Innoscripta SE: 60% EBIT margins & rapid growth but why did the 2025 IPO flop ?

Management summary:

Innoscripta, a young German “SaaS company” which IPOed in 2025 came to my attention because it is extremely profitable (EBIT margin 60%) and growing like crazy (10x in sales since 2020). However, because of the unique revenue model (success fee instead of software fees) and a rapid decrease in quarterly growth in 2025, I am currently not investing, although the stock is not super expensive at 21x trailing P/E. But I will keep a close watch.

The 2025 IPO

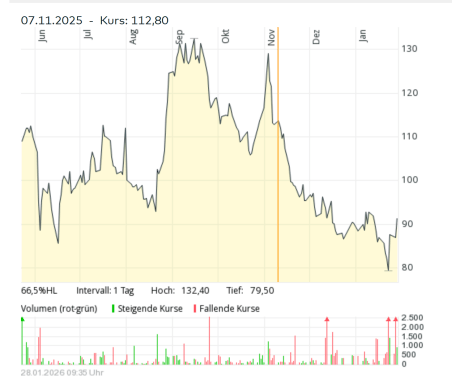

Innoscripta was one of the few “official” IPOs in Germany in 2025. If we look at the share price, it was not a very successful one: