 and lost around 2/3 of its value since then. They develop technology ” for targeted therapeutic enhancement – Acoustic Cluster Therapy (ACT®). ACT® sonoporation is a unique approach to ultrasound-mediated, targeted drug enhancement”, whatever that means. The company has no revenues, “pass”.

102. Solstad Offshore

Solsatd is a 320 mn EUR market capo company that “operates offshore service and construction vessels for offshore and renewable energy industry worldwide. It provides platform supply vessel, anchor handling vessel, subsea construction, and renewable energy services.”.

Looking at the stock chart, the company went through hard times and was restructured in 2022 including a debt-to-equity swap.

Operationally, things look relatively good these days, but the company still carries a lot of debt (~2 bn EUR) and is making losses on GAAP basis. Largest Shareholder seems to be Aker who snapped up other Norwegian players in the past. “Pass”.

103. Adevinta

Adevinta is a 8,4 bn EUR market cap online classifieds company that was spun-off from Schibsted in 2019. Schibsted owns ~34,8% and interestingly Ebay owns almost the same amount. Looking at the chart, we can see that initially the stock perforemd very well before than suffering from 2022 on:

The business as such looks attractive. High growth rates (+40% in 2022) and decent operating margins. However, a large Goodwill impairment in 2022 led to a GAAP loss.

Based on the projections, the stock is valued a ~15x EV/EBITDA for 2023 and they expect to grow at “low double digits” for the next years. Although the stock is not cheap, it is defintely one to “watch”.

104. Nel ASA

Nel is a (much hyped) 2,2 bn EUR market cap company that is active in the Hydrogen Economy. Nal manufactures Electrolyzers and Hydrogen Filling station equipment. Looking at the chart we can see that Nel has been around for some time and had a frist hype cycle just before the financial crisis:

Compared to other companies in that space, NEL actually does have sales (~90 mn EUR in 2022), but is not making money. Losses are actually higher than sales. Personally, I do not believe in a mass market for Hydrogen as a car or truck fuel at least for the next 10 years or so, therfore I’ll “pass”.

105. Arctizymes Techno

This “fancy name” company has a market cap of 180 mn EUR does something with enzymes and surprising to me is actually making a small profit. Nevertheless, at around 13xEV/Sales and 50x EV/EBIT with only moderate growth, I do not think that this is interesting. “Pass”.

Nr 91 Wilson ASA was taken private in March/April and is no longer listed.

Adevinta will scale well so bottom lines will grow much faster than topline, also really asset light so low capex and amortization belongs to aquisition immaterials = EBIT not far from EBITDA.

But the best part is that you can get Adevinta for free via Schibsted, they own 28%, not 35 as you wrote – and they intend to decrease the position going forward but think Adevinta will need a strong owner. So either a decrease or hole sale of the stock and look up ends in Q3-23.

Schibsteds MV is ~50, their (93% crossowned thue Polaris media) stake in Finn is worth ~30, rest of marketplaces atleast10, newspapers atleast 10, Lendo, Polaris and Prisjakt ~7 and then you got 50 other businesses or minority holdings on top of that.

The Adevinta stake is worth another 27.

If you look at Schibsted remember that they have been highly succesful in developing and selling businesses and that there are no lack of potential future sell off candidates, with Lendo being the closest in time. So the disinvestment part of the cashflow statement is interesting.

Presented to you without comments:

https://partnershipinvesting.substack.com/p/arcticzymes-technologies-high-margin

Thanks, will look at this. Very interesting.