Lufthansa AG, the large German airline company has a serious problem with pension liabilities. Some people even call it the “flying pension plan”. In the past, under IFRS, they could defer the recognition of higher pension liabilities over a very long-term via the so-called “corridor” method.

However in 2013, IFRS 19 changed this. Now, pension liabilities have to be fully recognized in equity via OCI (other comprehensive income).

This is what Lufthansa wrote in their 2012 annual report:

Change in accounting standard IAS 19 will lead to higher pension provisions

The Group runs defined benefit pension plans for staff in Germany and abroad, which are funded by external plan assets and by pension provisions for obligations in excess of these assets.

In the context of these defined benefit pension plans, the amendments to the accounting standard IAS 19, Employee Benefits, applicable as of 1 January 2013, mean that actuarial gains and losses from the revaluation of pension obligations and the corresponding plan assets are recognised immediately and in full in equity, without effect on profit and loss. One important effect of this retroactive application of the standard

will be that the balance of actuarial losses previously carried off- balance-sheet will be offset against equity at one stroke as of

1 January 2013. After accounting for taxes, this will reduce Group equity by EUR 3.5bn. The change in the accounting standard does not result in higher pension payments, however, nor does it establish an obligation to make additional contributions to fund assets.

When I read their Q1 2013 report, I was however really puzzled:

On the very first page the show that the equity ratio remained relatively constant (15.4% against 17.7% at year end). Based on the information above (3.5 bn pension off-balance sheet liability) and 8 bn equity, the equity ratio should have been dropping by almost a half.

Further on, they write the following in the quarterly report:

The revised version of IAS 19 Employee Benefits (revised in 2011, IAS 19R), application of which has been mandatory from 1 January 2013, had a substantial influence on the presentation of the assets and financial position in this interim report.

The revision caused pension obligations and other provisions under partial retirement and similar programmes to go up by a total of EUR 3.8bn as of 1 January 2013 compared with the financial statements for 2012.

On the same page the reiterate the almost unchanged equity:

Shareholders’ equity (including minority interests) fell by EUR 262m (– 5.4 per cent) to EUR 4.6bn as of the reporting date. The decline

is largely due to the negative after-tax result of EUR – 455m, offset by an increase of EUR 166m in neutral reserves from positive changes

in the market value of financial instruments. The equity ratio of 15.4 per cent was lower than at year-end 2012 (16.9 per cent).

So wtf happened ? How can you increase liabilities by 3.8 bn and equity remains unchanged ? Even if we look at my “beloved” OCI statement (page 23) we can see that OCI statement, we can see that OCI is in fact POSITIVE ?

Dark Side of IFRS Accounting: Restatements

Before it gets to exciting, let us introduce to an instrument from the “Dark side” of IFRS accounting: The so-called “Accounting Restatements”.

Definition:

An Accounting restatement means, that already “closed” accounting periods will be “opened up again” and the P/L will be retroactively changed. Usually this is done, when real errors (or fraud) are detected and the auditors force the restatements. In some special cases however, very creative CFOs use this tool to shift losses into the past and bury them in the hard to read (and understand) part of the accounts.

How to detect ?

Well you can either try to understand the “change in equity” portion of the balance sheet. Which is quite hard sometimes. Or you perform a quite simple check:

Just look at the equity of the last report (here annual report 2012) against the value of the current report. And surprise surprise:

In the annual report 2012 (which was only issued a few weeks ago), equity for 31.12.2012 was stated at 8.2 bn EUR. In the quarterly report issued now, equity for 31.12.2012 now suddenly has shrinked by 3.4 bn to 4.8 bn.

So just to summarize this:

Between issuing the annual report 2012 in Mid mArch and the quarterly report which was issued in the beginning of May, Lufthansa decided to change their accounts retroactively for a fact which was already well known since quite a long time.

This is not illegal,but in my opinion they could have explained that better that they used a restatement to book this retroactively.

Why did they do it ?

The reason is relatively clear in my opinion: In order to not put a spotlight on the fact that now almost 50% of the equity have disappeared. The strategy so far looks quite succesful:

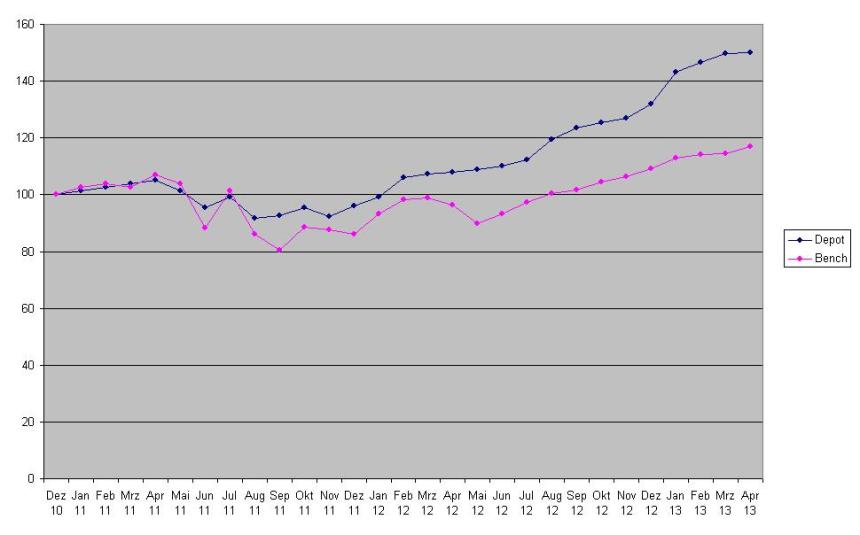

The stock even outperformed the DAX.

What to do ?

One interpretation of this is that the capital market is so efficient and this has all been priced in already. The other interpretation would be that Lufthansa is trying to bury bad news into past results and this opens up a nice short selling opportunity if reality finally catches up with investors.

I tend two favour the second interpretation.

For a cpaital intensive busienss like airlines with no real moats, the book value (or replacement value) is not a bad proxy for the value of an airline. Lufthansa now “jumped” from around 0.8 times book to 1.6 times book.

| Name |

P/B |

| DEUTSCHE LUFTHANSA-REG |

1.61 |

| GARUDA INDONESIA PERSERO TBK |

1.31 |

| INTL CONSOLIDATED AIRLINE-DI |

1.31 |

| MALAYSIAN AIRLINE SYSTEM BHD |

1.25 |

| SINGAPORE AIRLINES LTD |

1.01 |

| AEROFLOT-RUSSIAN AIRLINES |

1.00 |

| THAI AIRWAYS INTERNATIONAL |

0.97 |

| CATHAY PACIFIC AIRWAYS |

0.96 |

| AIR NEW ZEALAND LTD |

0.93 |

| AER LINGUS GROUP PLC |

0.89 |

| QANTAS AIRWAYS LTD |

0.68 |

| AIR FRANCE-KLM |

0.63 |

| SAS AB |

0.44 |

| DELTA AIR LINES INC |

na |

| |

| Avg |

1.00 |

Funny enough, the average of those 13 airline companies for P/B is exactly 1.0 but that is a coincidence. On the other hand, I don’t see a compelling reason why Lufthansa should trade signifcantly above book value.

Going forward, Lufthansa will be on my “short watch list”. I am tempted to bet that most analysts didn’t really understand what Lufthansa has done and P/B will most likely go towards the industry average.