Broedr. Hartmann (ISIN DK0010256197): A truly Egg-citing Special situation ?

Disclaimer: This is not investment advice. PLEASE DO YOUR OWN RESEARCH !!!

- Introduction

- “Catalyst”: Lowball bid from Majority shareholder

- Delisting in Denmark – what I found so far

- Majority Shareholder Thornico

- What is Thornico’s ultimate goal ?

- Scenario Analysis, Risks & Summary

- Introduction

Broeder. Hartmann (not to mistake with Paul Hartmann AG) is a company I looked at during my All Danish Shares series in last July. I think it would be fair to call it a “hidden champion”. Their business model is focused almost 100% on egg packaging which as such is already something I like a lot. Their main product looks like this (only the box, not the content):

Or this:

Extremely sexy product, isn’t it ? In reality, they also seem to offer paper based apple packaging in Brazil and India, but egg cartons are their main product.

In Mid 2022, when I looked at them first, the company was still struggling. This is what I wrote then:

From the fundamental side, things seem to look a lot better these days. In 2023, they have updated the guidance already 2 times as can be seen in this table from the half year report:

The share price has basically not reacted to this and is still ~-50% compared to the peak:

As of now, they trade at a 6,7x EV/EBIT (2023) which is quite cheap for a business that has decent margins and returns of capital and is globally diversified despite its small size. Here a quick overview on some indicators:

TIKR so far has not updated estimates for 2023, so in TIKR the stock looks more expensive for 2023 than the updated Guidance indicates..

Cash Flow has also recovered nicely. It is hard to predict this but looking at this chart from the 6M report, I would guess that currently they trade at at least 10% FCF/EV yield:

I am not sure if that level is sustainable. By the way, reporting is quite good for a small company.

- “Catalyst”: Lowball bid from Majority shareholder:

The majority investor (Thornico Holdings, 69%) just has launched an opportunistic low ball bid at DKK 300 and wants to delist and squeeze out minority shareholders. This has been preceded by another special board meeting, where Thornico exchanged a few of its board members in order to “align better with the Strategy” of Hartmann. A few weeks later, Hartmann’s CFO resigned and was replaced.

To give credit where it is due: I was alerted to this by a Twitter thread from a young (local ?) investor:

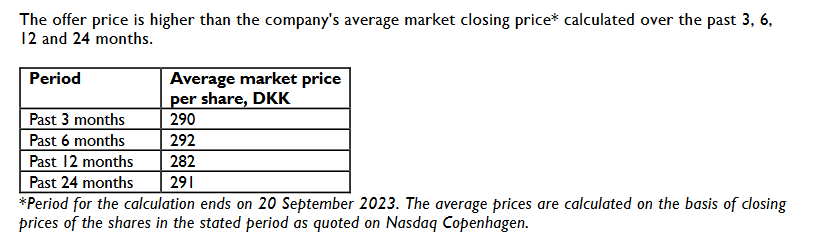

Although I would not see it as a “scandal”, it is clearly an opportunistic lowball bid. They justify the amount in the offer by stating that this is above the average as lined out in the company communication:

3) Delisting in Denmark – what I found so far

According to several sources, a Delisting in Denmark needs to be approved by 90% of all shareholders. This seems to have been implemented only in 2020, before it was easier to delist (only ⅔ vote required).

It seems to be that the Stock exchange (not the regulator) is allowed to decide if an offer is reasonable or not. However, according to the original document, they would not judge the valuation, just if it is totally unreasonable or not:

With their current 69%, there seems to be little chance that they will get even close to the 90% required. A lot of investors might be anchored on the higher prices from 2-3 years ago and might (rightfully) consider this as a lowball bid.

The special shareholder meeting is scheduled October 16th. If 90% of the shareholders accept and the stock exchange does not reject the offer, sharholder will have 4 weeks to sell the shares to Thornico at 300 DKK.

4) Majority Shareholder Thornico

The main shareholder, Thornico is a holding company owned by Father (Thor) and son (Nicholas) Stadil. Here is a picture of these 2 Gentlemen:

The Group is active in Food, packaging, Sports equipment and real estate. Within packaging, there are two other companies, one in China and one in Malaysia.

However, the most relevant Group company that relates to Hartmann is Sanovo, a company that offers every imaginable technology around egg production, including packing machines. I could imagine that combining Hartmann and Sanovo could make a lot of sense. Interestingly, Hartmann bought a packaging company from Sanovo called Sanovo Greenpack in 2014.

In recent years, there seemed to have some troubles in the empire, especially in the now discontinued shipping segment where they had to suffer a bankruptcy.

Thornico has bought its first stake in 2011 according to the annual report and back then offered to buy all shares at DKK 95:

In 2012 then, Thornico increased its stake to 68,5% after purchasing the shares from the other two big shareholders:

In 2013, Thonrico slightly increased their stake to 68,6%, but since then the stake has remained constant, although according to TIKR they have increased their stake to 69% (Half year report still says 68,6%).

According to an article, D/S Norden paid ~60 mn USD to Thonrico for the shipping activities, meaning that they might have some cash lying around to fund an increase in the Hartmann stake.

Christian Stadil interestingly has his own personal website where he presents himself as a mixture of visionary, artist and martial arts expert. He also seems to have created a Champagne label that should be drunk straight from the bottle.

Overall, they seem to be quite shrewed capital allocators.They bought the initial stake in B. Hartmann at a very interesting point in time at around 100 DKK/Share and have recovered most of this already by dividend payments. I don’t think that they are evil guys, but they also don’t seem to throw around money either.

5. What is Thornico’s ultimate goal ?

- If they really want to delist, they must know that 300 is too low as there is no premium. So in order to get more shares they must make a higher bid

- Maybe they want to scare investors and just want to increase their shares for cheap

- Maybe it was a very opportunistic move and they won’t pursue it further if it fails

My current impression is that they really want to get rid of minorities, especially because they started with a board reshuffle. Hartmann is also their only listed holding, so I guess they prefer to have everything private. In addition, I think they might want to link Hartmann closer to their other “egg related” activities as I guess that customers do overlap a lot.

My guess is that they are maybe afraid that the stock gets too expensive if the turnaround is confirmed and Hartmann would show a great FY 2023 result. 300 DKK per share might be the lowest price they can bid as a starter, otherwise the stock exchange might directly call this unreasonable. Shrewd as they are, maybe they thought: I have to increase the bid anyway, so let’s start with the lowest possible number to anchor people on this.

If that is true, I guess they will need to come up with an offer that is clearly higher than the current 300 DkK at a later point in time.

6. Scenario Analysis & Summary:

So in principle we have 3 base scenarios:

- Offer gets accepted at 300 DKK by more than 90%, Stock gets delisted.

- Most shareholders do not accept and life goes on as before

- Thornico increases its offer to get above 90% and then delists subsequently

Personally, I think 1) is very unlikely. 2) is clearly more likely. For 3) one could assume different prices at different probabilities.

This is my first attempt at modeling the case based on a share price of 310 DKK for a time of 6 months:

For a lapse of the offer, I assumed that the share price goes down to the lowest price YTD 2023 which was 269 DKK, which I think is conservative.

Summarized over my assumed scenarios, the expected return is ~18,3%. Of course, any or all of my assumptions could be completely wrong, but I do think that this is interesting as a special situation.

Personally, I do think the downside is quite limited as the stock really looks cheap and attractive stand-alone, but one never knows. In theory, Hartmann would even be a good investment if they don’t increase the bid, but for now I only see it as a Special situation with a time horizon of 6-12 months.

There are clearly risks, as always. The worst case scenario would be that the free float gets smaller, let’s say to 20% and subsequently, the economic situation again gets bad for one reason or the other. In such a scenario, there could be clearly a downside to the stock which I try to capture in the “offer lapses” scenario. Maybe the probability is higher than 20%, but who knows ?

I therefore allocated ~2,5% of the portfolio into this Special situation. I have funded this via further sales of Schaffner.

The game plan is to revisit the case at least after 6 and 12 months unless something happen like a higher bid or so.

Disclaimer: This is not investment advice. PLEASE DO YOUR OWN RESEARCH !!!

P.S.: I would be very grateful for more information about Danish regulation with regard to delisting

P.S.2: Although it does not relate directly to Hartmann, a post about egg packaging must contain this Video snippet from German goal keeper legend Oli “The Titan” Kahn:

Oliver Kahn best moment: Eier wir brauchen Eier!

P.S. 3: I also looked at the Hafen Hamburg Situation. However I Like this one much better.

Thornico increases offer to 360 DKK even before the shareholder meeting.

https://view.news.eu.nasdaq.com/view?id=b78c6edaab730f780bd76702b25aa31e3&lang=en&src=micro

My target return has been reached.

This was a great news and even more brilliant trading idea! I’m for the first time in this kind of situation. Are you personally waiting for the general meeting or selling on the exchange for the price < 360? "Thornico has stated its intention to offer purchasing all shares from the other shareholders at a price of DKK 360 per share with a nominal value of DKK 20" – how can you normally subscribe to the offer and what is the consequences if you don't? Thank you in advance!

Hi, I have sold already. Normally, you should get the offer document via your broker and it should state how you can accept the offer. If you don’t accept, you might end up with an illiquid, unlisted “private equity” position. Eventually they will squeeze you out, but I am not sure how that works in Denmark. This is the reason why I took my money off the table.

Very good analysis! Your case with the highest probability. But I think at 360 Hartmann is still undervalued…. It’s a shame the takeover will go through.

Very interesting situation that reminds be a little of Hunter Douglas 1-2 years ago. What do you know a Thornico? Is there an obvious party to propose a counterbid?

I have written about Thornico what I know. And no, there will be no couterbid. Maybe some special sit funds looking for a better outcome.

Counterbid unlikely as the 70% holder would oppose it. The board to however represent ALL shareholders even they are all with connection to Thornico after all independent were thrown out in July 2023. The listing laws require the board to take care of all shareholders and Nasdaq regulation is for a fair value assessment when there’s a takeout.

Having said that, it now looks like that more than 700.000 shares will vote ‘no’ . 500.000 shares needed to say ‘no’. I suggest to vote in advance as the direct voting at the EGM might be obstructed by ‘technical glitches’ as seen in other digital shareholder meetings

Kann der Bieter nicht einfach per zig Tendern Aktien einsammeln? Es gibt immer dumme Investoren bzw Instos, die irgendwann verkaufen aufgrund der Illiquidität.

Solides Business, aber die langfristige/10-jährige Aktienpreisentwicklung scheint irgendwas negatives zu reflektieren (es sei denn, es gab Disposals oder Ähnliches), da gab es ja gar kein Wertzuwachs.

Schade, dass es nicht zu einem Bieterwettstreit kommen kann hier.

Manchmal macht es Sinn, statt stumpf auf den Chart auch mal auf die darunter liegenden Zahlen zu schauen. Russland und Corona haben denen Zimeilcih reingehagelt, aber der Turn-around ist quasi bestätigt. Und wenn Thornico nicht die Mehrheit hätte, wäre der Kurs logischerweise höher. Und Thornico will logischerweise nicht warten bis das jeder gecheckt hat. Und klar, können sie alles mögliche versuchen, aber wenn die Zahlen immer besser werden (was sie ja tun) behält der ein oder andere die Aktie doch. oder kauft sogar welche.

Quick question:

What happens in such special situations with stocks of the company traded on other exchanges? Like Hartmann is traded as CQ5:FRA in Frankfurt and CQ5:BER in Berlin Both in €.

Their value is somewhat aligned with Copenhagen price but sometimes there are also differences (like today even BER and FRA moving differently)

I guess that the German listings are super illiquid. I always trade at the home exchange.

Can the bidder go final like in UK takeovers and potentially scare minority holders? Why hasn’t the share price moved in all these years? Any fundamental/non-fundamental reasons?

WHat do you mean with “go final” ? The share hasn’t moved for the last 2 years, why is anyone’s guess.

Nice approach for calculating average prices. They must think the average investor is afraid of downturn and has not much hope for the stock. Why would we be investors in the first place. This will be nice show down 🍿

Danish regulation is that you need 90% of the votes to decide a listing. With 70% clearly voting for their own suggestion it’s the minority holders to vote against. Proxy voting should be done correctly ASAP for minority holders. Too often proxy voting from shares held in nominee account (State Street, Clearstream etc) are void due to simple irregularities

Thanks for the reminder. Will do so or at least try to do so.

Valued as Elopak or Hutamaki you get even higher. Using 2023 EBIT guidance mid point (425m DKK) the eV should be either 4bn DKK or 5bn DKK. Net debt is 750m DKK and there’s 6.92m shares out => 600 DKK in Hutamaki case. And there’s US plastic packaging producers wanting to go into moulder fiber via M&A